Learn the major differences between trading stocks vs trading forex, and which one is better to trade.

Instead of boring you with the bloated history of the Forex market, I’ll skip right to retail Forex trading which is what you will be doing. Before the late 90’s, there was no retail Forex trading. You needed several million in an account to trade the Forex Market, and even then – you were a small client in a big sea.

But due to leverage and an expansion of the Forex market – it became possible, via brokers who allowed retail participants, like you, to enter the Forex trading arena.

Before we talk about what makes the Forex market so popular and which core trading skills are needed to trade Forex successfully, let’s have a quick look behind the curtains of the Forex market.

What is Forex Trading?

The Forex market is one of the most diverse, fast-paced markets around. Banks, businesses, governments, investors and traders come to exchange and speculate on currencies in the Forex market which also is referred to as the ‘FX market’, ‘Foreign currency market’, ‘Foreign exchange currency market’ or ‘Currency market’.

It is the largest and most liquid market in the world. The daily traded volume changes frequently, but according to the Bank for International Settlements (BIS), trading in the Forex market averaged $5.1 trillion in April 2016.

The FX market is open 24 hours a day, five days a week and currencies are traded worldwide from the major financial centers of New York, London, Paris, Frankfurt, Zurich, Tokyo, Hong Kong, Singapore and Sydney. This means, when the Forex trading day in the U.S. ends (5pm EST), trading begins anew in Honk Kong & Tokyo.

The various trading sessions of the FX market can be divided into three major categories;

- The first being the Asian session which covers the Wellington, Sydney and Tokyo sessions. This continues into the start of the second session which is

- The European/London session. This is the largest session in terms of volume, transactions and volatility, constituting over 37% of all Forex trading activity throughout the world.

- The last session is the NY/US session which starts around 8am EST and continues till 5pm EST. This is the second largest session by volume and transactions.

How You Can Trade The Forex Market

The FX market allows you to buy and sell a currency of any country against another currency.

The most popular currencies in Forex trading are the US dollar (USD), the Euro (EUR), the Great British Pound (GBP) and the Japanese Yen (JPY). The USD is the most commonly traded currency while the Euro is 2nd. Thus, the EUR/USD (Euro vs. the USD) is the most traded Forex pair on the planet.

To give you the most basic example of how you can trade the Forex market and profit, if you think the Euro is going to rise vs. the USD, then you would buy it vs. the USD via the EUR/USD pair. On the other hand, if you think the Euro is going to fall in value – then you would sell it vs. the USD. This is the basic mechanic of Forex trading.

Basic Features of The Forex Market

There is no centralized trading exchange in the FX market vs the stock market (e.g. New York Stock Exchange). All Forex trades are carried out electronically, over-the-counter (OTC) with the prices quoted by the major banks. There are about 13 major banks which do this, thus, not all banks will have the same exact price on currencies.

Highly Liquid + 24 Hour Trading

The FX market is highly liquid (over $5 trillion a day) which ensures that an investor can buy and sell a currency at virtually any point of time with lower trading costs than for example stocks. It also means you can get a better price than trading stocks because there are more buyers and sellers, thus more pricing available.

Also unlike stocks, a retail Forex trader can profit (and to be fair, lose!) in both rising and falling markets. With stocks, it is much harder to go ‘short’ (trying to profit from a fall in price in stocks), thus you have more competitive advantages in trading the Forex market. This makes it much easier to profit in bull and bear markets vs trading stocks.

Daily fluctuations in the currencies are often less volatile than stocks, often times less than 1% change in the value of the currency. This is why many Forex traders rely on the leverage to increase the value of potential movements. In the retail Forex trading world, leverage can be as high as 250:1 (although we recommend no more than 100:1 for Non-EU). With 100:1 leverage, you can trade $100 worth of a particular currency with only $1, giving you a chance to profit from the average daily movements in the FX markets and currency pairs.

Forex Brokers

Forex brokers play an important role in the FX market as they are the crucial link between the individual (you – the retail Forex trader) and the Forex market. Individual investors cannot trade the Forex market directly via the major banks (unless you have at least $1 million USD).

Brokers profit by providing individual investors and traders (like you) an opportunity to trade the FX market simply through matching buyers and sellers.

It’s important to understand the Forex market is not a zero sum game (meaning one buyer for each seller). Often times smaller traders (retail traders) make trades that are matched by one large buyer/seller, and both of you can profit. This happens with larger FX players having different holding times or prices than you.

So an example is you buy the Euro vs. the USD at 1.15 and have a target of 1.16. Meanwhile the larger player has a target at 1.10. If the price rises to 1.16, you profit, while the larger player can hold the position for a larger move, perhaps later down to 1.10. The key to understand in all of this is that the Forex market is not a zero sum game, and both buyers and sellers can profit. Understand, however, that they can also lose.

How Forex Brokers Make Money

The primary method Forex brokers make money is by the spread, which is the difference between the Bid and Ask price for a currency pair. Think of it like how a real estate broker finds a buyer (you) for a house that is being sold (by the seller). The spread is a tiny markup in price from the actual currency pair.

The second method a Forex broker typically profits is from charging commissions. This is generally specific to the type of account you have, and how much trading volume you do per month. The majority of FX brokers today do not charge commissions, but make sure to check with any potential broker you sign up with.

Why has the Forex market become so popular?

Learning how to trade and make consistent profits is not an easy thing. However if you can learn how to trade Forex successfully, it can offer a lifestyle that can’t be compared to most other jobs. This is because you can work from home, or trade from anywhere in the world as long as you have an internet connection and a laptop.

Imagine being able to work from anywhere in the world, wearing whatever clothes you want to, working at whatever time you want to, while on vacation, travelling, home or at the coffee shop. These are some of the many reasons trading Forex has attracted so many traders to the FX market over the last decade.

If you are willing to work hard and learn the necessary skills for Forex trading, you can become a full- or part-time FX trader.

I personally was tired of working in an office, having others tell me what to do, what to wear, when I got paid, when I got a raise, and how much I’m worth. If you want to work from home and have no limit to how much money you can make (understanding that there is always risk involved when you trade!), then you should definitely learn how to trade the Forex markets.

NOTE: Successful Forex trading is simple, but not easy. It will require you to work hard, get the proper Forex training, and learn to build a successful mindset. You’ll have start with the basics of Forex trading, eventually learn how to trade price action, have good risk- and money management, and understand successful trading psychology.

Along those lines, below are some of the core skills which are critical to you becoming a successful and profitable Forex trader. These skills can be learned and strengthened through mindset books and/or mindset training courses.

Discipline – Good discipline is very important for any Forex trader. Having good discipline ensures you are able follow your trading plan (rules) consistently, while avoiding poor trading opportunities.

Successful FX trading is all about strict risk- and money management which is impossible if you lack the discipline required to consistently adhere to your rules. Think of it how a professional poker player learns to make money from profitable hands, fold weak ones and protect their bankroll.

Traders struggling to make consistent profits trading the FX markets often show poor discipline, consistently violating their trading plan and risk- and money management rules. Nobody becomes a professional football player by having poor discipline.

Resilience – New traders often times are very excited and motivated to learn how to trade Forex successfully, especially with the opportunity to work from home and make money anywhere in the world, 24 hours a day.

Learning how to trade takes time, just like it takes several months or even years to become proficient in speaking a new language. It will also challenge your mindset and discipline, just like it takes more effort to get in physical shape than you expect.

The process of learning to trade successfully will require resilience, or the ability to endure ups and downs (just like any profession or business). Hence have the expectation from the outset you will likely have to work harder than you expect.

Emotional IQ – As in everyday life, decisions made under heavy emotional influence are often not the best ones. Have you ever made a hasty financial purchase you later regretted, or said something to a friend/loved one you later felt wasn’t the best idea?

The same applies in trading. You’re going to learn a lot about yourself, how you relate to money, abundance, success, discipline and more when trading.

Therefore it is important for aspiring traders to work on their mindset and emotional IQ so you can make calm and collected decisions while trading.

Patience – One key aspect to trading Forex successfully is to spot a good trading location and enter at the best possible price. Just like when you buy a house, you want the best price possible, the same is true when trading the Forex market.

Beginning traders often find themselves in situations entering too early or too late. This is because of either a) being impatient and wanting to get in the trade, or b) not being confident the trend will continue.

This is where patience comes into play. You have to be able to wait for the price action to come to your exact price while avoiding getting in too early or late. It’s hard to wait when you think you might be missing out on a trade and thus potentially losing money.

A successful trading mindset (just like in business) is a patient one that knows exactly when to strike and when to wait.

Probability Mindset – There are no certainties when trading the Forex market. No one really knows if price will go up or down. You only have ‘probabilities’ that a market will go up or down.

Successful Forex trading therefore is all about thinking in probabilities and finding setups that make money over a series of 100, 1.000 or 10.000 trades. This is the same way a professional poker plays. While they know the potential ‘probability’ a card will come up, they don’t know for sure if it will, so they have to play the probabilities in their favor.

A probability mindset can be hard for aspiring traders to adopt but is critical in order to succeed in the Forex market.

The most important thing is to a) avoid looking for confirmation (which doesn’t exist in the market), and b) think in probabilities.

What are the Advantages of Trading the Forex Market

- As mentioned before, the Forex market can be traded anywhere in the world as all trading is done online. Thus you can trade Forex from anywhere in the world as long as you have a laptop and an internet connection.

- The high liquidity of the Forex market means you can enter or exit a trade/position instantly, compared to certain stocks where (in the worst case) can be ‘stuck’ in a position because there is no buyer or seller available.

- You can profit (and of course lose!) in both rising and falling markets trading Forex , unlike stocks, which you generally can only buy as a retail trader.

- Forex trading does not require massive starting capital since you can start trading with as little as $100 due to the leverage available, something most Forex brokers offer.

- Instead of working your way through the jungle of thousands of stocks, you can focus on a few currency pairs only, offering several high probability trading opportunities 24 hours a day due to the consistent volatility and liquidity in the Forex market.

One Proven Way to Profitably Trade the Forex Market as a Retail Trader

If you are going to learn how to trade Forex through, you’ll need to learn from a Forex training course or by working with a proven Forex mentor and Forex trader. Only then can you know if your trading mentor’s strategies and techniques work. One good way to determine the quality of a Forex mentor and/or Forex training course is to see how well the students are doing by looking at Forex success stories.

I’ve shared my Forex trading results for 2017 along with multiple Forex trading success stories from my students and can teach you how to trade successfully. I do this using price action strategies which I’ve built over the last two decades working as a Forex broker on wall street, trading for a hedge fund, and trading privately for the last two decades.

You might hear how you need to learn technical analysis or learn about fundamental trading to make money trading Forex . It’s important to understand, that while banks, hedge funds, prop firms, and individual traders may use these methods to place trades in the market, all those decisions are based upon one variable – information.

Regardless of how they obtain the information, that ‘information’ has to be turned into an ‘order’ or a trade (i.e. I want to buy the EUR/USD at 1.1500). All of these ‘orders’ combined are what is called ‘order flow’.

Because we do not have direct access to the order flow in the Forex market, we have to learn how to read its ‘footprint’, which is contained in the price action which is visible on all Forex trading time frames. Price action has the fingerprints of order flow all over it. This is why you have to learn price action trading.

This skill, once learned can be done on any instrument, Forex pair, trading time frame or environment (up/down trend, ranging market, high or low volatility).

Reading price action in real time and trading price action successfully is a learnable skill that anyone can do with the proper training course, trading books or mentor, all of which we provide at 2ndSkies.

The skill of being able to read Forex price’s movement over time will enable you to;

- see where the institutional players are more involved (buying or selling)

- where are key support and resistance zones

- where to find precise entry and exits (trade locations)

- whether the market will breakout to new highs or lows

- how to make money in Forex trend trading

- finding tops and bottoms in trends

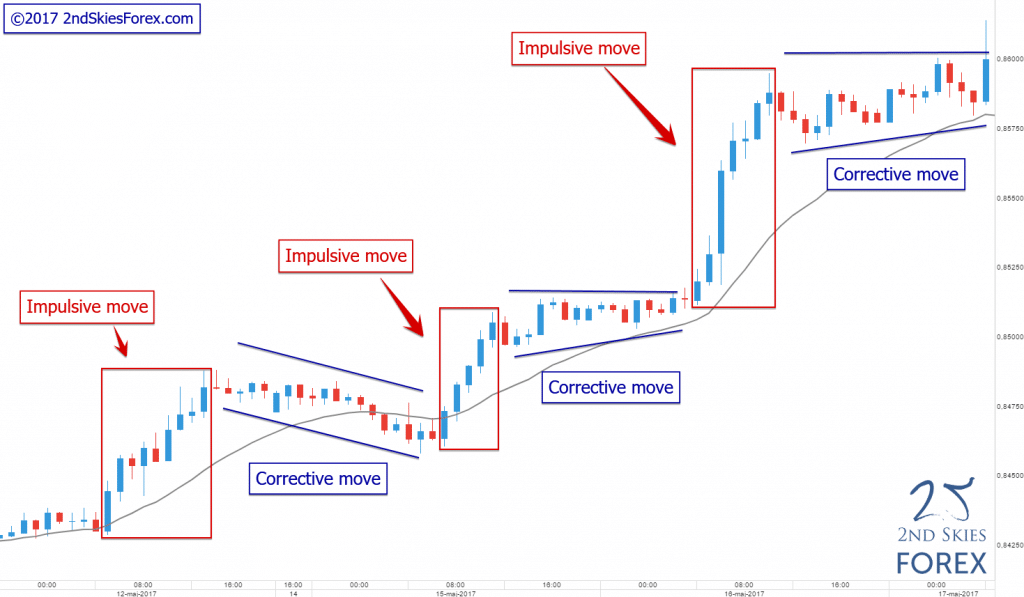

- what are impulsive vs. corrective price action moves

- what kind of market environment you are in (bull/bear trend, range, low/high volatility)

and more…

As you can see, the Forex market can offer fantastic opportunities for those willing to…

- drop the retail ‘get rich quick’ mindset

- set realistic long-term goals

- properly learn the profession of trading like a professional

- choose one trading method and stick to it

- work on and improve upon their mindset

While the Forex market has the potential to offer amazing rewards, it also carries risk. Many come to the trading world only thinking about the potential rewards but completely neglect the immense risk involved which definitely is the fastest way to lose all your money.

Therefore, it is of outmost importance that you approach your potential future trading career the right way, like you would with any other professional profession. You wouldn’t attempt to jump into an commercial airplane and take off without any prior training, would you? No, of course not. But this is exactly how most retail traders approach the Forex market the first time.

Only the fact that you’ve taken the time to read this article already shows that you are on the right track and are willing to approach this the right way.

There are many ‘funded’ trading programs out there such as TopStepTrader, The 5%ers, SMB Capital and more. But should you actually join these funded trading programs?

In today’s video, I dive into several of them in detail, and what I found was somewhat shocking.

Hence don’t forget to watch this video to see whether you should join these funded trading programs or not.

Disclaimer: I was not paid to write any of these reviews. These reviews are my opinions only and should not be construed as fact or the truth about these programs. They are just my opinions on what they are lacking or doing well with. As usual, do not take my opinion at face value and do your own research.

What’s Inside?

- What are some forex day trading strategies you can use?

- Do you recommend any rules for day trading forex?

- Will I need particular skills to day trade the forex market?

A Personal Note From Me:

I’ve never been a trader who could only trade higher time frames, or only lower time frames. Technically I could, and I’ve had to depending upon where I live in the world + what time zone I’m in.

But when it comes to making money trading, you have to do what is most natural to how you think and perform. What I realized about myself 15 years ago while working as an FX broker, was that my mind likes to be active. My mind performs best when I’m be working on both short term and long term activities.

I also feel like having both skills gives me way more options and opportunities to pull money out of the market.

My suggestion for you is to find that which is most natural to your every day thinking, mindset and skill sets. For some of you, it will be day trading only. For many others, it will be swing trading or position trading on the higher time frames. And for a smaller portion of you, that will be a marriage between the two.

For those of you that are naturally attracted to day trading, or are interested in learning the skills and upsides to day trading – read on.

The Benefits of Day Trading

A healthy way to look at day trading is examine a parallel profession and skill – that of online poker players.

Trading and online poker have skill-sets which mirror each other incredibly (risk management, controlling your emotions, calculating probabilities, etc). Hence, if you have good skills as a trader, you most likely have a solid set of skills to make money in online poker (and vice versa).

I’ve spent many a nights with my trading friends playing poker in casinos and various private tables. 75% of the time, we make money. The last time I went into a casino poker room with another trading friend of mine, I doubled my buy in, and a lot of that success had to do with my skills as a profitable trader.

When you look at online poker players, you’ll almost never see a poker player only playing one table. Over 80% of them are playing multiple tables at the same time, with some I know handling 16 tables at a time for hours on end.

Now you have to ask yourself: why do online poker players prefer to play more tables vs less or just one?

The answer is simple: MATH! If I am a good poker player, and have an edge on one table, then if I can repeat the edge across multiple tables, I can make more money.

The same goes for day trading. If you have a profitable trading strategy and skill set, the more trades you make, the more money you make as that edge plays out more x’s per day.

More trades (technically) =’s more opportunities to make money. This is one advantage that day trading has over swing trading.

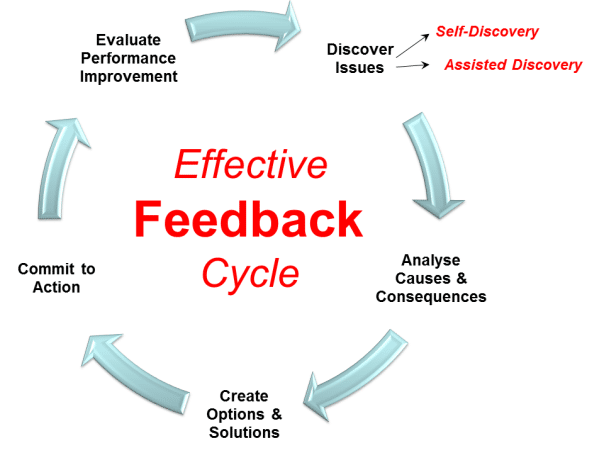

Another major advantage of day trading is you get more feedback faster.

The more trades you make with a particular strategy, the faster you learn the in’s and out’s of that strategy, such as what environments it works best in, and which ones it performs poorly with.

By also exposing yourself to a lot more candles, price action context and structures, you’re creating a more abundant data set to digest, memorize and work with.

I could list a whole host of other benefits (such as not having over-night risk), but for now, I’m guessing you can see why day trading has some serious benefits.

For now, let’s jump into a few tips, tactics and strategies for day trading.

Day Trading Tip #1: Do Not Trade Against These!

The first core model I use to trade price action context on any time frame, particularly day trading, is impulsive and corrective price action.

For those of you that are new to trading impulsive and corrective price action, click on that link above.

Now assuming you know what an impulsive move is in the forex market, I’d like you to do an experiment:

Look at all your losses, particularly the ones where you opened the trade, and it pretty much went negative right off the bat and ended up a loss.

When you look at the charts leading up to your entry, and how the price action acted after, count how many of them you were trading against impulsive moves. I’m guessing in the majority of those losses you were trading against them.

If you find this to be true, then you want to be trading with impulsive moves as much as possible when day trading.

Day Trading Tip #2: Always Trade With A Minimum Risk vs Reward Over This

In one of my latest articles, I talked about 6 trading statistics you should know if you want to make money trading. One of them was from a study done by FXCM, whereby they noticed traders who had a 1:1 risk to reward ratio were 300% more likely to profit vs traders who used negative risk:reward ratios.

This statistic applied to all time frames and types of traders (day and swing traders). Because you are more active day trading, you’re applying your edge more often in the forex market. Hence you have to be super on point in making sure the math works out in your favor as you’re trading at a faster pace, and thus exposing your equity more often to risk.

Hence, use nothing less than a 1:1 risk to reward ratio when day trading.

Day Trading Tip #3: Limit The Number of Instruments You Trade

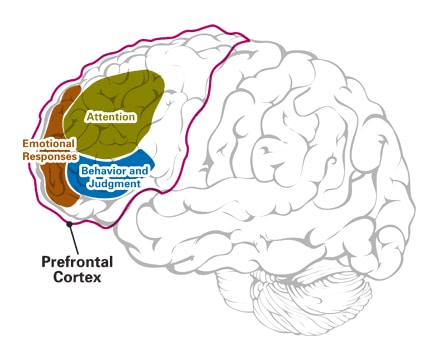

Because of the time sensitive nature of day trading, every calculation, analysis and decision you make must be done faster. This increased speed of processing in your brain also taxes your working memory and thus increases your cognitive load.

To reduce this strain on your brain, I’d suggest day trading a few instruments or forex pairs, possibly even one.

If you’re day trading only the forex market, I’d suggest one major pair, one minor pair, and one exotic to add some extra spice 🙂

Ideally you are choosing forex pairs which are most correlated with your region and time of day. So USD and European currencies if you are in the UK/Europe/North America. For Asia/Australia/New Zealand, I’d suggest at least 2 currencies from your region (JPY, AUD, NZD, CNY, SGD, KRW) and minimally one USD pair.

If you’re day trading stocks, I’d recommend one or two indices from your region, and at least one consistently volatile stock from your region. You can also look for an ETF as well.

If you’re day trading commodities, I’d recommend a natural resource, such as WTI/Nat Gas, one precious metal, such as gold/silver, and one agricultural product.

The number of instruments isn’t fixed. A good rule of thumb is to only trade as many instruments as you can mentally handle. If it’s too taxing and stressing on your brain, you’re likely trading too much.

Day Trading Tip #4: Have A Max Risk Profile

I’m guessing many of you struggling traders have experienced how easy it is to get carried away with risk, particularly when you’re on a winning a losing streak. To keep guardrails in place so you don’t start over-trading and going off the reservation, I recommend having a max risk profile as a day trader.

A max risk profile is simply creating a line in the sand that once your losses for that day, week, month are passed, you stop trading for the time being and regroup.

If you could only have one max risk profile, it would be a max risk per month. If you are open to having two of them (my minimum suggestion), it would be a max risk per month and a max risk per trade. A more robust risk profile would be to have a max risk per month/per day/per trade.

I always recommend risking a fixed % per trade, and generally do not recommend more than 1% per trade (in the beginning, ideally <1% per trade). Per day, I’d recommend no more than 4-5R, so 4-5x your max risk per trade. Per month I’d recommend a max risk of 9.9% per month.

Why 9.9%? Because the statistics show that for every double digit draw-down you have per month, your chances of recovering your account just back to break even decline exponentially.

Having max risk profiles will protect you long term and keep you in the game when things are tough so you can bounce back and get to profitability.

Day Trading Tip #5: Plan This Ahead of Time

As a day trader, you’re often using a lot of working memory + brain processing power in your pre-frontal cortex for all the decisions/calculations/analysis you have to do in real time with alacrity.

This can increase the cognitive load and thus tax your brain, leaving you with little bandwidth to make important trading decisions in real time.

Because of this, I’d recommend planning these two things ahead of time:

#1: Plan your trades ahead of time. This includes doing your price action context analysis ahead of time, along with identifying your key support and resistance levels and the types of trade setups you want to take ahead of time.

Of course, we’re always flexible to take new trades should they emerge, but we want to plan as much of this ahead of time so when it comes time to trade, you’re already prepared and can just pull the trigger.

#2: Plan If/Than scenarios ahead of time. Some examples of if/than scenarios you can prepare for are:

-your trend direction gets reversed

-you get stopped out and the market is showing a reversal setup

-the market breaks a key level you think will hold

By planning these ahead of time, you avoid being married to one side of the market, thus remaining flexible so you can take advantage should the market change directions when you least expect it.

Day Trading Tip #6: A Good Strategy Can Be As Simple As Targeting 15-20 Pips A Day

Since you are wanting to day trade, it’s important you are going for targets which can easily be hit within a day’s session, or ideally a 24hr period. What this translates to is going after targets which are consistently hit on any given day.

Thus whatever instrument you trade, whether it be forex, stocks, indices, or whatever, that the average daily movement and volatility for that instrument makes it easy for you to find trades that will hit those targets.

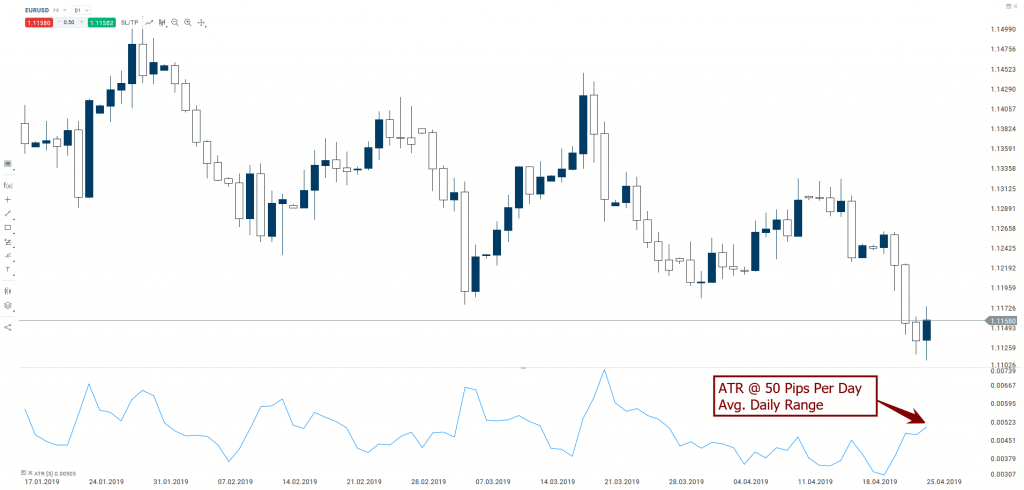

A simple way to do this is to pull up the ATR indicator on a daily forex chart for your instrument and set it to 5. This will calculate the average daily range per day over a 5 day period.

In the example below for the EURUSD, the 5 period ATR on the daily chart is 50 pips with a high of 69 pips over this year and a low of 30 pips.

What this means is, if you want to day trade the EURUSD pair, you could simply go for 15-20 pips a day which should be a relatively easy target to hit.

Obviously you’re going to need a strategy to help you capture those 15-20 pips per day, and we teach many strategies like this in our price action course. But as you can see, this is a relatively workable target to go for each day with the right price action skills in place.

In Closing

There is so much more I could talk about when it comes to day trading forex, or any market for that matter. But the key points to remember are:

- Day trading has some major advantages over swing trading when it comes to multiplying your income

- Day trading also has some specific challenges swing traders do not face with the time pressures involved

- Only day trade if it suits you personally and feels natural

- Don’t trade against impulsive moves whenever possible, and make sure to plan out ahead of time as much as possible

- Create a proper risk profile to protect you when you’re not performing at your best

- Go for reasonable targets that can be achieved easily within a day

If you learn to do this above well, along with all the tips and tactics I mentioned above, with the right training and mindset, you can find it a very profitable endeavor.

Some of my best trades were day trades that took no less than a couple hours to hit their profit targets. It’s a nice and rewarding feeling to grind out several profitable day trades over a few hours, then go out and enjoy the rest of your day as you made your money.

If you’re interested in learning more about day trading forex (or any market for that matter), in our price action course, we teach strategies and skills to day trade on any instrument, time frame or environment.

My hope with this article is that you who are naturally inclined to day trade find it much more workable and profitable through the methods and tactics we shared above.

With that being said, please make sure to leave your comments and feedback as we’re always looking to hear from our community.

Until then – good health and success to you in trading and life.

To make money trading forex (or any market for that matter), you’re going to need statistics to improve your trading performance. When it comes to improving your trading performance, 9x out of 10, you should be choosing data over opinions.

I’ve trained thousands of traders, and often times, the difference between winning and losing money came down to one data point or statistic, and at most 2-3.

In today’s trading article, I’m going to share with you 6 trading statistics every forex trader (and all traders) should know. Let’s jump in…

Trading Statistic #1: You Better Have This

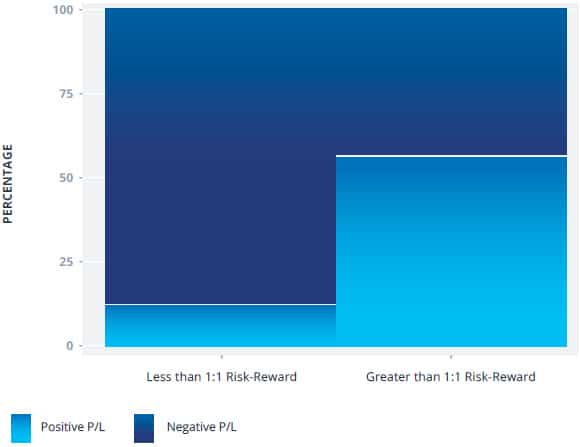

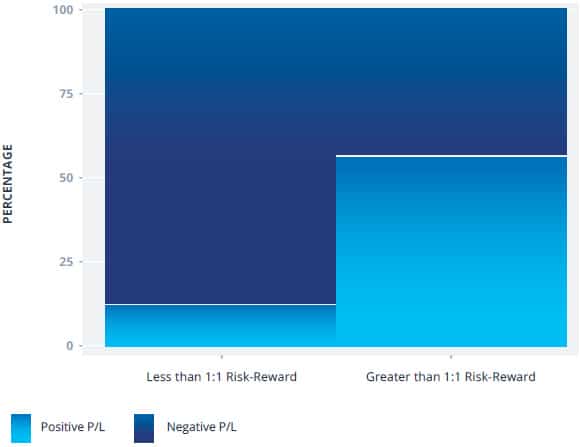

In a highly fascinating study, FXCM did an analysis of traders who had negative risk:reward ratios vs traders who had a 1:1 risk:reward ratio or higher.

For those of you who don’t know what the risk to reward ratio means (risk:reward), it basically measures the money at risk on your trade vs your potential reward. To give a few examples:

- If I’m risking $1000 on my next trade, and my take profit is at $1000, then I have a risk:reward of 1:1

- If I’m risking $1000 on my next trade, and my take profit is <$1000, then I have a negative risk to reward ratio, meaning I’m risking more than my potential reward

- In contrast to that, if I’m risking $1000 and my take profit is $2000, then I have a positive risk:reward ratio of 1:2

Getting back to the FXCM study, they found that trading strategies with a negative risk:reward (i.e. <1:1) had only a 17% chance of making money trading.

Meanwhile, if a trading strategy had a 1:1 risk:reward ratio or higher, they had a 53% of making money (see image below).

Another way to put this is: if your trading strategy has a negative risk to reward ratio, you have a 300%> chance of losing money vs a trader who is using a even or positive risk:reward ratio.

You should now be realizing two important things when it comes to setting profit targets and building a trading strategy:

#1: Make sure you minimally target a 1:1 risk:reward ratio on every trade

#2: DO NOT sacrifice your risk:reward ratio (and take it negative) just to increase your % accuracy

Trading Statistic #2: Risk of Ruin

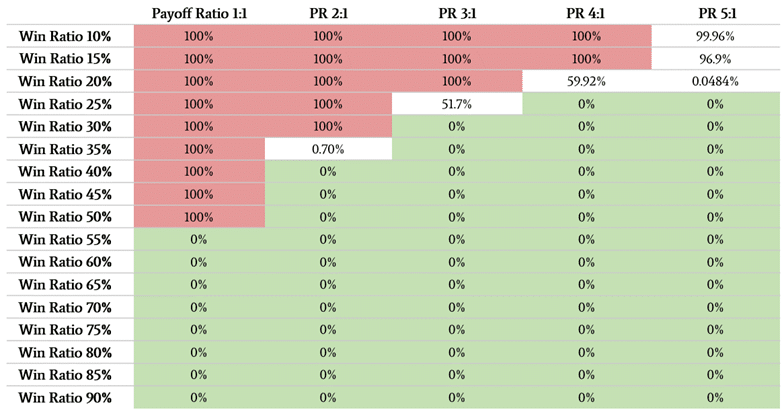

Originally designed for casino games, the risk of ruin (RoR) is one of the most important trading statistics you need to know. To put it simply, the RoR will mathematically tell you in one statistic whether you are going to make money or blow up your account.

The risk of ruin statistic basically looks at your overall payoff ratio (or Avg.+R per trade), your % accuracy and your % risk per trade. Over a sufficient number of trades (100 or more), you can determine your risk of ruin and know – based on your current trading strategy, whether you will make money, or blow up your trading account.

Below is a table showing the risk of ruin statistics using 1% risk per trade, and measuring various payoff ratios and accuracy %’s.

If the box is red, you have a 100% of blowing up your acct. If the box is green, you’re going to make money trading. The number inside the boxes tells you the % chance you will blow up your account.

What you’re looking for in your RoR is 0, meaning you have a 0% chance of blowing up your account. Hence, if you want to make money trading, you’ll need to know your risk of ruin.

NOTE: We have a FREE risk of ruin calculator which you can use by clicking on the link

Trading Statistic #3: Trading Strategy Durability

The durability of your trading strategy is critical. This is because the markets are always in flux, which also means your accuracy %, and thus your performance will always be in flux.

Most profitable trading strategies operate within a range. So if your trading strategy is 60% accurate (on avg.), due to winning and losing streaks, you’re trading strategy is likely to fluctuate in terms of accuracy (~between 50% and 70% accurate).

Hence it’s important to have a strategy that can under-perform, yet still have enough margin of error to make money trading.

Now using the risk of ruin table from above, do you notice any patterns when it comes to profitability? When you go further to the right on the top/horizontal axis increasing your payoff ratio (or Avg.+R per trade), you’ll notice the number of ways you can blow up your account decreases, while the number of ways you can make money trading increases.

Another way of stating this is:

You have more ways to lose money at lower payoff ratios, and significantly less ways to make money trading.

The obvious correlate to this is:

The greater your payoff ratio, the more ways you can make money trading, and thus have a smaller window to lose money.

In short: try to build a trading strategy with a payoff ratio > 1:1. You’ll have a much easier time handling draw-owns and recover faster when you get back on track. And that = more durability.

Trading Statistic #4: Most Beginning Traders Are Poor Learners

Being that we have over 10,000+ students in our trading courses, we’ve been able to collect a lot of statistics on our students, particularly when it comes to trading performance, and how they train.

In deciding to conduct an internal study on how our students train and learn in our online trading courses, we found dozens of fascinating statistics. But one pattern we noticed is that most beginning traders are poor learners and have bad learning habits.

Why do I say this?

When students buy one of our online trading courses, one of the first things they receive is a welcome email. In this welcome email, we explicitly instruct them to watch the welcome video 1st because it contains key information on how the course works, what training models we find best and how to best use our trading methods.

How many students actually watch the welcome video? <20%. And how many students actually watch the lessons in order? 27%. From this, I think we can make the conclusion that most beginning/struggling traders are poor learners.

Now ask yourself this: do you normally just read books out of order in terms of chapters? Do you try to skip belts and skills when training in martial arts or learning to play an instrument? No, so why do you do this when it comes to learning how to trade?

There are many likely reasons, but the lesson should be clear: don’t sacrifice your learning process by letting your impatience win the day. Doing so decreases the chances of you making money trading.

Trading Statistic #5: Proper Risk Management

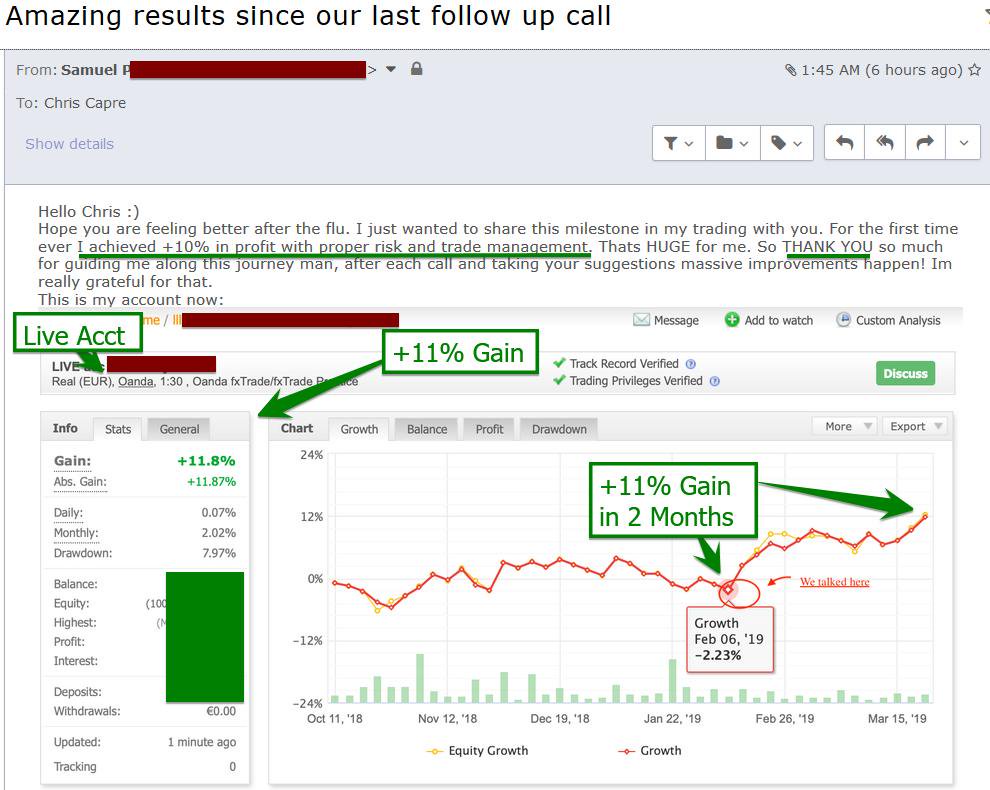

For my price action course members, they get a free skype analytics session with me whereby I analyze their trading performance over a number of trades, and help them find ways to make more money trading.

Many times, after 1-2 sessions, the student turns profitable. I recently shared an example of this on my twitter account with the student making +11% profit in 2 months.

Now out of the 1000’s of trading accounts I’ve analyzed from my students, how many of them are using consistent risk management on our first call? <30%! What I mean by ‘consistent risk management‘ is risking the same % equity per trade.

NOTE: To learn why we recommend a fixed % risk management system, hit that link.

To put it simply: if you’re not risking the same % equity per trade, then you could be risking more on your losses (and thus losing more), while risking less on your wins (and thus winning less).

That is outright masochistic. If you want a surefire way to blow up your account, constantly change the risk % per trade and just do what you want. However, if you want to bypass this avoidable pain and suffering, make sure you have a consistent risk management system and fixed % risk per trade.

Trading Statistic #6: How to Absolutely Fail At Trading

Over the last 12 years, I’ve gotten to review thousands and thousands of my students accounts, statistics and trading performance. I’ve taught many students to make money trading and become consistently profitable traders.

How many of my students were able to make money trading without proper risk and money management? ZERO! No explanation needed.

Hence, if you absolutely want to fail at trading, then just risk what you want without any data, math or statistics to support your decision.

In Closing

If you want to make money trading, you’ll need to know your stats and understand what the data is communicating about your trading performance. There are many ways to get sufficient data and statistics about your trading performance. Two free services you can use are myfxbook and fxblue.

I’d suggest getting your account connected to one of those services and looking at your data to see where you’re at. This will help give you a partial roadmap of how to become a profitable trader.

But beyond getting the stats, most likely you’ll need an experienced trader and trading mentor to evaluate your performance, and give you quantified feedback on how to improve your trading. That + the feedback and guidance they can give you to correct your trading mistakes can often be the difference between winning money, and losing money trading.

If you’d like to get actionable guidance on how to become a better trader, click here to join my price action course, giving you access to me, the members trade setups forum, and over 60 hours of trading lessons to improve your performance.

With that being said, por favor make sure to share your feedback with a comment below.

Until then, may you find real progress in your trading performance and mindset.

You often hear “It’s imperative to your trading success you are trading with New York Close forex charts…” but has anyone ever provided statistical evidence as to why you need these? Surely if its true, someone would be able to provide the evidence? I mean, you must need them to trade your pin bars, fakey’s and inside bar setups, right?

Or at least demonstrate how New York Close forex charts are what institutional traders are using?

In today’s trading lesson, I’m going to talk about what institutional traders are talking about, what they are not, and why pin bars, fakey’s, inside bars, and more – are NOT talked about by institutional traders.

If you do the research, the answer will become clear.

Watch this live forex trade on the $EURGBP profiting +121 pips with only a 27 pip stop loss!

In this trading video, I’ll share the exact price action strategy, stop loss and take profit they used to bank this winning trade, along with suggestions to improve trade performance.

Watch this live forex day trade profiting +91 pips on the $NZDUSD and a +5.95R return. Learn the exact trading strategy used, including the entry trigger, stop loss and take profit.

This trade also banked a +5.95R return, meaning for every $1,000 risked, they made $5,950 profit in return.

In this top forex trade review, we share with you a live trade from our student that profited +248 pips in just 4 days (trend-trading). His total +R return on this forex trade was +5.52, so for every $1000 he risked, he would have gained over a $5500 profit.

I’ll share with you his exact trading strategy, stop loss, take profit and ways that he could have improved his trade performance increasing his profit potential.

In this top trade review, we share with you a live trade from our student that profited +53 pips in 3 hours day trading the forex market (counter-trend).

His total +R return on this trade was +4.17, so for every $1000 he risked, he would have gained over a $4000 profit.

I’ll share with you his exact strategy, stop loss, take profit and ways that he could have improved his trade performance increasing his profit potential.