Today we’re going to have a look at a very interesting company in the healthcare sector, specifically the space focusing on minimally invasive care with the use of medical robots.

One company operating in this space is Intuitive Surgical (Nasdaq: ISRG) that produces and sells so called ‘da Vinci’ and ‘Ion’ surgical robots with strong focus on Artificial Intelligence (AI).

The use of surgical robots has steadily been increasing in the last decades as they allow for minimally invasive surgery which leads to fever complications, faster recoveries, shorter hospital stays and thereby lower costs for both hospitals and patients.

Now, why do we like Intuitive Surgical as a potential long-term investment? Here are a few key points that we think creates a strong case for continued and stable growth of the company:

- The company has already more than 6000 da Vinci robots operating globally with 1.2+ million surgeries being performed annually using their machines which accounts for 79% of the robotic surgery market.

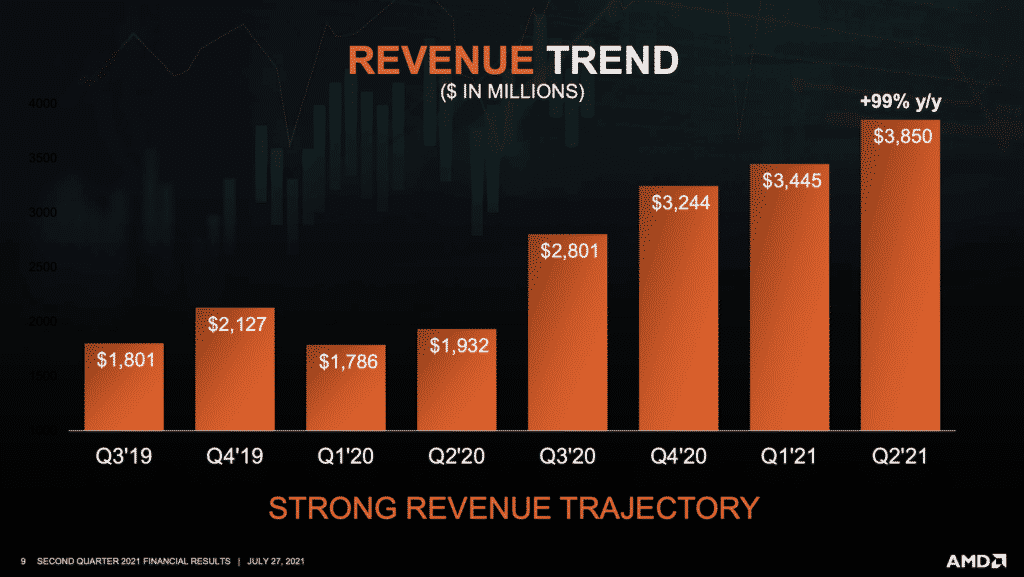

- Annual revenue has climbed to more than $4 billion in the last decade which is a 148% increase.

- It’s continuously introducing new robotic platforms such as the recent addition of the Ion platform which allows for minimally invasive lung surgeries.

- Each robotic platforms continuously needs accessories and service which creates strong recurring revenue annually.

These key points alone should get most investors interest.

Now, on top of this, also add the fact the company is pushing heavily into the field of AI and being a market leader in the field the amount of data they will be able to collect for machine learning is massive, adding further value to potential investors in the stock/company.

Thus, not only does Intuitive Surgical have a very strong core business in place, if they play their cards right, there’s a lot of untapped potential available for the company which is why we think ISRG is a great potential candidate for any long-term portfolio.

Technical Analysis

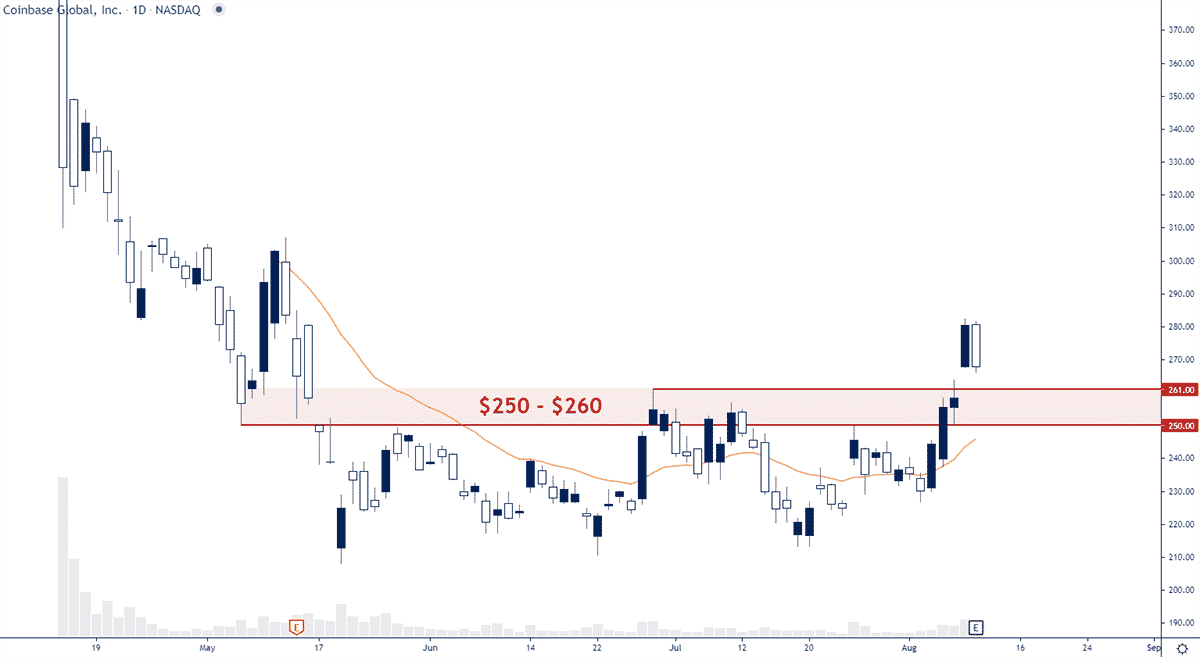

This stock has been a one-way-train pretty much since 2009 and current price action does not hint about any major pullbacks manifesting soon. Thus, investors looking to acquire this stock might have to settle for minor pullbacks in the strong long-term trend.

Looking at the weekly chart above, we do think that potential pullbacks towards the $875 and $825 support zone would be good opportunities to look for long-term entries in this stock.

Option Positioning

Currently there are about 28K calls and 25K puts, so a relative balance between the two. Option traders have about 12% of the gamma rolling off for the September Op-Ex, so not a gangster amount, thus no option expiry pressure at the moment.

The key gamma positioning is around $1,000, so we expect pullbacks here to be the first layer of support.

FULL DISCLOSURE: Chris Capre currently has no stock or option position in ISRG. If you’d like to learn more about Chris’s trades and positions, you can get access via the Trading Masterclass where he shares his live trades, further investment ideas and daily market analysis.

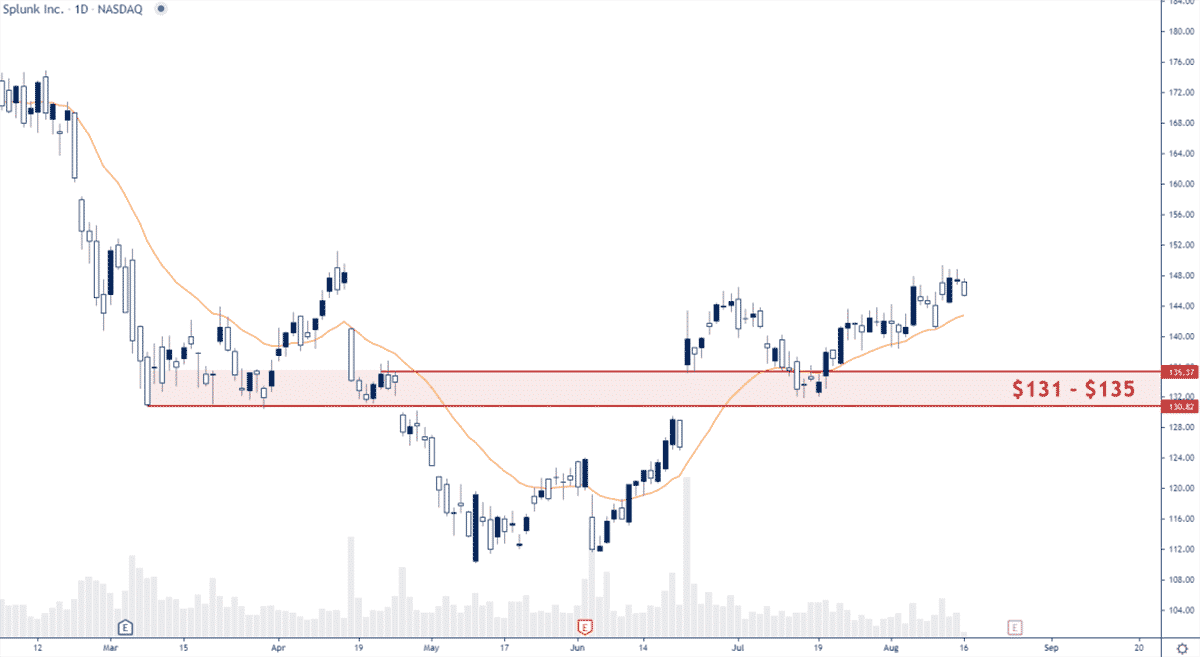

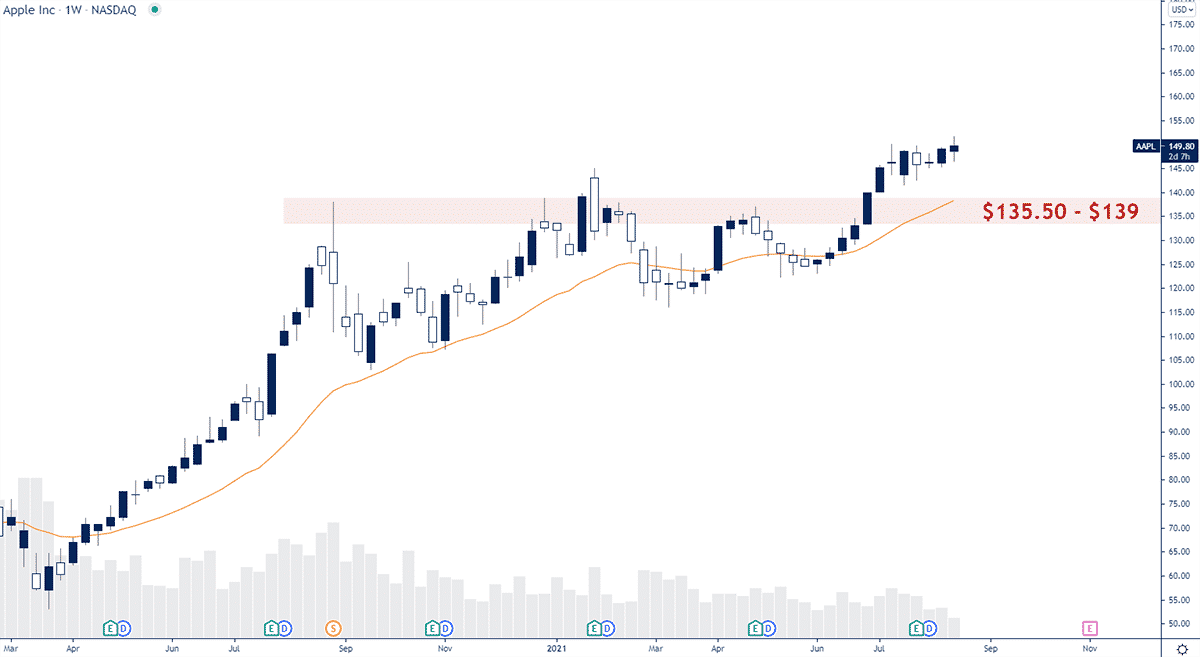

After holding for almost a year, the key resistance between $135.50 to $139 ultimately folded to the bullish pressure after a successful breakout in June this year.

After holding for almost a year, the key resistance between $135.50 to $139 ultimately folded to the bullish pressure after a successful breakout in June this year.