You could say the story of Codexis, Inc. (Nasdaq: CDXS) is one from the pages of a fairy-tale, with a happily ever after. After facing tough and potentially business-terminating decisions in 2013, the company came up trumps and has become stronger. Since then, the only two times Codexis stock price ended a year below its starting point were in 2019 and 2020. The year 2021 was a blast, but can this stock repeat this trick?

Source: RF._.studio

Codexis is a synthetic biotech that produces enzymes that help pharmaceutical companies reduce waste, thus increasing yield. The biotech company now has companies like Merck (Januvia) and Tate & Lyle (Stevia) in its customer books. Other companies in its books include most of the biggest pharmaceuticals. This is a testament to how useful the products that emerge from Codexis are.

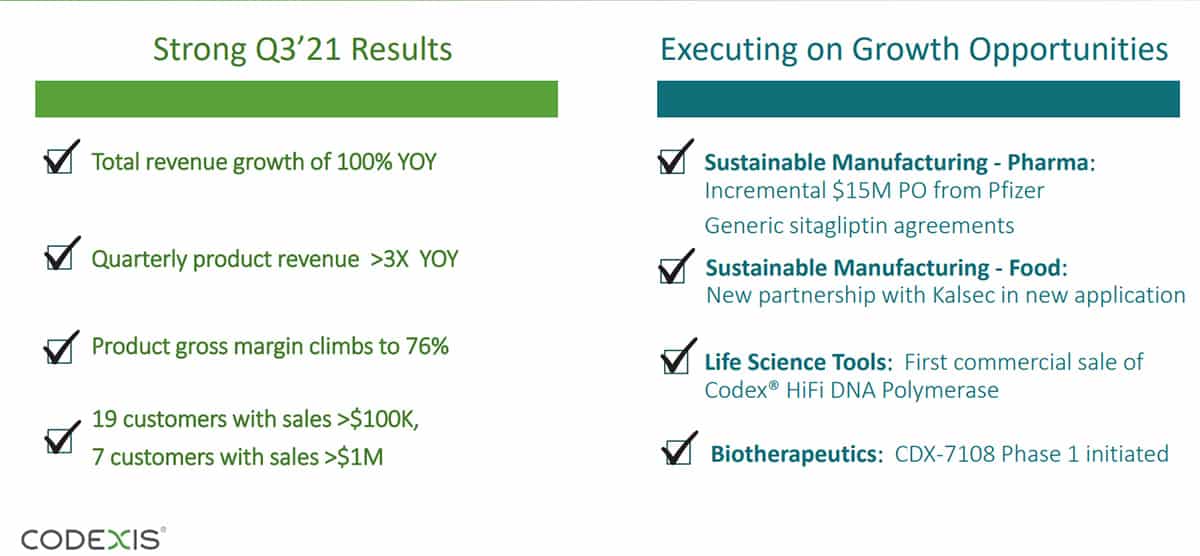

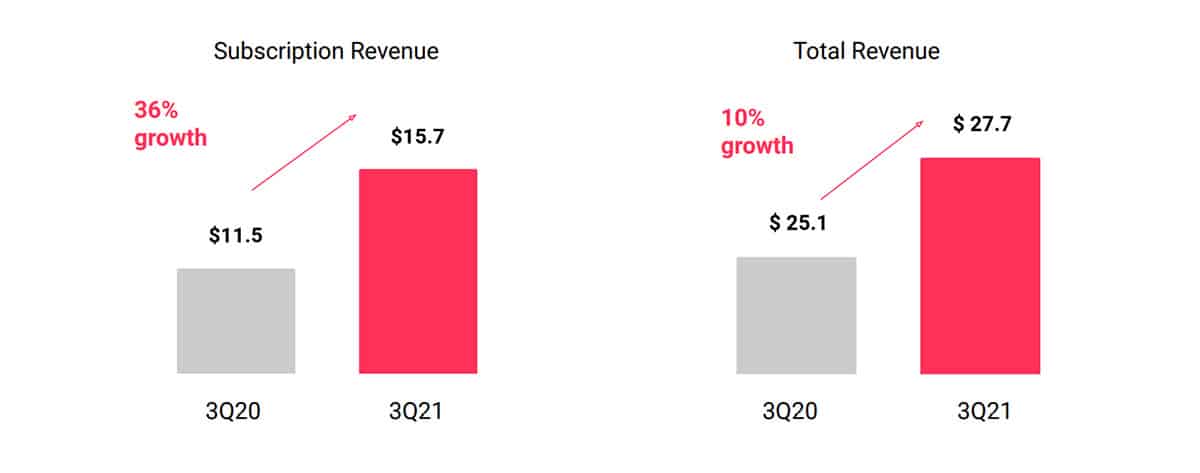

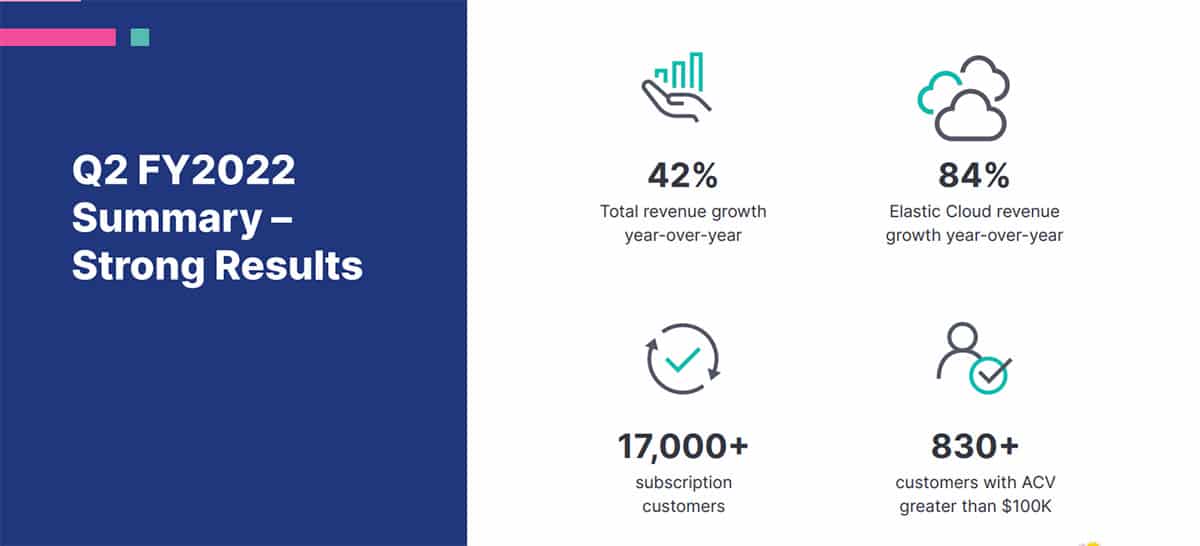

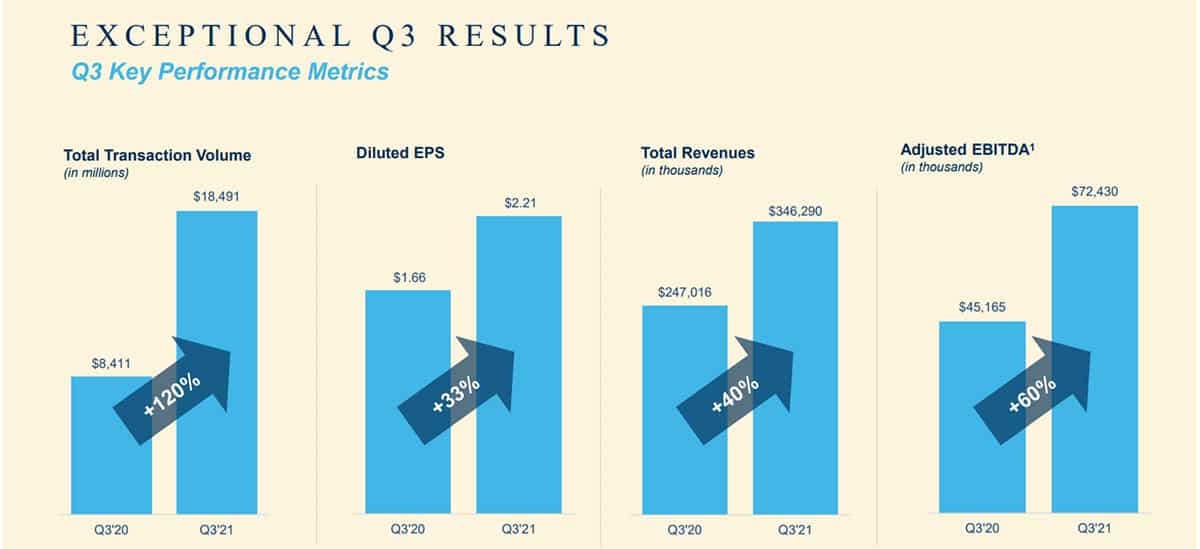

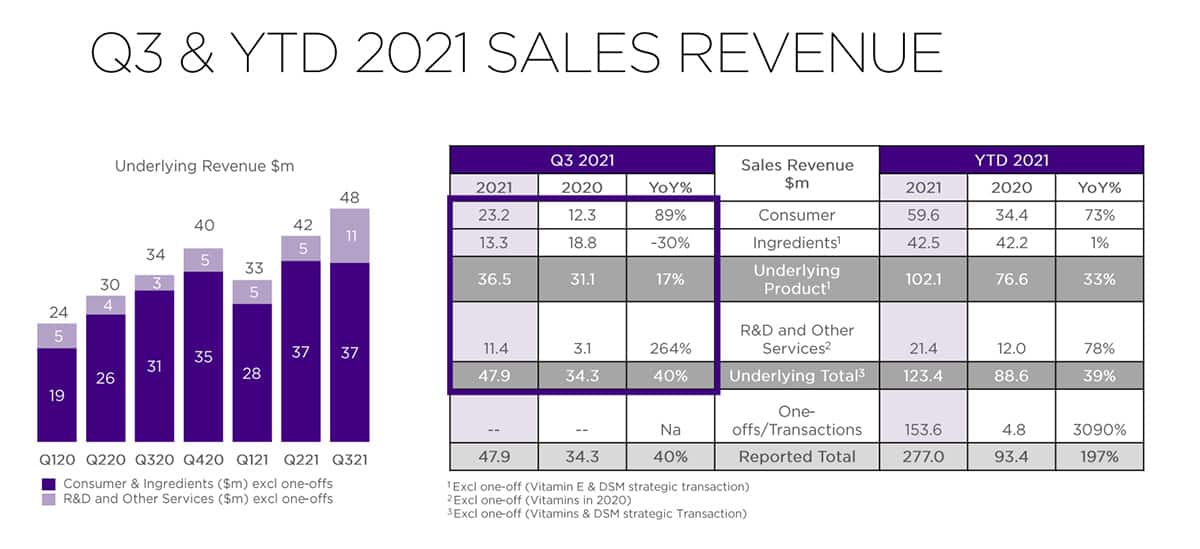

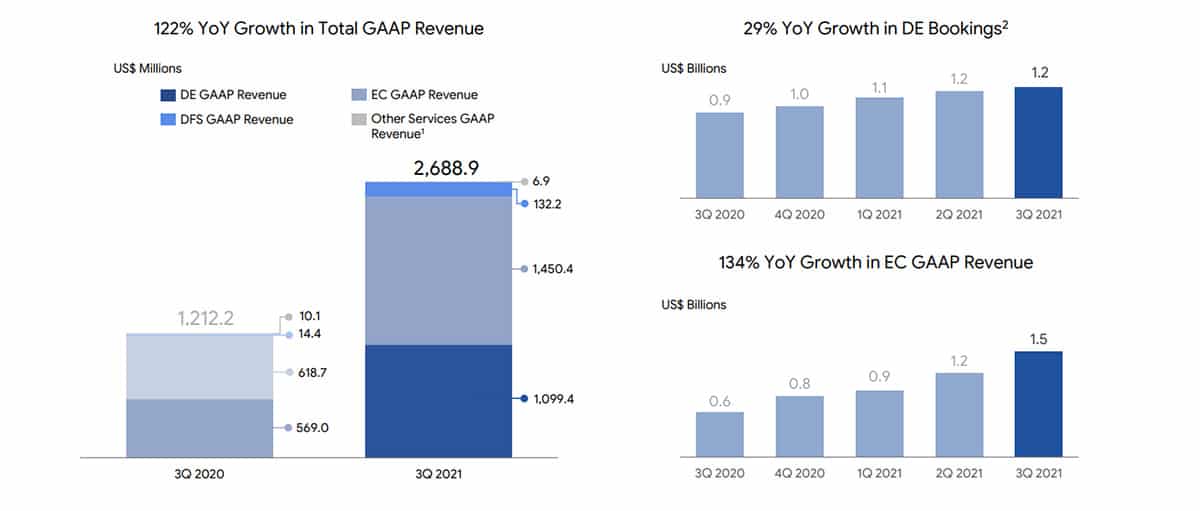

Revenues are looking good for Codexis, as the company recorded a 100% year-on-year growth to $36.8 million in total revenue in the 3rd quarter of FY 2021. The company’s Performance Enzymes made up 88% of the total revenue while Novel Biotherapeutics made up the rest. And with $119 million in cash, the company has a lot of free cash to burn to sustain its growth.

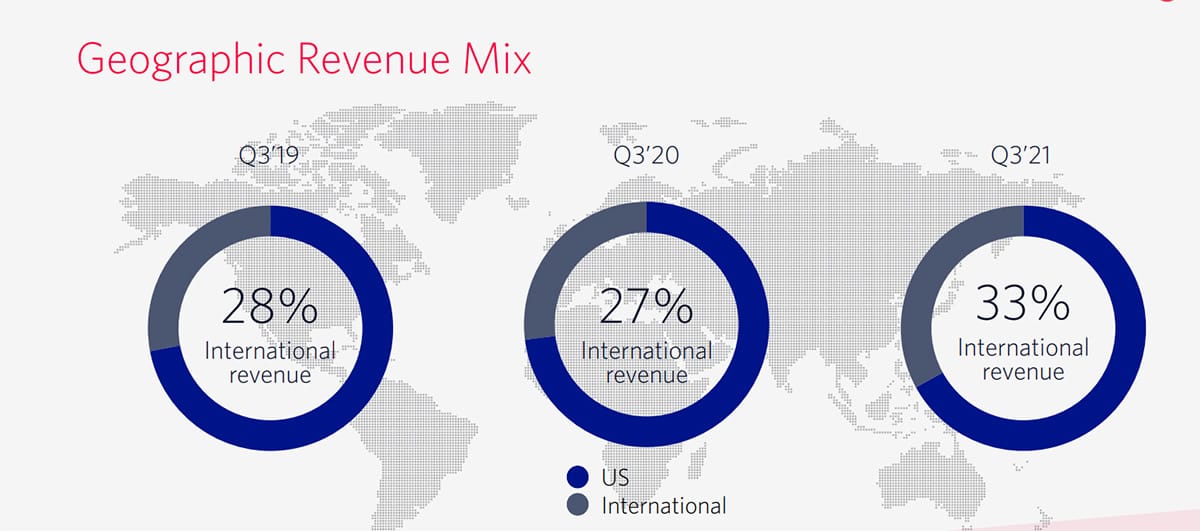

Source: Codexis

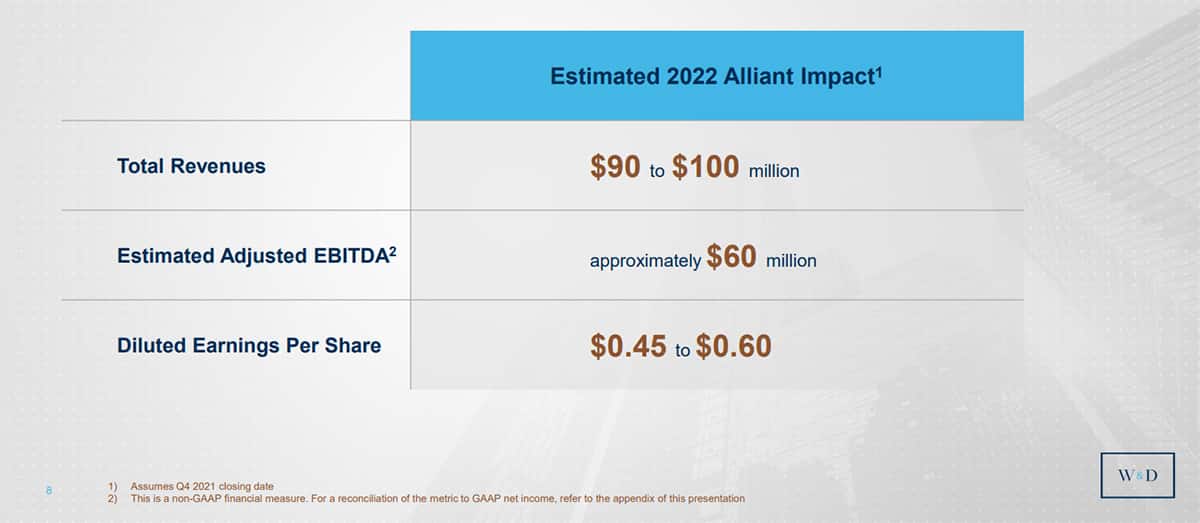

With these exciting growth narratives, it is safe to say that Codex ended the quarter on a strong note. It’s no wonder it has the confidence to increase its FY 2021 guidance to a $98 million to $103 million total revenue.

Technical Analysis

Contrary to the Wix stock which we most recently reviewed, 2021 was a great year for holders of Codexis shares. The stock soared by almost 90% before taking a breather in November. The breather came in the form of a correction that pulled the stock down by 35% from its all-time peak of $42.

After bouncing aggressively off the $28 – $30 support level, CDXS looks set to continue its bullish charge. It has risen by 8% from the support level as we speak. There may be more upside for this stock, as it currently sits in the bullish territory above the 25, 50, and 100 simple moving averages.

The closest upside price target for CDXS is at the $40 – $41.6 resistance level. But if the stock fails with this attempt, it may consolidate for a while or fall back to the lower $18 – $19.5 support level.

Long term, we remain bullish on this stock.