If you would invest in a new growth stock, it would be one that has reported at least two quarters’ worth of revenue as a public company and isn’t facing hostile competition from everywhere. Lucid Group, Inc. (Nasdaq: LCID) isn’t any of these. Why then is there a lot of noise behind this stock, with investors being highly optimistic?

Source: Lucid

Lucid operates in the Electric Vehicle (EV) manufacturing industry, and many investors are pitching it to be a tremendous competition for Tesla in the coming years. While there’s no way to be certain about that, we know why investors are optimistic about the stock.

The EV manufacturer made its shares tradable to investors in the US in late July, but nothing really happened until the EPA gave its longest-ever EV range rating (520 miles) to Lucid’s Air model in September. The Tesla product with the highest rating, Tesla Model S, falls short by an entire 100 miles. An EV’s mile per kWh is one of the major yardsticks with which the technology of the manufacturer is measured. And having been redesigning, re-engineering, and remaking their batteries since the company was established in 2007, the achievement of this feat isn’t surprising.

Lucid recently made its first set of customer deliveries of Lucid Air, and the customers are full of praise for their purchases. Wall Street called it a “worthy Tesla opponent”, and Fortune said it “blows Tesla away.” Even Motor Trend had a lot of positives about the EV before eventually awarding the car the Motor Trend Car of the Year award.

The EV manufacturer intends to build enough capacity to produce 20,000 units of the Lucid Air model by 2022, and be able to produce 500,000 electric vehicles by 2030. The manufacturer also plans to add three more launches to its collection in 2022.

Everyone looks forward to seeing how Lucid scales going forward. But if the company can match the success it’s had with the Air model, the stock could be valued much more than it is now.

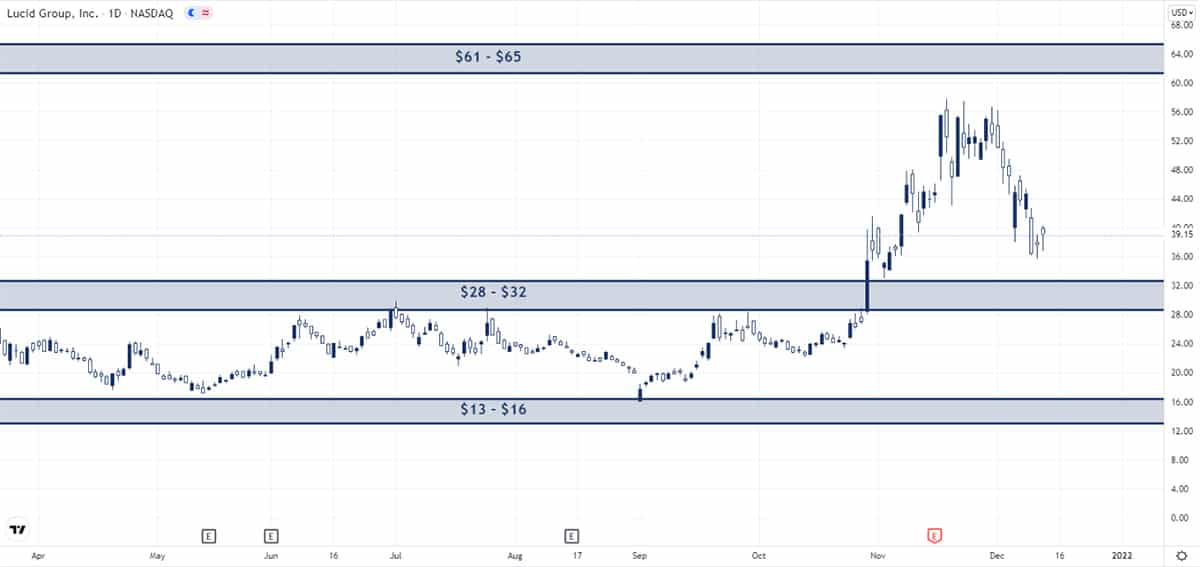

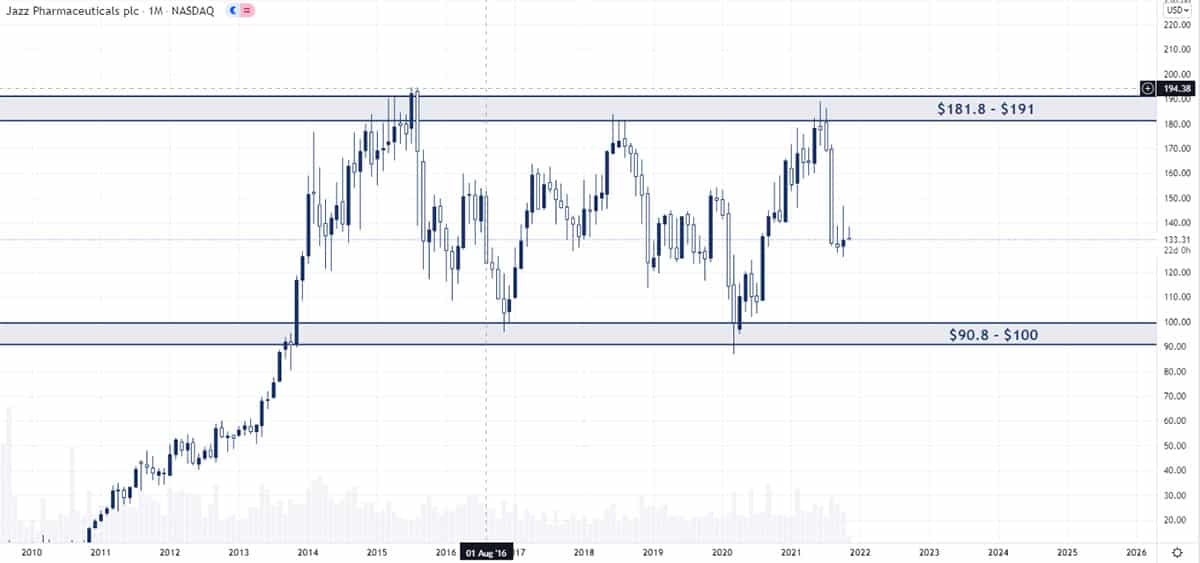

Technical Analysis

The recent cascade of good news has caused the Lucid stock to leap in recent weeks. The stock hovers between the $61 – $65 resistance level and the $28 – $32 support level. Whatever happens here could determine what happens to the stock in the near future. A breakout from the resistance level could mean a continuation of the bullish trend, while the breakout from the support level could send the stock price even lower.

But whether you buy at a breakout or a return to a support level, we hold a long-term bullish outlook on the stock provided the fundamentals remain steady.