There are a multitude of markets, strategies, and styles for how traders make money. As a whole, traders make money by speculating on the rise and fall of the prices of financial instruments. The various markets traders often speculate on are stocks, options, forex, crypto, commodities, fixed income, and other derivatives.

Traders place buying and selling orders that end up with a profit if their trade thesis is correct, and a loss if it’s not. Below we’ll give a comprehensive explanation of the various possibilities on how traders make money.

The Various Markets Traders Can Make Money In

The are numerous markets where traders can participate with other buyers and sellers to make money. You’ve probably heard about the stock market, the option market, the forex market, the crypto market, the futures market, or the commodities market. Each market offers various financial instruments traders can buy and sell to profit from a change in price.

We’re going to go through these various markets and how a trader makes money in each.

Who Is A Stock Trader, And How Do They Make Money?

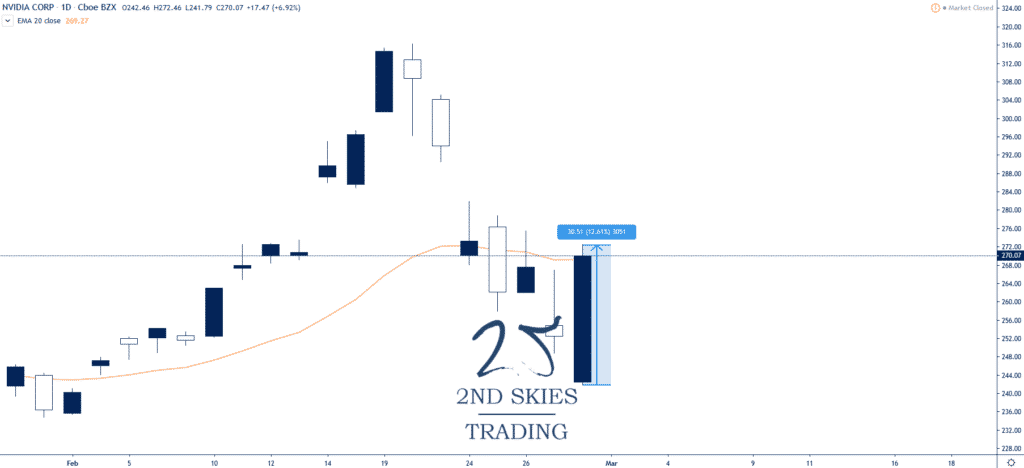

Stock traders are individuals or groups that make money off the rise or fall from a company’s stock price through buying and selling. The amount of money a stock trader makes is determined by a) the size of their position (in shares) and b) the dollar value the stock share prices move in their favor

Some basic ways a stock trader makes money:

Buy Low, Sell High

This is a method through which stock traders aim to buy a stock when it’s cheap and sell it off at a higher price in the future.

Imagine it’s 1998 and you think Amazon could be worth much more than it currently is in a couple decades. You decide to buy $5000 worth of Amazon shares at $5 per share which would be 1000 shares. Two decades later, you return to your trade and find that the stock price of Amazon is now over $2500 per share. You own 1000 shares of Amazon, and at $2500 per share, your initial 5K investment is worth $2.5 million dollars.

You happened to buy Amazon when it was ‘low’ and had correctly assumed it would gain in price, thus selling it higher. This is one of the simple ways in which you can buy low and sell high.

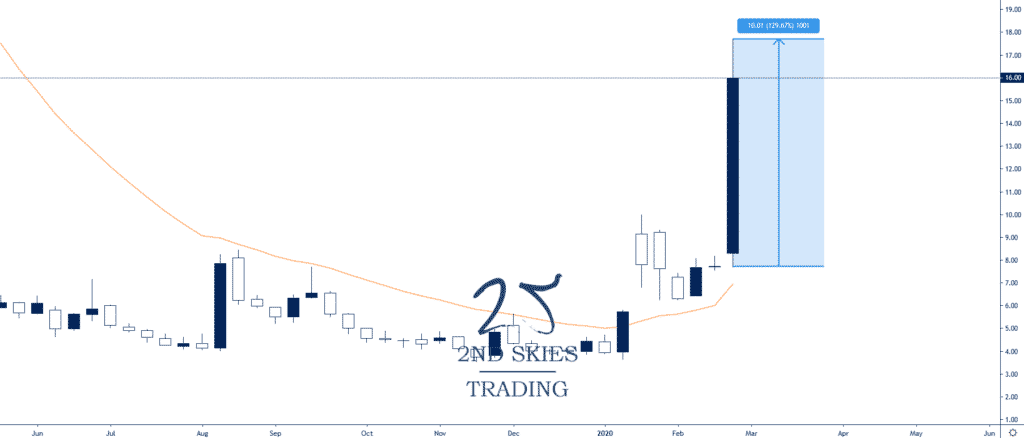

Short Selling

Another way to make money through stocks is what we call short selling. This is the opposite of the example below above. Here the goal is to sell high and buy back lower.

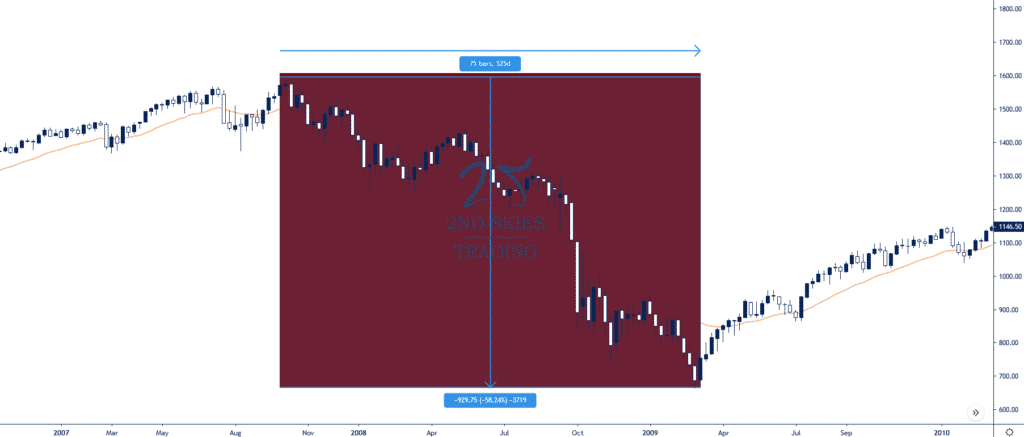

Let’s imagine it’s 2007 and you’re worried about the housing crisis and how it might affect banks who own a lot of the mortgage back securities that were so rampantly traded.

You found a stock you think is vulnerable to the housing crisis called Bear Stearns. It’s currently priced around $120 per share, and you think it can go lower, so you decide to ‘short sell’ the stock. Now how do you sell a stock you don’t own?

Technically you ‘borrow’ the shares from someone who has them, then sell them, then buy them back later for a lower price, thus pocketing the difference.

Since you were pretty prescient and were right about Bear Stearns going lower, over the next several months, the stock went down from $120 per share to $60 per share, and you closed it out for a $60 per share profit.

That is how you short sell a stock.

Dividends

One of the unique ways a stock trader makes money is by buying dividend stocks. Dividend stocks are stocks of companies that pay income to their investors quarterly, or annually via a ‘dividend’ which is a small distribution of cash from the company to the shareholders. This is done as a reward for owning their stock. The dividend a shareholder gets is often a percentage of their investment.

Hence, every time a dividend is given by the company at scheduled dates per year, you can either a) get the dividend proceeds put into your account, or b) have those dividends reinvested into more shares, thus increasing the size of your position.

Traders who often seek dividends are looking for ‘passive’ income as they don’t have to do anything to get the dividend income.

Who Is A Futures Trader, And How Do They Make Money?

A futures trader trades ‘futures’ contracts with a broker to buy or sell a financial instrument at an agreed price and time (in the future).

Imagine you think the price of a commodity may rise by the next 6 months. Futures allows you to get into a contract that mandates you to buy the commodity by December at an agreed price if you don’t close it before the future contract date. Your contract is with a broker or a dealer.

When December comes, if the commodity increases in price as predicted, you profit. But instead of buying it at the current high price, you can buy it at the lower, agreed upon price. The difference between the current price and the price you purchased it at is your profit.

However, if your speculation is wrong and the commodity’s price falls below your agreed upon price, the contract mandates that you buy it in December at that higher price for a loss.

Keep in mind this is only if you don’t close the future contract before the contract expiry.

Who Is An Options Trader And How Do They Make Money

Options trading is a form of derivative trading whereby you trade contracts that are called ‘options’ on an underlying stock, index, or ETF. They are called ‘options’ because you have the option to convert your option contract into a long or short stock/index/ETF position, or close it for a profit/loss based upon how the trade works out.

All options are traded on a specific underlying (like a stock or ETF) at a specific ‘strike’ price on a specific expiration date.

If the contract moves in your favor, either in terms of direction, time, volatility, or any combination of the three above, you profit. If the sum total of the ways above moves against you, you take a loss on the trade.

All option contracts are traded for a ‘premium’ which is the value of each contract. For example, you could buy a call option on Apple stock at the $150 strike price for the June 17th expiry for $3.00 with the $3.00 being the ‘premium’.

Each contract you trade is for 100 shares, so 1 contract x $3.00 x 100 shares = $3.00.

If Apple stock rises and your call contract is worth $5.00, then you profit the difference $5.00 – $3.00 (premium you paid) which is $2.00. For one contract, that would be a $200 profit, or a 66% increase on your investment.

The beauty of trading options is that you can make money on the stock going in your direction, you can make money via time, you can make money by an increase or decrease in volatility in the underlying, or any combination of the above.

Options simply give you way more ‘options’ in terms of how to make money, far more vast than simply buying and selling, or needing the stock to go up or down.

Who Is A Forex Trader And How Do They Make Money

The Forex (or foreign currency exchange market) is another financial market that allows traders to make money by buying and selling currencies against other currencies. If you own US dollars and spend US dollars in the US, the overall value of your US dollar going up or down against other currencies doesn’t matter too much to you.

But when you travel abroad to another country, the value of your US dollar versus other currencies matters. When you trade currencies, you’re always trading the value of one currency versus another.

Forex trading deals with currency pairs, which are two currencies valued against each other. The most popular and traded currency pair is EURUSD, with the first currency (EUR = Euro_ being the main currency, and the second currency (USD = US dollar) being the ‘counter’ currency. So, if the price of EURUSD is 1.21, it means 1 Euro is worth 1.21 US Dollars.

Another example of a currency pair is the USD/JPY—which is the US dollar vs the Japanese Yen. If the price of the USD/JPY pair is 101, it means 1 US dollar is worth 101 Japanese yen.

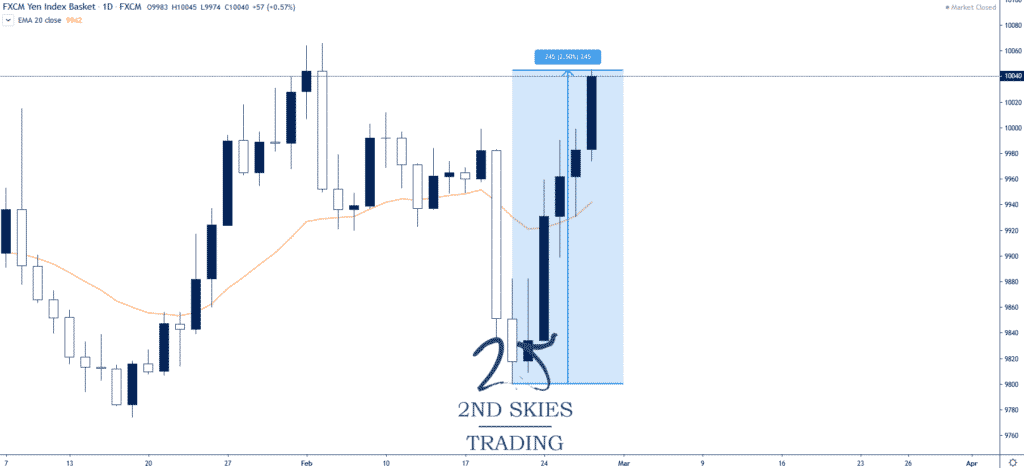

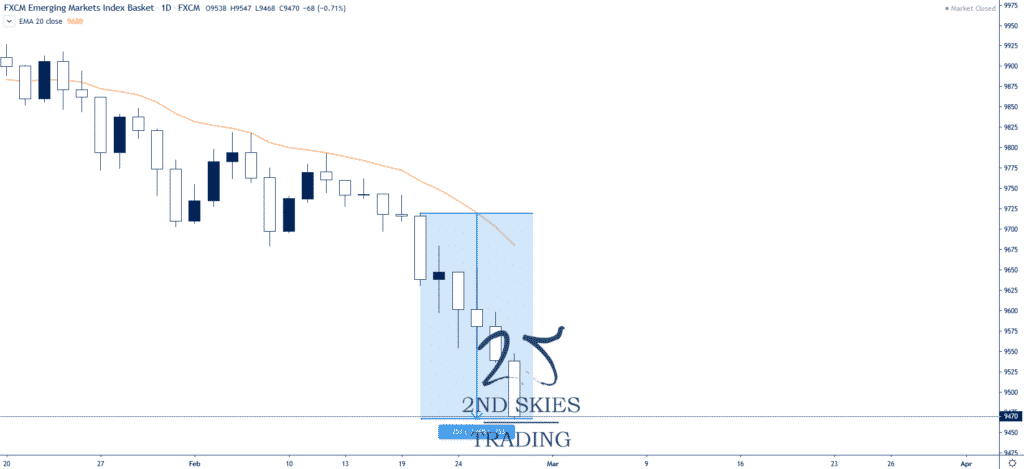

When trading Forex, you profit through the fluctuations in the price of a currency pair going up or down. This means you can make money in both directions and can trade long (buying the first currency against the counter currency) or short (selling the first currency versus the counter currency). If you buy the EUR/USD pair and it goes up in value from the time you buy it, you profit. If you sell the USD/JPY and the USD goes down in value to the JPY, you profit.

Hence by making trades on the value of one currency against the other, you can profit.

Who Is A Crypto Trader, And How Do They Make Money?

Crypto trading is the latest entry into the financial markets space. A crypto trader speculates on the price of cryptocurrencies, intending to profit when their speculations are correct. Just like trading forex, when you trade the value of one crypto currency, you are doing so by trading one crypto currencies value against another.

There are several ways to make money through crypto trading, but the most popular are:

Spot Trading

This method involves buying a cryptocurrency at a low price to sell it at a higher price. Spot traders must purchase/own the cryptocurrency they are trading.

Futures Derivatives Trading

This method involves trading cryptocurrencies as commodities in the futures market. Unlike how it is in spot trading, the trader doesn’t have to own the cryptocurrency(s) being traded before they can make money from it.

Arbitrage Trading

Arbitrage trading takes advantage of the different prices of the same cryptocurrency across exchanges. A cryptocurrency exchange is a financial platform that allows you to buy, sell, and trade your crypto assets.

So, a trader may buy bitcoin (a popular cryptocurrency) from one exchange with a lower rate and immediately transfer it to another exchange where the same cryptocurrency is listed at a higher price, selling it for a profit.

Methods For Trading the Financial Markets

While we have discussed the essentials of how traders make money, this article would be incomplete if we didn’t offer you a glimpse into how traders decide on what to buy or sell.

This brings us to various methods for trading the financial markets.

There are two main trading analysis methods for traders, regardless of whether they’re trading stock, forex, future, crypto, or options. These trading methods are:

- Fundamental Analysis

- Technical Analysis

- Sentiment Analysis

- Flow based Analysis

What does each mean?

Fundamental Analysis

Fundamental analysis is primarily focused on the macro/economics behind the underlying instrument to try and determine if the stock/currency/etc will rise or fall.

For a stock, this could include looking at the earnings figures over a period of time, the financials of a company, the price to earnings ratio, or many other economic variables behind the company’s performance to determine its value and if it should be priced higher or lower.

While we feel this is an important aspect of ‘information’ that drives price, we feel its incomplete by itself.

Technical Analysis

Technical analysis is a methodology focused on using charts and technical pieces of information to determine if the underlying is under or over-priced (meaning should it go up over time or down over time).

Technical analysis involves using price charts of the underlying over various ‘time frames’ from the 1 minute charts (for day trading) up to the weekly or monthly charts (for long term trading).

Traders who use technical analysis can employ strategies using price action, indicators and other technical methods to determine what the next direction and price is more ‘probable’ for the underlying.

While we consider technical analysis important as a piece of ‘information’ to make trading decisions, we also feel its incomplete by itself.

Sentiment Analysis

Sentiment analysis involves using the overall ‘sentiment’ (or impression) of the underlying to determine what the majority of traders are most likely to do with the underlying (i.e. buy or sell it).

This can include using data sets like social media (positive vs negative mentions), the number of people talking/writing about the underlying, the ‘commitment of traders’ reports for forex currencies, and more.

This approach takes a ‘gestalt’ approach to traders assuming that which is most discussed or talked about is most likely to move.

While we consider this an important piece of the ‘information’ puzzle regarding trading, we also feel its incomplete by itself.

Flow Based Analysis

Flow based analysis involves looking at data sets that give traders information about the order flows of the market. This could include looking at the volume of shares traded, the open interest and volume for the options traded, looking at time and sales, level 2, or other forms of analyzing flows.

In our perspective and 21 years of trading, this is the most important methodology for analyzing the market and making buying and selling decisions.

Why?

Because all forms of information used to make buying and selling decisions must eventually become an order (a buy or sell order). Once that order becomes ‘actualized’ (meaning activated in the markets) it becomes part of the entire pool of orders.

Order flows are the one thing all the various models have in common. They must all go through the channel of becoming a buy or sell order.

And the collective order flow in the markets is the most proximate driver of price action. Thus, if this is the most ‘proximate’ driver, then this is the closest derivative we have to understanding how the price action on our charts changes moving up and down over time.

Thus, we prefer this model simply because it doesn’t matter what the ‘reason’ a trader bought or sold something (whether it was technically based, fundamentally based, sentiment based, or flow based), the common denominator in all of them is they all become an order which becomes part of the flow.

Hence our methodology focuses on what are the flows that are driving the market (regardless of the reason behind them) and then look at that to determine how the price will move.

Categories of Traders

Traders come in different categories or types. The trading category a technical trader belongs to depends on their personality, capital, and time horizons for holding positions.

The categories of traders are:

Swing Traders

Swing traders are characterized by trades that last for over a day and generally up to a few weeks or months. They are interested in catching substantial market moves that often last for days or even weeks.

Because of its nature, swing traders often refer to the hourly and 4-hour timeframes to make their trades. Although they may check other timeframes of the same commodity to get a clearer view of the market, you’ll mostly find them on those two timeframes.

Swing trading does not require much time on the chart, so traders who are busy with other jobs might prefer this.

Position Traders

Position traders are long-term traders. They make trades that last for months or even years. Warren Buffet is a position trader who likes to hold positions over long periods of time and capture large trends.

Position traders are primarily unconcerned about minor short term price fluctuations on the chart. Instead, they’re in the trade with months or even years in their crosshairs.

The daily, weekly, and monthly timeframes are the favorites of position traders. Also, position trading requires even less time on the chart than swing traders.

Day Traders

Day traders want to start and end trades within a single trading day. Some day traders even close every open trade at the end of their trading hours because they don’t want to leave them open overnight.

Day traders make decisions quickly and therefore must think and calculate quickly. They most commonly use time frames from the 1 minute up to the 1 hour chart.

Scalpers

Scalpers are traders that attempt to accumulate many quick profits from small trades that only last for minutes, sometimes even seconds. They don’t care about the big moves, unlike the position or swing traders.

Scalp traders base their trades on the accumulation of many trades regardless of the general market trend. The 5, 10 and 30 second charts along with the 1-minute, 3-minute and 5-minute timeframes are most commonly used for scalpers.

Algo Traders

While the financial markets have been around for decades, algorithm traders (algo traders) are only as new as a few years ago.

Algo traders rely on computer algorithms to make trades on their behalf. These traders may not know much about the financial markets they’re trading, but they trust the computer to make their trades.

These categories are not constricting. A trader can switch from one to another as it pleases them. Again, it mostly boils down to trader personality and natural skill sets.

Can Trading Make You Rich?

Trading can make you rich, just like many businesses or professions. However, not everyone will be rich in trading. In fact, the statistics of traders who failed in trading way outnumber than those who became successful.

Trading takes a lot of time to master as it requires many skills to develop before you can make money trading. And trading is very risky so its important you understand all the risks involved in trading, specifically as it pertains to the markets you are trading.

How Much Do Traders Make Per Year?

It is hard to tell how much a trader makes per year because there are a lot of factors involved, such as capital/investment amount, trading skill, trading instruments, and so many more.

Two traders may buy the Amazon stock at the same time and price, but one may buy more shares than the other. Also, one may be using leverage, allowing them to potentially gain more than the other who isn’t leverage trading. And for each trader, the losses or gains would be different.

By the way, leverage is an extra amount a broker lends you to make trades that your capital would typically be unable to cover, thus increasing your potential profit (or loss).

Generally junior traders at major banks are making $200-300K per year in their first few years, but many of the top bank traders are making tens of millions per year.

Conclusion

If you forget much of what we covered in this article, remember the following key notes:

- Traders make money through their speculations about the price fluctuations of financial instruments. They then make trades to back their speculations.

- The trading analysis methods are fundamental, technical, sentiment and flow based trading methods. Fundamental traders use news and economic reports to inform their trading decisions. Technical traders use charts containing the historical price movements of the commodity to inform their trades. Sentiment traders are interested in the overall gestalt of what traders think (positively or negatively) about the instruments they are trading to make decisions. Flow based traders look at the overall buying and selling flows to see where the price is most likely to move.

- Traders come in categories, including swing, scalp, day, position and algo traders.

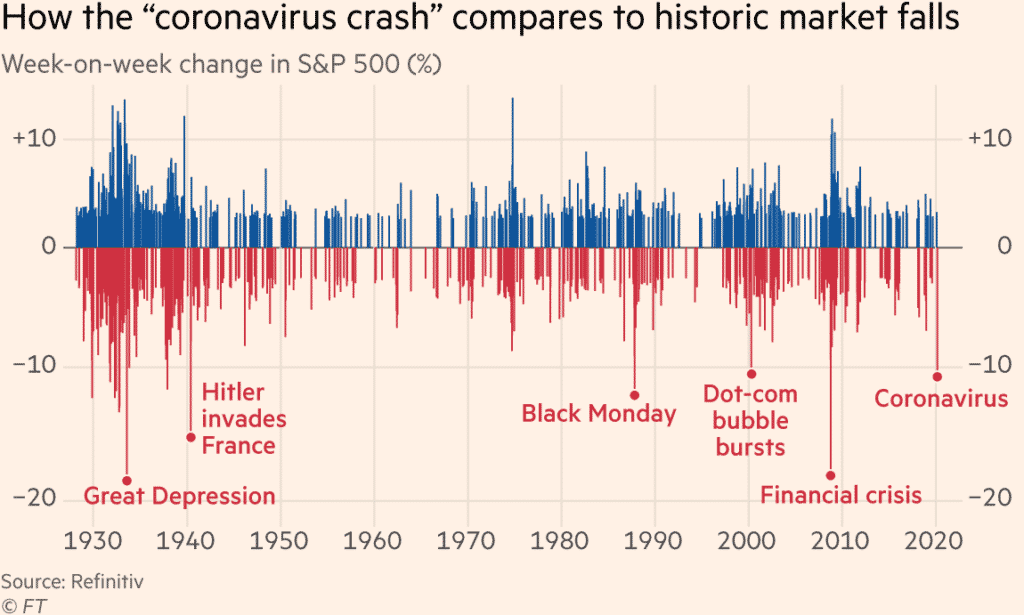

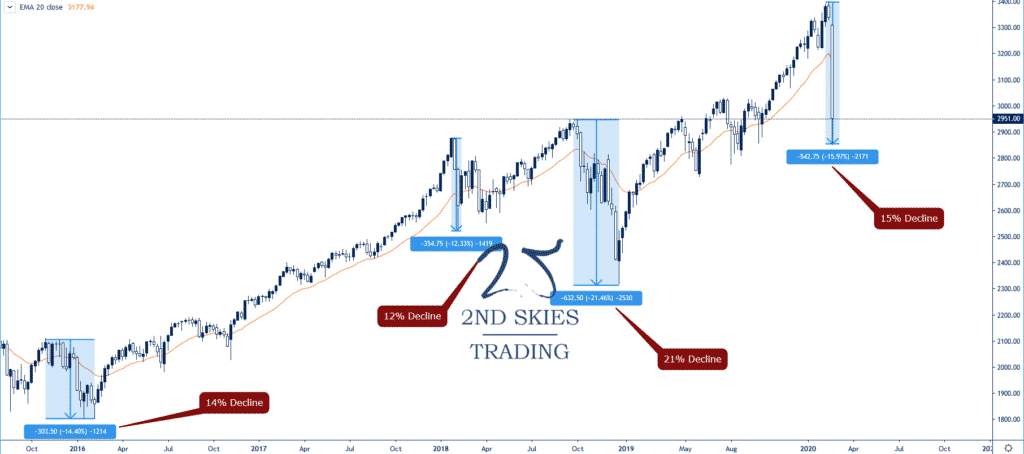

And finally, remember that the financial markets are very volatile and not constant, but dynamic. You could lose all your money invested if you don’t have proper risk management strategies.