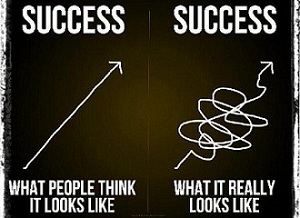

Did you know you could have a 50% accuracy ratio for your trading, always have a 2R profit target, and still lose money? Its true, (although its a low probability), but remains true nonetheless. How? Because of two key factors: % account risked and your risk of ruin ratio. At a bare minimum, you have to understand 4 things about your trading to know mathematically if you will make money.

What are those 4 things? That is what this forex money management plan article is going to cover in detail. I will begin by discussing what these 4 things are, and how not knowing them will hurt your account. Then I will describe the risk of ruin formula and why its essential for your trading performance. I will end by sharing a forex money management secret that will impact how you think about money management and risk.

The 4 Things You Need To Know

Any article discussing forex money management plans and performance without discussing risk of ruin is incomplete at best and detrimental to your account at worst

Why?

Because at a bare minimum, you need to know 4 things about your trading to know if you will make money or not. They are the following;

1) Risk to Reward Ratio

2) Accuracy

3) % Risked Per Trade

4) Your Risk of Ruin

Simply put, you could be trading a 1:2 reward to risk ratio, and still lose money. You could know #1 along with your accuracy, and still lose money. You could know your % risked per trade and still lose money. But if you know those three + #4, you can mathematically know whether you will make or lose money.

How?

The Risk of Ruin Formula

What is the Risk of Ruin formula, how does it apply to my trading performance?

The risk of ruin formula is designed to communicate statistically if you will make or lose money trading. You can mathematically know for a fact if you will make, or lose money by knowing your risk of ruin. But you cannot calculate the risk of ruin formula without three key pieces of data. They are:

1) Risk to Reward Ratio

2) Accuracy

3) % Risked Per Trade

Combined together, these above will give you your risk of ruin (ROR). The ROR is a number representing the % chance you will ‘ruin’ your account, e.g. blow it up. Not a pleasant thought, but a highly useful piece of data and essential for your success.

What you want is a 0% ROR (risk of ruin) or a 0% chance of blowing up your account. The inverse of this is you mathematically will make money.

Now remember the first thing I said about how a trader with 50% accuracy always having a 2R reward could still lose money? Let me share why via two risk or ruin tables below.

Trader A Risking 10% of Account Equity ROR Table

| Win Ratio % |

Payoff Ratio 2:1 (2R Profit) |

| Win Ratio 40% |

14.2 |

| Win Ratio 45% |

3.41 |

| Win Ratio 50% |

.813 |

| Win Ratio 55% |

.187 |

| Win Ratio 60% |

.0401 |

| Win Ratio 65% |

0 |

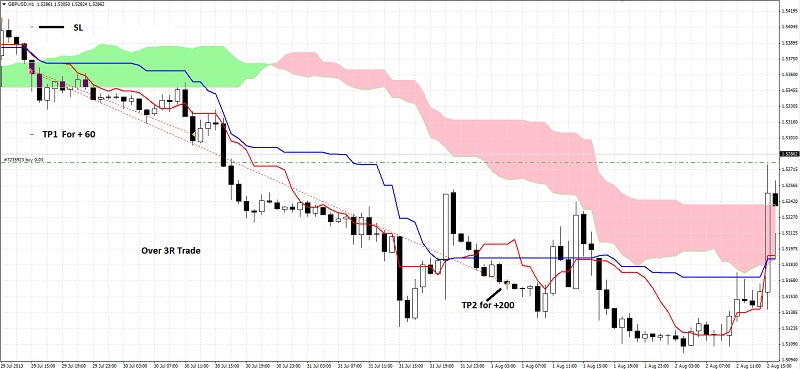

Looking at the chart above, by risking 10% of your account equity per trade, having a win ratio of 50% and a payoff ratio of 2:1 (2R per trade), you have a .813% chance of ruining your entire account. Although this is a low probability, it is still a possibility. You actually have to be 65% accurate to mathematically ‘know’ you will make money.

Now lets take the same win and payoff ratios (50% / 2R), reduce the risk per trade to 5% of your total equity, and see how the numbers change.

Trader B Risking 5% of Account Equity ROR Table

| Win Ratio % |

Payoff Ratio 2:1 (2R Profit) |

| Win Ratio 40% |

2.03 |

| Win Ratio 45% |

.116 |

| Win Ratio 50% |

0 |

| Win Ratio 55% |

0 |

| Win Ratio 60% |

0 |

| Win Ratio 65% |

0 |

In this second table, only those with a 40-45% accuracy have a mathematical chance of losing money. But those at 50% accuracy have a zero % chance of losing money, thus mathematically will make money. What is the key difference? The % risked per trade. This is why it is absolutely critical to your money management strategy to use a % equity risk model, not a meaningless ‘dollar risked per trade’.

Also notice how risking 5% per trade instead of 10% drastically changed the accuracy levels needed to make money? Trader A needed a 65% accuracy level to be certain they could make money, while Trader B only needed a 50% accuracy level – a 10% difference!

It should also communicate an essential point;

Any forex money management strategy article or website talking about trading without mentioning the above, is giving you totally incomplete information about money management which could kill your account. In essence, you could be trading blind to the numbers which hugely determine your success or failure in trading.

A critical piece of information? Absolutely. Something you’d want to know? I’d certainly hope so.

One Last Point (A Secret About Money Management)

There is one thing almost never talked about when discussing trading money management strategies. It is a huge point why working with a % equity model is far superior to ‘dollar risked per trade’. And it has to do with your mind.

If you are setting the risk per trade based on a ‘dollar value’, that dollar value actually means more to your mind (and thus emotions) than an ‘neutral’ % of your account. Why? Because you spend money in terms of dollars (or euros, or whatever your local currency is), not %’s of your account.

So if you are making a trade, and thinking ‘Oh, I’m going to risk $5,000 on this trade‘, that very thought of ‘$5,000’ can (and most likely will) conjure up a host thoughts about rent, bills, car payments, or a wave of other things.

These thoughts are far more likely to engage any fears you have about the ‘dollars you are risking per trade‘ than a neutral 1 or 2% which has ‘no reference‘ to how much you spend, may need, or what it could buy. In essence, there is no ‘trigger‘ in your mind about % risked per trade, but there certainly is about the ‘dollars risked per trade.’

By shifting your trading money management strategy and trading mindset towards a % equity model, your mind will be more focused on the actual trade. This is opposed to dealing with the thoughts ‘Oh, that $5,000 is a lot of money to me. I’m about to risk $5,000 which could pay for my rent, my mortgage, or my debts‘.

This mind trick actually helps to reduce the emotional triggers when trading, thus leaving your cognitive mind less burdened with thoughts of the money, and more focused on the trade. This is a huge reason why a % equity model is far superior from a trading mindset perspective than a ‘dollar risked per trade’ model. Food for thought, but I hope this clarifies the huge advantages and information available when thinking about forex money management in terms of a % equity of your account.