Now that we have discussed the Two Necessities To Trade Successfully of what you need to trade successfully in part 1 of this series, it is time to get into part 2 of the series which is Developing the Two Traits. These are traits which you may not have at the moment, but you can totally develop with relative ease, a passion to be a successful trader, and with a little work.

A Question and Common Characteristic

Before I describe what the two traits are, why you need them and how having them will help your trading, I am going to ask a critical question:

Do you really think you can become a successful trader without developing certain skills which you may not be good at already? Do you really think all successful traders were just good at everything needed to be a highly profitable trader? Do you really think you can just learn a system and become a professional trader without having to work at something challenging?

All professional traders had to go through training, break through various obstacles, and jump over whatever hurdles they had to become a successful trader. The same goes for you.

One thing you will find as a common characteristic of successful people (in all fields, especially in trading), is when they are faced with something they are not good at, they become good at it. They do not stop and say, ‘oh, I don’t have that so i’m just not going to do that,‘ or ‘oh, i’m not good at that and will never be so I cannot be good at trading, or martial arts, or business,‘ or whatever field they are working to become skillful at.

When faced with something they are challenged with, they start the learning process to become good with that skill set.

Michael Jordan, considered to be one of the best basketball players of all time, was not great (not even good at defense) when he entered the NBA. In fact, he was below average. When his coaches told him this, what did he do? He trained for years to become a better defensive player.

What happened?

-He became the 1988 Defensive Player of the Year, 4 years after turning pro (meaning he already was considered a professional in his field while still below average in a key skill set)

-He was elected to the All-Defensive Team 9x

-Awarded the ‘Steals Champion’ 3x (player with most steals in the entire league)

So even Michael Jordan had to work at things, well after becoming a pro. And what made him great was not just his ability to score and to win, but to become good (if not great) at things he was once weak in. That is the mark of a professional.

My guess is you do not enjoy the areas you are most weak in when it comes to trading for two reasons;

1) they are a reflection upon where you are at (thus exposing you to self-judgment and criticism)

2) you simply are not good at them…yet.

Think about the first time you played pool/billiards or some other sport. Then think about how much more fun it was when you got good at it. Remember, you had to go through training to get good at something, and the same goes for trading, especially your weak aspects so keep this in mind. Perhaps your weak aspects are not memory or pattern recognition, but at being disciplined in trading. Or perhaps you are disciplined, but are bumping up against your Equity Threshold. Whatever it is, develop it so it becomes your strength. Remember, the height of your trading success is determined by your weakest skill set, so think about this deeply.

Another important thing is to ask yourself if you are critical towards yourself and your weaknesses. Do you really think you’ll develop those skills if you are constantly being highly critical of them? Being self-critical and judgmental might inspire you to become better, but if used improperly, will be a hindrance to your growth as a trader.

It will likely manifest in you beating yourself up for mistakes you’ve made over and over again, instead of taking real concrete steps to develop those skills. It will manifest in you being less open to your ability to change and grow, instead of being humble about the process. Food for thought when thinking about what we will discuss next.

What Are the Two Traits?

All highly successful and profitable traders who make their living from trading have these two traits. They are;

1) Great Pattern Recognition

2) Developed Memory

Pattern Recognition

Think about this – what are all trading systems built of? Patterns. All profitable systems are based on patterns that people have noticed in the market. They can be;

–Price Action Patterns

–Ichimoku Kinko Hyo Patterns

-Patterns of volatility

–Understanding Price Action

or anything regarding the market.

But one thing is for sure, they are the result of some pattern which became the basis for a rule-based system to trade the forex market. Whether it is a discretionary or algorithmic system, it is based on a pattern. Thus, your ability to discover and discern patterns is a critical trait you need to develop.

Developed Memory

Another trait of successful and profitable traders is a developed memory, meaning they remember what they see in the markets, they remember the price action, what the market looked like when it reversed, what characteristics were present and were not when it did, when it trended. They remembered these key things which either;

a) helped them build a system around it

or

b) helped them to identify key opportunities

Not all trading opportunities will be purely from your system, and some will be something you spot, or have an intuition about, and are sub-consciously picking up on it.

Ask yourself, have you ever seen something in the market, something that was not a signal from your trading system, but something peculiar you recognized, and either got out of a trade which saved you a lot of money, or got in the market which did what you thought it was going to do?

That is from something you remembered but could not fully intellectualize, yet had enough awareness to make your move. It was something you picked out in your memory which you had seen before, and alerted you to the opportunity. This is why it is critical to develop your memory so you can;

a) build your own trading systems (or improve on what you are already trading)

or

b) find the best trading opportunities in the market

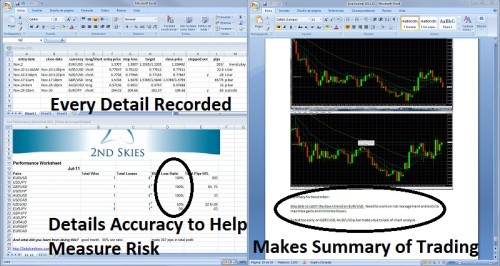

There was a video on FXStreet where Chris Capre predicted where EURUSD will end the year. This was during an ad hoc interview with FXStreet. Keep in mind, this was October that year, and I had not only called the top within 70pips, but also called a 900+pip drop while predicting the small range it would end the year at. How did I do this? Through pattern recognition of the price action and a developed memory to spot the pattern.

The Good Thing

Now many of you might be saying, ‘well, I have a bad memory, or I’m not that good at recognizing patterns‘. And guess what? That’s ok, you don’t have to have them now to be great at trading. The good thing is you can develop them with relative ease and a little training.

Remember, the brain has a neuro-plasticity to it, meaning it is elastic in what you can learn, develop and become good at, especially memory and pattern recognition. So with the right training, you can improve these in no time while also increasing your IQ (useful for trading and life).

When you need to become a fast runner, you go to the track and start training. When you need to lift heavy objects, you go to the gym and train the right muscles. And when you need to improve your memory and pattern recognition skills, you go to a brain gym.

What is a brain gym? It is a program (could be in a school, class or on the internet), whereby you do various activities and exercises to improve key aspects and regions within your brain. Some of the areas are;

-Speed of Processing

-Problem Solving

-Attention

-Flexibility of Thinking

-Pattern Recognition

-Memory

What we have learned about human learning and the central nervous system, is to develop something like memory, it is far less effective to just do memory exercises. Why? Because the brain is so interconnected, that having weak connections in many areas, but having just a strong memory, decreases the overall brains performance. But by developing many key areas, all the increased connections help influence all the other areas and increase their performance. So to develop your memory and pattern recognition skills, you have to stimulate all the areas in the brain. How can you do this?

Lumosity (http://www.lumosity.com). They have on their site activities you can do each day (few mins per day) to strengthen and develop all these areas, especially memory and pattern recognition. They have won numerous awards, are being used in test schools, along with hospitals to work with the brain in improving performance.

They track your performance so you can see the development over time, while keeping the activities and games fun and challenging appropriate to your skill level. By doing these simple but fun exercises everyday through the internet, you can not only increase your IQ, but develop your memory and pattern recognition skills to improve your trading.

In Closing

We can now see how critical it is to have the Two Traits (pattern recognition and a developed memory). The good thing is if you are not strong in these areas, you can easily develop them with little effort through the brain gym I suggested (and am a member of).

Developing these two skill sets not only empowers your trading, but also helps you to build your own price action systems, ichimoku trading models, or spot the best opportunities out there.

It could lead you to improve your current system, or build a completely new one. It could mean shorting when your system is already long, or help you to protect your profits. It could also lead to you finding one of your weak points in trading by remembering/noticing the pattern, and then taking key steps to correct it. When you become your own teacher in trading, there is nothing limiting you to becoming a highly successful and profitable trader, but it all starts with developing the Two Traits.

For those of you who did not read What Do You Need to Trade Successfully, visit the link to download the article.

Meanwhile stay tuned as part three in this series is coming in the next few days where we talk about Building the Three Habits.