What’s Inside?

A key topic that orbits around price action trading is “how do I trade with candlestick wick patterns in the forex market?” The problem with this question is it comes with some misunderstandings about price action, order flow and what wicks really communicate.

The goal of today’s article is to give you a new perspective on trading price action wicks that most ‘internet gurus‘ won’t tell you. It is to give you an understanding of candlesticks, what they communicate and how to relate and trade them.

We’ll give you this understanding and how to trade with candlesticks through 4 key points on forex price action wicks.

But before we get into trading wicks, we have to understand the foundation of where our approach comes from.

Key Point #1: The Difference Between Price Action & Candlestick Trading

I approach trading from a particular perspective that a) order flow is the proximate driver of price action, and b) all activated orders in the market are based upon ‘information‘.

NOTE: If you want to learn more about how I trade price action context, click here.

But to simplify it, trading price action ‘context‘ is trading the overall ‘structures‘ or ‘Gestalt‘ of the market. And you cannot get this through 1, 2 or 3 candles.

People who trade based upon 1, 2 or 3 candlestick patterns, such as pin bars, or fakey’s, or engulfing bars are candlestick traders.

Fun Fact: The fakey pattern or setup, is really called the Hikkake pattern, given that name decades ago, which today many forex ‘gurus’ have renamed to make them sound like their own.

Regardless, candlestick pattern traders are not ‘price action traders‘. They are ‘candlestick traders’. Essentially, candlestick pattern traders believe 1, 2 or 3 candlesticks define the price action context and order flow in the market, and thus give you trade setups.

But ask yourself, why do many key support or resistance levels hold without a pin bar rejection. Why would it do that if the pin bar is such a superior tool for recognizing and ‘confirming‘ whether the key support or resistance level will hold? Why do banks, hedge funds, and prop traders place orders at particular prices well before a pin bar has ever formed, and not based upon the New York close daily charts?

NOTE: If you want to learn why a typical pin bar entry is a retail entry, click here.

When you start to ask these questions, the foundation for trading pin bars and candlestick patterns breaks down. That leaves you with trying to understand the underlying order flow in the market. And you do this by learning to read and trade price action context.

This is how we approach the market.

Now that we have this foundation, we can move on to how do we relate to forex price action wicks (or any wicks)?

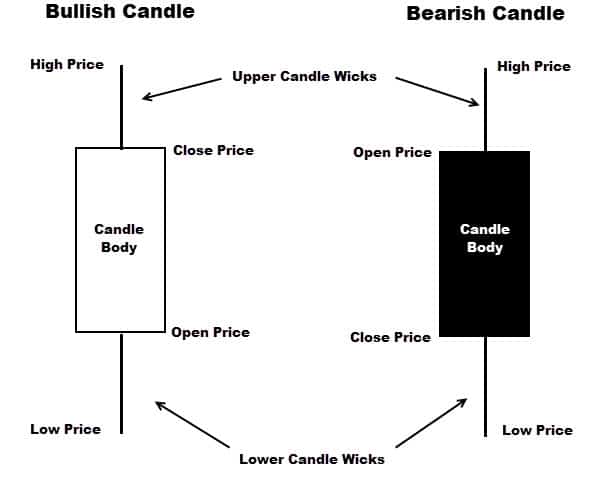

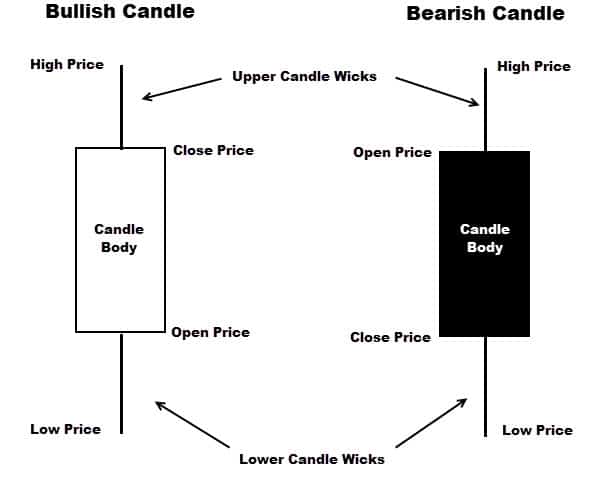

Key Point #2: All Wicks Are Rejections of Value

When you look at the essence of what a wick represents in terms of the price action and order flow, you come to the conclusion that all wicks are a communication. They communicate that the order flow was rejecting that pricing and value.

If the market accepted it, it would close there, and remain there.

However, there is a ‘but’ in there. The ‘but’ is while wicks in the forex market = a rejection of value, they are not for defined periods of time or defined moves in pips.

What I mean by ‘not for defined periods of time‘ is a) beyond the close of their candle, and b) they are not going to define how long the market will reject that move or value from that moment forward.

What does give you this information? Price action context.

The goal of price action context is to give you a ‘probabilistic framework‘ for what the market is more likely to do. Wicks will not give you this information, nor give you a probabilistic framework for how to trade this.

Hence you have to come back to price action context.

The most essential point to understand here is forex price action wicks (or any wicks) = a rejection, but we cannot understand how that rejection will manifest, so we have to take these as a grain of salt.

What this also means is that 1, 2 or 3 candlestick wicks will not ‘confirm’ a rejection of a specific kind (which is what we want if we’re going to trade said ‘confirmation’ or rejection).

If you want to understand why confirmation price action signals will crush your account, click here.

Key Point #3: Opening And Closing Of Candlesticks Do (And Do Not Matter)

Wait a minute, how can the opening and closing of candlesticks ‘matter’ and ‘not matter’? Let me explain.

In very ‘particular’ circumstances, the opening and closing of candlesticks will matter. Such as:

- if you are trading some sort of ‘opening’ gap strategy

- if you are trading specific types of breakouts

- if you are trading specific candlestick patterns

There could be a few more circumstances, but by and large, the majority of time, the opening and closing of candlesticks do not matter.

What matters more is order flow and price. This is why most institutions, hedge funds, and prop firms know their price ahead of time, regardless of the close. They know where they want to get in, and where they want to get out, regardless of the candle being open or closed.

Hence the opening and closing of candlesticks matter, but on a limited scale.

Key Point #4: How Do You Trade Forex Price Action Wicks?

There are many ways I relate to forex price action wicks (or any wicks) in my trading, but I’ll give you a couple wick trading strategies below.

Trading Strategy For Wicks #1: With Trend Wicks Will Be More Reliable (or ‘probable’) Trading With Trend vs Counter Trend

If a wick represents on a base level some sort of ‘rejection’, which side is most likely to ‘reject’ the price or value? The with trend players, or counter trend players?

With trend is the answer. With trend players are more often controlling the market and order flow, so they’re more likely to reject a price effectively cause they’re largely in control.

I personally like seeing with trend rejections on pullbacks heading into a level because they are showing a more ‘probabilistic framework’ of order flow in the market.

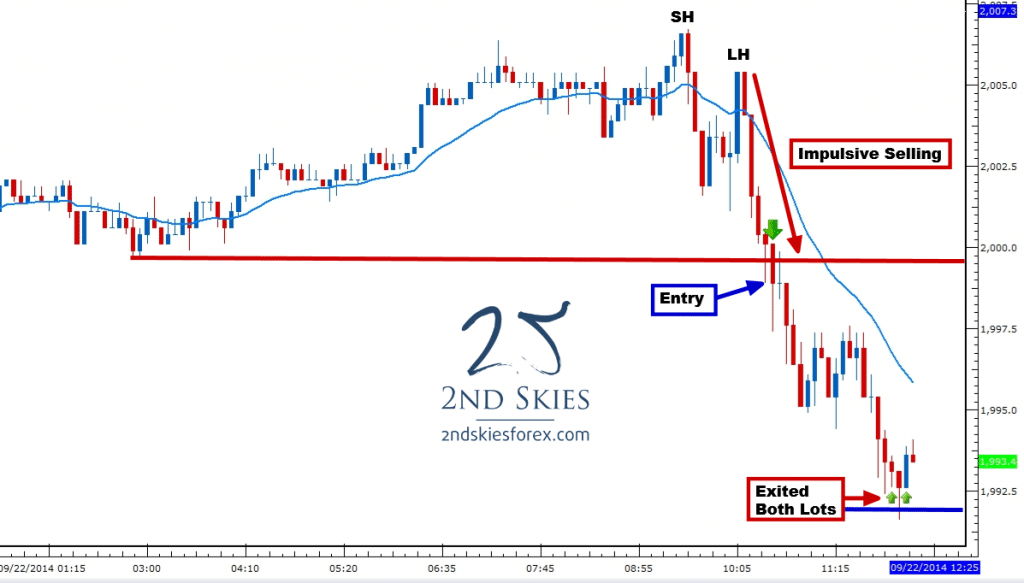

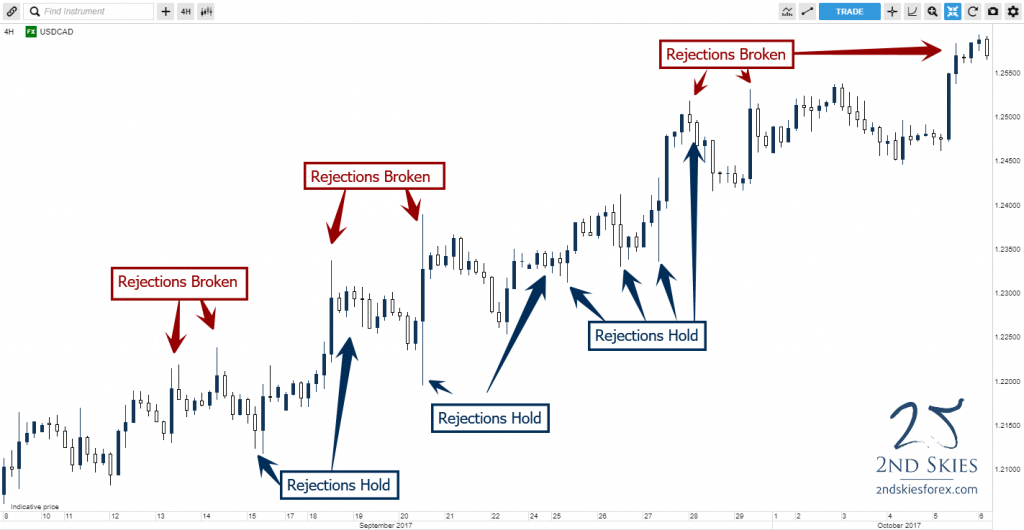

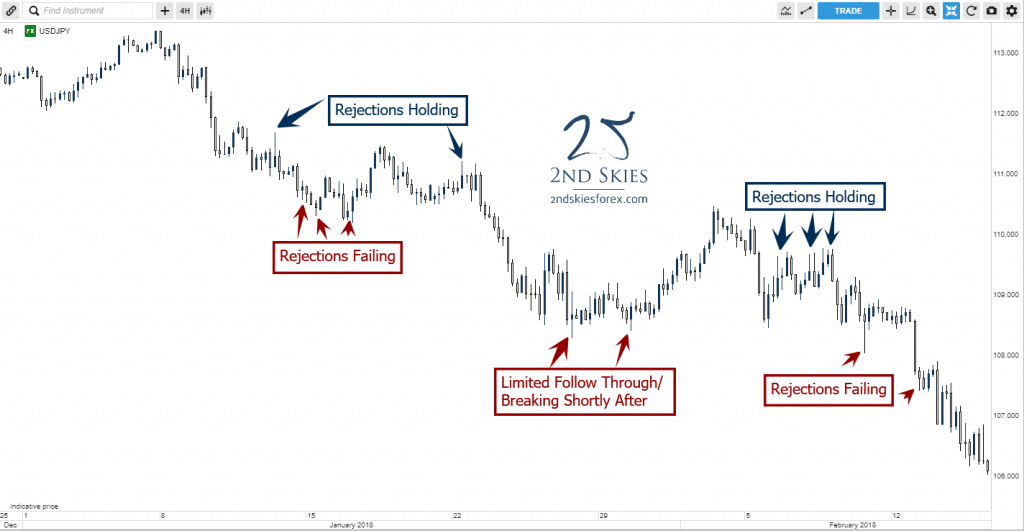

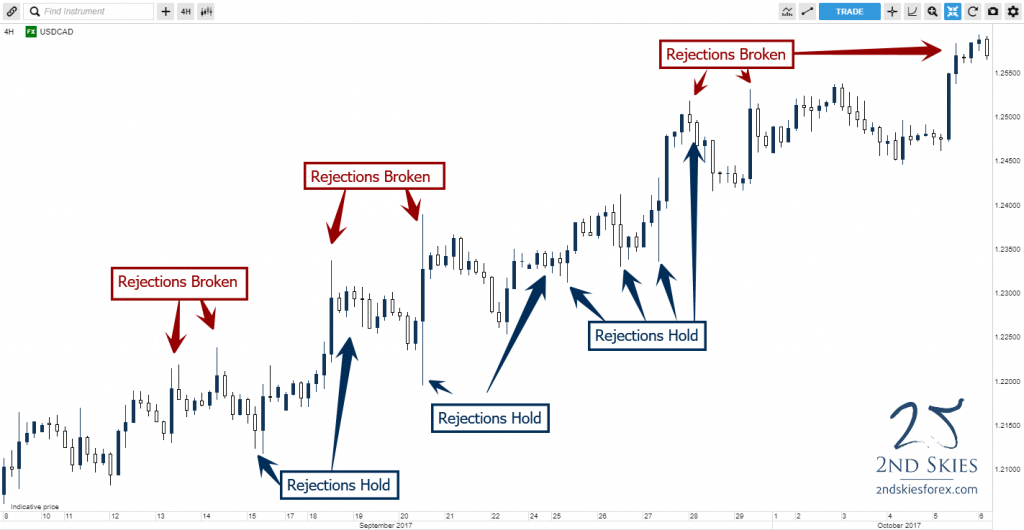

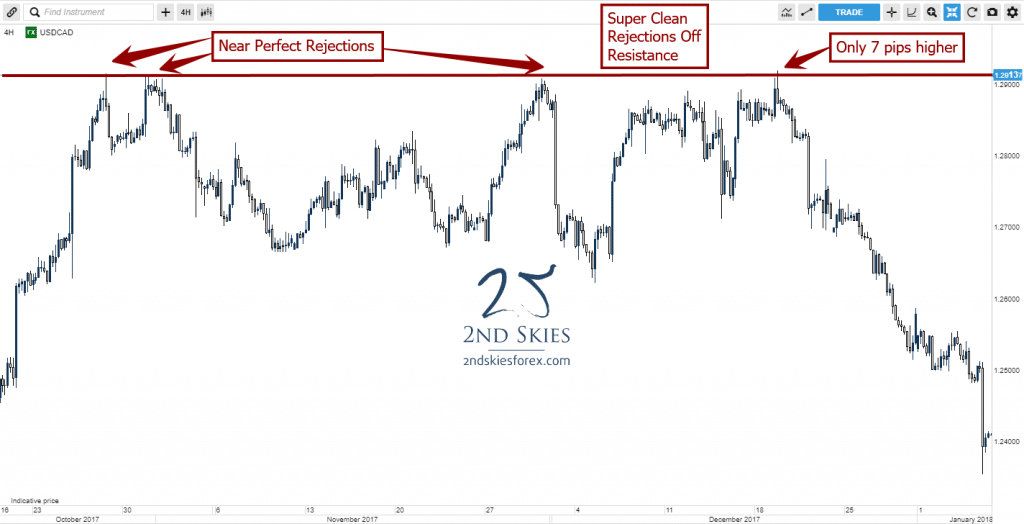

Below is an example of a good chart showing this on the USDCAD 4hr chart.

Notice how the majority of the wicks and rejections with trend hold, while the counter-trend rejections fail?

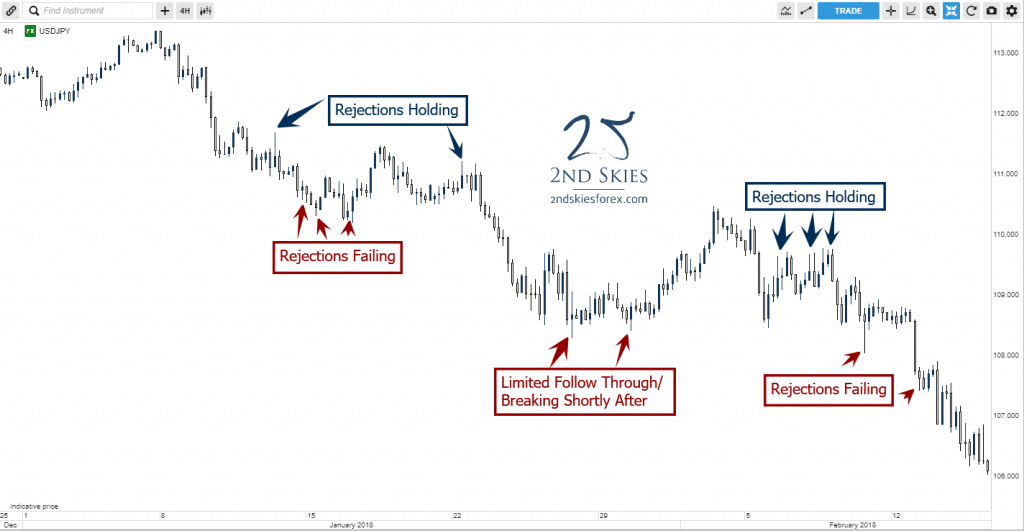

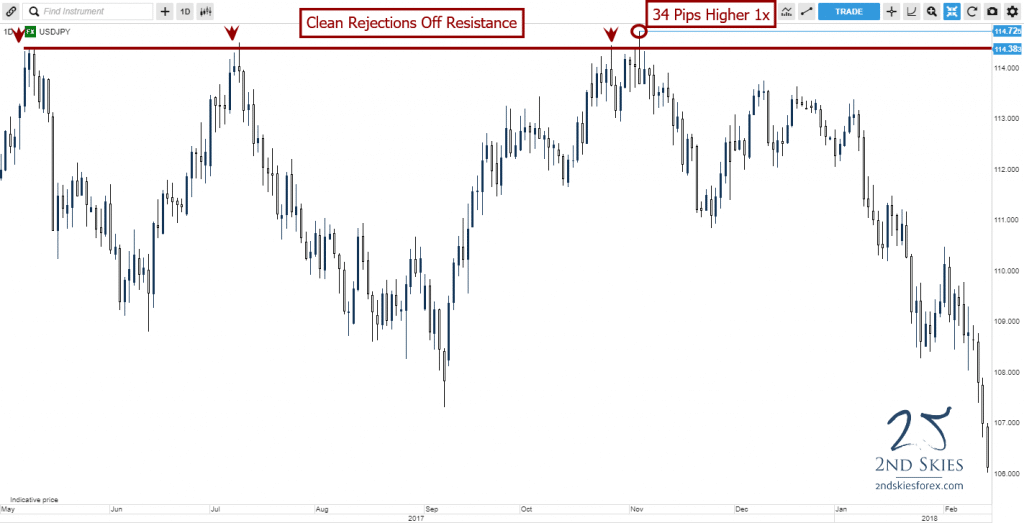

Below is another good example of a chart on the 4hr USDJPY chart.

Hence when trading, if you are trading with trend, wicks rejecting price in your favor make your trade more ‘probable’, while trading counter trend are less ‘probable’.

If you wan to learn more about trading with a probabilistic mindset, click here.

Trading Strategy For Wicks #2: Clean Wick Rejections Off Key Support or Resistance Levels Are Best

What do you mean by a ‘clean’ rejection or wick off of a key support or resistance level?

While I relate to support and resistance as ‘zones‘ of order flow, sometimes they line up super well to where you can clearly see price is rejecting off a very specific price and value.

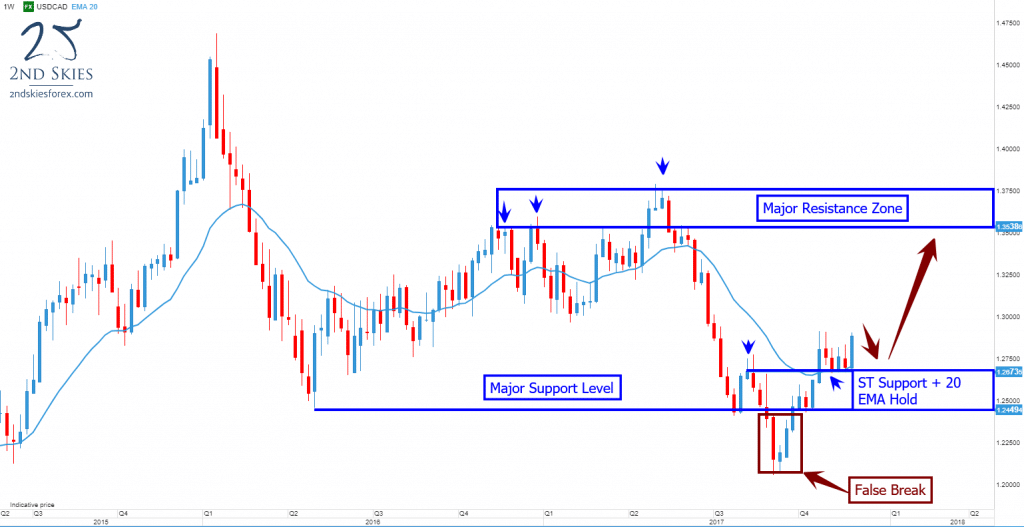

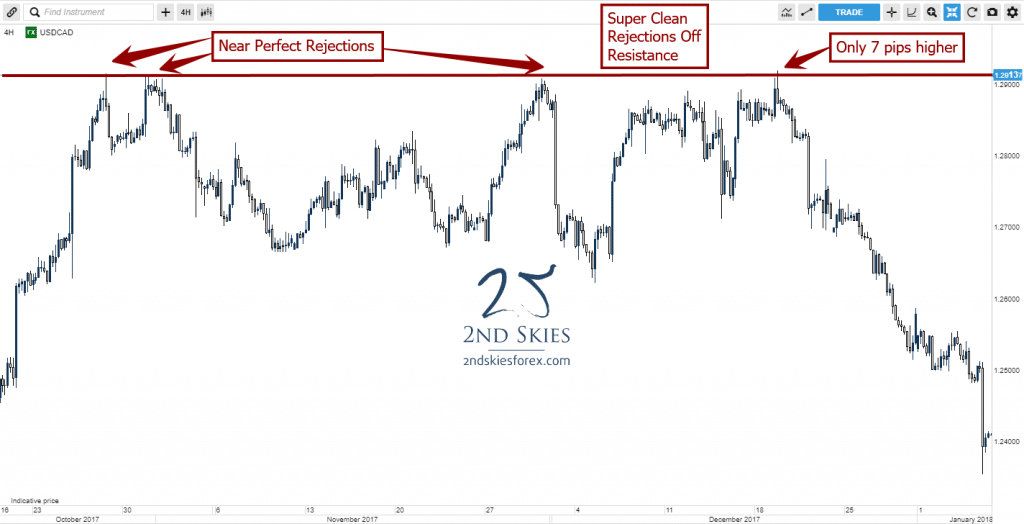

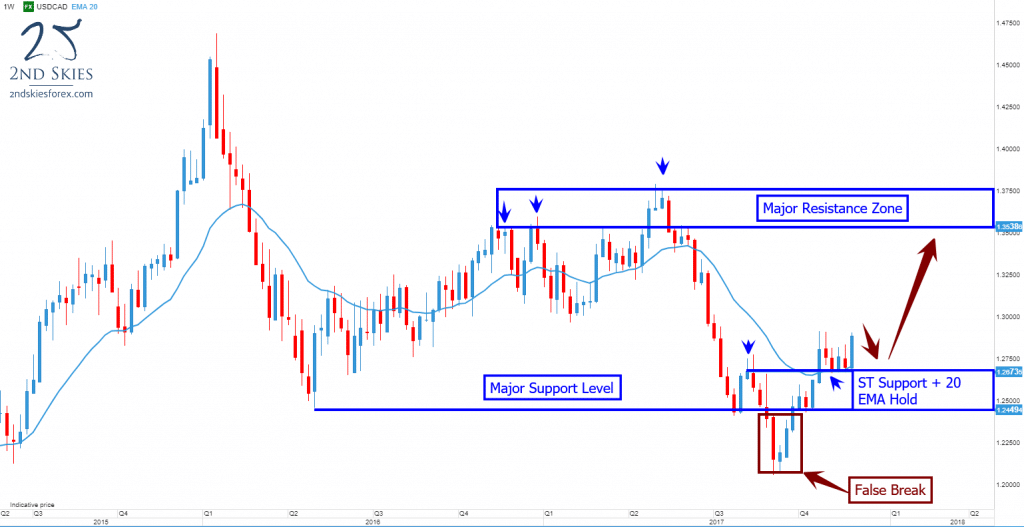

Case in point, take a look at the USDCAD 4hr chart from mid-October last year to mid-Jan this year (~3 mos).

You can see in the chart above, the price action rejected off of the key resistance level near 1.2913 six times in a 3 month period with almost every rejection happening within a few pips of each other, and the biggest break being only 7 pips.

When price rejects very ‘cleanly‘ off of a key support or resistance level, they become more ‘probable‘ of a legitimate rejection.

Not all charts and key levels will look like this, but they do often in many price action structures, and can be good for building your ‘probabilistic framework‘ for understanding price action context and the order flow behind it.

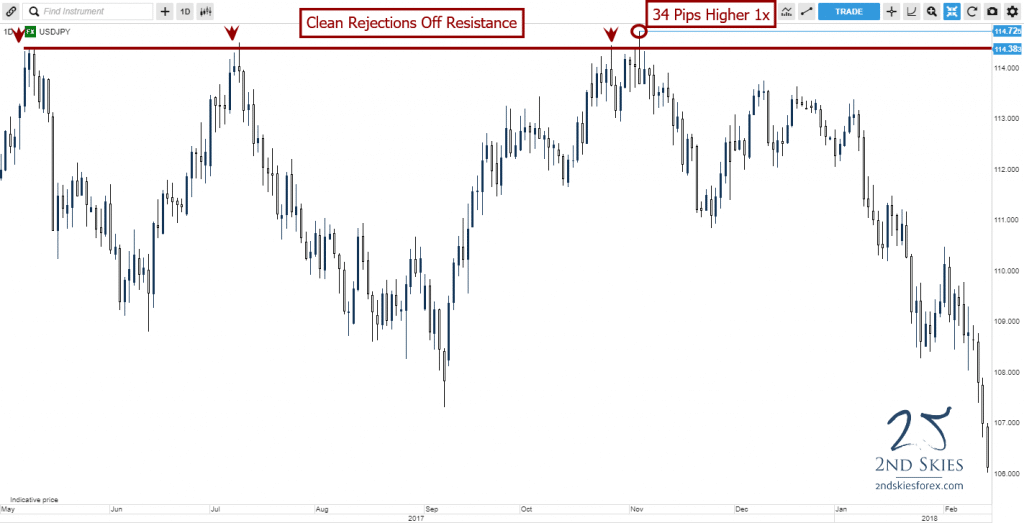

You can see another example of this below with the USDJPY daily chart.

Notice how 3 of the 4 rejections were almost at the same price with only one breaking by a small amount?

There are many other ways to understand wicks and rejections in the price action, but these are two good methods to work with that I use personally and trade profitably with my own money.

In Summary

Forex price action trading wicks (or wicks in any market) are important to understand, particularly from the perspective of order flow and price action context. Wicks ‘communicate‘ at a base level ‘rejection‘, but they do not by nature determine any rejection to follow through.

However there are ways you can use wicks in your trading price action, particularly the two methods I mentioned:

- with trend wicks add to your ‘probabilistic framework’ better than counter trend wicks

- clean wick rejections off of key support and resistance levels also add to your ‘probabilistic framework’ for trading

Now Your Turn

What did you learn from this free trading article? Do you feel you understand candlestick trading wicks, rejections and how they work in forex applications?

Make sure to leave your comment below, along with share this via Twitter or Facebook with those you think can benefit from this.