“It’s got me thinking, maybe I don’t have what it takes to be successful at forex trading.”

Half question + half truth, I hear this a lot from traders struggling to make any consistency or profits.

Ever asked this question? I have in my early years (many times). The answer though will shock you.

What I’m going to say is not ‘politically‘ correct in the forex trading world. I’m guessing most ‘gurus’ will not tell you this either.

The truth is, right now, in all probability, you don’t have what it takes.

And I don’t mean in the sense of the Henry Ford quote “If you think you can or cannot do it, you’re right.” That is not what I’m talking about.

What I’m saying is direct and crystal clear – most likely, you do not have what it takes to make money trading.

Wait, what? You’re a trading mentor, why are you saying this?

Because the answer – that you don’t have what it takes to make money trading, is true. Now if that seems depressing, daunting or scary, then you need to know this other key point.

The flip side to this coin, is you actually have what it takes to make money trading.

Confused? Keep reading as I’ll clarify in this article. In fact, I’ll take both sides of this coin, and show you why I’m right on both accounts.

First we’ll jump into the original sentiment – that you don’t have what it takes.

Then we’ll dive into why you have what it takes, and how you can re-wire your brain to making money trading.

What you’ll end up with is:

a) an understanding of why you think ‘maybe I don’t have what it takes to make money trading‘

and

b) how you can transform this sentiment while leveraging your firepower

Let’s begin.

Why You Don’t Have What It Takes

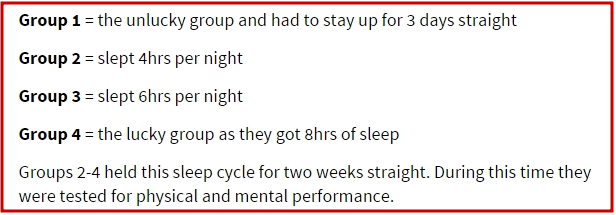

I’m going to start off with a number: 200,000. That is how many years ago some of our earliest ancestors (Homo Sapiens) emerged.

190,000 years later we shifted from hunter-gatherers to form small bands of farming collectives.

During the last 9,900 years, a ratio about our everyday existence held steady. It is a ratio that is still affecting you today while you trade.

What is the ratio you need to know about?

That 1 in 8 people died from protecting their families, loved ones, and fellow neighbors.

In the last 100 years, that ratio fell from 1 in 8 to 1 in 100. However, you, myself, and pretty much everyone today is still acting as if it was 10,000 years ago.

Our brains and nervous systems today still ‘react‘ as if 1 in 8 of us will die today.

Why is that?

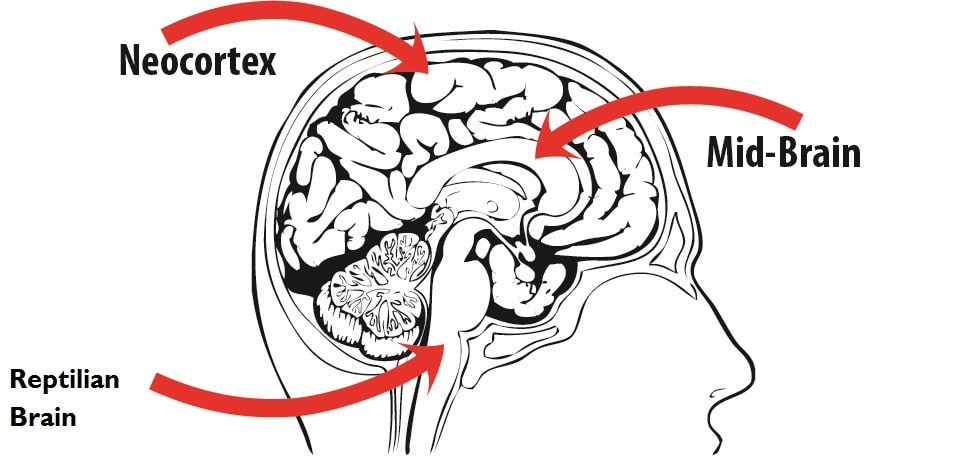

Evolution. For 99% of our existence, our brains ‘evolved’ to protect us from threats. The goal was simple – survive to continue our existence.

This is an understandable goal. However it is probably the most dominant reason why you struggle with trading today.

Why?

Teflon & Velcro

What does teflon and velcro have to do with your trading today? I’ll get to that in a moment.

Just understand, for 9,900+ years, there was a rule our brains operated by. It was Eat Lunch, Don’t Be Lunch.

This rule got so hard-wired into our brains, it now dominates the neural real estate you think, act, love, work and trade with today.

Every buy and sell decision you make is influenced by this rule and wiring in our brain. In fact you are probably aware of this right now.

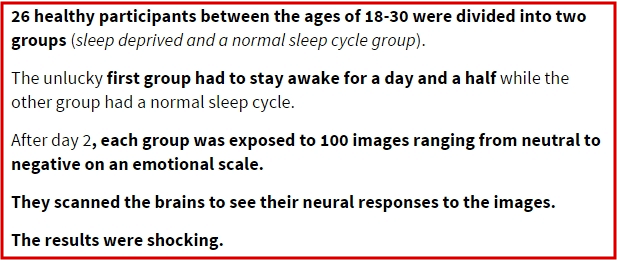

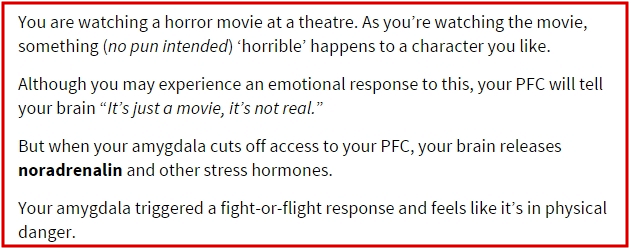

Ever heard of the fight or flight response? It’s a survival reaction we have to either fight or flee when facing extreme danger.

Problem is, this doesn’t help us make money in forex trading. In fact, it makes it damn near impossible!

It is also responsible for a bias you have, which is at the root of this question ‘Do I have what it takes to make money trading?‘

What is this bias you have?

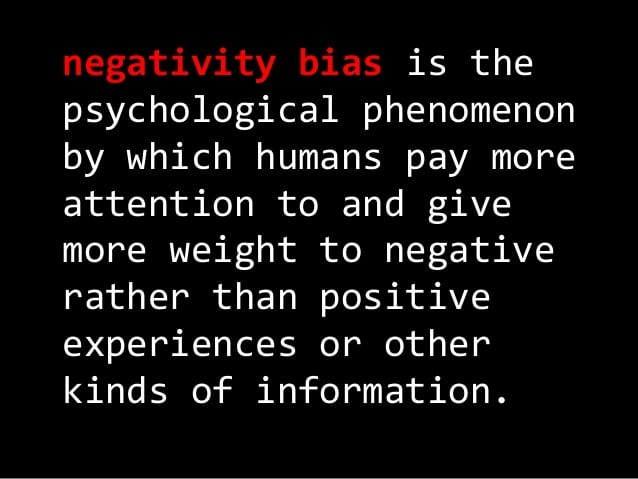

The Negativity Bias

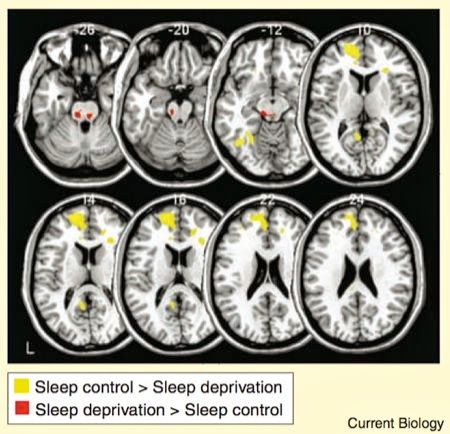

Because of the rule (eat lunch, don’t be lunch) that dominated our mental activity over thousands of years, we developed a bias.

Every human brain has this bias wired in today. You were born with it, and likely will die with it.

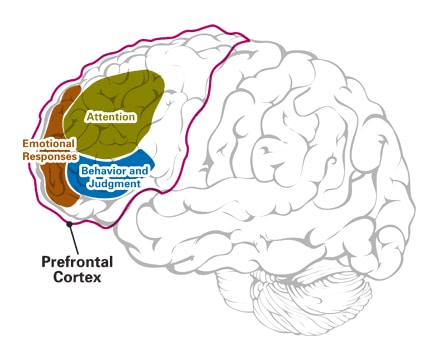

In fact, this bias is so strong, if we mapped out all the neural connections for detecting threats, attacks, fears, doubts, & critiques, the ratio would be over-whelming.

You’d be outnumbered by a long shot, and not the kind of odds you’d bet against.

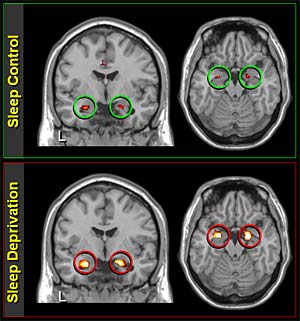

As it stands today, your brain will react with lightning speed to a threat (<.1 secs). How long would it take you to ‘respond’ to a positive stimuli?

About 5-7 seconds. Why?

Because threats could have killed us, jokes (maybe bad ones) will not.

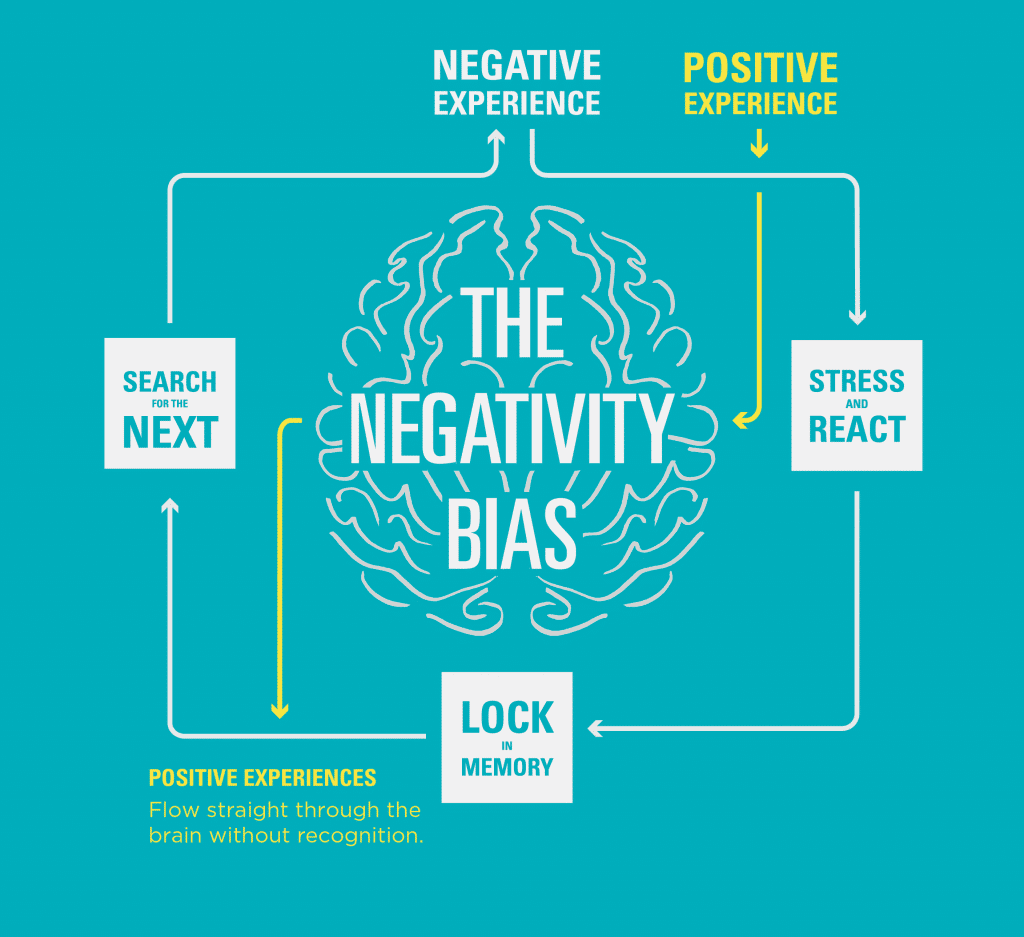

Thus a negativity bias was born and dominates your trading today.

Take a look at that definition above and read it again. Let it soak in.

Now, if you are giving more weight to your negative experiences than positive ones in trading, how do you think that will shape your brain, neural wiring and mindset?

Before you fully ponder and answer this question, let’s get back to how this and our evolution affects our trading mindset.

Lamentably, there is nothing in our evolutionary history which was built towards trading successfully.

This is why when the price action moves against your trade, you are ultra-sensitive to it. It is also why every pip the market moves for you elicits a much smaller reaction.

Velcro & Teflon: Why Your Brain Isn’t Wired for Success in Trading

Back to the analogy of velcro and teflon, positive experiences slide off your brain (like teflon) while negative ones stick (like velcro).

The best example of this is – what days can you recall the quickest and easiest with the most details? Days you won a ton of money? Or days you lost big?

I’m guessing for every 1000 that answer this question, 9900+ will say the ‘big losing’ days. This is your negativity bias at work. This is thousands of years of evolution at play.

You are fighting an uphill battle from the beginning.

It is also the reason why it’s true that you don’t have what it takes to make money trading.

The way your brain is likely wired right now, you don’t. Most of our evolution as humans is against us trading successfully.

There is no bias for you – only against you.

Hence when you think (maybe I don’t have what it takes to make money trading), technically, you’re right. Most likely it is your unconscious mind communicating something to you.

GOOD NEWS!

You also have what it takes to make money trading.

Wait, what? You just gave me 1000 words why I don’t have what it takes to make money trading.

How can I not have what it takes, and have what it takes?

There is more irony in this statement than you know. But first, I’ll share with you why you have what it takes.

EDN & SDN

The great thing about your brain & genes, is also behind the reason why you have what it takes to make money trading.

The initials above (EDN & SDN) hint at this.

In one word – neuroplasticity. There are two key forms of neuroplasticity which are your weapons to re-wire your brain. They are:

1) EDN = Experience Dependent Neuroplasticity

2) SDN = Self-Directed Neuroplasticity

EDN is a shortened way to say your brain learns, adapts and changes from experience.

It means you can wire in new habits and correct mental errors to your trading performance right now.

A great way to remember EDN is through the following statement:

Neurons that fire together – wire together

Another translation or implication of this is: the most dominant neural networks will 95% of the time determine how you trade each day.

Regarding SDN (self-directed neuroplasticity), the best way to remember it is:

Consistent passing mental states create lasting neural traits.

Hence, if while you are trading, you are constantly:

-angry

-frustrated

-doubtful

-fearful

-or stressed while trading

You’ll only make these neural networks stronger. This only increases the chance you’ll make bad trading decisions.

And it certainly won’t help you protect your mental capital.

Wait, I thought you said this will help us make money trading?

It can and will. If you want to go beyond the negativity bias for trading, you have to employ different neural networks.

It also means you have to change the mental activity while you are trading.

The good thing is, this is not a long step for you. In just 20 minutes a day, you can re-wire this bias for success. I’ll tell you how at the end of this article.

Both/And

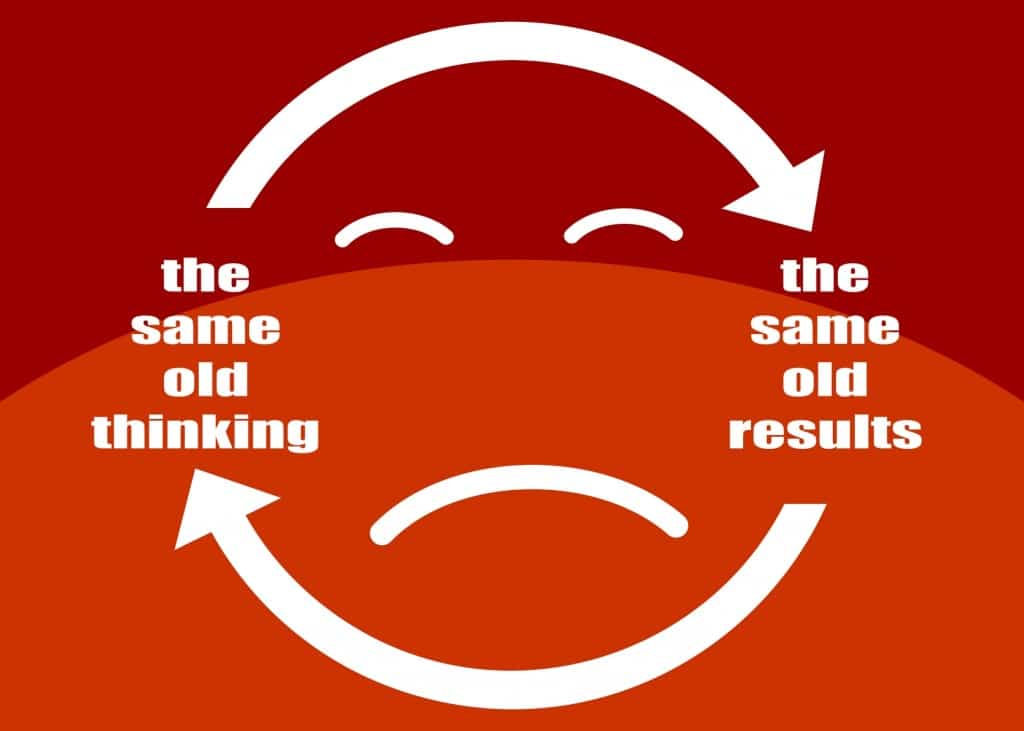

Remember how I told you it seemed strange to say you have what it takes, and also do not have what it takes to make money trading?

Both of these are true. The answer is not binary, or either/or.

Your brain has an evolutionary bias that means it’s next to impossible to make money trading.

But your brain also has built in mechanisms (neuroplasticity) which also make it completely possible to make money trading.

One interesting thing about the negativity bias is what it does to your brain and thinking. When this bias is dominant, you tend to see things in binary. You see things as either/or.

How Does This Affect My Forex Trading?

It means…

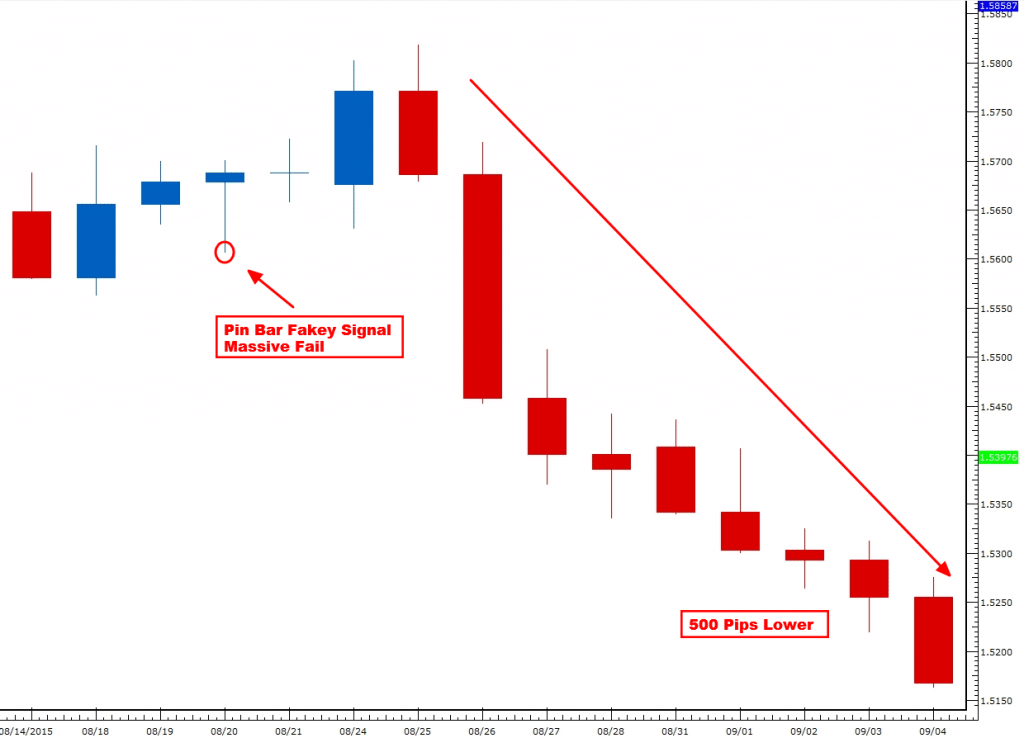

-you’ll see every loss as ‘bad’, not as a learning opportunity

-when your stop loss is hit, you wonder if you did something ‘wrong’, not as it being a part of trading

-breaking even is viewed as something is wrong, not how close you are to breaking through

Hence when heavily influenced by this negativity bias, it means you’ll either think you have what it takes, or don’t. If you tend to think in either/or most of the time, or make these statements a lot, this bias is strong in you.

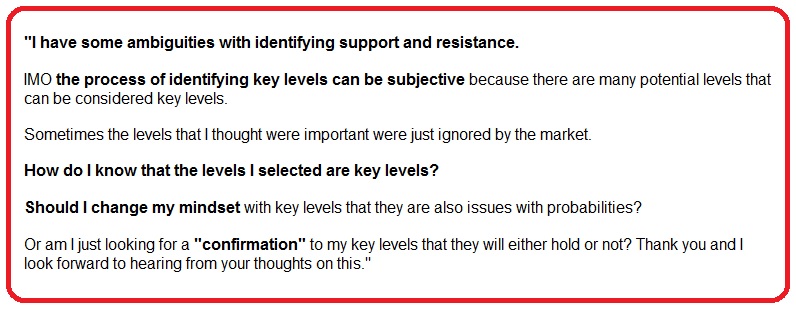

It is also probably why you are not trading and thinking in probabilities (only black and white).

An upgrade to this is seeing things as both/and.

This translates to:

-finding the ‘positive’ in things which seem ‘negative’

-understanding that a losing streak is part of the game

-looking for solutions instead of focusing on the problems

If you are wondering which side of this coin you are on, listen carefully to what you say to yourself while trading over the next few days.

Are you saying more of the ‘either/or’? Or are you finding ‘grey’ areas between contrasting points? The best place to look is in your thoughts/mental activity while trading, and you’ll have your answer.

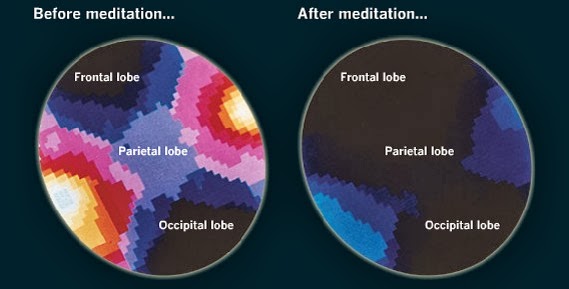

NOTE: A great way to rewire this either/or negativity bias is via meditation.

Meditation helps you create a whole-brain state which heavily reduces the chance you’ll fall into the either/or state or negativity bias.

Click on this link to learn a meditation practice for trading.

In Conclusion

As you can see now, successful forex trading is challenging not because there is something wrong with you, but a simple fact of evolution. We currently aren’t wired to trade successfully.

It is also true you have inherent mechanisms in your brain to make money trading.

You can:

-learn the skills needed

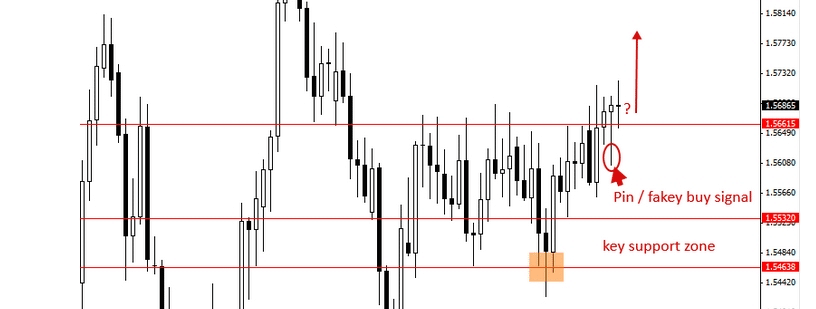

-can pull the trigger when your price action setup is there

-can stick to your plan & fill out your journal

-can make money trading

Evolution isn’t in our favor, but it’s time we shed this negativity bias which 90+% of the time no longer serves us and stand out from the crowd.

To do this, you’ll need to build a new bias. You’ll need to re-wire your brain for success in trading and life.

If you want to know how, then check out my Advanced Traders Mindset Course which focuses specifically on this.

Now Your Turn

Have you asked yourself this question? Ever wondered if you can make money trading?

What ‘aha’ moments did you have from this article as I want to know so make sure to comment below.

Until then – may good health and successful trading be with you.