Chris Capre’s current live open price action & ichimoku trades: USDMXN, EURRUB, EURMXN, BIG, DIS, AC, ISD

New to Forex? Then check out my FREE Learn Forex Trading Course with videos, quizzes and downloadable resources

Top Trade Review: Check out our latest Forex Top Trade Review with Sascha (our Course Instructor) nailing it for +201 Pips!

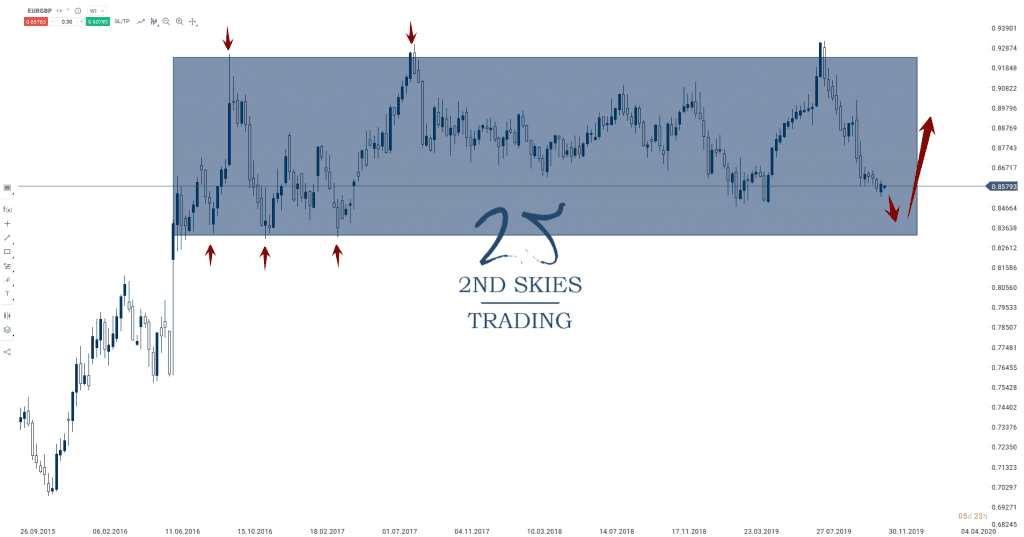

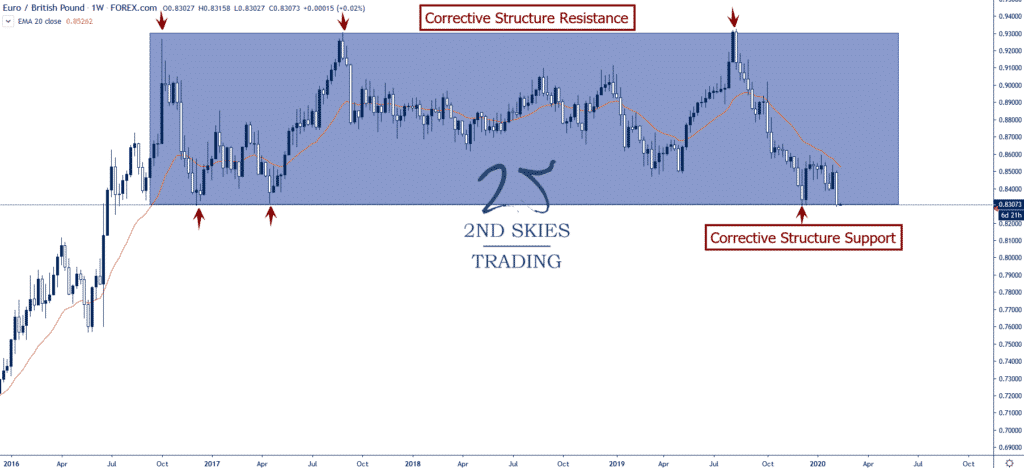

Forex Trade Idea: EURGBP – Potentially Breaking 2 Year Corrective Structure (weekly chart)

Price Action Context

Since the summer of 2016, the EURGBP forex pair has been trading inside a large corrective structure between 8300 and 9300.

While the pair bounced off the structural support level around 8300, the pair didn’t manage any material upside gains, climbing no higher than the mid-85 handle.

I’m suspecting a break of this key support level soon, which would open up the pair to some technical selling and a potential move towards 8080.

Trending Analysis

MT neutral while inside the large corrective structure, ST bearish.

Key Support & Resistance Levels

R: 9042, 9300

S: 8300, 8080

Stay tuned with our members market commentary for updates.

******

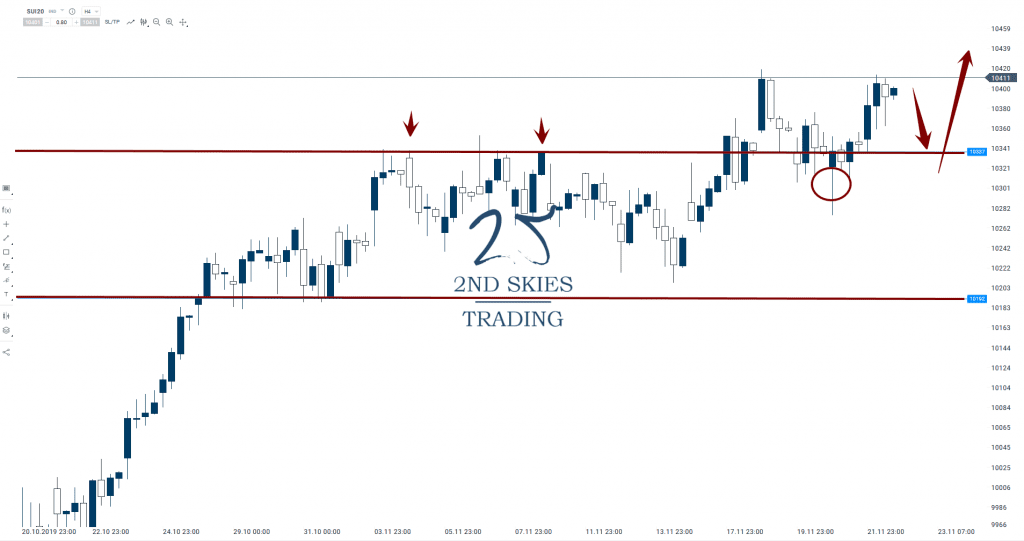

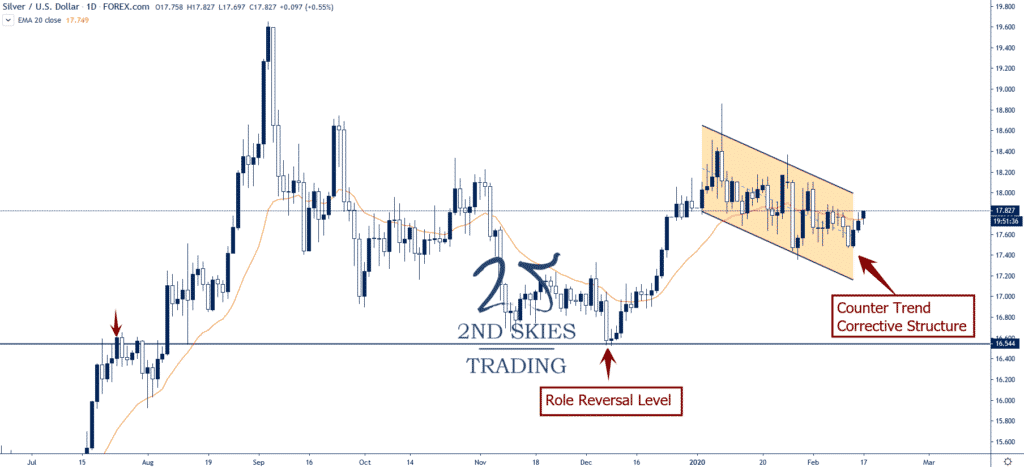

Commodity Trade Idea: Silver (XAGUSD) – CT Corrective Structure, Looking to Buy (daily chart)

Price Action Context

Holding above the role reversal level at 16.54, Silver (XAGUSD) has stayed mostly buoyant above the RRL and hitting a yearly high of 18.81 before falling back.

Looking at the chart below, the selling pressure is weak and inconsistent, forming a CT (counter trend) corrective structure.

With the bounce off of 16.54 being highly impulsive, and the pullback corrective, I’m suspecting the next leg is more likely to the upside, and am looking to buy.

Trending Analysis

ST bearish while inside the corrective structure, MT bullish while above 16.54 on a weekly closing basis.

Key Support & Resistance Levels

R: 18.66, 19.56

S: 17.36, 16.54

******

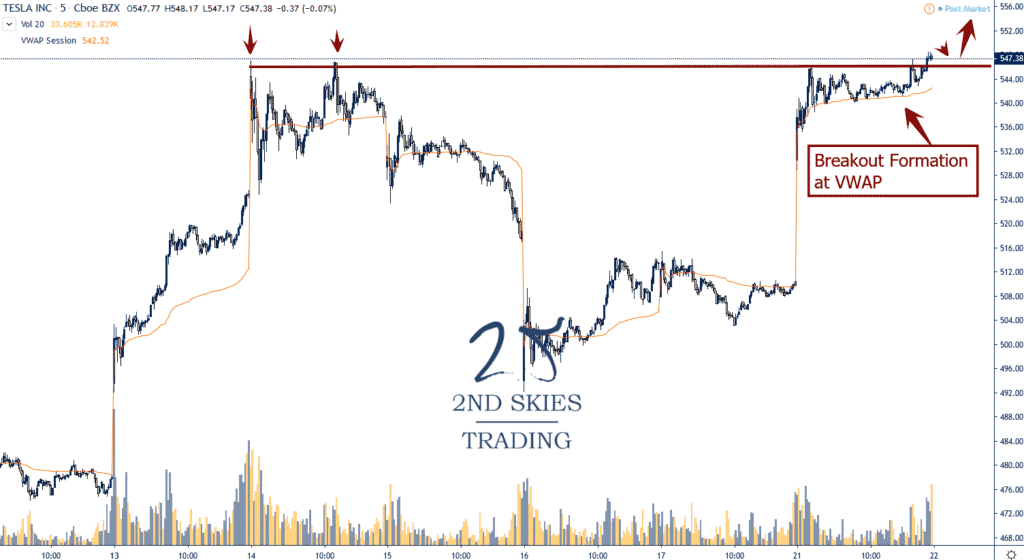

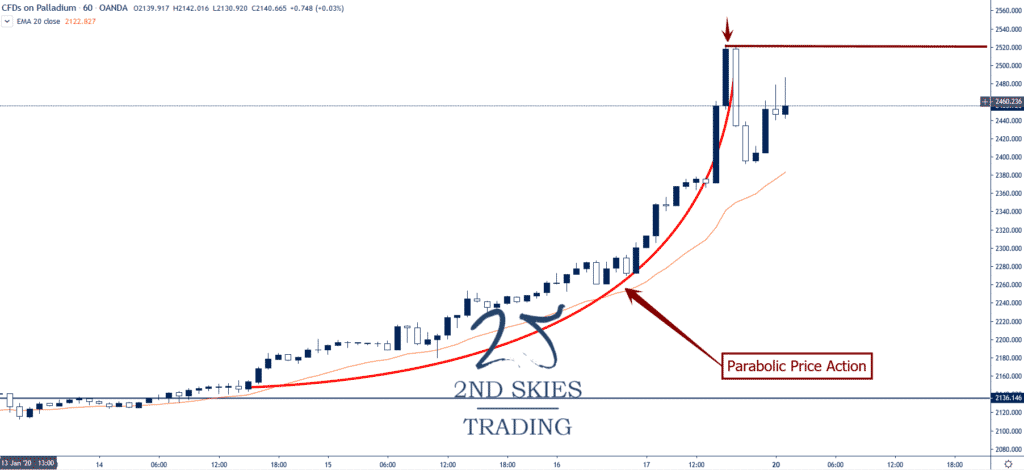

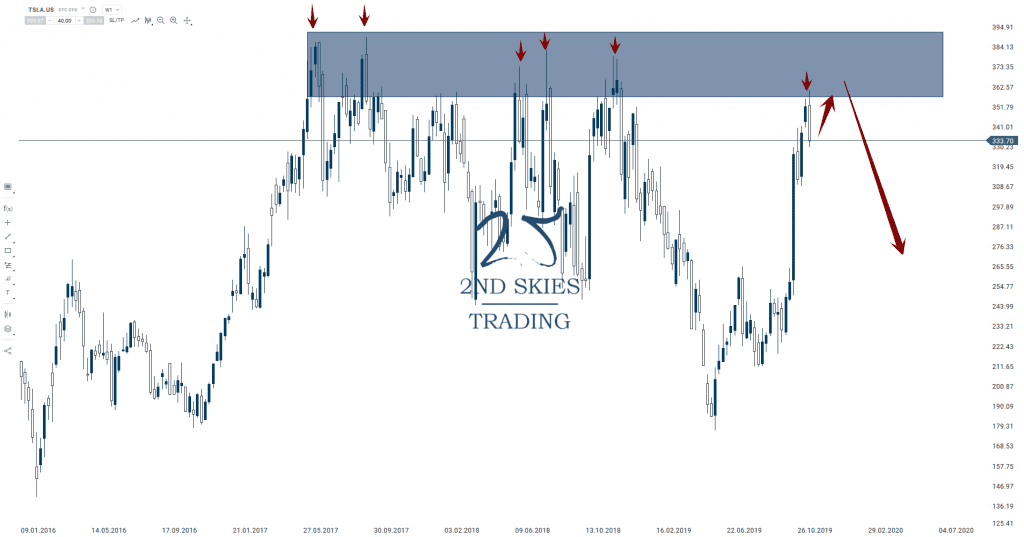

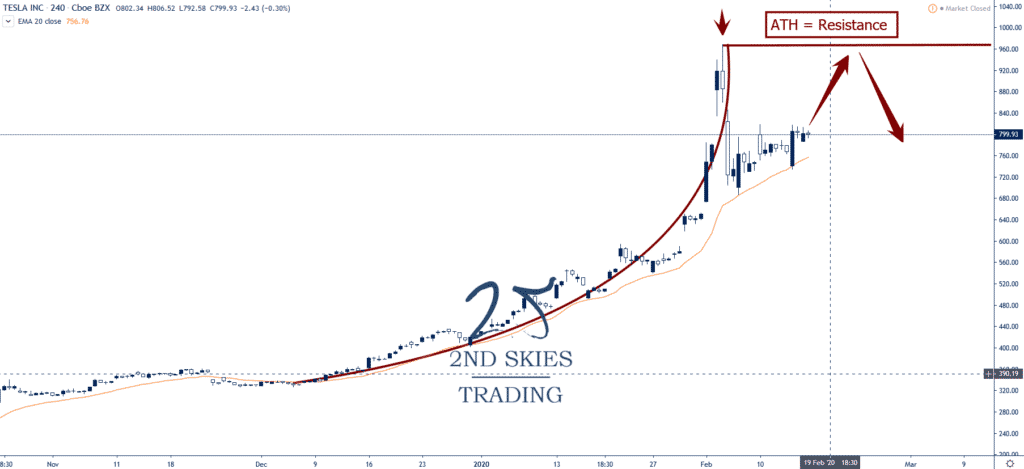

Stock Trade Idea: Tesla (TSLA) – Parabolic & Exhaustion Price Action, Potential Sell Setup (4hr chart)

Price Action Context

After creating one of the mother of all short squeezes, Tesla has gone parabolic, climbing from 424 to start the year, rip-roaring up to an all time high of 965 by the 4th of Feb.

When you look at the price action in the chart below, you can clearly see it went parabolic, however the price action is showing signs of exhaustion.

For bulls, the stock has been holding the daily 20 ema, but now that the 965 is a part of history, the 2nd time around, it should act as resistance, potentially offering a sell setup.

Trending Analysis

ST & MT bullish while above the daily 20 EMA and 683 on a weekly closing basis.

Key Support & Resistance Levels

R: 965, 1000

S: 683, 542

******