Is the Bull Trend Over in Silver?

Silver and Gold have had one of the best bull runs of my 26 year trading career. Since the beginning of August, $SLV (Silver ETF) has gained a massive +225% going from the low $33’s to just shy of $110 over 6 months. It was one of the surest bets for the 2nd half of 25’ and the first 3 weeks of 26’. The precious metal ETF gained 22 of the last 21 of the last 24 weeks.

Weekly Chart Silver $SLV

However, the fairy tale bull run may have come to an end. Starting last Thursday, we witnessed a huge impulsive selloff from $110 on Thursday to $68 earlier today.

This is a drop of over -32% over just 3 trading sessions, with its current price just shy of $75. The question flooding my chat room has been without a doubt “is it time to buy the dip?”

First, let’s dive into a few details, then I’ll give my assessment of whether the bull trend is over, or if we should buy the dip.

Is History Repeating, or Just Rhyming?

There’s a good chance many of you have not been trading since 2010, but for those of you old enough in the markets, Silver had a bull run similar to the one we just witnessed.

Ironically, in Aug of 2010, $SLV went on a gangster bull run talked about far and wide across trading circles and desks. From Aug 23rd to late Apr in 2011, $SLV gained +175%, closing bullish 24 of 35 weeks launching from the mid $17’s to the low $48’s.

$SLV Weekly Chart 2010-2011

However, these gains were only fleeting. After peaking at $48, a week later it was down to $33, shedding almost 31% in a flash catching many traders offsides. From there it would not reclaim this $48 peak till October 2025, on its way to $110 just a few sessions ago.

So, the question remains, is history repeating itself, or just rhyming?

While we don’t have that answer as there is more of this story to be told, we’d like to point out a few things:

- Over the last week of options trading, SLV was pumping out more options than $TSLA, only trailing $SPY and $QQQ!

- Last week $SLV traded over 6 million contracts, just shy of SPY at 6.8M

- Before the collapse, $SLV had a 99th percentile IV rank (currently 82.5%)

- Last weeks share volume was the largest weekly print on record!

The above translates to a lot of bullish leverage that finally got unwound. This pullback was necessary as it was going parabolic, and when you have everyone piled into long calls/long shares, with leverage that high, losses will be large. This is an important lesson in trading – that the biggest losses often come with the biggest leverage. And it’s possible there’s more unwinding to be had.

Who Could Have Seen This Coming?

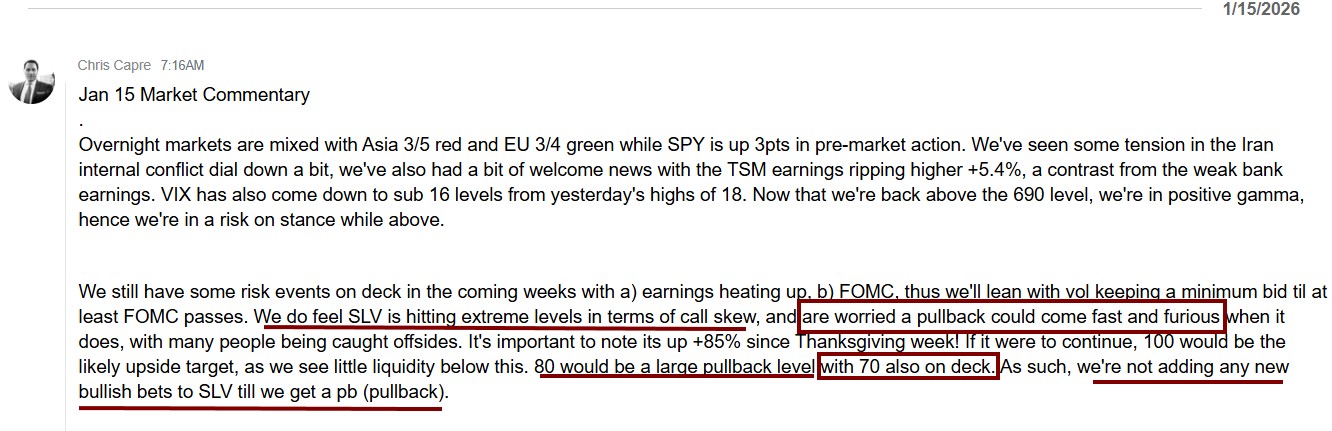

Not to toot our own horn, but I’d like to present to you exhibit A below, which is our morning market commentary we sent out to our traders and students on Jan 15th this year.

Morning Market Commentary Jan 15th, 2026 (Chris Capre)

As you can see, we pretty much nailed this on the nose. We mentioned the super high call skew and are “worried a pullback could come fast and furious”…along with predicting “80 would be a large pullback level with 70 also on deck. As such, we’re not adding any new bullish bets to SLV till we get a pullback”

FYI, $SLV only spent three sessions north of $100, and dropped to $68 before stabilizing just above $70.

I’m not sure how we could have called this any better, so kudos to our students and traders that made money trading the pullback.

Is the Silver Bull Trend Over?

While we think this bull trend has many similarities to the 2010/2011 bull run, the underlying macro conditions are somewhat different. Back then, we had a global financial crisis. For right now, the problems with the market are mostly isolated to the US economy.

Everyone piling into bullish gold and silver bets appear to be a bearish bet on the US economy going forward. We don’t see the underlying conditions within the US economy improving (substantially or materially) till H2 of this year. Thus, we’re inclined to think the bull trend may not be over.

However, we do still think there is some deleveraging in the $SLV and $GLD space, and the bounce on the price action has been corrective.

When big bull trends like this reverse, its hard to find an accurate/soft landing spot. Thus, its recommended to find a big range where you think the pullback will end. We believe that is between $50-70, hence, will be watching the PFP system (positioning, flows and price action) carefully for signs of a stronger bounce and transition.

Until then, stay tuned to our morning market commentary, and make sure to check in with our option flow report for TTM members on Monday before the market opens, along with our live trading webinar each week to see when we’ll take our next bullish $SLV trade..