Nial Fuller’s 71% Drawdown in the AxiTrader Competition

UPDATE: Click here to see my analysis of Nial’s Fuller’s trades in the AxiTrader Million Dollar Trading Competition – it’s more shocking than I originally thought.

A former student of Nial Fuller who is now in my price action course asked me about Nial winning the AxiTrader competition.

Of course Nial Fuller talked about how he used “sophisticated money management strategies” and “wasn’t day trading“, but it turns out he lied – he was day trading, and was using horrible risk management.

With all things Nial Fuller, once you dig into the details, a completely different picture emerges from what he says.

So make sure to read this article about why Nial Fuller lied about his price action trading in the million dollar trading competition.

Now I’m not going to talk about the fact he and AxiTrader are business partners, or the fact AxiTrader actually allowed their business partners to join vs. pure clients. I’ll leave that to y’all to decide on.

But here is my summary of why Nial Fuller & AxiTrader represent everything bad about the trading industry below.

Only Nial Fuller would:

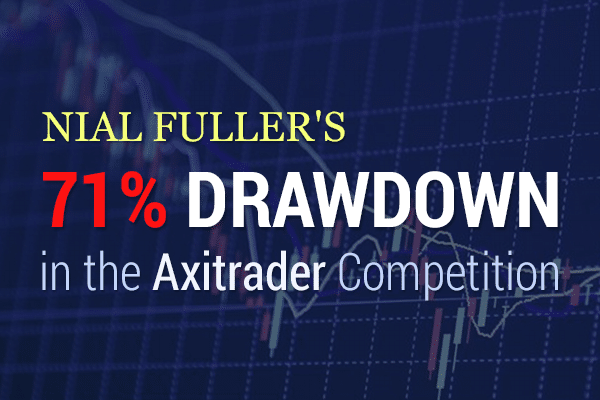

- Enter a trading competition with the absolute smallest acct possible (5k)

- Trade less than 10 times (by his own admission) for 6 weeks

- Completely throw risk and money management out of the window by having a 71.4% drawdown over 3 days!

- Another 50+% drawdown over another 3 day period!

- Call his risk and money management system ‘sophisticated’ (see below)

- Brag about it

And for proof, below is an image which shows you the details Nial forgot to mention about his heavy 71+% and 50+% drawdowns.

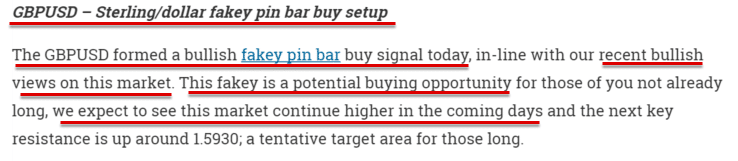

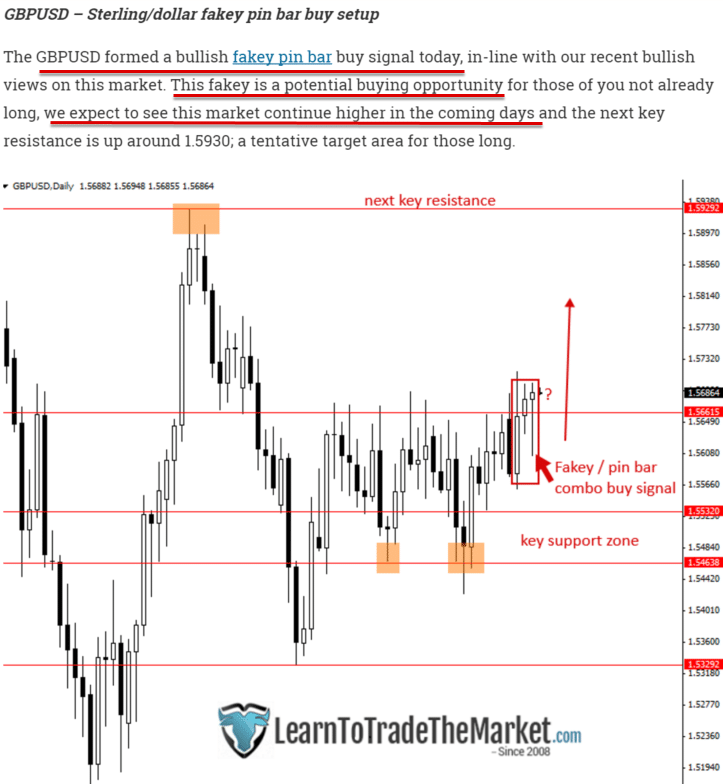

Keep in mind, this is the same guy who on Aug 20th, 2015 was bullish on the GBPUSD lauding his bullish fakey setup (commentary below).

Now make sure to remember the chart below & attached to this commentary.

Remember, this is a buy signal in line with his bullish views on the market.

Why am mentioning all this?

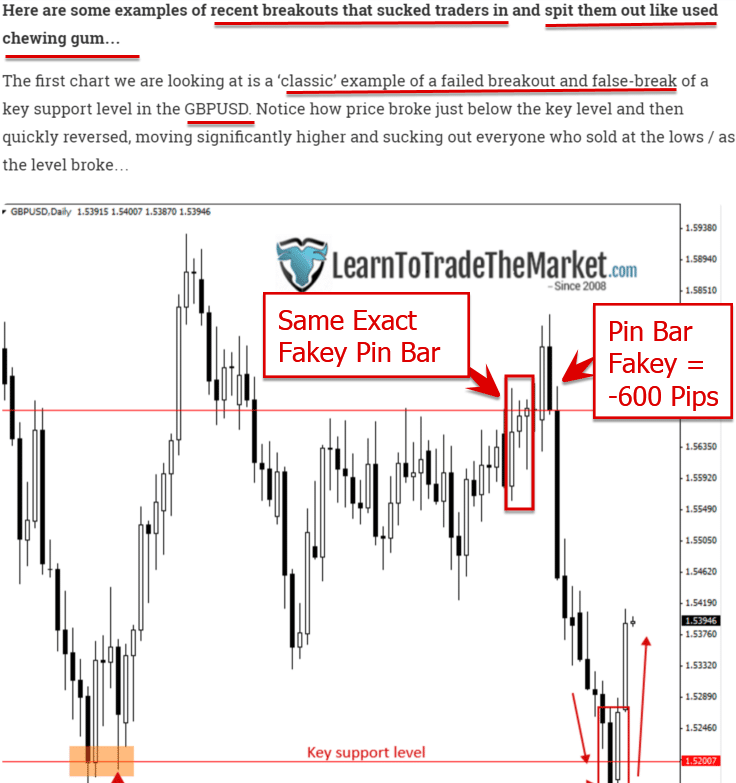

Because the same pin bar fakey setup Nial Fuller was lauding above, magically a few months later was a trade that “Sucked Traders in and spit them out like used chewing gum“ (in his own words – see below).

So which is it Nial?

Is this a great fakey pin bar trade that you were bullish on, or a ‘classic’ false break that ‘suckered traders’ (like yourself)?

And will you (ahem) Nial Fuller make some ‘editorial’ adjustments to your above article now that the hypocrisy is fully on display?

Inquiring minds want to know.

EDITORS NOTE (Jun 1 5.18pm EST)

After an editorial review, I realized I made a mistake. While Nial Fuller was bullish after the fakey pin bar combo that failed for 600 pips, the ‘false break that suckered traders in’ he was referring to was the break of the support level down below. My mistake and I apologize for the error.

BUT….

In a strange twist of irony, even when I’m wrong about Nial, I’m right. How so you say?

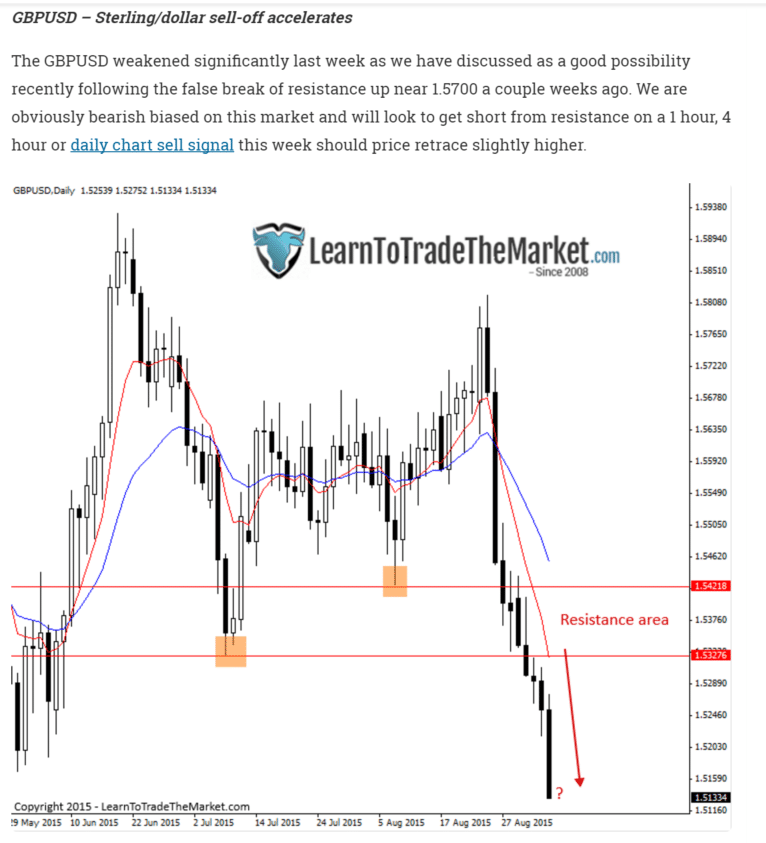

A look at this commentary of the false break that ‘suckered’ traders in ironically reveals the same thing. That he was ‘obviously bearish’ after the break of the key support level and looking to sell (see below – 3rd line).

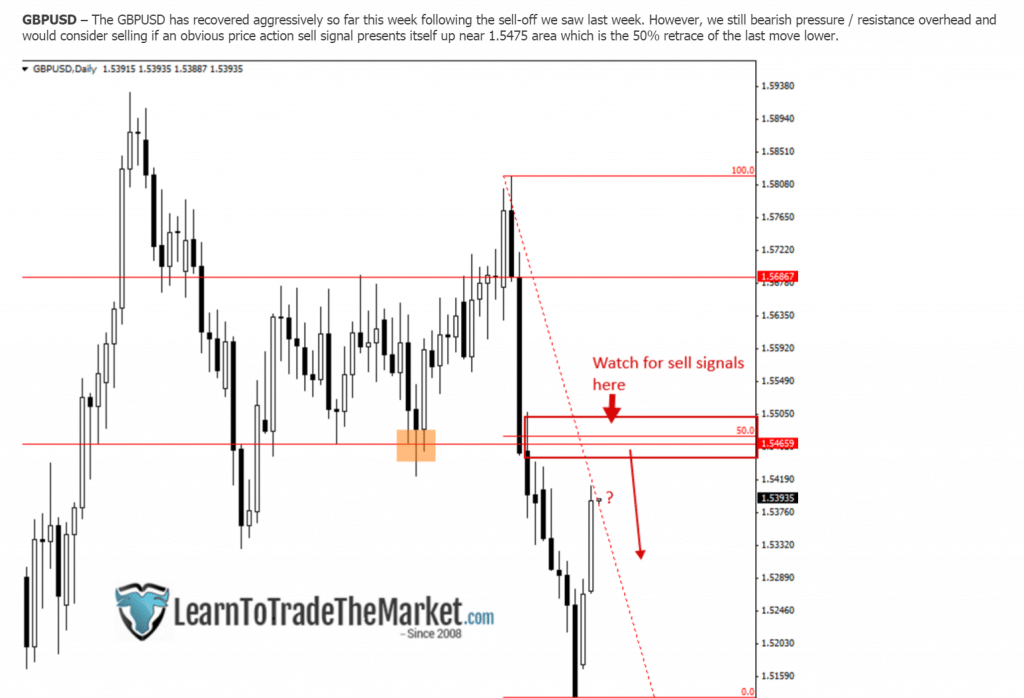

To top this off with a cherry – after the market formed the famous false break, he was still bearish and would consider selling (see below as well).

So different trade – same result. He’s bearish, but later, he wants to point out any of you that were short were ‘suckers’.

Regardless, this should give you a good idea about Nial Fuller.

Along the lines of marketers and all things bad for the industry, only AxiTrader would:

- Invest $1MM in someone who threw money and risk management out the window

- With a 5K acct

- Over 6 weeks and do < 10 trades

- Produced a 71.4% drawdown + a 50+% drawdown

and say ‘YES, I WANT TO INVEST $1MM IN THAT GUY.”

Brilliant!

Now ask yourself the following question:

Who is Nial trying to attract with this promotion?

Is he going after the veteran trader? Is he going after someone who’s had a few years of experience and knows what is a reasonable return on risk?

Or is he going after the newbie trader who will only see the % gain and dream of tripling their account? And what kind of clients are AxiTrader going after by promoting results and performances like this?

I’m guessing you can figure out the answer (newbie traders who wouldn’t see the difference).

And this is why Nial Fuller and AxiTrader represent everything wrong with the industry. They talk about % gains, but fail to mention the risks it took to get said results.

In fact there was no mention of the risks or the downside. Only upside! Those don’t make for the best marketing materials. Nor do they make the return seem so impressive now do they?

They certainly don’t speak of a ‘sophisticated’ risk management system. But you won’t hear that from Nial Fuller or AxiTrader. And that is why they are bad for the industry (IMO).

Nial Fuller & AxiTrader are targeting newbie traders in the hopes they will open up an account playing on the idea ‘you too can triple your acct’.

But one last question naturally arises, which is:

When does making less than 10 trades over a 6 week period represent anything about one’s skill set or ability?

To put this in perspective:

- Would you understand a basketball player’s strengths and weaknesses over 10 shots sparsely taken over 6 weeks?

- Would you know what kind of golfer someone was by watching them hit the golf ball less than 10 times over 6 weeks?

- Would you feel comfortable putting $1MM behind a poker player whom has only played 10 hands over 6 weeks?

Let me know on which planet or universe you think this is a good idea. Yet this is what Nial Fuller & AxiTrader would want you to believe.

I know this article is controversial. I know it may irk some feathers. But I’m willing to bet many will cheer my sentiments/opinions on this as a key topic that has plagued the education industry.

Do you agree with what I’ve said above or not? If so, why not?

I’ll look forward to your comments below.

RIGHT ON CHRIS!!! I gladly admit that I once was a sucker for scam artists like Fuller. But I have “grown up” and reading this crap makes me so angry about the nonsense they peddle and the dreams they crush. Thanks again for being the adult and write a thoughtful and careful rebuttal. I hope it spreads far and wide.

Hello Brian,

Yeah you are not the first to convey this expression, and sadly won’t be the last who feel like Nial Fuller scammed them. It’s easy to peddle dreams – far better marketing. Nobody wants to hear it will take longer and more work than you think up front.

But am glad you supported this and for sharing your sentiments.

Well, you set my first impression right, Chris. Then I thought, well, to continue trading after a 71% draw down takes some disipline, but of course with such a small account and being a partner of AxiTrader and all, it’s a no-brainer to see thru the scam….Take care Chris:-)

Hello Lars – yeah nothing to lose after a 71% drawdown. Ironically he never mentioned it ahead of time, which is convenient. If he loses, nothing is lost as he put no skin in the game ahead of time.

Shows the lack of confidence in his trading IMO. And yes, the partnership with Axi is a little off to say the least.

I really liked what you had mentioned. It shows how much active and professional are you with your work by keeping an eye on them and revealing their cheap marketing strategy to trap people towards them. Cheers

Hello Osama,

Indeed – Nial Fuller uses all kinds of cheap marketing tactics to trap newbies in so glad you noticed.

Well said ,a few years ago I nearly fell in the trap of buying his carbon copy so called price action course.

Lucky I did my research..

Yeah – Nial Fuller’s course is pretty carbon copy. Good thing you went in another direction!

Chris, would you agree that such competition is never a good way to measure performance? If there should be a competition, it has to be of a longer duration (1 to 2 years) in order to really seek out the good traders.

Some very good points Kirk. First off, I think competitions like this by and large are useless.

They are for super small periods of time which represent very little. In this case, 3 mos is nothing in the life-cycle of a trader. On avg, 30% of all traders will be profitable in a quarter, but being profitable for 2-4 quarters in any year is much harder.

That plus competitions really create an artificial trading environment wherein traders are using really bad habits (i.e. with risk and money management) all to win the competition.

It’s a catch 22 because if it’s for a short period of time, it means very little as anyone can win. But if it’s over a long period of time, then you wire in bad habits.

So neither is really desirable, unless you want to sucker in newbies.

I’d say at a minimum a competition (if there is going to be one) should be for a year and that there should be a max risk per trade for every participant. Otherwise someone could risk most of their acct on one trade and win it all, yet that wouldn’t represent any skill in trading.

Just my thoughts….

From overnight Nial wins prestigious competition ?? but who organizes ??? FXCM no..AXITRADER … !!

Nial it makes one or two trades in a week ?? …

On the other hand I could see inconsistencies in certain explanations as in bars fakey ….

That in my country has a name and we all know … ) )

Indeed Francisco – in many countries this has a name. Pretty shady IMO.

Hi Chris,

Funny thing was I saw your course first. Than saw Nial’s. I ended up joining him (ignoring my intuition and went for the bling). Few months in I was like.. “What the EFF?? ”

I remember lying down on a bed looking at EURUSD and found a pin bar at a perfect location with what … confluence if I remember?? (so happy now that the old habits are gone), took that trade, went no where with it. Didn’t made sense contextually. Trade went into profit eventually but the next trade came by after a few weeks. Lost my skills… restart.

Meaning of Fakey by the way = Filthy. Annoying. Killing. Eroding. Yucky.

*** London seminar .. Alex and I. A tribute to his work and yours via Trading Sweatshirts 😉

Ha – too funny about the FAKEY.

Yeah, many people go for the bling. Then they regret it later.

And yes, you won’t build your skills trading his way.

Great article Chris. I remember the day I started going through your course and saw the light after sitting in the weeds in Fullofit’s course. Funny thing is I still get his emails and I laugh because he peddles his ‘fakey’ set up as a proprietary set up and only he teaches this one candlestick pattern which is why you need to join his course. Lol well the ‘fakey’ is in actuality called the Hikkake which was discovered by a gentleman named Daniel Chesler whom published this pattern with rules to trading it many years before ‘Maverick’. Again this is another lie by deNial Fullofit selling you a bag of goods that are empty promises which promise to make your pockets empty.

HA – he really says he’s the only one who teaches the Fakey/Hikkake pattern? Dear lord, he just can’t help himself but lie all to bring in those unsuspecting newbies.

Hopefully this article and your comment will shed a greater light on it.

But thanks for sharing your experience as a former member of his.

You hit the nail right on head there Chris!! I’m a 2S APA course member and before becoming one I came very close to paying for Nial Fullers course. A conversation I had with him over the phone when I called him regarding his course fee is what stopped me from joining. It was when I told him I was a newbie and my goal was to become a forex intraday trader, he straight out told me in a very negative and disempowering tone that trading on an intraday basis was a complete waste of time as any price action occurring between key levels and signals that he teaches and “APPARENTLY” profits from is nothing more than just noise and to avoid even looking at it. After that phone call I did some more research and then immediately came across 2SFX. After reading your bio and watching your videos I signed up as an 2S APA member without any hesitation and it has since been the best decision I’ve made in my journey to becoming a successful FX trader. I salute you Chris for putting this article out there so that any newbies, inexperienced traders and anyone blinded by Fullers trading methods like I once was can see just how fictional his ways of trading really are.

Thank you & Well done Chris!

– Nick

Hola Nick – yeah, he seems to think day trading is the devil and something that shouldn’t be done. Clearly he doesn’t know many professional traders, as many of them are making their living every day doing that.

I’m glad to hear you found working with us a good decision.

And thanks for the salute on this as it was definitely a risk putting an article out there like this as many traders have been blinded by Nial Fuller’s strategies and rookie approach to the markets.

Can I know what broker do you use? After know this I consider looking another Fx reliable broker.

Hola Steffen,

I currently have most of my funds with SaxoBank. But some others I’d recommend would be FXCM, FxPro and Gain Capital. Hope this helps.

Hi Chris,

Your speculation is spot on and resonates with what I had in mind, I never bothered to dive into the details to find out the risk management of his performance, I would’ve thought Nial Fullers would automatically publish the statistics in his article if the title was well earned by him but I guess it’s the devil in the details that he was reluctant to share with the public, the way how he only highlights the raw return rather than the return in terms of risks involved is exact the poison what the newbies are seeking after, I guess anyone who dreams about overnight success with minimal effort or years of sweat and tears learning from the market, gets what they deserve one way or the other, unless they bump into someone who is mindful and with utmost integrity like yourself. I’m a long term follower of your methodology in trading and want to express my gratitude one more time here.

Yep – the devil is in the details when it comes to Nial Fuller. You can’t mention the drawdown if you want to sucker in newbies who dream of tripling their acct in a few months.

But thanks for being a long time member – tis appreciated.

Not sure how to reply back or append to my comment but here is what I found additional.

How often do I have to trade?

There is no set frequency you are required to trade. The competition is open to any trading style and traders are welcome to trade as frequently or infrequently as they wish. The winner will be determined by a combination of profitability, return on investment, drawdown analysis and strategy implementation.

What ever Axitrader is on about is definitely shady OR they themselves are not being honest OR their analyst is a high school dropout. If they see a winner is a 71% drawdown contestant, than I feel sorry for them.

Whoa – very interesting find. I thought it would have been purely based upon % return. But if it was based upon drawdown analysis as well – that makes it more interesting.

I am glad somebody finally scratched the surface and digged into the details.I too was suspicious when i saw Nial Fuller winning this competition.But i doubt if AxiTrader will ever give him 1 million $ to trade with these risky approach.This competition was more of a marketing gimmick to lure newbies.And the tragedy is every other broker is involved in such ‘short-term’ trading competitions including the likes of FXCM,FxPro & Oanda.

Yeah the details paint a different picture when you look at them. Pretty crazy AxiTrader would give people money with those kinds of drawdowns

Hi Chris.

I agree 100%. Why is that… I tripped over the ‘news’ of winning the competition by NF last week. I looked at the news, read the percentage win and the timeline of the competition AND at the hosting company. Then I had problems to stop shaking from with laughter. There wehe no need for me to kook deeper . Everybody who knows the ‘idea’ and ‘teaching’ of NF was able to see the idiocy of the whole thing. But he is able to catch the newbies and to make his money with this kind of promotion. But every trader who wants to learn, should run as fast as possible.

You have evplained very well

Hopefully the newer traders or ones who have some experience will run the opposite direction.

Hi Chris,

Maybe I’m missing out something here, but how could Nial come out with a 369% return from <10 trades in 6 weeks? Is the figure is a fake?

Another thing of no concern to this discussion: Very few brokers offer FX options,

Saxo Bank is one but they are pretty expensive I hear. I assume you are hedging

you FX positions with options, so why is so few brokers offering FXO's?

Lars

Hello Lars,

Simply put, it’s gambling. You could easily go into any casino, throw huge portions of money on red or black, hit a few and walk out with a ton of money. It’s very hit or miss with just a few trades over 6 weeks. That is why it represents very little. A year of trading would be a different story, but 6 weeks and < 10 trades doesn't represent anything. RE: FXOptions That is another subject (not in line with this discussion). But you can email me on this.

Hi Chris,

Can you please do a post on FX Options? I am looking to open an account with Saxo due to the availability of those instruments. Thanks in advance 🙂

Hi Chris, I know you don’t take criticism too well but i will play devils advocate here. I completely understand where you coming from but what I want to highlight here is that atleast he took part in a competition and showed his account. Not many educators out there willing to put their neck on the line.

Interesting you say I don’t take criticism well. You’re one of the first to mention this. In fact many people have joined simply because they said I took criticism well.

But regarding your point – Nial Fuller didn’t put his neck on the line at all. He never mentioned he was in the competition ahead of time. There is no risk in this (by not saying anything ahead of time), because if he loses, then there is no risk and he never needs to mention it. But if he wins, then he can brag about it.

So there was no ‘putting his neck on the line’ there now was there?

And what does entering into a few months competition really prove? 3 months and < 10 trades is nothing in the life-cycle of a trader. So not much of a representation here. But thanks for sharing your sentiments.

In a trading competition, you can do what you like…

This would be what we call a ‘rhetorical’ statement, e.g. obvious.

Lol, this is so funny.

I pretty much thought the same.

I was laughing hard when I first saw this indicent on twitter

Indeed – many a traders thought the same and emailed me about it.

Coincidentally when I first got to know Nial Fuller was the winner of the Axi competition, I immediately thought of you. So I am glad you wrote this article. As Axi long time client, I feel disgusted they let their business partner joined the competition against the other retail traders. Where’s Axi’s integrity? I don’t even think he is ‘trading’ in fact this is pure GAMBLING with this so called ‘sophiscated’ money management. Now it makes me wonder should i stay with Axi or move on.

Hello WYD – yeah I’d be not so happy with Axi after this. And yes, Nial Fuller was gambling.

Perhaps time to look for another broker…

How will I be assessed?

To be considered for funding we expect traders to be able to demonstrate the following general conditions:

Ability to manage leverage consistently

Drawdowns of less than 1.5% per month for a money manager, or less than 5% per month for proprietary traders (of notionalised capital)

Profitability

Risk-reward, as measured by the Sharpe ratio

Got this from the Axi Select website. Still got me wonder how Nial got chosen to be the winner of the competition.

Me thinks this is for the AxiSelect incubation program – not the competition. But if it is, then it’s quite confusing.

Holy crap, last year i was about to join his course. But somehow it gave me a bad vibe. The nervous interviews on YouTube, the obvious child like approach to trading were overwhelming signals this guy is not the real deal. I’m so thankful I didn’t waste my time and money on this guy and found a real mentor right here !

Hello Mike,

Yes, you and many others are glad you didn’t waste your money on Nial Fuller’s course. Glad you are a part of our community.

Great to see such kind of articles. It’s rare to find people of influence condemn such cons. Most of the time most people get to learn about such atrocities by their own experience. But with more of such articles, more people will be saved the pain of losing cash.

Have to agree Blaise – hopefully people will start to wake up to this.

What, we’re not talking about THE Nial Fuller, are we? The one widely regarded as “the authority” on price action trading, even if he says so himself?

That would be the same one. Who nobody else says it, but he certainly does.

I fully agree with the fact that it was not adopted any”magical” moneymanagement trhoughout the competition. A 70% drawdown speaks for itself.

I so clearly remember the big announcement of Fuller winning the comp.

Thanks for a great analogy of what really went on. Very enlightening. Be closing my accounts with AXI also.

Has anyone posted this link on his website?

Cheers.

Hello Sifufx – yes, it was important to bring this information and perspective out.

Am glad to hear you’re closing your accts with Axi as it never disclosed a major business partner of theirs was in the competition.

chris, do you still trade using ichimoku??? I know i am and finding alot of success

Hello Ninner – yep, still do. Just recently posted a live trade video in the ichimoku course (https://gammalevelcorp.wpengine.com/advanced-ichimoku-course/) for a +650 pip winner and around 100 pip stop

Kind Regards,

Chris

good work chris, i know i just took a 800 pip winner in a pair with about 100 pip stop as well…i really like the cloud and presents good trading ops…

kind regards,

travis

Congrats Travis. Yes Ichi can offer some really big winners so glad you like it

Hi Chris… looks like this link is broken. Is there an up to date one?

Hello Robin,

Which link are you referring to?

Its the link above my reply… https://gammalevelcorp.wpengine.com/advanced-ichimoku-course/)

Try it now…

No, still get the same message “Sorry, We Couldn’t Find That Page”

Try the link in my original response. It should be refreshed now.

do u have forex managed account or signal service?

Hello Mrk Tanvir,

We do not. We teach people how to trade, not fish for them.

Kind Regards,

Chris Capre

Hi Chris,

I just come across this article after researching exactly what you wrote about. This tells me why. Apart from what has already been said, as a general rule he doesn’t ever publish his personal trading results (if he ever trades) – and never performs live trade videos or the like. Also if you look at his hundreds of articles on the site and his so called “17,000” + members, how does he have any time to trade…and if he is such a great trader why does he push so hard to market his course?

I read another analysis on his marketing tactics and he was basically spamming and google pulled him up on it and wiped his tactics out.

I’ll also mention another fact that had me wondering about NF’s methods was an article he wrote on money management and the complete disregard and bagging of a percent stop (he mentioned the usual 2% stop as absolute rubbish but funnily enough didn’t provide a viable alternative except for very vague comments about coming up with a dollar figure you are comfortable with.) That is horrible advice for a newbie.

I will have a look now at your philosophy on price action as I also believe that is the methodology to follow. Just the right way and right direction.

Hello Getulio Jr.

I think there is a misunderstanding here – that you actually know what you’re talking about. Many years ago I decided not to write that book and focus on other projects. So it’s not that the book took 4yrs, but that I changed course.

Kind Regards,

Chris

It seems as if I can only post things you want to hear

Hello Michael,

There seems to be a misunderstanding here.

We’ve already replied to you via your email. All comments are moderated to avoid spam or inappropriate language.

As per our policy, only neutral (and or/positive) comments/dialogue/language are allowed. Yours was neither and had inappropriate language.

You also copy/pasted the exact same original message and posted it an hour later. Who copies their messages to sites they post on?

As to your comment above, we have no problem posting comments from people who do not agree with us as long as they can communicate like an adult without using inappropriate language and engage in an actual communication and dialogue. Case in point – Bilal’s comments in this very article are an example of someone who doesn’t ‘agree’ with me. Perhaps you should do your homework before making inaccurate statements.

Best of luck.

My post didn’t have anything inappropriate in it. At all. Just my own strong disagreements against this article. I copied my previous post for network issues just incase it did’t go through.

Like I said before, you only post things you want to hear. And if you call Bilal’s comment as an example of someone who doesn’t agree with you, then wow, no wonder you thought mine was inappropriate. I understand your reason for doing it, but I don’t understand why you did it on this particular article since strong disagreements against this are bound to happen, and they should be posted aswell and not just what you and everyone here want to hear(well, not if you can help it).

Hello Michael,

In an email you called me a dictator and coward. Comparing me to Hitler for not allowing your post which also called me names and was mostly just slinging mud seems immature and extreme.

I have a copy of the email if you’d like me to prove this and demonstrate your inability to communicate like an adult without name calling or slinging mud.

As I stated in my email – Nial would never allow anyone to post a comment like your original one. So you’re comparing me and judging me by a standard you won’t even hold Nial to. Yeah that makes sense.

Please show me the hundreds of examples (or even a few) where Nial would allow such comments posted on his site. I’ll probably reincarnate 3x before that ever happens.

And Nial also ‘approves’ all his comments on his site as well. So calling me a coward for not allowing any/all comments on the site would also make Nial a coward as well. Very interesting logic you have there.

Lastly, as I stated in my email – we are hit with spam and all kinds of comments that are inappropriate to just automatically be published. Hence why we ‘approve’ each and every one.

I don’t have a problem with people disagreeing with me – as long as they communicate like an adult, don’t engage in name slinging (like you did in your post and email), and actually engage in a real dialogue with neutral or positive comments only.

You don’t just let anyone come into your house, shit all over your furniture and sling mud at you. In the same manner – that is exactly how we relate to situations like this.

Best of luck and I sincerely wish you success in trading, and happiness in life, because anyone who wants to go on someone else’s site, and call someone they really don’t know a coward and a dictator, maybe (just maybe) could use a little more happiness in their mind and life.

Kind Regards,

Chris

While you are at it, please go to Nial’s site and show me how many comments that were like your original comment in nature, and are ‘allowed’ on his site?

I’ll see you in a 100yrs when you are hopefully able to find one 😉

That risk management is atrocious.

Hi Chris, I’m new to forex trading and came across this post after researching reviews on Nial. I’ve been looking at different strategies and wanted to learn as much as I could (demo accounts, books, articles, etc) about FX trading before going live with an account. Could you reply or PM me with why his methods are wrong or at least point me in the right direction? I’m not looking for hand holding just a solid foundation to learn as much as I can before going live.

Thanks in advance,

Mike

Hi Chris. Here is my 2c for a bit of fun. I joined Nial Fuller in Oct/Nov 2010 and paid the princely sum of $350 for the LTTTM handbook and access to the website and daily report as such. There was only about 8 pairs traded and as a newbie that was enough. His manual was bad – I mean embarassingly bad with basic spelling mistakes and things all over the place – but as a newbie I just didnt know better. So for the next 12 months i tried to become a trader under the LTTTM method and learnt pin bars/ fakeys etc. My results were terrible as I tried to put on the same trades i saw him doing but i always got stopped out or didnt see things as our trading mentor did even though we were following the exact method. Well, after losing confidence to trade I moved away from his advice and sought a reliable trading mentor.

Things I noticed:

-Best ‘hindsight’ trader I have ever come across. Things would be explained differently if a setup went astray after.

-Never made trading performance available (didnt ask as i didnt know any better)

-Constantly self marketing about LTTTM and also about how bad other methods are

Needless to say, I didnt prosper under this tutelage and after years of looking around was pretty much gun shy about paying for education after that experience. Thought about asking for my money back but as youve noticed – there is pretty much an agressive cult following that wouldnt allow any questioning of the method/educator.

Fast forward 6 years later and i have found a trading educator who is transparent and teaches a profitable method. I just wish I didnt have to ‘pay my dues’ at LTTTM before I did as I could have used that money for more beneficial things.

It was a competition! Have I missed something??

Yes, you clearly missed something about how Nial Fuller lied about his million dollar trading competition, how he traded, how he really trades, his lack of ‘sophisticated money management’, and more.

You should probably read my latest piece Beware: Nial Fuller of Learn To Trade The Market Trades Like A Gambler (and lied about it)

https://gammalevelcorp.wpengine.com/forex-videos/beware-nial-fullers-trading-like-gambling/

Hi Chris, I totally don’t agree with you since your review is not professional and unfair. I mean “in trading competition” there is a game rule and objective for selecting the winner based on highest return in a limited period, say 2 months, and everyone can join with a minimum equity, say $500. In this case, traders can do any extreme techniques just to achieve the highest return since other performance parameters won’t be considered.

It will be different if selection is intended to fund investment purpose which needing longer period of portfolio performance record, say 12 months. Every aspects and factors will be qualified including draw down, annual roi, winner rates, etc.

“to make you easy to understand, i give you an analogy i.e. you try to comment a motogp competition by using a public traffic standard regulation. Then you blame that Rossi is no good in safe riding due to over speed, etc.” It’s easy to understand right ?!

If you are fair enough tthen please post my comment.

That’s all from me. It doesn’t mean I under estimate you. I may learn from you one day. Cheers.

Hello Rahmat,

While I appreciate your candor, nothing changes the fact that Nial Fuller lied (blatantly) about his million dollar trading competition. For example:

Nial Fuller Lie #1: “I don’t day trade…I only traded a handful of times.”

Turns out this is a complete lie as he traded 51 times in ~6 weeks, with half of his trades closing within a day. Nial Fuller is lying here, plain and simple.

Nial Fuller Lie #2: “I used sophisticated money management strategies…”

Also a lie. How is having inverted risk to reward ratios ‘sophisticated’? How is 29% of his trades having no Stop Loss (or Take Profit) ‘sophisticated’?

How is having a 53% of blowing up your entire account ‘sophisticated’? How is having a 73% chance of blowing up half your account ‘sophisticated’?

Plain and simple, Nial fuller wasn’t using anything ‘sophisticated’. He’s lying here to (IMO) make himself look way better than he actually traded.

Nial Fuller Lie #3: “These are the exact same strategies I teach in my course.”

Also a lie…where in his entire course (or teaching body for that matter) does he talk about closing trades out within hours, or minutes of opening them, when they’re barely in profit, or haven’t violated his stop loss? You can go through every one of his trades he did this on and see there was no counter-exit pin bar, or any other price action signal. He wasn’t doing ‘set and forget’. He was actively managing every single trade (which is the complete opposite of what he teaches).

Nial Fuller wasn’t trading as he taught, or the methods he teaches in the course. Nial Fuller was gambling. If it’s so easy to demonstrate he was trading the way he taught, why has he never spoken once about his trades publicly, or to his members? If he did trade the way he teaches, those trades would be a goldmine of teaching material demonstrating how well they work. But he hasn’t.

That should tell you something…that Nial Fuller lies and trades nothing like he says he does.

So while you state my ‘review is not professional and unfair’, which I clarify further in my latest video (Beware: Nial Fuller’s Trading Is Like Gambling – https://www.youtube.com/watch?time_continue=1514&v=uu_g-OsNVkk), please tell me how my numbers are inaccurate, and thus ‘unfair’?

Please tell me how my stats and analysis is off of his trading performance.

NOBODY to date has been able to challenge these numbers. So unless you can counter my arguments and data with other numbers, it seems my ‘review’ is actually ‘fair’ and quite ‘accurate’.

Kind Regards,

Chris

Hi Chris, it’s good that you made the effort to reply to such comment. It provides further clarity and we learn a lot from that. I like how you reason things. I am your student, but I don’t trade anymore because I couldn’t commit. However I continue to read the stuff you post because those mindset stuff applies to outside of trading as well.

Hola Kirk,

I can understand the other person’s position, especially if they haven’t seen the latest video/analysis we did. But am glad it provided more clarity.

Still to date, NOBODY has been able to dispute our stats, which to me is a clear sign what we’re saying is accurate and backed by data.

RE: Trading

I’m sorry you were too occupied to commit. Hopefully you can in the future when you have more time, resources and abundance.

But am glad to hear the mindset material we offer is helping as it definitely applies to more than trading.

All the best – Chris

I think it’s not nice to talk behind his back. I think it’s better to have some questions like why he did it this way? and how could you do better than him in this competition?

Hello Victor,

Nial Fuller is well aware of this article. He’s welcome anytime to challenge our article. We’ve also posted an update to this: Beware – Nial Fullers Trading is Like Gambling (https://gammalevelcorp.wpengine.com/forex-videos/beware-nial-fullers-trading-like-gambling/) where we show how he lied about not day trading, the use of ‘sophisticated’ money management and not trading his strategies at all.

Now if you want to talk about the facts/data we presented in our two pieces, of if Nial Fuller wants challenge our statements with data and facts, he’s more than welcome to.

And we’ve shown our verified forex trading results for 2017 here (https://gammalevelcorp.wpengine.com/forex-videos/chris-capres-verified-forex-trading-results-2017/). Good luck getting Nial Fuller to publish last year’s verified trading results. I’ll be 100yrs old before that happens!

First off I think he is a scammer too, but so are you. I’m just here to comment on your logic. Even though I think some fishy stuff was going on with that competition, your analogies about only taking 10 trades over 6 weeks are severely lacking, its the mark of a good basketball player to know WHICH shots to take, same with the poker player and the trader. A good portion of a trader’s edge is knowing when not to trade and how to not over trade.

Hello FY,

How interesting you have to use a disposable email address to make a comment here.

Regardless, first off, clearly you haven’t watched my latest update on Nial Fuller’s AxiTrader Competition (https://gammalevelcorp.wpengine.com/forex-videos/beware-nial-fullers-trading-like-gambling/) . The actual trades were made available from the competition.

Turns out he actually traded 51x, so you’re logic about ‘it’s a mark of a good basketball player to know which shots to take’ isn’t accurate, nor relevant.

Now if you watch the video, you’ll realize Nial Fuller lied about the million dollar trader competition. He lied about:

1) “Only trading a handful of times” when he actually traded 51x

2) “Using sophisticated money management” when he had horrible risk parameters, inverted R:R’s, often times not having a stop loss or take profit…and more

3) “These are the exact same strategies I teach to others” when he traded nothing like he taught (closing trades with hours, inverted R:R’s, etc)

Now regarding your comment about me being a scammer, I’ve already demonstrated that I make money trading which you can see here with my audited 2017 forex trading results (https://gammalevelcorp.wpengine.com/forex-videos/chris-capres-verified-forex-trading-results-2017/).

So clearly your statements about me being some sort of ‘scammer’ are completely inaccurate. I know how to trade, and I know how to teach, and there is nothing y ou can do or say to change that.

Perhaps it’s better next time if you do your homework before making completely inaccurate statements.

But have a great weekend, and I sincerely wish you the best of luck. Someone who goes around making false statements on other people’s websites using fake names and email addresses most likely (IMO) needs the help.

A lemon is a lemon, if Nial lied he lied and that is very pathetic since I like watching is videos. I can’t speak about Chris’s course because I never used it, actually I paid for the membership and just have not used it because I feel overwhelmed when I log in and sell all the strategies.

Just incase Chris’s reads this my username is kaleb2005

Hello Rick,

Yes, a lemon is a lemon, and Nial Fuller definitely lied about his price action trading in the trading competition.

RE: Our Course

Thanks for the feedback. So my suggestion is to follow the suggestions in the welcome video, whereby we talk about just focusing on the videos in section 1 on price action context, then to start practicing those skills.

Hence, you probably shouldn’t be focusing on our many strategies until you’ve gotten the core skills and foundation down.

Should you have any questions, do not hesitate to email directly as I’m happy to help.