Our 2025 Market Predictions: Hits, Misses & Lessons

As we write this, 2025 is ending. Before releasing our full 2025 trading performance results, we wanted to do something few market commentators are willing to do — publicly grade our predictions.

Anyone can make bold calls. What matters is accountability.

Below is our full 2025 prediction scorecard. Some calls were spot-on and highly profitable for traders who followed them. Others delivered mixed results. The goal here isn’t perfection — it’s transparency, learning, and sharpening the edge going forward.

Prediction #1:

There will be a change in the world order after this quarter in 2025

This prediction proved highly accurate.

The most significant shift in the global order during 2025 stemmed from changes in U.S. trade policy under President Trump, particularly the widespread implementation of tariffs. These policies materially altered long-standing economic relationships, including those with the United States’ two largest trading partners, Canada and Mexico. Additional tariffs were later expanded globally, signaling a broader departure from prior trade norms and agreements.

The deeper implication of these actions is not simply higher tariffs, but a structural shift in how the United States engages with the world. Two key realities emerged:

- Prior trade agreements became functionally irrelevant.

Policies negotiated under previous administrations were no longer treated as binding or durable, increasing uncertainty for governments and global businesses alike. - The traditional concept of U.S. “allies” weakened.

Trade relationships increasingly became transactional rather than cooperative. Countries were no longer differentiated as allies versus competitors, but instead as compliant or non-compliant with U.S. economic demands.

Taken together, these changes marked a clear break from the post-WWII, rules-based global trade order. Markets, currencies, and geopolitical alignments adjusted accordingly throughout 2025.

As a result, we consider this prediction not just directionally correct, but one of the most consequential macro calls of the year.

Prediction #2:

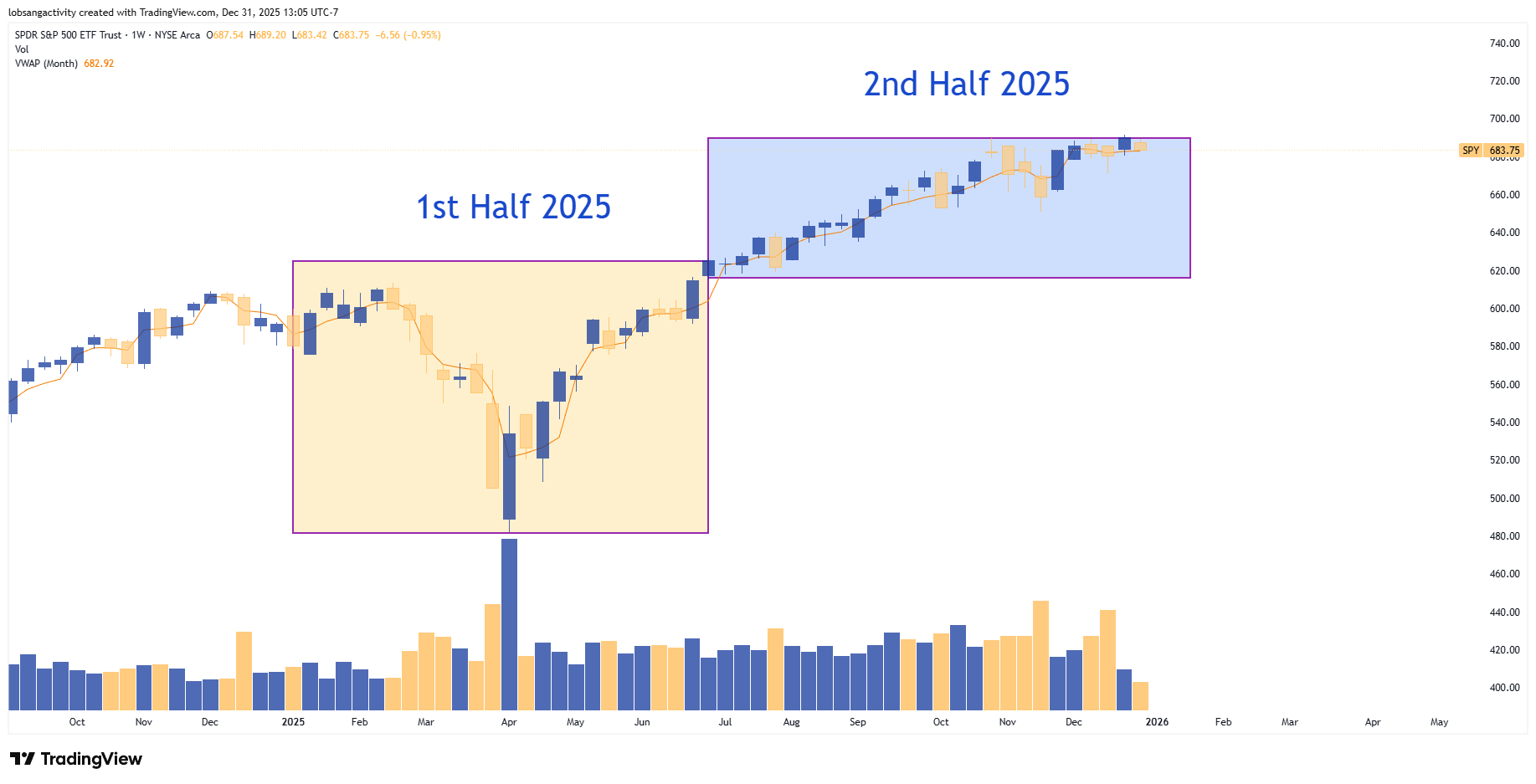

The First Half of 2025 Will Be More Volatile than the Second Half

This prediction also proved accurate.

Market volatility in 2025 was heavily front-loaded, with the first half of the year experiencing significantly larger price swings, sharper drawdowns, and faster regime shifts than the latter half. Equity indices, particularly the S&P 500, saw repeated volatility spikes driven by policy uncertainty, tariff announcements, and macro re-pricing events early in the year.

By contrast, the second half of 2025 was characterized by more stable market behavior. While trends remained active, price action became more orderly as markets adjusted to the new policy environment and macro expectations stabilized.

Several factors contributed to this volatility compression:

- Policy uncertainty peaked early.

Markets reacted sharply to new trade policies and geopolitical developments in the first half of the year, creating frequent volatility shocks. - Expectations reset by mid-year.

Once tariffs and policy direction became clearer, risk assets repriced and volatility declined as uncertainty was replaced by known constraints. - Positioning normalized.

Extreme hedging and speculative positioning seen earlier in the year gradually unwound, contributing to calmer price action.

A simple comparison of weekly S&P 500 price behavior between the first and second halves of the year illustrates this clearly, with larger ranges and faster reversals concentrated in the first half.

As such, we consider this prediction decisively correct and highly actionable for traders who adjusted risk exposure accordingly.

Prediction #3:

One New War Will Begin While a Current Conflict/War Will End

This prediction was partially correct.

We anticipated that one existing geopolitical conflict would reach a resolution during 2025, while a separate, new conflict would emerge elsewhere. The first half of that forecast materialized: the Israeli–Palestinian conflict moved toward de-escalation relative to prior years, reducing its intensity and global market impact.

However, the second half of the prediction did not fully play out. While geopolitical tensions remained elevated across multiple regions, no clearly defined, large-scale new war emerged that met the threshold implied in our original forecast.

This outcome highlights an important distinction between persistent geopolitical risk and formal conflict escalation. Throughout 2025, markets contended with ongoing regional instability, proxy tensions, and diplomatic friction, but without the ignition of a new, dominant war event capable of reshaping global risk pricing.

As a result, we assign partial credit to this prediction: one component was directionally correct, while the second did not meaningfully materialize within the year.

Prediction #4:

If Trump Fulfills Some of His Main Campaign Promises (Mass deportation, tariffs, tax cuts for big business), This Will Jump

This prediction delivered mixed outcomes across the variables we identified.

We expected that if President Trump moved forward with core campaign policies—specifically broad tariffs, aggressive immigration enforcement, and tax incentives for large businesses—the result would be renewed inflationary pressure, rising long-term interest rates, higher agricultural commodity prices, and downward pressure on U.S. equities.

In practice, the results were uneven.

Inflation did increase following the implementation of tariffs, aligning with our core thesis that trade barriers would raise input costs and consumer prices. Agricultural commodities also advanced, reflecting higher production costs and supply-side distortions.

However, other components of the forecast did not materialize as expected. Despite inflationary pressures, U.S. Treasury yields—particularly the 10-year—did not rise materially. Additionally, U.S. equities, including the S&P 500, remained resilient and ultimately moved higher rather than declining.

This divergence underscores a critical macro lesson from 2025: inflationary policy does not always translate into higher long-term yields or weaker equity markets when growth expectations, capital flows, and global demand for U.S. assets remain strong.

As such, we classify this prediction as partially correct. The inflation and commodity impacts aligned with expectations, while the interest rate and equity market responses did not.

Prediction #5:

These Stocks Should Do Well in 2025

This prediction proved highly accurate.

We identified U.S. financials—particularly large banks and financial services firms—as a sector positioned to outperform in 2025. Our thesis centered on improved net interest margins, capital strength, regulatory tailwinds, and the ability of major institutions to benefit from higher nominal economic activity.

Specifically, we highlighted the following names:

- Citigroup (C)

- JPMorgan Chase (JPM)

- Visa (V)

- Financial Select Sector SPDR Fund (XLF)

The year-end performance validated this view:

- C: +64.8%

- JPM: +34.3%

- V: +10.5%

- XLF: +61.4%

Average return across all four positions: +42.75%.

Three of the four significantly outperformed the S&P 500, with relative outperformance ranging from approximately 20% to nearly 40%. Even the weakest performer in the group delivered positive absolute returns.

This outcome reinforces the importance of sector-level positioning during macro regime shifts. While much of the market narrative in 2025 focused on technology and AI, financials quietly delivered superior risk-adjusted performance for investors who recognized the underlying structural advantages.

Overall, this was one of our strongest and most actionable predictions of the year.

Prediction #6:

Options & Trading Volumes Should Remain Strong, With Possibly 0 DTE Coming to Single Stocks

This prediction proved directionally and structurally correct.

We anticipated that options trading activity would remain elevated throughout 2025, driven by increased retail participation, institutional hedging demand, and the continued growth of short-dated options strategies. In particular, we highlighted the potential expansion of same-day (0DTE) options beyond index products and into single-stock markets over time.

While 0DTE options did not formally launch for individual equities in 2025, overall options activity reached historic levels. Multiple options expiration cycles during the year recorded some of the highest notional delta exposures ever observed, underscoring the growing influence of derivatives on underlying price behavior.

The data supports this trend:

- Total SPY options volume exceeded 14 billion contracts in 2025, up from just over 10 billion in 2024.

- SPY share volume also increased meaningfully, rising from approximately 14.63 billion shares in 2024 to 18.08 billion shares in 2025, an increase of roughly 24% year over year.

These figures reflect a broader structural shift in how market participants express risk, hedge exposure, and trade short-term price movements. Even without the formal rollout of single-stock 0DTE products, the demand for shorter-duration optionality and higher trading frequency continued to intensify.

As a result, we consider this prediction accurate, particularly in its identification of a long-term structural trend rather than a single product launch.

Prediction #7:

Circling Back to Trump’s Tariffs, If They Go Into Play…

This prediction produced mixed results, largely due to the difference between bilateral currency performance and relative performance across the broader G7 and global FX landscape.

Our original thesis was that the imposition of U.S. tariffs on Canada and Mexico would exert downward pressure on both the Canadian dollar (CAD) and the Mexican peso (MXN) by increasing trade friction, reducing export competitiveness, and weakening cross-border capital flows.

In bilateral terms, both currencies performed better against the U.S. dollar than anticipated, supported by U.S. dollar softness, shifting interest rate expectations, and capital reallocation dynamics. On this basis alone, the prediction would appear incorrect.

However, when viewed in a broader context, both the CAD and MXN underperformed relative to other major global currencies, including the euro and the Japanese yen. Against a composite G7 currency basket, both currencies lost ground over the year, reflecting the structural drag imposed by trade uncertainty and tariff-related risk.

This outcome highlights a key FX principle: currency performance must be evaluated on a relative, multi-pair basis, not solely against the U.S. dollar. While the bilateral USD pairs masked some of the weakness, relative performance measures confirmed that tariff pressures were a meaningful headwind.

As such, we classify this prediction as partially correct.

Prediction #8:

If Trump and Musk Remain Friends, TSLA Will Likely Head To…

This prediction proved largely accurate, both in direction and in sequence.

Our original assessment was that President Trump and Elon Musk were unlikely to maintain a long-term alliance. The reasoning was straightforward: both individuals exhibit dominant leadership styles and strong personal brands, making sustained cooperation structurally unstable over an extended period.

We anticipated that Tesla would initially benefit from the perceived alignment between the two figures, followed by heightened downside risk once the relationship deteriorated. The key elements of the forecast were as follows:

- Tesla shares would experience upside momentum during the period of perceived political alignment.

- SpaceX would benefit from increased government contracts and favorable policy treatment.

- A breakdown in the relationship would trigger a sharp repricing in Tesla shares.

The outcomes closely tracked this framework.

Tesla shares approached the projected upside target, reaching highs just below the $500 level before peaking late in the year. During the same period, SpaceX secured additional government support and contracts, aligning with expectations.

Following the deterioration of the Trump–Musk relationship, Tesla experienced a rapid and severe decline. Within months, shares fell by more than 50%, declining from peak levels to lows near $214 in early April, consistent with our expectation of a material downside move following the political split.

While the precise upside price target was narrowly missed, the broader sequence, timing, and magnitude of the move validated the core thesis. As a result, we consider this prediction correct, particularly in its identification of relationship-driven risk as a key catalyst for volatility.

Prediction #9:

The Eco-System Around AI Will Offer…

This prediction proved highly accurate.

Our thesis was that while leading artificial intelligence companies would continue to benefit from secular AI adoption, some of the most significant upside in 2025 would occur in the infrastructure and ecosystem surrounding AI, rather than in the most visible, headline names.

Specifically, we argued that as AI models scaled, demand would accelerate for the underlying resources required to support them—data storage, compute infrastructure, networking, and AI-adjacent hardware—creating outsized opportunities in less crowded trades.

The results strongly supported this view.

While core AI leaders delivered solid performance—such as NVIDIA advancing approximately 37% and Meta gaining around 11%—several ecosystem companies dramatically outperformed:

- Seagate Technology (STX): +215%

- Western Digital (WDC): +280%

These gains significantly exceeded returns from many of the most widely owned AI stocks, despite receiving far less attention in mainstream market narratives.

This outcome reinforces a critical investment principle: second-order beneficiaries of technological revolutions often outperform first-order leaders once adoption reaches scale. By focusing on the infrastructure layer of AI rather than solely on model developers, investors were able to capture superior risk-adjusted returns in 2025.

As such, we consider this prediction decisively correct.

Prediction #10:

Circling Back to Trump and Musk, If They Remain Friends, This Country Will Benefit

This prediction produced mixed and still-evolving outcomes.

The original thesis was that if President Trump and Elon Musk maintained a cooperative relationship, U.S. policy toward China would likely become more pragmatic and less restrictive, particularly in areas related to technology, manufacturing, and capital flows. The expectation was that Musk’s business exposure and strategic interests in China could influence a softer policy stance.

In practice, the results were uneven. On one hand, certain restrictions were relaxed, including the continued sale of advanced U.S. semiconductor technology to China, suggesting a degree of policy flexibility. On the other hand, tariff pressure on Chinese goods remained elevated, reinforcing a more confrontational trade posture.

This divergence reflects an important reality of 2025: U.S.–China policy was shaped by competing forces rather than a single coherent strategy. Strategic competition, domestic political considerations, and economic pragmatism all exerted influence simultaneously.

Given the partial alignment with the original thesis—and the fact that China policy remains highly contingent on future geopolitical events, particularly around Taiwan—we classify this prediction as mixed rather than incorrect.

This forecast may ultimately be resolved by future developments rather than fully adjudicated within the 2025 timeframe.

2026 Predictions?

Our 2026 outlook will be published shortly. If 2025 taught us anything, it’s that regime shifts matter — and 2026 is shaping up to be another inflection year. We’ll focus less on headline narratives and more on the structural forces, second-order effects, and asymmetric risks that tend to matter most when regimes change. Stay tuned and we hope to be working and trading with you in 2026!