Reviewing Trades – Two Crucial Tips

Being a huge football fan, on Sunday my monitors are littered with NFL action. Since I don’t have a TV, I watch all the games online. Before or in between games, I’m glued to the NFL network which is both highly educational + entertaining.

Yesterday I heard a great example of a player who went to a team building exercise on a non-practice day. They went bowling. With 4 on each bowling team, plenty of down time before tosses. What was this defensive lineman doing in between tosses? On their iPad reviewing plays. That is someone who recognizes the value of reviewing their work.

In the NFL & Trading

Reviewing your work is critical because it helps you to see where you are trading well, what you need to improve on, and how to direct your energies going forward. All great professionals review their work, both in the NFL, and especially in trading.

Those traders who do not review their work (+ prepare mentally each day) are what I term ‘Trader Philanthropists‘. I call them that, because they are donating the money to the market. Traders who make money come prepared, are passionate, work hard and are well trained. You have to do the same.

Below I will share 2 crucial tips for reviewing your trades.

Review Tip #1 Catalog Each Trade via Screenshot or Video Recording

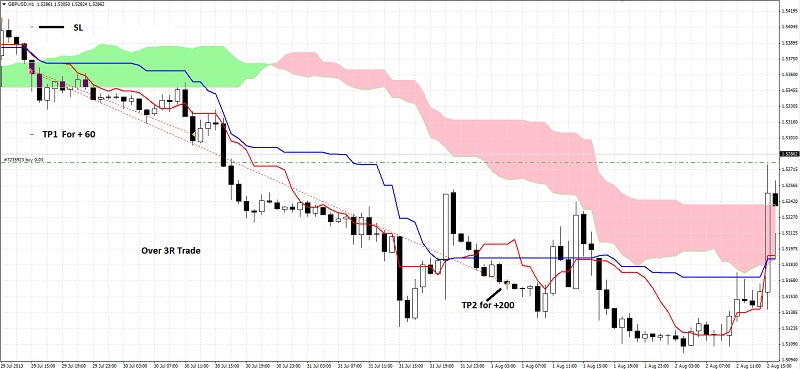

For the traders in my private members forum, I teach them to minimally take a screenshot of each trade showing the actual entry and exit points on the chart.

Why?

Trading is a highly visual process, and having the actual charts of the trade we took gives us a lot of data to work with. Seeing those trades with the green arrows (winning trades) time and time again builds confidence while increasing pattern recognition. Below is a typical screenshot saved for a trading journal.

Yes we get experience from making actual trades, but reviewing them is like doing an additional trade. This is because the mind doesn’t differentiate much (from a learning perspective) between real trading, and reviewing your trades. Every time you review a trade, its like doing another lap around the track. Each lap builds those trading muscles in your trading brain.

My two suggestions for doing this are via screecast (screenshots) and camtasia (video recordings).

*NOTE: Here’s a cool trick in MT4 for getting screenshots of your trades; 1) go into your trade history, and find the actual trade, then 2) drag the trade onto the pair and chart. You’ll then see two arrows with a line showing your entry and exit, SL & TP (example below).

Review Tip #2 Journal Each Trade At a Set Time

I know journaling trades may not seem like fun. That is because you haven’t tasted the value in it yet. 13 years ago I started practicing yoga. Within the first year, I was practicing it daily, along with meditation. Why?

Because I had a taste of the benefits. I felt stronger, more flexible, relaxed, creative, energized, and healthy. When things got challenging and I wanted to slow down, I just remembered the benefits outweighed my temporary discomfort.

Journaling & reviewing trades is the same.

I recommend journaling at the same time each day. By building habits and these mind programs around trading, you build the neural networks to become disciplined.

Being disciplined builds confidence and communicates something important to your self-image.

It builds confidence because when you stick with it during tough times, you get through them faster in the future knowing you’ll keep moving forward.

It communicates something important to your self-image by strengthening the feeling that ‘I will do what it takes to be successful at trading‘. That belief becomes empowering to your successful trading mindset.

I fill in my journal at the New York Close being a natural impasse in my trading day. For you, try to find a low activity moment, or at the end of your trading day. Try not to do it when you are exhausted, or you’ll likely imprint the idea of ‘exhaustion‘ with ‘journaling‘.

Just like my dentist suggested brushing my teeth while doing something fun – by association, you are more likely to do it.

In Summary

If making more money trading, increasing your consistency, and getting better at something that can last you your life is not inspiration to review your trades, then I’m not sure what will be.

We all know plenty of people who played an instrument for a while, but eventually gave up even though they showed promise. Don’t be that person. Be the one who plays guitar at gatherings and wow’s an audience.

Life wants us to be skillful, to be good at things, to be professionals at life. Be that football player who in between turns at bowling, is reviewing their work to see how they can improve. The learning process of a trader never ends, and requires some ‘sweat capital‘. The rewards are far worth the effort, especially in trading.

Now it should be noted these tips are ‘mechanical’ in terms of process, meaning they are sharing with you the ‘what to do’. In the following article, I will share with you the ‘how to’ in filling out your journal to enhance your trading mindset.

*Please make sure to share your comments, whether you agree or disagree. And if you do disagree, please make sure to share why as I value different points of view on this.

Hello, Chris.

Would you recommend against journaling each trade after it’s finished as opposed to doing the whole day’s trading at once?

Depends upon your trading style. If you are highly active, then no, wait till all trading is done. If you are not so active, you can do it. But it could distract your attention and thought process from setups forming in the moment.

Ideally they are done during low activity times, not while you are racing around the track!

Kind Regards,

Chris Capre

I am really thankful about your articles… this part is true: “Just like my dentist suggested brushing my teeth while doing something fun – by association, you are more likely to do it. ” …… my major goal is to becoming in a full time forex trader, at the moment I just trade eventually when I find a good setup and my body allow me to do it after a long day at the office. It turns out I was doing really well by the begining of the year, however, I was asked for doing a two-month training in my office. After that time without doing forex, I havent been unable of getting fit to my trading dicipline again, I feel really disappointed about that, since my pattern recognition ability I had in previous months seems loose. What do you recommend me to get into the game again?… do I need to start over again?… I feel my professional career is dragging me out of the forex life…

Hello JT,

Am glad you like the articles and find them helpful.

From what you said, it sounds like you have a full time job and are not able to trade a lot or have much time. My suggestion would be M-F to be trading EOD (end of day) strategies on the daily and 4hr charts.

This will allow you to engage the market while not needing to manage them at work. To do this, you’d need to use set-and-forget strategies which I teach in my Price Action Course. They are rule based as well, so all you have to do is spot the rules for a setup, and execute the trade as the SL, TP, and Entry are all built into the rules.

Now you will be less active, but you will be able to participate in the market while building up your chart reading skills. Make sure its a set time of the day so it becomes consistent which will build neural networks in your mind for this.

On the weekends, I recommend using Forex Tester 2 to train live forward simulation, so you can execute your systems, but do it at a faster pace. Consider it like going to the batting cage in baseball…allows you to get more swings in, but will help build your pattern recognition skills.

Hopefully this gives you some options.

Thoughts?

Kind Regards,

Chris Capre

Hi Chris

Is it necessary to have a written/typed journal in addition to screen shots?

Couldn’t a screen shot with a few comments tell the whole story.

Paul

Hello Paul,

Good question. Ask yourself, can you put personal/mental notes on a screenshot? Likely not. This is why I keep a trading/performance journal.

Hope this helps.

Kind Regards,

Chris Capre

Chris thanks for writing fx goodies every week, I enjoy reading your work. As it is full of life, wisdom, and practical working fx education. My question/sentiment are similar to Paul’s, looking forward to your comments.

Hello Jewell,

Glad you are enjoying it and finding it full of wisdom and practical advice as well.

Kind Regards,

Chris Capre

great work chris

precise and well articulated

Hello Manu,

Glad you liked it and found it well articulated.

Kind Regards,

Chris Capre

Great article Chris, thanks! I am wondering, how to avoid over analyzing? If I am trying to review my trades, I easily get into fight with myself especially if the trade hit the SL. I find hard to decide, If I made a mistake (wrong pattern recognition) or If I did everything OK but the trade simply didnt work out this time. I know I need more practice, studying and etc, but because of all of this, I somehow avoid reviewing my trades because It show me, that I can easily convinced myself that I saw pattern either right or wrong. I was thinking to post more trades on forum and get the opinion from experienced members, which I highly value. What do you think? Anyway, thanks for this article, I am glad It made me realised why I was putting so much afford into avoiding reviewing my trades. I knew reviewing trades its one of the most important thing, I just dont want to face all this battles…

Petra

Really loved the article! I think that it’s a great example of real dedication, passion and will to succeed and give all your best to be really good at what you do. So, loving the approach.

I, myself take screenshots at the entry and at the close of every trade that I take and recently I have gathered two separate folders with all the winners and all the ones that didn’t work out. I have it on my tablet too so when I’m on the go and I have time to kill I can watch it. Great to see my UJ trade in the article btw.

excellent article. you are definitely the best forex mentor out there

G

Thanks for sharing this crucial tips. You’ve taught me a lot with your guide this is very helpful information!