Set and Forget Trading Strategies

What’s Inside?

- Can I trade set and forget with a full time job?

- What are some set and forget trading strategies you can use?

- What skills do you need to trade set and forget in the forex market?

In my last article, I showed how you can do forex day trading.

This week I’ll be covering how you can do set and forget trading in forex, stocks, commodities, and global indices.

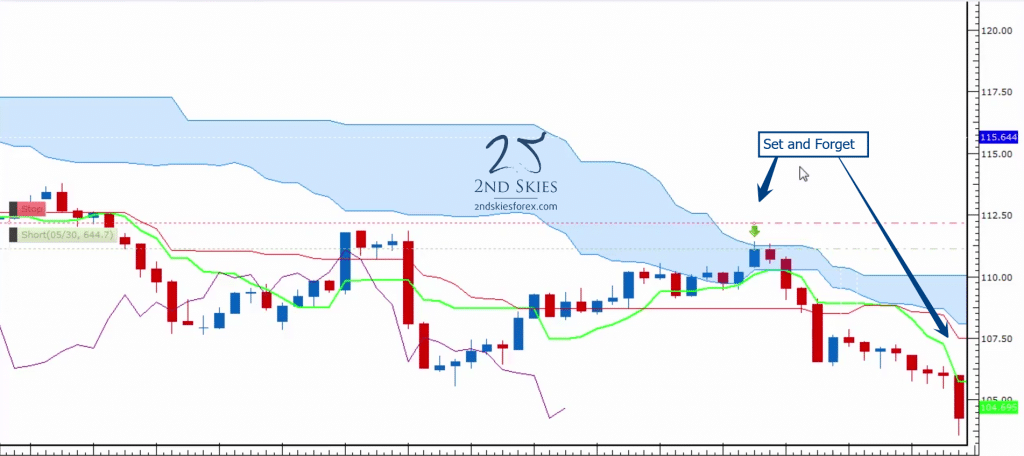

The basic definition I’m working with when I’m talking about ‘set and forget trading‘ is whereby you open a position with a pre-defined stop loss, take profit and entry location, and once the trade is activated, you let it go with no trade management.

This means you let the trade run until it hits your take profit, or your stop loss. Hence the name ‘set and forget‘.

This can be done on any time frame, meaning you can do set and forget trading on the weekly time frame, the daily or 4hr charts, or even the intraday charts such as the 1hr and below.

Yes, you can even day trade using set and forget, meaning you take a trade for the day and close it when it hits your SL, TP or the daily session is done.

The key point is once your trade is active, you do not manage the trade.

Now let’s get into some of the key points and topics you’ll need to know around set and forget trading.

Can You Trade Set And Forget With A Full Time Job?

Short answer? Yes, and something you should (most likely) use if you have a full time job and only 1-2 hours per day to trade the forex markets (or any markets for that matter).

The opposite to set and forget trading is to actively manage your trades. I wouldn’t recommend this if you lack any of the following:

- Really solid price action skills to be able to read the price action context in real time, and thus be able to manage your trade to get the optimal profit out of it.

- Have a baseline profitable track record showing you can manage your trades

- Have the time to consistently watch your positions

- Have pre-defined conditions/rules/patterns to help you exit your positions early

Hence, if you lack any of the following above, then you should be trading set and forget.

Additionally, if you’re just starting out in the markets, I’d also recommend trading set and forget to build a baseline showing you can find trades, entries, and have well placed stop losses and take profit levels.

Now that we’ve established who should be trading set and forget, let’s get into my suggested rules, tips and strategies.

Trading Set and Forget Tip: Have A Pre-Trade Routine

Trading takes a very particular mindset and mental activity to do it profitably. Very rarely will your work mindset perfectly lead you into the right trading mindset.

Because of this, I recommend having a pre-trade routine, whereby before you even start trading, that you sit down at your computer and clear your mind, making sure you’re relaxed, clear and focused before you make any trading decisions.

All you need is about 5-10 minutes of mental preparation to get yourself into a clear state for trading.

NOTE: If you want a simple 5-10 minute practice to get ready for trading, read my article on meditation for trading.

Once you are mentally settled and ready to trade, then you’ll want to load up your trading platform and begin your pre-trade analysis.

For your pre-trade analysis, you’ll also want a routine that is structured and fixed. What I mean by this is:

- You trade ideally at the same times per day

- You only look at a fixed set of instruments every day that are a part of your trading plan

- You start with a top down analysis, meaning you start with the higher time frames, and work your way down (if you’re doing multiple time frame analysis)

- You begin by analyzing either the price action context first, or the Ichimoku context if you’re an Ichimoku trader

Once you have the above completed, it’s time to select which trades meet your criteria, and then enter your entry location/price, your stop loss and take profit levels.

NOTE: You should always trade with a minimum of 1:1 risk to reward ratio (or better). If you want to learn more about why you need this minimum risk to reward ratio, click here.

As to choosing your risk to reward ratio, I don’t recommend it always be a fixed number, but it should always satisfy the minimum 1:1.

Targets should always be set based upon the price action context (or Ichimoku context). If you have a particular trading strategy that suggests a specific target, then fine, fire away. But you should always be targeting a take profit location you can hit with a profitable trading edge over time.

I don’t recommend any fixed targets until you have a sufficient baseline and data to clearly back up what your most optimal target is because you could be getting out too early just based on a fixed target.

If you are new to trading, then I’d suggest somewhere between 1.25R and 2R. ‘R‘ simply refers to your risk, so if you’re risking 100 pips, 1.25R would be 1.25 x 100 pips, so 125 pips.

As to position sizing, I’d recommend no more than 1% per trade, and if you’re a beginner, then better to be extra cautious and use .5% risk per trade as you’ll likely make more mistakes in the beginning, and thus will need an extra buffer to compensate.

NOTE: We always recommend risking a fixed % of your equity per trade. To learn more about why we recommend this, click here.

Trading Set & Forget Tip: What Instruments to Trade

The most important rules of thumb for choosing what instruments to trade are the following 3 points:

- Don’t trade more instruments that you can easily manage/follow/analyze

- Whatever instruments you choose, stick with them for a minimum of 3 months to build a proper baseline

- Ideally stay within the same asset class till you have stability and profitability with that asset class

If you’re looking to trade the forex market set and forget, I’d recommend a minimum of 4-5 forex pairs, with 2-3 of them being major pairs, ideally one minor pair and one exotic pair.

Also make sure to trade only forex pairs which are most correlated with your region and time of day.

So USD and European currencies if you are in the UK/Europe/North America.

For Asia/Australia/New Zealand, I’d suggest at least 2 currencies from your region (JPY, AUD, NZD, CNY, SGD, KRW) and minimally one USD pair.

If you’re looking to trade stocks set and forget, I’d recommend one or two indices from your region, and at least 2-4 consistently volatile stocks from your region. You can also look for an ETF or two as well.

If you’re looking to trade commodities set and forget, I’d recommend at least one energy/natural resource product, such as WTI/Nat Gas, one to two precious metals, such as gold/silver, one to two industrial metals, such as copper or aluminium, and one to two agricultural products (corn, wheat, sugar, etc).

Now that you have your pre-trade routine, position sizing and instruments all set, the next thing you’ll need to setup will be the time frames you trade with.

Trading Set And Forget Tip: Time Frames To Work With

For day trading set and forget (meaning you open/close your trade within one day or one trading session), I’d recommend using the 4hr or 1hr time frames for your higher time frame context, then trading on either the 15 min chart, 5 min chart or 3 min chart.

For swing trading set and forget (meaning you hold your positions for days to weeks, perhaps a couple months), I’d recommend using the daily time frame for establishing your higher time frame context, then either making your trading decisions on the daily chart, 4hr chart or 1hr chart.

As to which time frame to make your trading decisions on, a general rule of thumb is to:

a) choose the time frame which looks the cleanest for your trade setup, and

b) which is most relative to your target size and holding time.

In terms of which time frame is best based upon your target and holding time, first you need to establish what your target is.

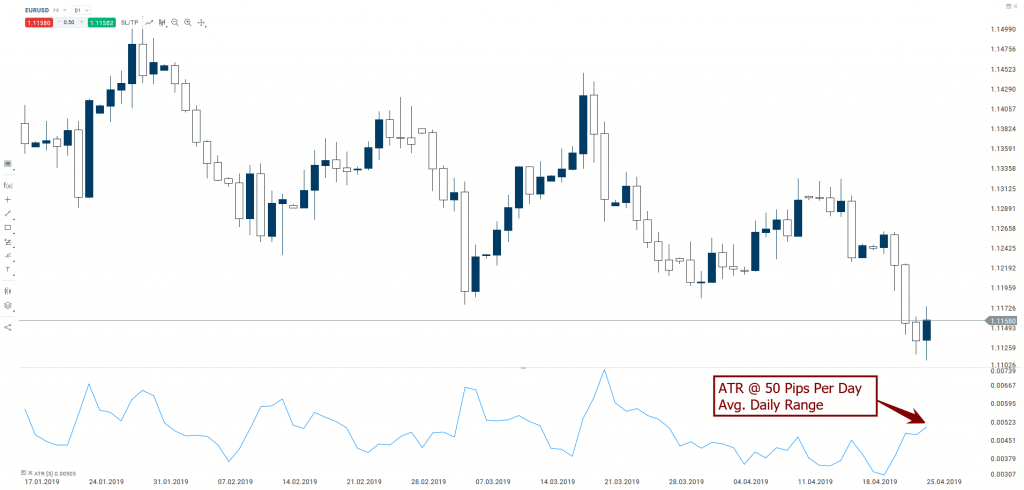

A simple rule of thumb is to setup an ATR indicator (set to 5) on the daily chart to see what the average daily range is for your instrument.

If your target is outside the current ATR, then you’ll likely need multiple days to hit your target and should be working with a higher time frame. If your target is within your daily ATR, then you’ll want to be using a lower time frame chart.

Set And Forget Trading Strategies

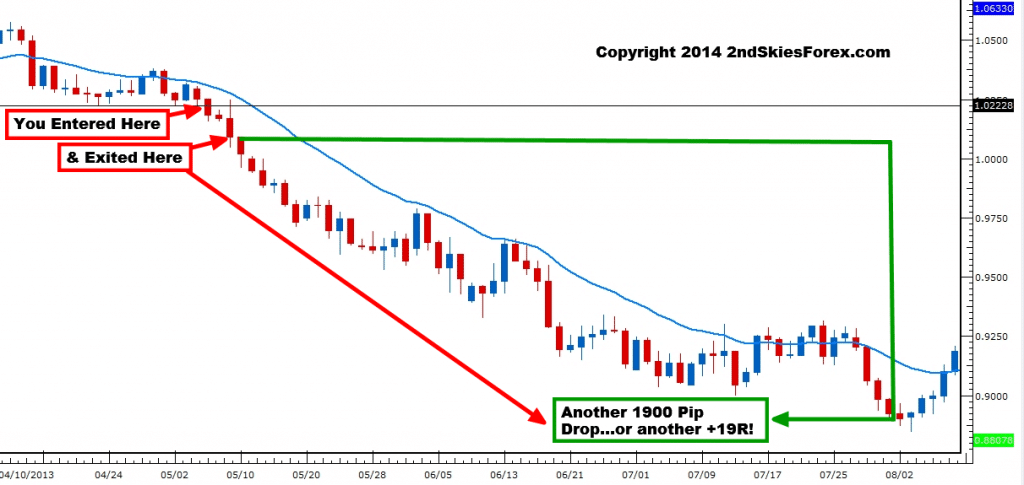

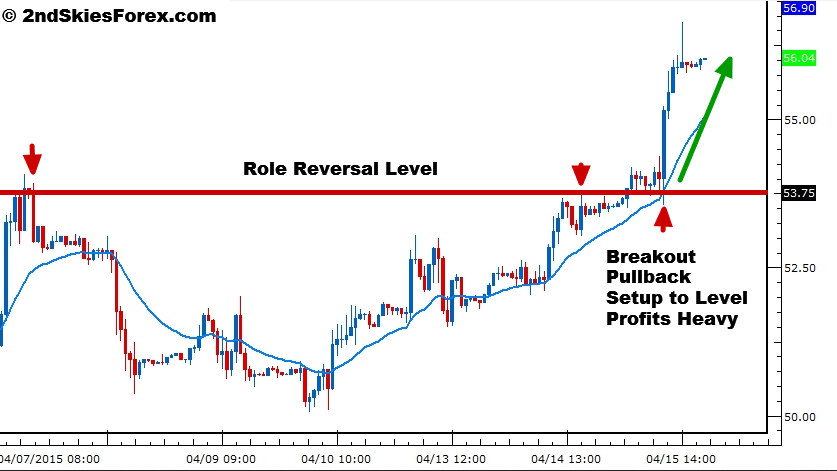

Whether you’re looking to set and forget trade forex, stocks, commodities or global indices, one consistently strong setup and trading strategy is the breakout pullback setup.

This is a straightforward strategy where you’re looking to trade with trend, and are waiting for the market to break above/below a key support or resistance level (break resistance for bull trend, and break support for a bear trend).

Once the market breaks its key level, you’ll then wait for a pullback to the prior support or resistance level to trade in the direction of the trend.

I have a video on how I traded the breakout pullback setup for +110 points on the UK FTSE with my own money which you can watch here.

I also have another video on the breakout pullback setup for +100 pips on the NZDUSD within a matter of hours. You can watch that video here.

The breakout pullback setup is such a classic and useful strategy that when you trade it with the right price action context can be a very profitable setup so it’s definitely one you’ll want to practice and master.

In Summary

By now you should also be well aware of how to trade set and forget, starting with your pre-trade routine, what instruments to trade and how many, what % of your equity you should risk per trade, what time frames to trade, and what strategies to trade set and forget.

If you’d like to learn more advanced methods to trade set and forget, along with see more examples of me trading live with my own money, then make sure to check out my Trading Masterclass course, where you’ll get access to our members trade setup forum, market commentary 4x per week and ongoing training.

With that being said, please make sure to leave your feedback on what you learned about set and forget trading from this article.

I’ll look forward to hearing from you, and wish you nothing but success in the markets while seeing real progress towards your trading goals.