Success Stories From Our Traders at 2ndSkiesForex

Without a doubt, this was a successful year at 2ndSkiesForex. As a team – our staff grew, we got smarter and accomplished many goals.

While this type of success is ‘satiating’, what really floated my boat was the students and traders. Many this year after hard work and lots of practice + training broke through.

One student got funded $100,000. Another finally broke through to profitability after blowing up several accounts. And one student did +25% over a 6 month period.

There are many more successful trader stories like this at 2ndSkiesForex. While I’d like to share all our forex success stories, we’ll share a few to start the year on a good note and hopefully inspire you.

Getting Funded $100K after 8 Months

Harkanwalpreet Singh joined 2ndskiesforex in December 2014. You can see his payment receipt + account with us below.

He is a member of our Price Action Course & in February joined our Advanced Traders Mindset Course.

After 2 months of training diligently, he funded an account for $10K with the AxiTrader Select program.

5 months later he got funded $100K by the AxiTrader program. You can read the article about him getting funded here.

Note how they state he ‘performed consistently during volatile markets and complex trading environments‘

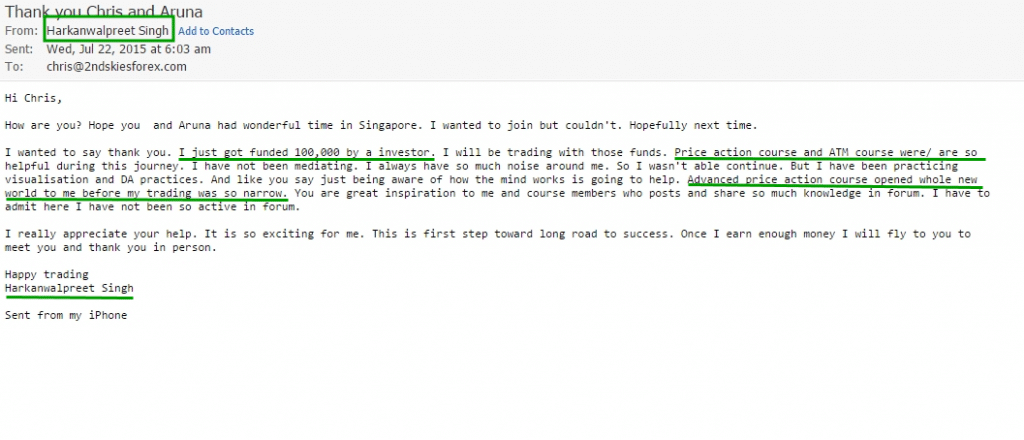

Below is his email to me about getting funded (click image to enlarge).

Mr. Singh is not a common forex trading success story by getting funded within 8 months. Normally it takes 1-2 years of hard work before you see this kind of result.

Instead of just learning price action strategies and trading techniques, he worked on his trading mindset.

Many struggling traders fall into the trap of just working on one skill – learning price action and making trades.

He realized how important a successful mindset is and did our core mindset techniques for months.

The result is consistent performance, handling volatility, and getting funded $100K.

What I think is unique about Harkanwalpreet is his maturity. Not long after getting funded, some personal family issues came up. He decided to suspend trading till the situation would pass realizing how is mindset was affected.

Instead of just hammering on, he knew when to take a break and not trade. This shows awareness, discipline and maturity.

If he asks, I’ll be there at every step of the way, and may even fund him myself if he continues to perform.

To me his forex story is a great marker of success and I’ll look forward to watching him grow.

Gaining +25% in 6 Months

Nazar Bent is from Canada and joined 2ndSkiesForex back in the summer of 2014. You can see his receipt of our price action course from June that year below.

As a student unhappy with his college studies, Nazar knew from the moment he started trading this is what he wanted to do full time.

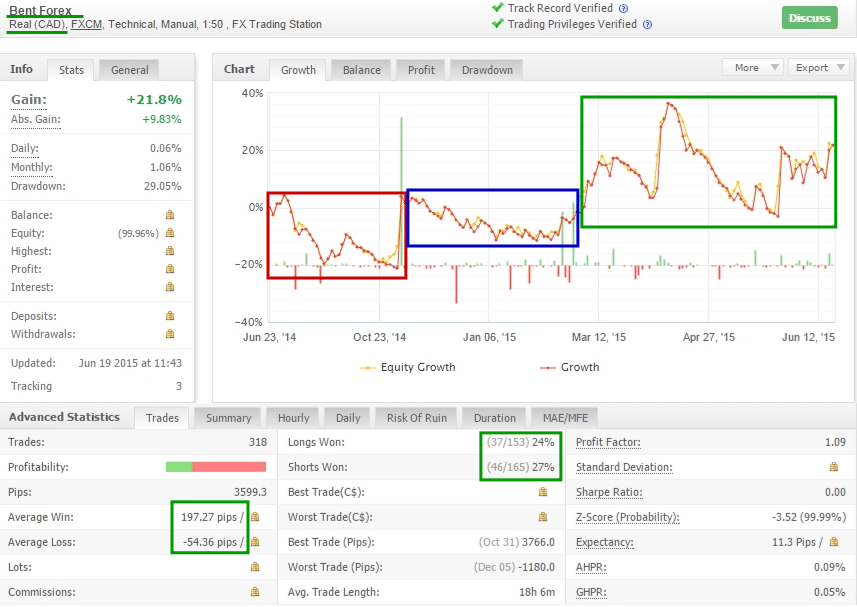

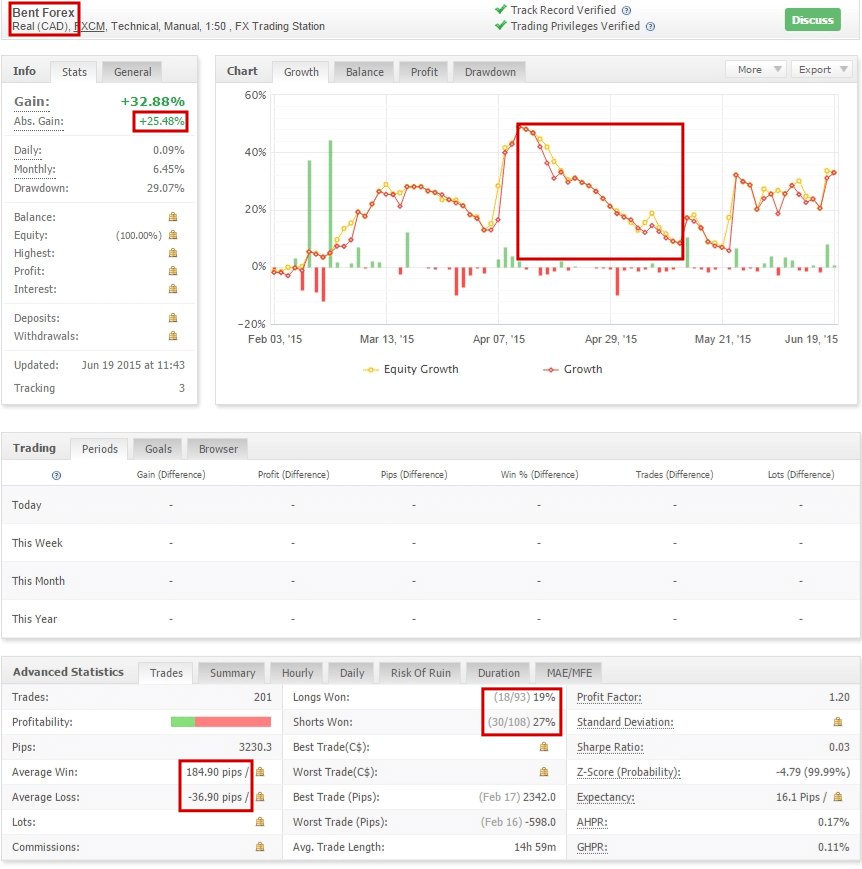

Below is his myfxbook account since he started with us.

To summarize:

1) in the beginning, he struggled like most traders (red box), but he kept working at it

2) after finding a groove, he started to stabilize (blue box)

3) since February 2015, he’s gained +25% over 6 months (green box)

Below is a zoomed in screenshot from his Feb. trading on.

Notice the red box in the middle? This is what happened when trying a new strategy. After giving that up, his gains returned and trading stabilized.

What should be noted is his accuracy + risk to reward numbers. He’s only averaging about 23% for his accuracy, yet is still making money.

Why? Because he’s crushing his +R per trade with his avg. win 184 pips and avg. loss 36.9 pips. This goes to show you don’t need large stops when trading price action.

And his average trade length is < 1 day also demonstrating you don’t need to hold trades for weeks to make good money.

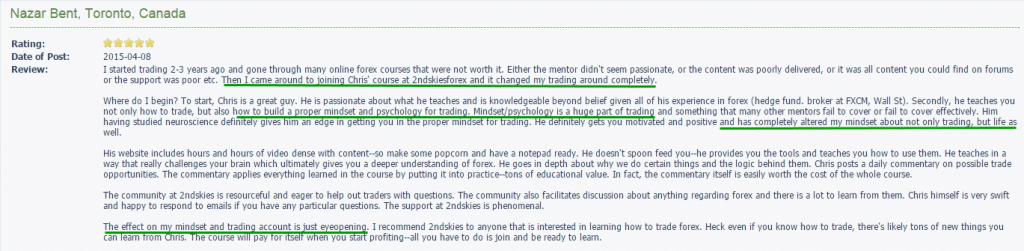

I’ll talk more about accuracy later, but below is his review of us on forexpeacearmy (click image to enlarge).

Notice how he mentions his trading changed when joining us. Also key is how he zero’s in on building a proper mindset and trading psychology.

I feel this is something we excel in with our heavy focus on building a successful mindset and unique approach.

Nazar is one of most dedicated students to becoming a professional trader. I’ve told him if he keeps it up, I’ll fund him personally.

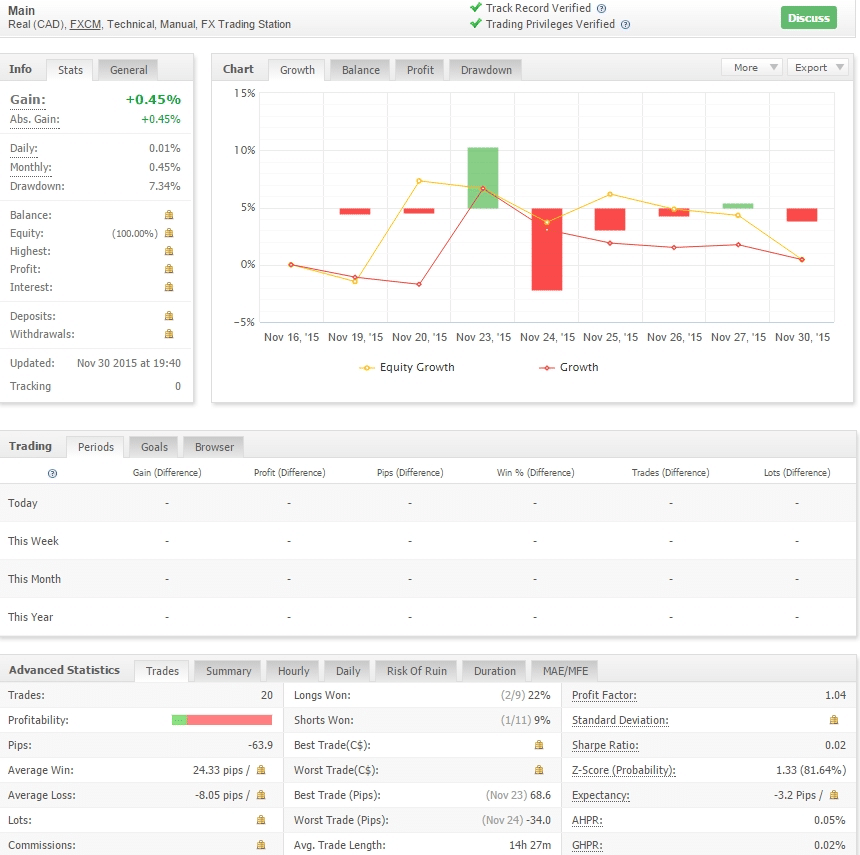

What is interesting to note is his performance when he opened up a new account for me to monitor. His trading has been mostly flat (see below).

He’s openly admitted the psychological pressure of trading for me has affected him. This shows honesty and self-awareness which I appreciate in his candor.

My guess is he’ll break through come 2016 and get back to his typical winning ways.

From Blowing Up Several Accounts to +23% in 4 Months

Shahab might just be the most interesting student & character I have. Before coming to trading, he sold expensive cars to high profile clients around the world.

We’re talking Ferrari’s, Lambo’s, you name it. He’s used to dealing with decent sized numbers of $250K+.

He’s also a risk taker, meaning he’s completely comfortable taking massive risks. This definitely translated into his trading as his swings were massive when he first came to me.

He wasn’t taking trading or training seriously and within 1.5 years blew up several accounts. Trust me – he deserved every dollar he lost during this time and he knows it.

Then he contacted me about really digging in. So in the summer of 2015, we started doing 1-1 mentoring (which is not cheap at $10K per month).

He also lives in Canada and we often go out for tea or lunch, talking trading, mindset and success.

Shortly after, he found a groove trading some of our advanced price action models + his own system.

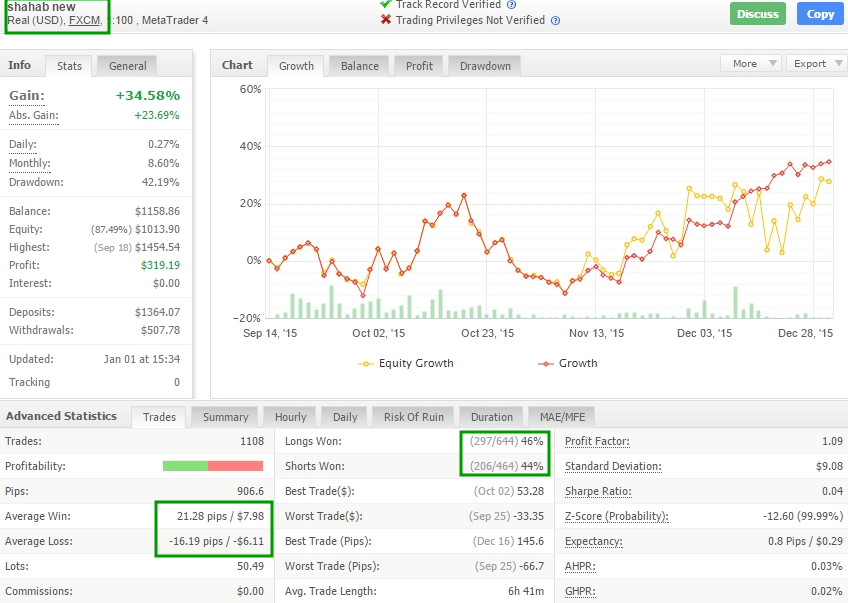

Here is his myfxbook account below.

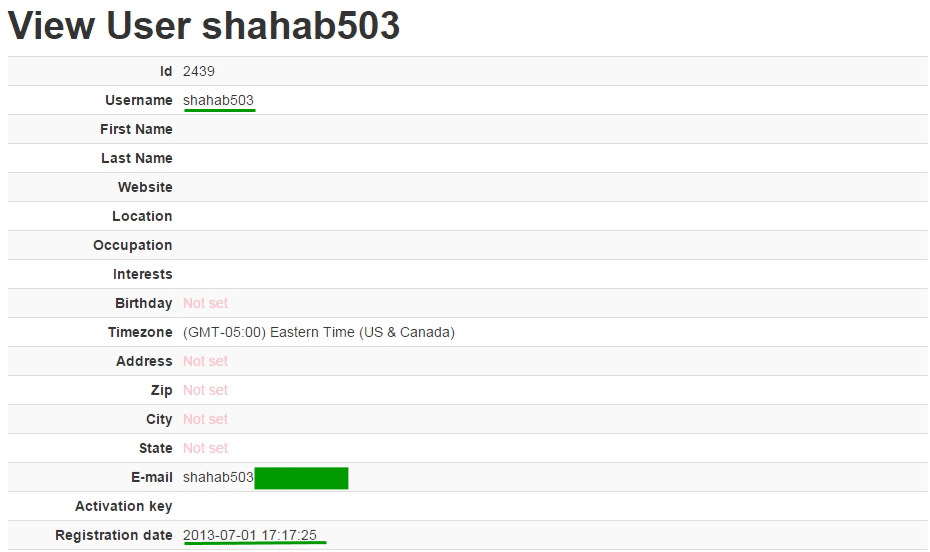

‘Shahab503‘ is the name of his myfxbook profile. It’s also the name of his account with us below:

Now, there are several things that should stand out here from his myfxbook account above:

- he’s day trading (done thousands of trades) & continues to have massive swings

- he still shows the tendency to go over risk parameters and isn’t as conservative as I’d like him to be. This is an improvement in the right direction from where he was though!

- he’s got a lot of open risk (yellow line) which is way outside my normal risk parameters. Again, the key issue of risk and money management keep coming up so this is something he needs to work on

- his risk of ruin is just below 1% meaning there is a small chance he can blow up his account at this rate

- accuracy is still under 45%, but his avg win vs. loss is balanced enough at +1.3 and he has a positive profit factor over +1

Hence I consider Shahab to be a work in progress. Considering he was blowing up accounts faster than you could drink a pint of cold beer, I’d consider his progression a success.

Do I think he’s in the clear? No, absolutely not as he still has unhealthy habits around risk. But what I’m focused on is his progression instead of just a static number.

He’s not just where he is now, but what he’s becoming. His trajectory is in the right direction and his trend is upward.

How he performs from here is up to him and how much he wants to engage his level of discomfort and discipline. But from where he was, I’m proud of his progress and have positive hopes for him.

A Common Thread

If you noticed, there are several common thread across these success stories. They are;

- They all had rough beginnings and losses (like most of you)

- They stuck through the hard times and showed mental toughness in trading. This eventually led to a change & breakout in their performance

- Accuracy – they all had accuracy levels below 50%.

This last point I want to touch on briefly as it’s a heavily misunderstood subject.

Beginning traders think you need a highly accurate system to make money, but this simply isn’t the truth. There are a million ways to make money with varying levels of accuracy.

Generally the lower the accuracy, the higher the durability of a system as it doesn’t need to consistently win to make money. And let’s be clear, you are going to have losing periods (perhaps months) where you aren’t making any money.

If you system is dependent upon high accuracy, during this losing period you’ll likely experience a massive drawdown. These large drawdowns are psychologically harder to overcome.

Most professionals are between 35-50% accurate throughout all their trades over a year.

My accuracy for 2015 was about 46% but my +R per trade was above 2, so this shows a positive expectancy with proper control of risk.

What Level of Accuracy Should You Expect As A Beginner?

As a beginning trader, you should expect your accuracy to be between 30-50% while learning the ropes (perhaps lower). This is because you are still building your skill set and not trading sub-consciously, so performance will be affected.

Think of it like learning how to shoot a bow and how seldom you’ll hit the center. Yet with practice + training, you can start to get 9 and 10 points more often.

Hence do not be discouraged if your accuracy is low. Accuracy is not static and fluctuates on a weekly, monthly and yearly basis.

There are days when I’m highly active intra-day and can lose my first 5-7+ trades before hitting my first winner.

Akin to trading, professional poker players can play 40,000 hands before making new equity highs.

What this tells you is drawdowns, losing periods and corrections are natural. The difference is most people do not endure these times and give up or change their strategy.

What they miss is the breakout which comes through training, experience and diligence. Hence try not to look at your current state as your overall numbers. Success is a moving target just like your accuracy.

Be more concerned with progression, trajectory and process.

In Closing

I hope you found these forex trading success stories above inspiring and what is possible. To be clear, these stories are not written in stone. They could go backwards and not make it to the next level.

But they show you what’s possible, why psychological endurance is needed, and how important proper price action training + a successful mindset are to making money trading.

With that being said, will you become the next successful trader story?

Will you get funded $100K this year and start making consistent profits?

If you are looking to be the next forex success story, then check out my price action course where we change the way you think, trade and perform.

Make sure to leave your comments below as I look forward to hearing your thoughts.

Until then, may this be a year filled with good health, abundance and success.

I am sure that many people have been waiting for this kind of an article and motivation, so a good job done!

I bet many people will be motivated!

What I like is that lately each time you write you write completely from a new angle and on a different subject each time, shuffling the subject. It is like a magic box…you never know which kind of an article will come out next 🙂

Yeah, had a feeling some people/students/traders would find inspiration from this.

And yes, we are really tackling things from new angles and subjects as our knowledge base is growing fast, so glad you are noticing it.

Congratulations Chris.. Its only going to get better.

Ikenna

Thanks Ikenna – definitely going to get better.

Thanks for sharing this inspiring article Chris!

It just makes the rest of us even more thrilled and motivated to keep on working on the process, no matter what obstacle that are in the way!

We will all get there; it’s just a matter of hard work, discipline and not giving up..

You are one your way for sure victor so keep up the great work as you are only months away from being the next success story.

Chris! I’m next. Yep. You heard that right. 🙂

Before I was all about making it perfect but then I learned that even the elite or best of the rest can’t achieve that and so it is then I said I’ll go forward. And now I read this article. (Hang on! I heard that from the London’s Seminar 😀 )

100k? I want to manage in deca or centi millions sooner or later.

Anyhow, nice article.

Mark

Well I’m expecting you to be next soon amigo.

You have to consider the $100K is just starting out for the lad, so to have a 10K acct and start managing 100K within 8 mos of starting out is impressive. As he continues with his great trading, he’ll continue to get more capital in the 7-8 figure range in no time as there is a good group of investors behind him.

So you’re on deck and will wait for you to be next amigo.

Kind Regards,

Chris Capre

Chris great article .

I fully agree that this article inspires and motivates you to do things best.

They have learned doing the same course as I started I was doing two months ago. What else is required to get it .. work, work and more work.

Great article and great course.

Have a great 2016!!

Hello Francisco,

Definitely work, work and more work. Many people want the picture of success, but not the work that comes with it.

Glad to hear you are liking the course and found the article inspirational.

Kind Regards,

Chris Capre

Awesome article Chris, good to see traders doing well as a result of your PA and mindset programmes, I wish them all the best. These journeys are inspirational and at a difficult point in my life, it helps me keep an eye on the bigger picture.

Hello Apex,

Yes the traders mindset + price action course has been a powerful combination for traders this year it seems. My feeling is the mindset cleared things up for them on how to build a successful trading mindset while complimenting the price action strategies and techniques to round things out for them.

But if the article helped you look at the bigger picture regarding trading and life – then it’s done it’s job.

Kind Regards,

Chris Capre

This is really inspiring and motivating. How long would you educate yourself when there is a 100k, a million dollars or even more waiting at the end of the first education process?

Glad to hear you found it inspiring.

Regarding your question – are you asking me, or other people?

….and this is why I am part of the APA Cource with you Chris, I may not be as fast in my progression as others, but the good thing is knowing I am heading down the right road!

Excellent results, Chris! Very inspirational. Persistence and discipline will pay off in the end. 🙂

Very motivating Chris, and sums up why I am in your APA Course!

Hola James,

Good to hear you found it motivating as that was it’s purpose.

And glad to have you aboard.

Kind Regards,

Chris Capre

Will the mindset course be back in the summer? I realized yours is super cheap comparing to all the others and they have less information.

Hello Tom,

As of now, we have no plans to release it back to the public for 2016. We haven’t thought about 2017 yet as we have other projects we are working on, so most likely, it’s offline to the public for the year.

Kind Regards,

Chris Capre

Very inspiring! I’ve been working very hard recently and this article just added some extra boost 🙂

Thanks Chris for the great course and for all your effort in writing great articles like this! Have a great 2016!

Glad you are enjoying the course and found this inspiring.

Kind Regards,

Chris Capre

Regarding my question about following education: This was an open question to everyone including myself for reasons of motivation 🙂

Great and very inspiring/motivating article. Thanks for sharing.

I am actually not surprised your students are doing well. The Advanced Price Action course in combination with the Mindset course are like an afterburner for ones trading. I can only speak for myself. Both courses have completely changed the way I look at and approach my trading and everything related to it.

Before I joined your courses I was jumping from system to system as soon as things got tough (draw-down periods) and as a result never learned to trade properly due to that. It’s like driving a new vehicle every week. You won’t be able to master any of them.

Now, thanks to your material, I have the mindset and skills not only to sit through the draw down periods comfortably but also to limit their effect on my performance.

Another very inspiring article Chris! I have been learning so many things since I subscribed to the APA course, but the greatest is that I can be profitable with 25-30% accuracy – and as I think It’s very easy to handle psychologically if somebody understand deeply the importance the focus on the process, not the outcome philosophy.

After I understand deeply this very simple thing my views related to the trading (and every part of my life) turned upside down in a positive way, and this realization knocked out the source/core of uncountable amount of bad habits.

And yes, I’m looking to be the next story in 2016. 🙂

Best wishes to 2016!

Great stuff and congrats to the success stories. Hope to make is on this years list!

Hope to see you on the list next year as well!

Hello,

Just wondering hows the progress on the new price action course? will you write a post about it soon? what should we expect? Have you decided if it will remain below 500usd? 🙂 thanks chris

Hello Tom,

Recording videos as we speak for it. Likely launch early Feb or late Jan and will share details then as we don’t have a decision on the price, but will go up.

Kind Regards,

Chris Capre

Just found this article. What a breath of fresh air. It’s going on my wall! THANK YOU CHRIS!

Glad you liked it Peter. Hopefully you can become a member sometime and the next success story.

Hmmm, I can understand that many people are inspired and motivated by this article. “So many big numbers. I also want them and the success!” you may think. Of course! That’s the intention.

But I think the question is not “Is there anybody outside that can double, triple whatever-iple his/her account or make this or that money?” For sure there is! The question for everybody should be: What has this article got to do with me and MY trading? Will I become a better trader after reading it? Can I mimic the trades those traders were doing? I don’t want to offend anybody, but I have to confess that my answer is NO. So this article is marketing, which is perfectly ok since this is Chris’ website and he can write whatever he wants. I just wanted to point out and so everybody can think about what marketing does to him or her. Chris wants everybody to be aware of one’s own mental state when trading so why not here? (rhetorical question)

Specifically, the article mentions three of Chris’ (top) traders (who were willing to publish their account statements. Thank you guys!)

Ok, great, that’s cool to see guys who succeed that greatly. But what about the other students in Chris’ courses? How do they fare? What does their success look like? Are they still struggling or not and if so, for how long?

What I want to see published here is something like a statistic, for example. This number of people have enrolled in the courses, out of these, which are profitable, which do very well, and which don’t, for instance. With these numbers you can tell much better if Chris’ courses produce traders that are able to survive today’s low volatility forex markets. (of course, still, your personal mileage may vary …)

What this article wants to allude to is: It is possible to become a top trader, but (very but) will you be among them, too? Are you, yes, you reader, even able to achieve this? Not answerable because this question depends solely on you and your personality and your willingness and time to learn, practice, trade.

Don’t substitute the positive answer this article conveys with the answer to the question whether or not you are able to replicate the success of these traders. Two different pair of shoes. Nota bene!

I like to spend a few words about “Bent Forex” and his success. Yes, he is profitable, no doubt about it. But, hey, his equity curve is just up and down. Far from being a straight line from bottom left to top right. Bent’s performance would send shivers down my spine, if they were mine! Pure horror! Is he still active? His account at myfxbook seems to be orphaned since 2015! And this is a top trader??? Really? Sorry, Chris, please try again to convince me.

I wish you all the best, good trades and a sharp mind!

Cheers, Didi

Hello Didi,

I appreciate your comments and questions. However there seems to be some misunderstandings and confusions here.

#1 Bent Forex

You talk about his equity curve being up and down, and ‘far from a straight line’. This seems to be a major confusion here. Do you really think because a student starts with us, that his equity curve will all of a sudden be a straight line? When does any learning process work like that?

Secondly, how many long time profitable accounts are a straight line? Maybe 1, 2 or 3% Hence your ‘straight line’ request really isn’t accurate, feasible, nor realistic.

Case in point, look at Horseman Capital, one of the most profitable and successful hedge funds of the last 16 years. You can read about them and see their performance from 2001 – 2015 at this article (https://gammalevelcorp.wpengine.com/trading-strategies/why-you-need-to-build-these-muscles-to-make-money-trading/).

Go ahead and do their equity curve over that 15 years. Is it a straight line? Not at all. They even have a few down years. Yet they produced a %695 return! Variance happens, even to the best. That means equity curves will have ups and downs. That is unavoidable, even for the best systems and traders.

Bent’s equity curve not being a straight line isn’t an issue.

On top of it, when he started with us, he’s ‘learning’, and in a ‘learning process’. As with any learning process, there will be mistakes, there will be draw-downs, setbacks, periods of under-performance, and unlearning bad habits. All of those translate into an equity curve that will have challenges, peaks and troughs. The key is the overall trend and progression over time. Considering he went from a massive draw down to profitability over time suggests a lot.

And if you look at his equity curve, it stabilizes over time (from blue to green square). There is one period in the green part where he has a sizeable dd. I talk about this specifically in the article (which maybe you missed), but he switched strategies during this time from swing to day trading. After he stopped that, his gains returned and his equity curve started to normalize.

So it seems like your description and perspective about Bent Forex’s trading really isn’t reflective of reality.

#2 What about Chris’s other students?

In this part, you make a request stating “what I want is the number of people that have enrolled in the courses which are profitable and are not.”

Ok let’s examine your request. What you’re asking is that I get every student to share their myfxbook account and look at the stats. Never mind the fact I cannot force every one of my students to a) trade with a broker that uses myfxbook, and b) share their stats. My students share with me as they wish, and I have to respect their wishes here.

But let’s imagine I had some magic wand and could do this. Ok great. Now let’s say I have 2000+ students and today I have collected their myfxbook accounts and compared the data. What would that provide? A one time snapshot! What if the time I took this data, a majority of my students happened to be in profit at that time? Would that be a fair representation of their performance ‘over time’? No, so the only way this could be honest and reflective would be to keep doing these analytics/stats, say monthly, or 1x per year.

Ok great, let’s roll with doing it 1x per year. So 2000+ students…how much time do you think it would take to compile those stats, go through every myfxbook account, share their profits/losses, ability to manage risk consistently, draw-downs, etc? We’re talking 100’s of hours, and that is just for a 1x snap shot!

But my students are growing in numbers each and every year. Is this something I can scale easily when I have 5000 or 10000 students? No, not even remotely. I’d be spending 100’s, if not thousands of hours just to compile this data. How would I even work with my current students, address their needs, do my private analytics sessions with them, answer their questions, provide new content and give them market commentary, along with handle all the other things that go with running a business and staff?

I couldn’t, so what you’re asking for (while sounds great in ‘theory’), isn’t remotely realistic now when you think about it is it? No.

But let me ask you a couple questions:

1) Of the 100’s of trading educators out there, how many of them are sharing their students live myfxbook accounts and showing them making money? 1, 2 maybe 3% at best?

Hence while you see this as a negative, I see us as an outlier, sharing what most trading educators aren’t.

2) How many of the 100’s of trading educators out there have shown 1 year of audited/trading performance showing they make money like we did at this link (https://gammalevelcorp.wpengine.com/forex-videos/chris-capres-verified-forex-trading-results-2017/). 1, 2 maybe 3%?

Again, we’re doing what most trading educators aren’t…showing a) we know how to teach students to make money trading, and b) that we know how to trade and make money ourselves.

So what you see as insufficient, I see us as being unique, an outlier…and a breath of fresh air. Good luck trying to get more than 3% of the trading educators out there to provide what we have.

#3 Will I become a better trader after reading this article? Can I mimic the trades they were doing?

These questions seem to suggest a confusion. Nobody here is saying they can or should try to ‘mimic’ these trades. I don’t expect any of my traders to ‘mimic’ anyone’s trades.

I teach a core set of skills regarding trading price action context, risk mgmt, trading psychology and a successful mindset. Those in combination will make each trader unique. It will augment their strengths while reducing their weaknesses. And the result is they’ll (hopefully) find a trading style that works for them. That may be day trading, swing trading, position trading, higher time frames, lower time frames, this pair or another pair, or many different pairs/instruments. I’m not trying to use this article to teach people that they can ‘mimic’ these trades. That is not how I teach and a confusion + misunderstanding.

Nor do I expect my students to read any one article and be able to make money trading. Each article has its own purpose. Some are meant to inspire, some are meant to teach specific skills, some are meant to teach different concepts, some are meant to open up your mind to a different way of thinking about things, some are meant to build your own self-awareness. Every article has it’s own purpose.

This article is meant to a) demonstrate I can teach students to make money trading with varying styles/methods, b) show them things to look for in a good trading account and what to avoid (which I talk about in Shahab’s case), and c) inspire people that it’s possible. It’s a teaching opportunity.

So it’s not meant to tell current or prospective students to ‘mimic’ their trades. Hence there is some confusion here about what this article is meant to do.

#4 Please Try Again to Convince Me

My apologies if this sounds harsh and blunt, but my job and work isn’t to try and ‘convince you’. I’m not here to convince/allay/address every individual’s varying levels of doubts, skepticism’s, bars for approval, what they view as sufficient proof or not. Those variables are endless, and if I did spend my time trying to convince everyone, I’d have no time for anything else, let alone my students who pay for my time, teaching and feedback.

I’m sharing a message, a perspective, and whatever information I do. Either that is, or is not sufficient for you. I trust you and your natural intelligence to decide if that’s enough. I certainly don’t think one article is meant to ‘convince’ you. Far from it. That is what my entire body of work here is for. And if you go through all my free trading articles and videos, listen to what I’m really saying, my perspective, message, proof that I make money trading, I assume you and others will be able to make their own choice whether they want to work with me or not. And I’m ok with however people decide. I work with those that want to work with me. I cannot ‘convince’ everyone, nor am I here to.

Hopefully this provides some clarity and good information to work with.

But thank you for the positive wishes. I sincerely wish you also the best in health, mind and your ventures.

Kind Regards,

Chris

Hello

Chris,

thanks a lot for writing such a long and elaborate

answer. Wow, you are really deeply committed to bring your points across. This dedication

is truly exceptional and I (and certainly your students) appreciate it a lot.

However, for me personally, you do not need to write

such a long answer. For example, (just for me) it would suffice to write “We cannot

do this sort of stats. We have 2000+ students, which may or may not be willing

to share their performance data, and collecting and analyzing their performance

is too much work for us and we neither have the staff nor the resources at the

moment.” 3 lines and all well. Nobody would deny such a statement. Rest assured

I really do not want to waste your time, which is most likely even more

precious than mine.

Hopefully it’s ok for you if I comment on one or the

other confusions and misunderstandings I’m still having.

The equity curve of the “Bent Forex” system is no straight

line; it is up and down with a drawdown of nearly 30 percent. (You explained

clearly why that is.) Furthermore, his myfxbook system page seems to be

orphaned since 06/20/15. Maybe it was deliberately set up for you so you can

show it in this article. (Sorry, I have this nagging impression.) Maybe. I do

not know. Also the range from Feb. 15 to Jun. 15 is quite short. How is he

faring now? Can we have a look at what has happened to his account 2 years in

the future? Oh, I see, he does not want to show his results. That’s tough luck

for us. Hmmm. “…students share with me as

they wish, and I have to respect their wishes here.” Absolutely! But why do

you present him as a shining example of a successful trader? How do you know,

he’s really successful nowadays? How should WE know?

Btw, a (more or less) straight equity curve is IMO

possible, but maybe with algorithmic trading only.

Regarding my questions about the success of the other

students:

I get your point. It’s a lot of work collecting and analyzing

statistics (I’ve done it myself albeit not with trading data) and it costs much

time and money and you think it is not worthwhile because it is just a “one-time snapshot” and there might be

the possibility that the majority of your students is either in profit or in

the negative, so compiling such a statistic will have questionable value. Ok,

understood. So what value has a one-time snapshot of the “Bent Forex” system

for us readers?

How do you make sure, that your students understand

the material of your courses? How do you make sure that they master the process

of building trading skills? Each of them. Or is this rather up to them what

they do with course materials?

Just a last remark: Can you imagine that there is

somebody out there in the internet (apart from me ignorant sucker) who might be

interested in this sort of statistics which MIGHT help them decide whether or

not to enroll in one of your courses?

“Again, we’re doing what most trading educators aren’t…showing a) we

know how to teach students to make money trading, and b) that we know how to

trade and make money ourselves.”

Ad a) That’s good and after reading this article readers

know what they can expect after learning the materials you offer if they invest

time and energy to absorb them fully and build the skills necessary. Now

everybody can decide better if s/he wants to follow this path or not. I, for

one, will not follow this path since I do not want sleepless nights due to

massive ups and downs of my equity curve. Not all humans who visit your website

are equal.

Ad b) Never ever in my life would I question that you

and your team can make money yourselves! I just wanted to know how your student

traders fare … on average. I understand that this question is not easily

answerable. Although I, for one, find the answer to it more interesting and

valuable than the answer to question b) because I can deduce from it the chances

whether I am going to make it as well or not.

My apologies for wasting your time again, Chris. I’m

sorry for that and I feel we can discuss here many more things endlessly over

weeks, but I have the impression that would not be worthwhile for both of us.

Thinking about it, I have to confess that we may talk

past each other, just a faint hunch. Let’s think about it for a while …

I wish you and especially all your student traders all

the best, good trades and a sharp mind!

-Didi

Hello Didi,

Interesting, you talk about me spending too much time in my response, then you give an overly elongated response as well. Things that make you go ‘hmmm’.

RE: Bent Forex

He’s gone on to graduate school so isn’t trading at the moment so he can focus on his studies.

It’s a little weird though you’d think I’d deliberately set up an account just to show for an article. If you read the article in full, I show his course order/receipt. I also show his account creation. So you actually think I’d do all this, wait for him for months on end, just to use it for an article?

Wow, the cynicism + skepticism here (based on ZERO evidence) is a little ridiculous IMO.

RE: Straight Equity Curve

But we’re not talking about algorithmic systems here are we? And considering less than 3% of the profitable algo systems are like this, it’s kinda meaningless to talk about this.

RE: How Do I Make Sure My Students Understand The Material In the Coure

1) I do a trading analytics session with each student across 20+ metrics to analyze their performance, see what their doing right/wrong, and give them actionable insights

2) We have trader quizzes to test their skills

3) They post their trades/analysis and we give them feedback

Beyond this, there is only so much I can do. Best I can do is provide methods, testing, analysis, feedback and tools to give them every opportunity to understand. I can lead a horse to water, but I cannot make it drink.

RE: Collecting Stats

Again, the time and effort + man hours + costs to gather these aren’t worth it. It would be a very poor business decision and have a huge negative ROI. The amount of sales we’d have to get from it to be worth it would be a 400-500% increase or greater which is an incredibly low probability event. And its not a scalable solution.

Best of luck.