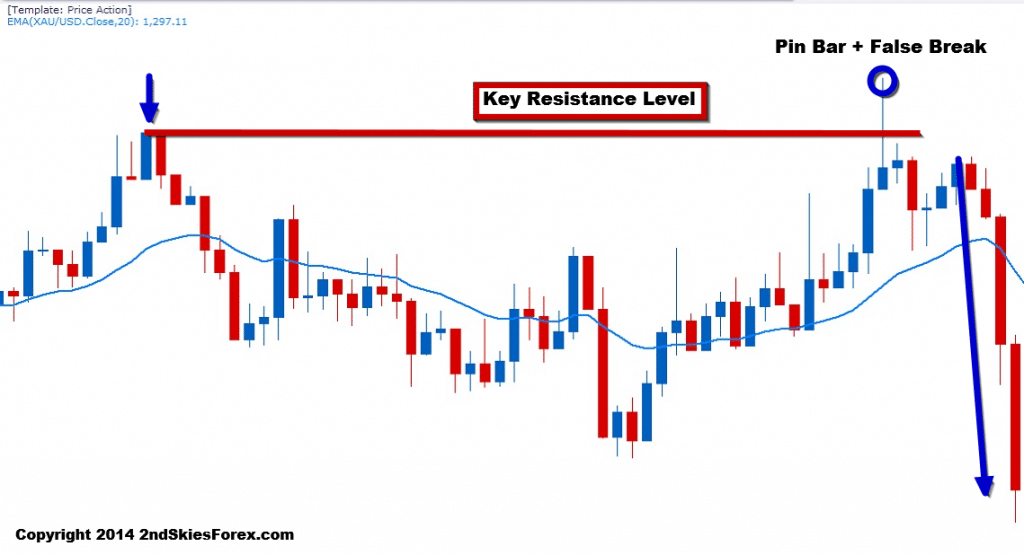

By now we have fully entered the summer trading months which are traditionally slower to begin with. When you combine the summer + the lack of ‘flow information‘ shared by bank traders under investigation, you have an environment of lesser volatility, smaller moves, and more false break setups.

With that being said, how can we maximize our time, while still remaining active and consistently profiting? Below is a mini how-to-guide for summer forex currency trading.

In this article, I will share 2 simple tips to help you trade pairs with stable volatility, larger moves, and also remain active during the slower summer months.

Summer Forex Currency Trading Tip #1: Switching Pairs & Instruments

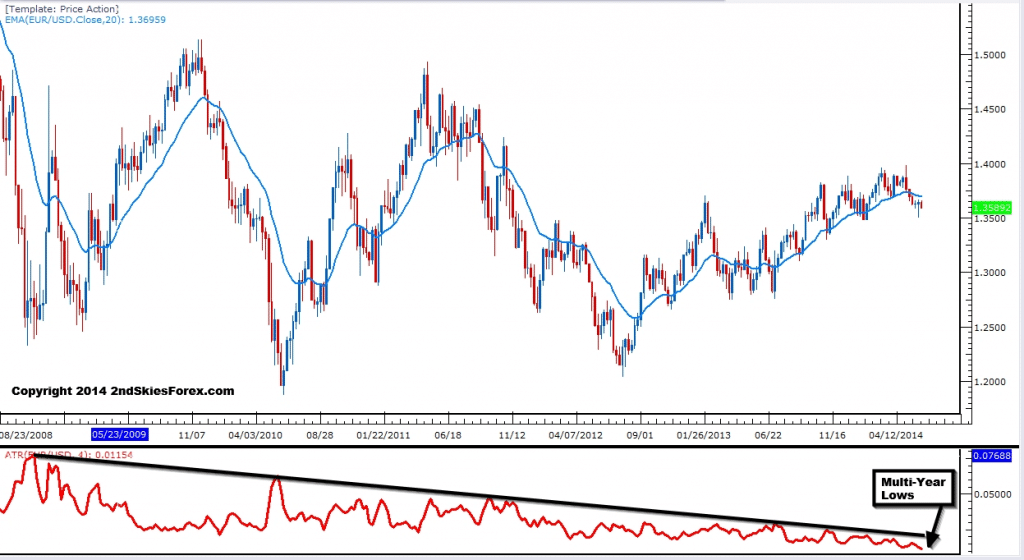

Below is the weekly chart for the EURUSD, the most heavily traded pair on the planet. Do you see that red line under the price action part of the chart? That is the weekly ATR which measures the average trading range (in pips) per week.

The average range of the pair on a week to week basis has been declining for years with it currently being at an all time low. It is the same for most majors, including the USDJPY and GBPUSD. If you are expecting a few hundred pip move on any of the above pairs, you could be sitting on your hand for days which is not the best use of your time. So what can you do about this?

My suggestion is to switch pairs that are more volatile. For example, instead of trading the GBPUSD or the AUDUSD, why not switch to the GBPAUD? It is far more volatile due to the ‘weighting‘ of the pair. If you can learn to spot good moves on the AUDUSD, then it will usually correspond to a directionally opposite move in the GBPAUD.

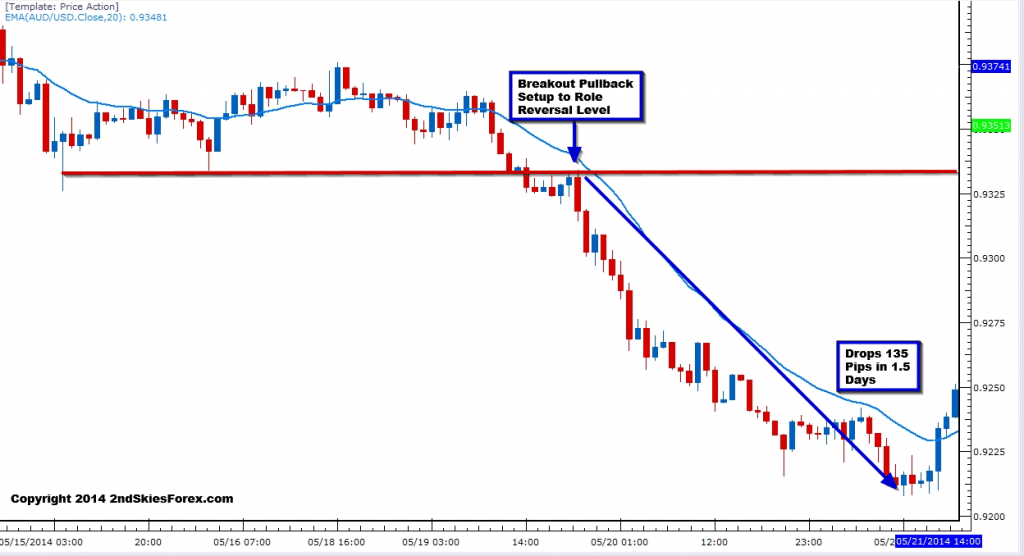

Take a look at the two charts below to get a better idea of this concept. In the first chart, we are looking at the AUDUSD 1hr intra-day chart. You’ll see the pair selling off heavy in the middle of the chart after a breakout pullback setup around 9330.

The trade happened in the Tokyo session, and took about 1.5 days to drop 135 pips. Now take a look at the chart below of the GBPAUD at that same time and notice the pattern.

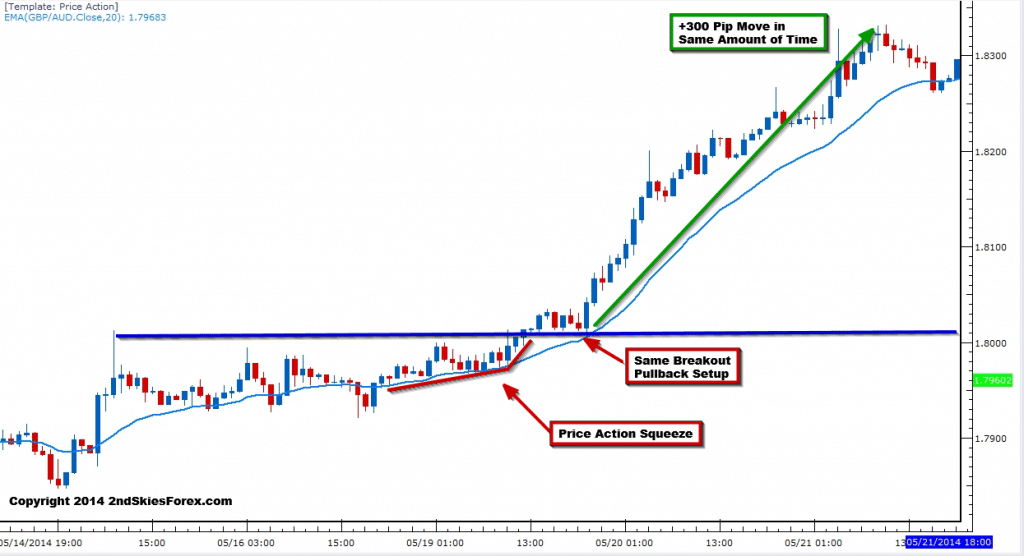

As you can see. the GBPAUD also make a breakout pullback setup off the role reversal level, yet it runs for +300 pips (a larger move by 2.2x). The size of each stop would have been relatively similar, which would have led to more profit on the second trade, and money in your account. Even an every day 40-50 pip directional move in the AUDUSD can lead to a +120 pip move in the GBPAUD.

Thus start looking at pairs which are naturally more volatile, and will be less affected by the lack of ‘flow information‘ shared by bank traders who are currently less active.

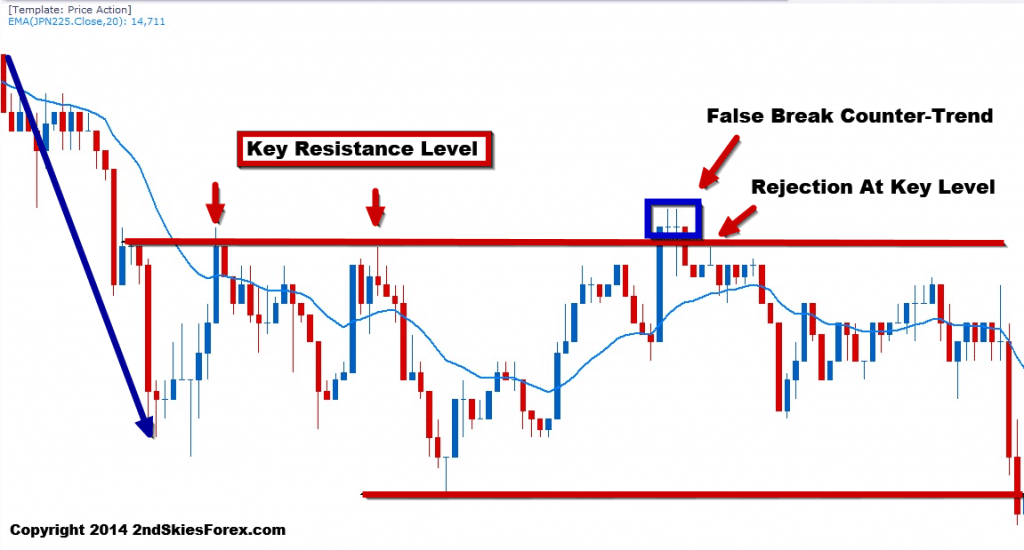

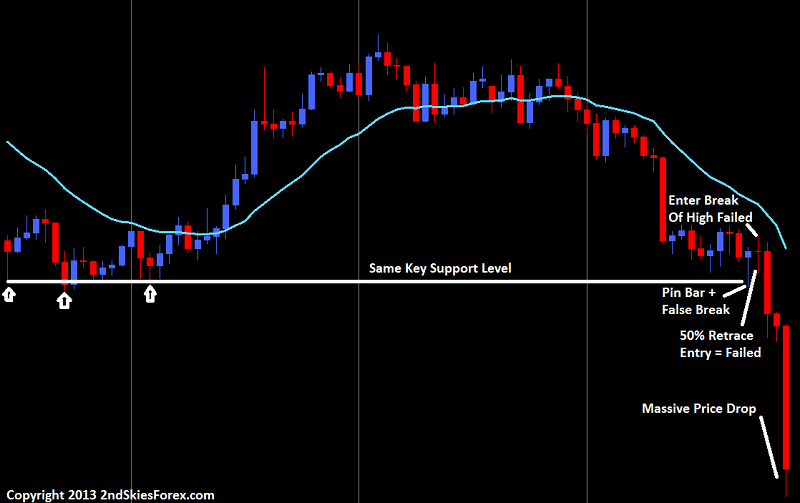

An additional suggestion would be to add other instruments, such as global indices and commodities. The Asian indices such as the Nikkei 225 and Hang Seng tend to have consistent volatility.

Along those lines, recently spent time with an HFT trader at IMC (Chicago). He mentioned how IMC is quite active in trading the Asian indices because of the higher volatility. Gold and WTI Crude Oil will also offer some greater volatility. Same with the German Dax and FTSE 100, so consider expanding your instruments giving you multiple options to trade.

Summer Forex Currency Trading Tip #2: Spend More Time Training

Since you are naturally less active during the summer months, why not use that time to build your trading skill set? Forget the idea of walking away when there is no trades to play golf, watch a movie, or read a book.

You want to be a professional trader who has the freedom of working from home, not having a boss who tells you what to do, what to wear and how much you get paid.

Do you get better at golf by sitting on the beach? Do you get better at playing guitar by reading novels? Do you get better at martial arts by playing video games? No, so why in the world do you think this applies to trading? It doesn’t, hence take advantage of the time available.

For those not familiar with it, Forex Tester 2 is a fantastic live simulation platform. You can take virtually any pair, and load up 13+ years of data on any time frame, then live forward trade it as if the price action was forming in real time.

I did a great video on forex training with Forex Tester 2 which shares several ideas how to accelerate your learning curve. This is especially relevant for those trading daily and 4hr strategies.

Ask yourself how long would it take you to log 500 trades if you only trade the higher time frames? Years perhaps? In less than a week, you can log the same amount of trades in FT2.

Think of it being the equivalent training of the golfer at the driving range, hitting ball after ball. Professional golfers on average will hit 500 balls a day. Do you think that helps their golf game and perfect their swing? Ponder that a moment for those of you only trading 3-5x a month, and how long it will take you to build your skill set.

I’ve had several students log thousands of trades after a few months using FT2. Go figure their trading is improving the most, and showing the greatest profits over the last few months.

NOTE: In the link I shared above to the video on FT2, there is a link where you can get a $50 discount on it.

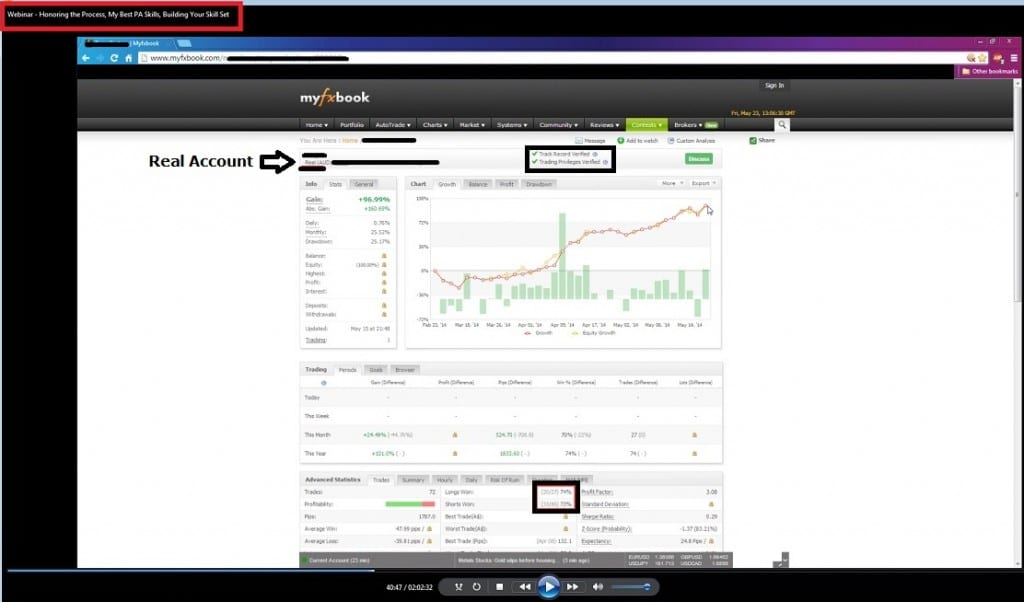

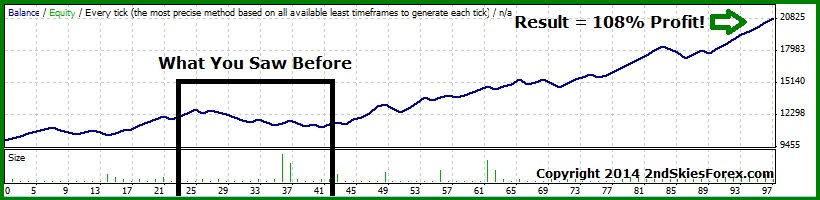

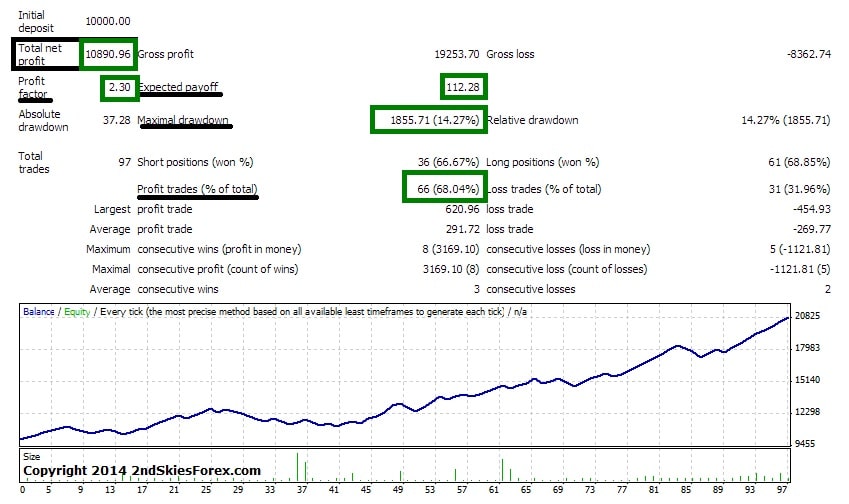

Along the lines of using FT2 to improve your trading performance, I recently did a private member webinar, where we showed a myfxbook account from one of our students. He is trading over 70% accuracy, and up about +96% on his live trading account, with his average wins well out-sizing their average losses. He profit factor is currently +3.08 and is up +1780 pips for the last 4 months.

Below is a screenshot from their myfxbook page we discussed in the webinar.

They trained over and over again in FT2 and are a member of my price action course.

While others are being lazy traders, they are building their skill set. If anyone is going to really trade for a living, it will be the ones who put in the hours and properly train.

In Summary

These are just a few tips you can use to help stay consistently profitable trading forex in the summer, while using the time effectively to build your trading skill set.

There are many more tips which I share with my course members, along with more ways to utilize Forex Tester 2, building a successful trading mindset, how to train properly, along with adjusting to the ever evolving markets in real time.