Tantalizing Stock? Elon Musk Becomes Twitter’s Largest Shareholder

Crypto traders would know too well the effects Elon Musk and his tweets had on cryptocurrencies in 2021, especially Bitcoin and Dogecoin. However, the kind of influence Elon Musk pulled on the stock of popular social media, Twitter, Inc. (NYSE: TWTR), this time around had little to do with his tweet.

Source: Akshar Dave

What happened?

Twitter stock was feeling the brunt of the tech sell-off, having dropped by 53% since October 2021. Then something happened, driving the stock up by 30% in just one day.

And guess who did (or didn’t) have something to do with it? Elon Musk.

A regulatory filing revealed that the CEO of Tesla owns a 9.2% stake in Twitter, making him the company’s largest shareholder. This filing triggered an immediate spike in the Twitter stock, driving it up by 30%.

What this means

Elon Musk has been hinting at a social media shakedown in recent times. He once created a Twitter poll where he asked his 80 million followers if Twitter “rigorously adheres” to the principle of free speech. 70% of those who took part in the poll didn’t think so. He then asked if a new platform was needed.

His purchase of TWTR stock answers the question.

Being the largest shareholder of Twitter, Elon now wields a lot of influence on what happens to the company. And if the height that TSLA stock has risen to is any indication, we can assume that TWTR could be on the same trajectory.

What next?

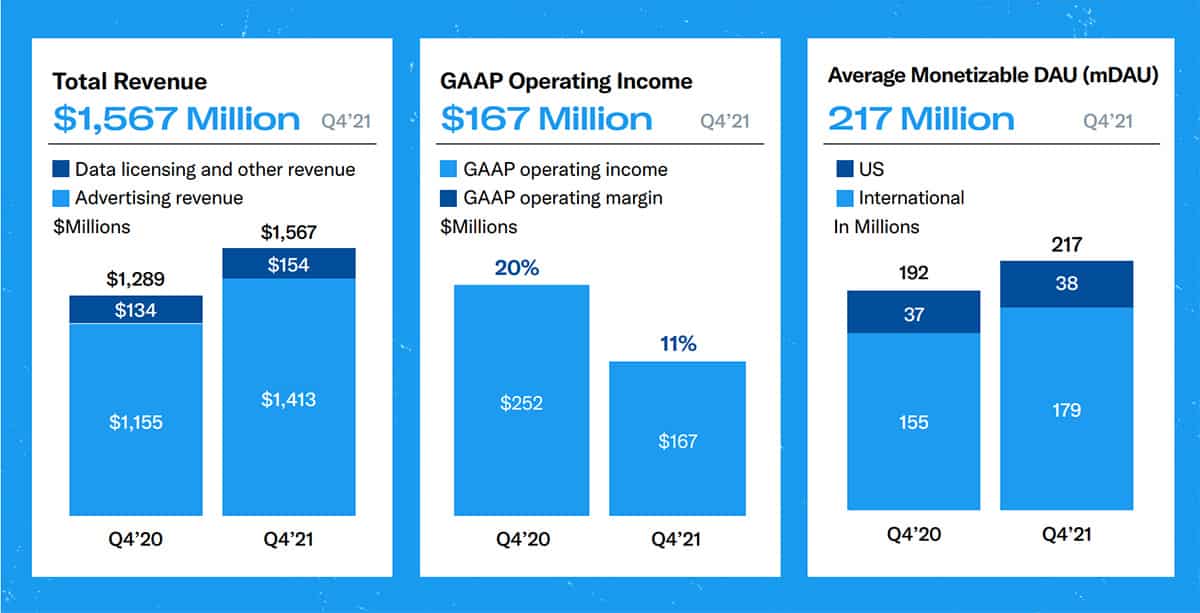

Twitter recorded 217 million monetizable Daily Active Users (mDAU) at the end of Q4 FY’21, a 13% increase from what it was in Q4 FY’20. This shows how Twitter is growing in popularity and adoption.

With this vast market, Twitter amassed a total revenue of $1.56 billion in the same quarter of FY ’21, 21% higher than it accrued in the previous year.

Other metrics also display the company’s growth and strength. And when you put it all together, TWTR makes a strong case for growth. It’s no wonder Elon Musk found it attractive enough to put his money on it.

Technical Analysis

The revelation of Elon Musk as a stakeholder in Twitter caused the stock to leap to the $48.5 – $51 resistance level.

We expect the price to re-settle after all the hype has died down. And this could mean the stock falling back to the support level at $41.

But if the stock defies the $48.5 – $51 resistance level above it, TWTR stock may find itself in the territory of the bulls.