Tesla or General Motors, Which One Should You Buy?

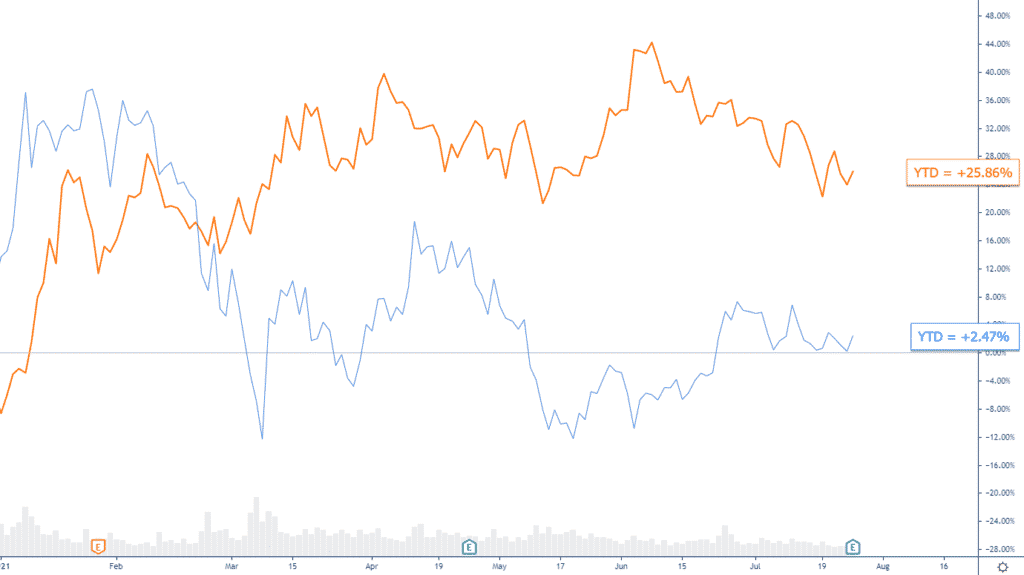

Take a close look at the chart below. These lines represent the 2021 stock price of two major car manufacturers, Tesla & General Motors.

One is up 25.86% (orange price line) on the year, while the other is up +2.47% (blue price line). If you had to guess, which is Tesla and which is General Motors?

If you guessed that the orange price is Tesla, you guessed wrong. It’s General Motors (NYSE: GM), and there’s a clear reason that the market is betting on GM’s future.

For many years, Tesla has been the innovation and market leader in the electric vehicle space. However, competition has not been sleeping. Whilst Tesla has been enjoying its time in the spotlight, major car manufacturers have not been idle. Companies like General Motors have been quietly crafting long-term plans to become major players in the EV market. They are now starting to execute these plans in an aggressive way.

The company has announced plans on investing $35 billion on electric and autonomous vehicle through 2025. That’s a 75% increase compared to its initial investment plans announced prior to the pandemic. This is in an effort to become an all-electric vehicle company by 2035.

With 2 EV’s on the road already, and a commitment to provide 30 new global electric vehicles by 2025 (yes, you read that right), its obvious that GM’s plans are super aggressive. This should make any competitor nervous.

GM is also more profitable than Tesla. With a net income of $6.43 billion in 2020 (5.25% profit margin) compared to Tesla’s $690 million (2.19% profit margin), GM has the bigger financial ‘muscle’ in the tug of war for market share in upcoming years.

Now, which one should you invest in, Tesla or General Motors?

Based on the strong foundation and aggressive growth plans of General Motors, we think General Motors makes for a better long-term investment for those looking to add exposure to the fast-growing EV market.

Technical Analysis

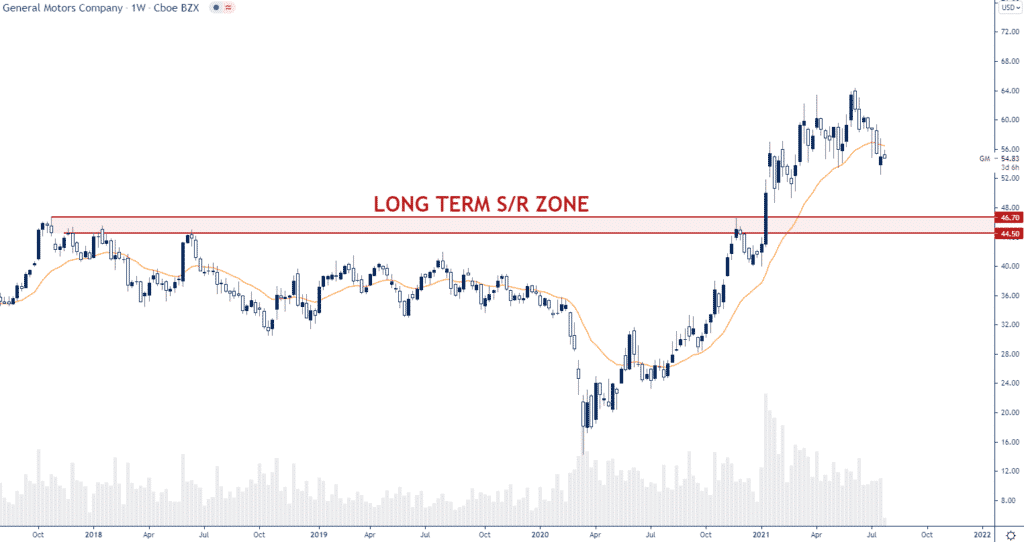

Looking at the weekly chart of General Motors (NYSE: GM) below, one thing that stands out is the long-term resistance zone. This is initiated by the all-time-high in 2017, followed by multiple rejections. It took bulls 4 years to clear this resistance zone. That happened on very strong volume in January this year.

The most recent price action shows a potential topping formation, and overall slowdown in the bull trend that started in March 2020. This suggests potential further downside in the stock over the next months.

The cleared long-term resistance has yet not been re-tested. If price can pull all the way back this support zone around $44.50-$46.70, we think this area has a high probability to act as a key support zone and a good price range for investors to look for opportunities.

Options Positioning

Currently GM has about 800K calls and 581K puts, so overall call/long heavy. Option positioning suggests support should come in around $50, which is close to our buy area, hence supportive.

FULL DISCLOSURE: Chris Capre currently has no stock or option position in GM, but he does have pending limit orders on GM. If you’d like to learn more about Chris’s trades and positions, you can get access via the Trading Masterclass where he shares his live trades, further investment ideas and daily market analysis.