Tesla Stock Split: A Trigger For More Stock Growth

Tesla, Inc. (Nasdaq: TSLA) revealed in an official regulatory filing and through a tweet that it would be seeking approval in its Annual Shareholders’ Meeting for it’s second stock split in two years. The last time the company split its stock, TSLA stock ended the year 90% above where it was immediately after the split. It has since increased by an additional 55% to its current price of $1099.

But what does this split mean for potential investors?

Source: Stephen Mease

What has happened

TLSA, in a tweet, said it will “ask shareholders to vote at this year’s annual meeting to authorize additional shares in order to enable a stock split.” This announcement puts Tesla among the ranks of the top tech companies, such as Alphabet (Google’s parent company) and Amazon, who all intend to split their stocks this year.

Tesla plans to split the stock in the form of dividends. While this does not directly translate to increased company value, it might be a catalyst for that.

If Tesla uses a ratio of 10:1, every shareholder will own nine more shares for every single one they held before the split. But each of the ten shares would only carry a tenth of the value they had before the stock split. So, if Tesla stock was trading at $2000 on the day before the split, it would have a new price of $200 immediately after the split.

Why It Matters

Stock splits are often good news for shareholders. Alphabet announced a stock split in February, and the stock jumped by almost 10% for it. Amazon announced a stock split in March, and the stock currently traded 21% higher.

Tesla followed a similar path in 2020 when it announced its stock split, and the price rose by close to 80% before the split became effective on the last day of August.

Judging from history, we can expect Tesla to do the same thing it did in 2020, which is also the same thing Amazon is doing. Short-term stock traders will have reasons to be glad about this because it means an increase in the value of their shares before the stock split.

Potential shareholders may also find this to be great news because it is easier to buy a stock priced at $200 than to buy one at $1000.

What Next?

Another good side to stock splits is that it shows how much confidence the board of directors has in the company. Already, Tesla is a popular stock among investors. Splits like this would only make it more popular.

Arguably the electric vehicle industry leader, Tesla has sold close to 2 million electric vehicles. And 32% of all cars sold since 2016 came in 2021, which testifies to the popularity of the company’s products among users.

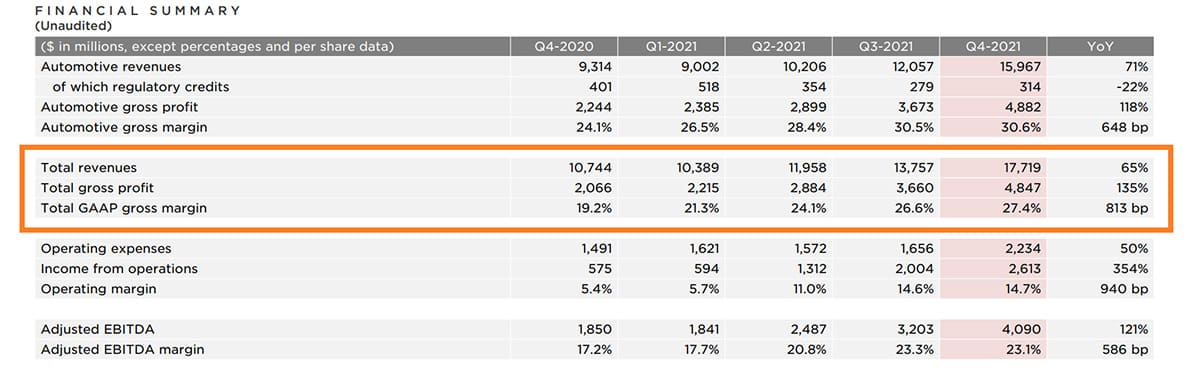

Financials have also been impressive, with a 65% YoY growth in total revenues to 17.7 billion at the end of FY 2021 and a 135% YoY growth in total gross profit to $4.8 billion.

Source: Tesla

And as more countries commit to their sustainability goals and EVs continue to trend among vehicle owners, you can expect TSLA company to continue its successful run.

Technical Analysis

The TSLA stock is very close to the $1170 – $1223 resistance level, and it may continue to break out of this level if the hype from the stock split continues.

Otherwise, there’s a support level at the $740 – $796 level to which the price may return if it bounces off the resistance level above it. Another critical level is the $900 price level, where the price is also likely to make a reaction.