The 2 Most Common Questions Forex Students Ask

Whether it be Monday or a Friday, Raining, Sunny or Holiday, I get asked hundreds of questions daily. About 80+% of them are the same (or similar). This is to be expected as a lot of people will encounter the same questions/experiences in their mind starting off in trading.

While some are legitimate q’s that need clarification, more often, they are the wrong questions being asked.

Today’s article will cover the 2 most common questions forex students ask. They are likely questions you have asked, or will ask in the future.

The following format I will use is 1) give ink to the question, then 2) deliver my response, and 3) share an insight related to each question. The goal of this is to help you see the questions you should be asking, and to help you shorten your learning process by taking the right steps forward.

Question #1: “How Long Till I Become Consistently Profitable?”

My Response:

In reality, I have no idea, and no other mentor/trainer does either. Why? Becoming consistently profitable depends upon the following;

a) how much time you can dedicate to this

b) your experience/skill level

c) how fast you will digest it

d) your psychological and emotional disposition (trading mindset)

e) how disciplined you are in following the rules

f) how the market will be in the future

There is probably more, but based on all this, how can I give you a specific answer?

Now, I’ve had students do this in a couple months. Some took six months, others took a year or more. In all honesty, there is no way for me to know or answer this specifically.

Insight:

For some reason, when people approach trading, they seem to have a general myopia about the learning process.

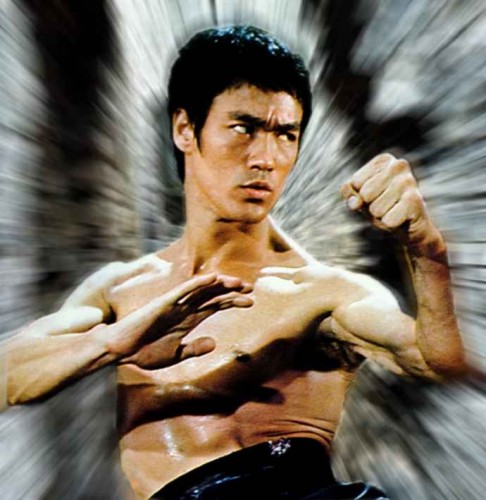

Imagine walking into a martial arts school and asking, ‘how long till I become a black belt?‘ Or a beginner walking into an archery school asking the head teacher ‘how long before I can consistently hit the bullseye?‘

Would you really walk into any of these schools and ask these same questions? Does any of the above scenarios make sense to you? I’m guessing not, so ask yourself why you feel trading is different?

I understand why you are asking this question – I really do! But this is not the question you should be asking.

What you should be asking is the following question:

“What are the skills I need to become a consistently profitable trader”

This same type of question can be asked in any of the above scenarios and would be totally appropriate to ask. In fact, they would actually speed up the learning process for you if you approached your training this way.

Food for thought.

Question #2 “What Kind of Reasonable Monthly Return Should I Expect?”

This is almost an identical version to the first question. A parallel of this would be akin to the developing archer asking “What would be a reasonable score I should expect to hit in competitions with your schooling?”

My Response:

How could anyone answer this? I have no idea of your risk profiles or tolerance levels, how you will perform, or more importantly progress over time, what systems you will trade, what pairs and on what time frames. I’m guessing even the Hal 9000 would not be able to answer this question!

Insight:

In archery, if you are absorbed by the thoughts of hitting the bulls-eye, you will have difficulty hitting it consistently, if at all.

Why?

Because to hit the bulls-eye, you have to execute the technique correctly and with great precision. How can you be totally present and sensitive to all your movements, position, stance, breathing, release, etc. if all your thoughts are on hitting the center target?

You cannot, and this is the irony of both archery and trading. To hit the target consistently, you have to actually NOT think about it, but instead execute the technique with great precision and consistency. This in turn is what allows you hit the bulls-eye.

In trading it is the same. To make money consistently, you have to execute your edge, use proper money management, and be mentally focused in the moment to read the market and execute your system well. If you do, the result more often than not will be you making money.

It is no irony that in martial arts, samurai sword fighting, or archery, that the main parts of how to perform well are all centered around controlling the mind. In their respective fields, Bruce Lee (martial arts), Musashi (samurai sword fighting) & Kenzo Awa (archery) all talked about this more than anything else. Your goal in trading should be the same as that is the root of where your performance (and answers to your questions) rest.