Trading Lessons from the Archery Range pt. 2

Yesterday was the most interesting class at the range in the last year and a half. Not because it was the last class before I move to another country, but because of the exercise we practiced for an hour and a half. It required an absolute sense of awareness with one’s technique, feeling and positioning, but it required something else. It required one to go against temptation.

The Exercise

After doing our usual warmup, we moved to our traditional 18m (60 ft.) distance, but had to shoot with a twist. Normally when we shoot, we actually start off with our eyes closed. We move through the first three steps of the position with our eyes completely closed so we direct all our attention to our positioning. Then we open our eyes to gather our aim on the target, and with the final pull of the cord, we release the arrow.

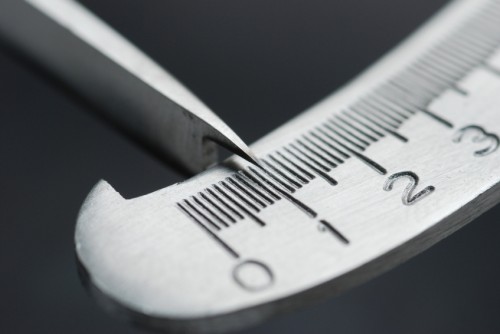

This time we did the same, except after we gathered our aim, instead of keeping our eyes open and focused on the target, we closed them again. We would pull the cord (with eyes open) till the arrow was about 1-2cm from activating the clicker (which measures the distance of the arrow pulled so we have the exact same pulling distance). This had to be done with complete feeling. But once we got there, we closed our eyes, and continued with the pull until the clicker fell and it was time to release. Why?

The answer has to do with temptation. When one is shooting, even though our eyes are normally closed for the first 3 out of 4 positions, once they open, and focus on the target, there is a natural temptation to relax our energy from the position/technique, and focus on the target. This often causes us to lose awareness of our bodily alignment that can have a tremendous impact on the release, flight and ultimately, the arrows impact on the target.

Remember, when shooting from 18m (60 ft.), any adjustments so much as a quarter of a cm could cause the arrow to move several inches off the target. This could happen in the hand that is holding the bow, the hand which releases the arrow, the back elbow’s alignment with the front gripping hand, or a number of other subtleties in the archers posture. In other words, any slight adjustment has huge implications. This is why archery is a precision sport.

Why Does This Happen?

70% of all the data our central nervous system takes in is through our eyes. This is the reason our maestro had us close our eyes for the first three segments of our positioning, so that our energy and focus, which often leaves our body when the eyes are open, stays completely centered in our body and alignment.

What also happens (and far more critical), is when we open our eyes, we tend to naturally focus on the target and loosen our awareness where it should be – not on the target, but right where we stand.

This exercise was completely designed to be a reminder of where our attention and awareness should always be. With our eyes closed, instead of our energy following the arrow, and leaving our body at the moment of release, it stayed with us completely. It was monitoring our follow-through, the expansion of the arms, and the relaxing of the bow. But far more importantly, it kept us focused instead of falling into the natural temptation of looking at the target. The practice of archery is really not just one of precision, but one of going against temptation.

How Does This Relate to Trading?

In trading, there are more temptations then there is in archery. The promise of working from home, having no boss, making more money than ever before, not having to follow a dress code, or show up when someone tells us, or work the way they want us to, go on vacation when we want, buy the things we never could before, to be financially free. There are massive temptations in trading and the list is endless. Trading – like archery, is a practice of going against one’s temptations.

There is another critical way archery and trading come together. When we are trading, it is ever so easy to relax our focus on what we are doing, and become focused (almost enchanted) with the target. With every new win, increased wealth is a possibility. Push a few buttons of the mouse and we can be richer than we were before.

However, when we relax our focus and concentration, we increase the probability for errors and losses.

How?

Hopefully, if you are trading, you have a system which is rule-based so there is no confusion about what is a valid signal, when to get in, where to take profit and where to put your stop. Assuming you do, then all you have to do is follow your rules. But how many people do this? How many people abandon their trading plan when executing or are in the middle of a trade? Let me know if these examples sound familiar;

-You took a trade that was not a part of your system

-You did not use the proper risk management and over-leveraged

-You were watching your balance instead of what the market was doing

-You were thinking of what you can do with your profits instead of trading your system

-You adjusted your stop before you were supposed to

-You increased your stop when the trade went against you

-Assumed the success/failure of the trade by the first few pips movement after your entry

-You took profit before reaching your systems target

-You closed the trade in fear or emotion instead of what the charts were telling you

Do any of these things above sound familiar? Have you ever done any of these things? If so, do not worry, as these are the traditional mistakes of a developing trader and you are in large company. But, if you have been doing these things and still are, it is pointing to something specific like the head of an arrow.

It is pointing to how you are losing focus before and during the trade. It is pointing to how you are focused on the target and not following a technique. It means your awareness has left you with the trade, like the arrow heading towards the target. Trading – like archery, is learning to go against one’s temptation. Trading – like archery, is a precision endeavor.

At all times, work to be focused on only three things; 1 ) trading your plan, 2) trading your system, and 3) keeping your eye on the markets, and not the targets (balance checking, profit checking, how close you are to your limit). By doing this, you short-circuit the opportunities for your emotions to steer you off course. By doing this, you eliminate the moments temptation can affect your trading for the worse. By doing this, you build the habits of successful and professional traders. Trading takes discipline and it is a skill based endeavor.

Luckily, skill is a drill and something that can be learned. Just make sure you are not drilling in the habits which take your focus, which keep the eye of your mind on the wrong target. Follow the three things you should be focused on, and your trading will take flight. You will become more disciplined, diligent, and build the right mentality. You will make less mistakes, and find greater consistency. When this happens, you will be well on your way to becoming a successful trader.

Remember to click on the ‘tweet’ and ‘like’ buttons below. Your comments are welcome so let us know your thoughts on this article.

Also, make sure to check out another great article on the topic called Willingness, Responsibility and Ownership in Trading.