4 Hour & Daily Forex Strategies

Not everyone is able to sit at the computer for hours a day and trade. In fact, many of you have full time jobs, family lives that keep you busy, yet you still want to be able to participate and trade in the market.

A lot of times, these are the emails I get from people, whereby they have the lives above, and only have a couple hours to trade after work. You don’t want to actively manage positions throughout the day because of work and are looking for a structured way to trade.

If this resonates with you and your situation, I recommend trading the higher time frames such as the H4 or daily charts.

Why?

Generally, the lower the time frame, the more detailed analysis you have to do, more variables you have to incorporate + the lower time frames require more attention due to price moving a lot faster.

More details + more variables = more time needed to make trade decisions on top of the need to monitor the charts more frequently. Thus not a favorable scenario if time is a very limited commodity for you.

The faster price movement also requires you to make many important decisions in a fraction of the time that you have at your disposal when trading on a higher time frame like the 4 hour or daily chart which significantly increases the cognitive load on a trader.

What is cognitive load you ask? Cognitive load refers to the total amount of mental effort being used in the working memory, similar to the working memory of a computer and refers to how much information an individual can consume/process in a given period.

A greater cognitive load means that you’ll exhaust your energy at a much faster rate which in turn can have an effect on your decision making.

Aspiring traders often are attracted to trading the lower time frames because they offer more ‘action’. But since they are not experienced enough, they are often unable to cope with the increased cognitive load, which renders them paralyzed at times or leads to very bad trading decisions.

Thus, trading the higher time frames is better suited for beginners and those with limited time available because

a) the skills of beginning traders aren’t fully automated yet and

b) the higher time frames require less time/attention.

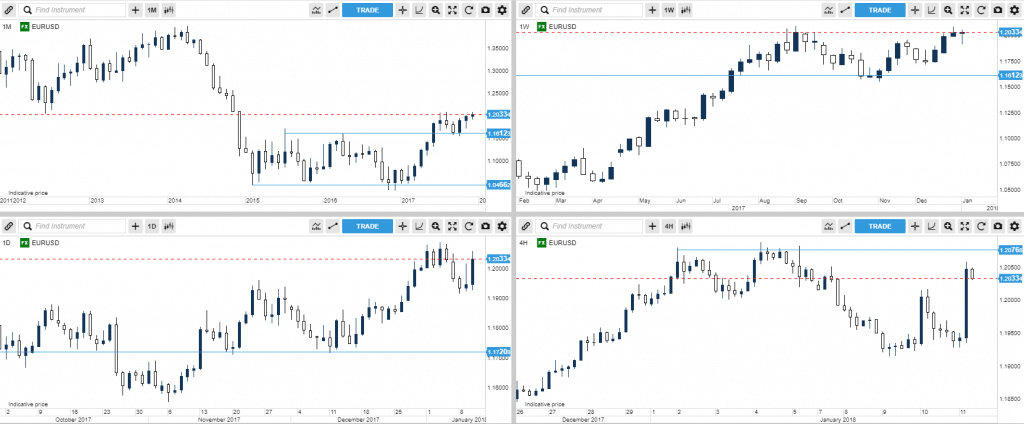

To clarify, here is what I consider the higher time frames:

Monthly/Weekly/Daily/4hr on EURUSD

The overall guide on how to relate to this is:

- Look at the monthly time frame chart if you are looking at several years+ worth of price action, and want to hold trades for about a year or more (often called ‘position trading‘).

- Look at the weekly time frame chart if you are looking at just a few years’ worth of price action, and want to hold trades for several months at a time, perhaps close to a year

- Look at the daily time frame chart if you are looking to do ‘swing trading’, and want to hold your trades for a couple days, up to a few months (perhaps quarter)

- Look at the 4hr time frame chart if you are looking to do swing trading, and want to hold your trades for a couple days up to a few weeks (perhaps a month)

NOTE: These are general ‘guidelines‘. They are not perfect rules.

Now, how do you trade price action on the higher time frames?

If your primary time frame for trading is the 4hr charts for example, then most likely you’re doing ‘swing trading‘. In essence, you’re trying to capture larger ‘swings’ in the market.

Many traders (perhaps like yourself) want to trade the higher time frames and are wondering what daily forex strategies you can use.

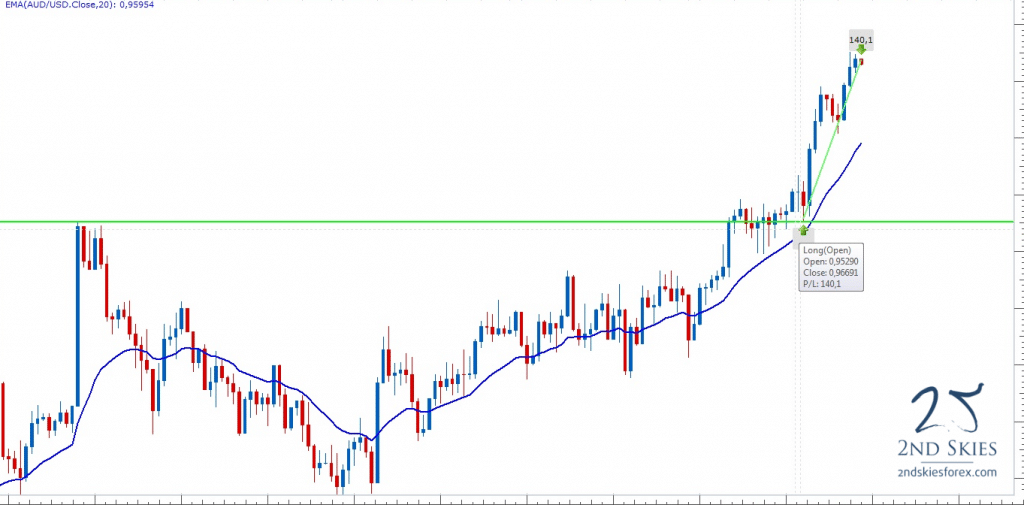

There are many strategies we teach in our trading course, but one I’d recommend is a role reversal setup (or breakout pullback setup).

This strategy is best used when you are trading with trend.

Below are 3 major components for a breakout pullback setup:

- find the overall price action context and trend on the daily time frame

- find a key support level (for bear trends) and resistance level (bull trends) that has been touched two times before (at a minimum)

- wait for the market to breakout and pullback to the level

If you’ve done those 3 things, you’ve likely found a good role reversal – breakout pullback setup.

There is more to this strategy, (what type of trend you are in, which are key support and resistance levels, what is the best price action context to trade breakout pullback setups, etc.), but you have the basics.

NOTE: If you want to learn more about this strategy and how to trade it, check out my price action course where I teach you exactly how I use this strategy with my own money.

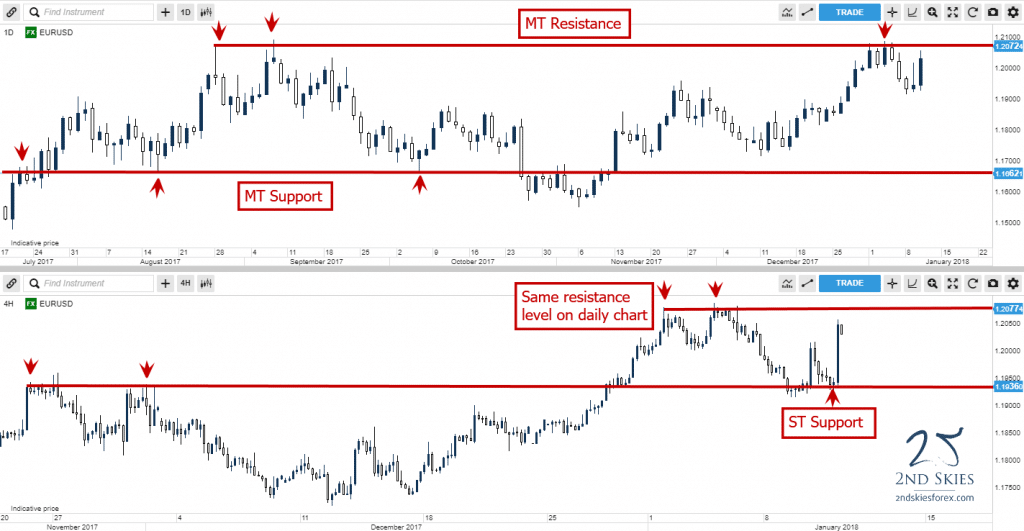

Without a doubt, you can use the breakout pullback setup on the 4hr chart (or any time frame for that matter).

Here are a few additional tips you can use when swing trading the 4hr charts:

- Have the daily chart as your ‘higher‘ time frame context. When in doubt, try to trade with this the most.

- Don’t expect the market to go straight to your target.

NOTE:It may require a few pullbacks before it gets there. Eventually with enough skills in reading the price action context, you’ll learn when those pullbacks are part of the trend, or leading to a major reversal. - Mark your support and resistance levels on the daily & 4hr charts.

Below is an example of how to apply support and resistance:

In Conclusion

For those of you who have very busy lives, with a full-time job, family, and general commitments that you are unable to sit and trade for hours, there is a way for you to trade and participate in the markets, while not having to stay up all night.

For this, I recommend trading using the higher time frames, allowing you to be engaged in the market and able to make money without having to sit and monitor charts all day long.

I hope this helps for all of you who fit into this category and that you found this article informative and useful.

Please make sure to leave a comment below and your thoughts on it

Kind Regards,

Chris Capre

Another great, eye-opening article! Thanks Chris.

De nada, glad it helped and thanks for the kind words

Chris

Hi Chris,

Yes, these are the timeframes that suited me for the moment and also what I am trading on now. You have also pointed out the server time which is very true. So which server time work best for your H4 and daily TF strategies?

Hello Eric,

It really depends upon the pair and the system because the performance varies significantly depending upon the system and pair.

For example, some pairs do really well with inside bars on the NY close, but others fail miserably. Yet those same inside bars

and pairs that fail miserably on the NY close, do really well on the London open, so depends upon each one.

This information is available to those in my Price Action Course which you are welcome to join.

Hope this helps.

Kind Regards,

Chris

Hello Chris,

Very interesting post, enjoyed reading it. With good information for thought.

Their is however one thing what comes in my mind about the practicality of using different server times.

As you stated that patterns perform differently with different pairs on different server times. But you only have one

of the server times with one’s broker of choice. Unless of course you have a broker for each server time, I find it a bit

unpractical! What is your view on this and how do you of your students manage this?

Hello Agnee,

Some good questions here.

First off, many of my students end up just trading one server time which is totally fine. If you have the right server time, you can be plenty active

in terms of finding setups and pairs.

This is the most simple approach.

Some students just run two demo accounts for the best server times, yet still trade off of one account/broker. You don’t have to have multiple accounts to trade another server time, just the charts for those signals.

So both of them are viable options, but none of my students ever really have any issues with this.

Hope this helps.

Kind Regards,

Chris

GMT/London Midnight

NY Midnight

European Open

NY daily close

could you suggest brokers with these 4 server times. it would be interesting if i could confirm a pattern successfully in majority of them. then that pattern would mean its a strong pattern.

FXCM UK

MBTrading

FX Pro

not sure who uses NY daily close, but I don’t find it necessary at all to confirm my signals across multiple server times.

Neither do my students or traders so seems like an unnecessary process to find good signals.

When it doubt – keep things simple.

Hope this helps

Kind Regards,

Chris

Hello Chris,

Another great article I’m just getting to. I am in the process of changing things so I have the NY close charts. Just feels better for me.

Keep up the good work and best wishes to you and yours!

Stan

Hello Stan,

Glad you liked the article and content and good luck trading.

Kind Regards,

Chris Capre

Hi Chris,

Fantastic article – thank you for posting it up for all to read.

Being new to forex would you advise to initially start trading with these time frames?

Best regards

Haider

London, UK