What Is A High Quality Signal?

I recently wrote a controversial article dispelling some of the misconceptions about the ‘Quality vs Quantity‘ argument, the ‘Less is More‘ being better for your trading. It has already garnered a lot of questions and responses on the web, which was its purpose.

But there are still some lingering and freshman ideas floating around there. Thus, I wanted to write a brief article to end the week highlighting some of the key takeaways, and what not to be fooled by.

High Quality Signals Only Come From Higher Time Frames

The idea that high quality trades, setups and signals only come from higher time frames really comes from an inability to see and read price action.

Ask yourself – what constitutes a high quality forex signal?

Some of the main components (regardless of time frame) should be;

1) a pattern that repeats itself with consistency and accuracy

2) a signal that offers low risk and high reward potential

3) a pattern that offers a clear entry and exit pattern

Let’s break down each one here so you fully understand them;

1) A pattern that repeats itself with consistency and accuracy

If you haven’t noticed, the markets are changing with daily ranges contracting massively and currently at 5 year lows. HFT algos now comprise 28% of the daily volume, but 3 years ago were 10%. So this would change how the price action unfolds considerably as they are using different techniques, technology, and patterns than traditional human traders would (or could).

Even though the patterns are changing, they are patterns that repeat themselves nonetheless, and for someone who is a real student of price action, you will be able to see these patterns on all time frames.

As long as the price action pattern is relatively consistent with both the formation and outcome, this is a key ingredient for a high quality signal, and thus a tradable event.

2) A signal that offers low risk and high reward potential

The size of my stop in relationship to my target is what constitutes a high quality signal. The greater this is above 2x reward v. risk, the better the quality of the signal. I still have to figure accuracy into the equation, as profit is really a measurement of risk, reward and accuracy.

Regardless, a 200 pip winner with a 100 pip stop offers the exact same profit potential as an 60 pip winner with a 30 pip stop. Assuming you risk the same on each trade in terms of % equity, they offer the exact same profit potential.

Now one thing should be pointed out;

Risking 100 pips, how many times would I be able to grab a 9x, or 11x reward play, meaning I could grab 900 or 1100 pips from that trade? I’m assuming not many at all, and something you’ve likely never done just risking 100 pips.

But what about risking say 10 pips and gaining 90? Since 900 pip straight moves are not common on a daily chart (maybe 5-6x a year), but 90 pip moves occur everyday, the latter once again offers more profit potential.

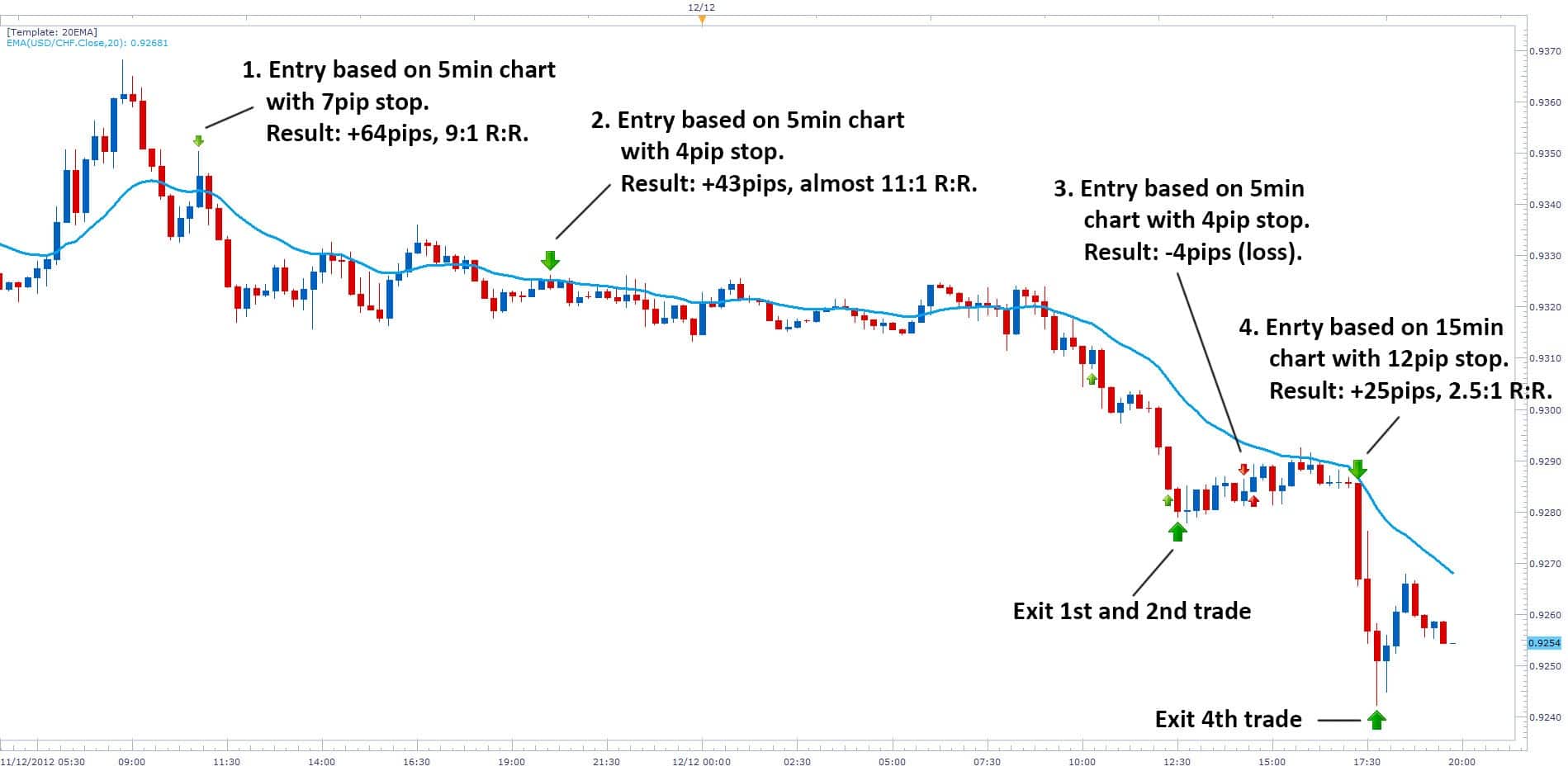

Just the other day, one of my price action course students did just that, snagging 128 pips on the day, grabbing a 9x reward play, an 11x reward play, and a 2+x reward play.

So you trading the daily charts only risking say 100 pips, would have needed to bank a 900 pip runner, an 1100 pip runner, and a 250 pip runner, just to equal what my student did in < 24hrs!

Ask yourself Mr. (or Mrs.) Daily Chart Trader Only, how many times will you be able to do that in one single day, let alone a year?

If you are on avg. banking 2x reward plays, and trading 3x per week, you would need an entire month of perfect trading just to equal his half day of trading. Add 3-4 losses in there, and you are talking 1.5-2 months to achieve what my student did in 24hrs.

Which would you rather do? Work for an entire month to make what you could in a day? Wait for months on end to find something you could achieve almost daily?

Food for thought, but high quality signals happen everyday. If you are not seeing it, you just haven’t learned how to yet, but with proper training in price action or ichimoku, you could.

3) A pattern that offers itself a clear entry and exit pattern

For any signal to be high quality, as discussed earlier, it has to be 1) repeatable and solidly accurate, 2) offer low risk/high reward potential, and 3) offer a clear entry and exit pattern.

For those that have read my article on understanding impulsive and corrective price action, you will remember my key model is to find impulsive moves and trade in that direction, as the next legs are likely to be a corrective move, followed by another impulsive move in the same direction.

Now using the same chart from my student below, look at the 4th trade which is the last one on the day (chart below).

Notice how he was using my model of following the impulsive and corrective price action, looking to short with trend on a corrective pullback and trade with the institutional money.

His first attempt failed for a small 4pip loss, but his second attempt caught a really opportune moment to get in, and immediately after his entry, the sellers came in with force, bottoming out with a pin bar setup that he recognized as a likely bottom, along with a few other clues from my price action course.

He ended up banking +25 pips on a 12 pip stop for a 2x+ reward to risk play, all in 15 mins.

Notice how he controlled the risk exceptionally well with precision and confidence, almost like a sniper would taking out his targets. For those with eyes, he had a clear entry and exit pattern, which is needed to have a high quality signal.

This was a high quality A+ setup that was obvious and was begging to be shorted. You will also notice he had a good strike rate, hitting 3 out of 4 trades for 75% accuracy, all while trading < 1hr charts.

To do this he had to be patient and disciplined. You don’t have to wait for days to find these trades, as they come daily. You just need to learn how to spot these high quality intraday price action setups.

He was looking for easy opportunities, acted with complete confidence, swiftness, precision and without hesitation.

He also avoided any risky situations, and used highly effective risk management, never risking too much per trade or more than necessary. He never interfered with his trades as you can see on trade 2, he had to be patient for the trade to mature. When it did, he took profit, but he never exited early.

And if you look at the 2nd and 4th trades, he was looking for the easy prey – the most obvious setups out there.

In Summary

As I stated in my prior article on quality vs. quantity – which is better for trading?, the ‘less is more‘ doesn’t apply mathematically and always hold up, as I’ve already demonstrated. Unless your accuracy is significantly higher, your ‘less is more‘ theory is actually a lot less profit mathematically.

Food for thought.

Now it should be stated I am not saying you should trade intraday only, or abandon the 4hr and daily charts. For those of you with full time jobs, families, and busy lives (many of you), I recommend trading the daily and 4hr strategies as these will be most suited to your situation and availability.

I always advocate finding what is most natural to you, your mindset and situation. This will always be the most profitable strategy you could engage in. For some that will be on the higher time frames and the ‘less is more‘ approach which has some advantages.

But for others, it will not be, as you have the skill set, mental aptitude, and availability to trade intraday. The key is to finding what would work best for you, and then learning that to the best of your abilities.

Just don’t fall prey to the ‘one size fits all‘ or ‘less is more‘ approach, because it may actually be ‘less’ for you.

To argue high quality forex trading setups only manifest on higher time frames is a sophomore understanding of trading price action, or trading as a whole. They manifest on all time frames, you just have to learn how to see them. That does not mean you should trade them all – just find a method of trading that fits you best.

Make sure though, you don’t fall for any one sided arguments saying quality is better than quantity, or vice versa, as the answer lies somewhere in between, and in reality – a balance of both!

Kind Regards,

Chris Capre

As always a first class article … most of people that follow your articles can relate the simplicity of what you doing using one moving average refreshing to see so few lines on a chart … its a question i often ask traders most scratch there head when i ask it … what determines a false signal to a True Signal … and how do you weed it out …

TT

Hello Peter,

Am glad you liked the article as its a critical subject and addresses some critical questions, along with using simplicity in trading price action.

But thank you for the positive comments.

Kind Regards,

Chris

Hi again, after reading this article it makes sense, thanks for sharing it

The article is correct in the sense that you can only make 3+ reward trades on short time frames. But you have to remember one really important thing: trading the 5-min time frame gives you just a few minutes to always know what to do right now! One wrong action from your site or the market can cause you being in an unexpected situation you did not consider with dramatic consequences! In this little time frames you just have to little time to think about the outcome your trade can have! The market is to fast. One day you will make a dramatic mistake you would not have made on the daily charts.

I do have a profitable 5-min strategy, but can´t trade it on the 5-min time frame over a longer period because of the above mentioned problems.

Hello Gerd,

I think you bring up some interesting points.

But I am going to disagree with you on a few.

There is no reason to have ‘dramatic consequences’ as you suggest if you are fixing the risk from the outset of the trade. As long as you are doing this, a loss is just a small % of your account which one should be prepared to accept from the outset. So I do not see this as an issue and causing any dramatic mistakes.

Also, all of my systems are rule-based, meaning if the rules hit, you are out of the trade, so no major thinking or decisions to make. My students also do not have any issues with all the rule based systems, so I think this is also not much of an issue.

But thank you for sharing as I think you bring up some interesting points.

Kind Regards,

Chris Capre

High Chris,

I find the 5M time frame exciting, but very dangerous and the 4H

more reliable.

I recently read an article on 60 Minutes about “how speed traders

are changing Wall Street” look below.

http://www.cbsnews.com/8301-18560_162-6936075.html

I like what you are saying about your systems are rule-based, but

still a little concerned about the article above, any thoughts?

Kind Regards,

Hugo

Hello Hugo,

Keep in mind we are never trading the 5m in isolation, but in concert with the 4hr. It can be used to refine a better entry

or take a smaller swing inside the with trend trade on the 4hr charts. When you do this, there is no issue.

On top of this, when you control risk, and are patient with your trades, you are not risking any huge amount, so risk is capped from the outset.

Thus, I really don’t see any reason why this should be dangerous if managed well.

As to the ‘speed traders’, they are using algos, and algos work on rules and patterns. If you can learn to detect them, you can take advantage of them.

Hope this helps.

Kind Regards,

Chris Capre

Hi Chris,

Thank You for the explanation, it makes sense.

Kind Regards,

Hugo