Set and Forget Trading – When To Use It and When Not To

A while back I heard a professional trader who ran a trading desk sum up ‘set and forget forex trading‘ strategies in one sentence:

“That is like getting in a car, putting your foot on the gas, and expecting to get from point A to point B without crashing – complete stupidity.”

By and large, I have to agree with him. There is a lot of confusion around set and forget trading, and it’s likely costing you money.

In today’s article, I’ll begin by sharing the fallacy in this way of thinking and how our brains are wired in relation to trading. Then I’ll cover the ONLY TWO SCENARIOS you should use a forex set and forget trading strategy.

From here, I’ll talk about evolving markets and how this relates to set and forget forex trading. After this, I’ll end with talking about how you limit your profits and how to avoid capping your growth as a trader.

The Irony & Fallacy of Set and Forget Forex Trading

The irony (and fallacy) hiding behind this one size fits all approach is it assumes you are responsible enough to make a good trade entry, stop loss and take profit, BUT you are clearly not mature, intelligent or responsible enough to manage a trade. How ridiculous.

To be fair, our brains are not wired for all the mechanics of trading, and our natural bias is negative towards most things, especially threats.

The translation of how this bias affects us is: we are more likely to close a trade when it goes against us (threat) vs. working for us (beneficial). And I’m sure you have experienced this yourself.

The Scenario

You are in a trade, everything is going for you, the price action is impulsive in your favor, you are in profit…and then…the first major candle goes against you. Immediately you think the move is over and you close the trade to lock in profit.

Has this happened to you? If so, its your brain and reptilian brain working against you.

(NOTE: For a great trading article on the negative bias in trading, read Why We Close Winning Trades Early)

Change & Growth Come Through Re-Wiring Your Brain

To be successful in trading (and anything), you have to re-wire your brain and change your habits. This is best done through repetition, focused awareness and skill based training.

We can either walk on eggshells around our negative biases (no growth), or we can learn to get past them (growth). Simply turning to a one size fits all approach for taking profit (or managing the trade) isn’t the answer. It leaves you crippled in terms of growth and assumes you’ll never get over it.

That is like saying you should never drink a beer (or glass of wine) because you’ll never be able to control yourself. Or you should never get a drivers license because you’ll never be responsible enough to drive on public roads. Ridiculous.

In reality, set and forget forex trading is simply ONE method for managing the trade. And it should (in reality) ONLY be used under two circumstances:

#1: You only have one, maybe two hours per day, and have no real way to manage your trades. Perhaps you work full time, have kids, and are just really really busy with a super tight schedule.

In this case, you are probably best employing a forex set and forget strategy as a profit taking method using daily and 4hr price action strategies, but there is a big assumption in this.

The Assumption

The scenario above assumes you are a) not trained in reading price action context, or b) your trade will likely hit its stop loss or take profit after you enter, but while you are busy.

Hence, unless you are not trained to read the price action context in real time, or the trade will close while you are at work, then you are a decent candidate for a set and forget forex trading strategy.

If your trade will take a few days, then this may not be the best method, because as it progresses, it may show signs it could go for a big runner. These are trades you have to take advantage of when they come, just like a really good poker player loads up on a strong hand.

Once you get good at reading the price action context in real time, you can also trail your stop and reduce your risk as the trade progresses. Almost every professional trader will reduce risk as their trades advance.

Very few will look at it as a hell or high-water scenario, which is what you are saying when you use a set and forget trading strategy as your method.

The other scenario is below.

#2: If after exhausting all other methods of managing your trades (taking profits and adjusting your stop), and the ONLY baseline method which showed profitability, then you’d be a decent candidate for the set and forget method.

This one is pretty straight forward, and the risk of ruin needs to support your decision. Without it, you could have the numbers working entirely against you without even knowing it.

Thus, if you are that trader who falls outside of the two above reasons, you should explore other options, and develop an accurate baseline for gauging which method you use.

Markets Evolve Over Time

The bottom line is the market evolves as it progresses over time. This can happen intra-day, daily, or over days and weeks. Those that train and learn to adapt with such changes in real time will have their finger on the pulse and maximize opportunities.

This is what institutional traders do. They adjust and evolve their positions as the market does, just like a poker player will become more aggressive (or conservative), based on the players around him, and the size of his chips.

Just realize if you don’t explore other options for managing your trades, and train to get beyond your weaknesses, your growth will be limited, and your profits will reflect this.

Having A Curfew on Profits

But perhaps that doesn’t sway you. No problem, just imagine the following scenario:

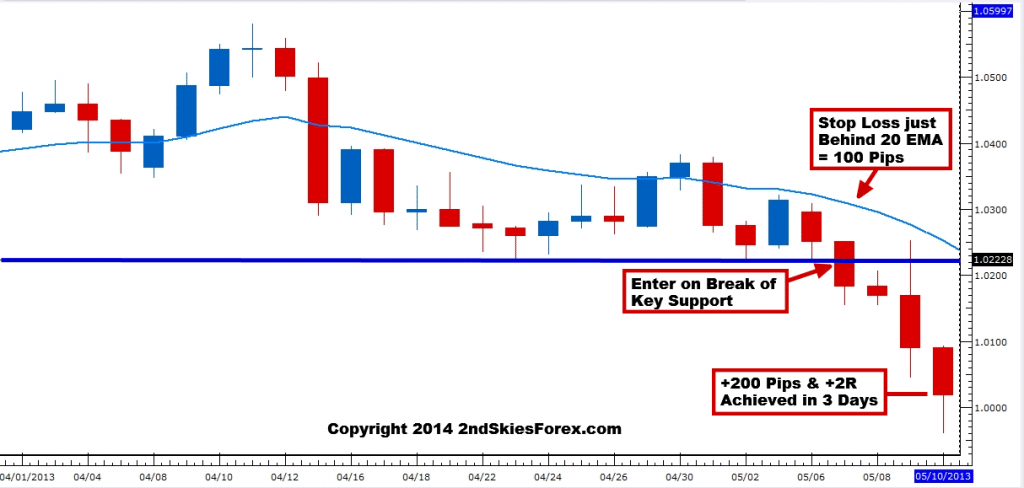

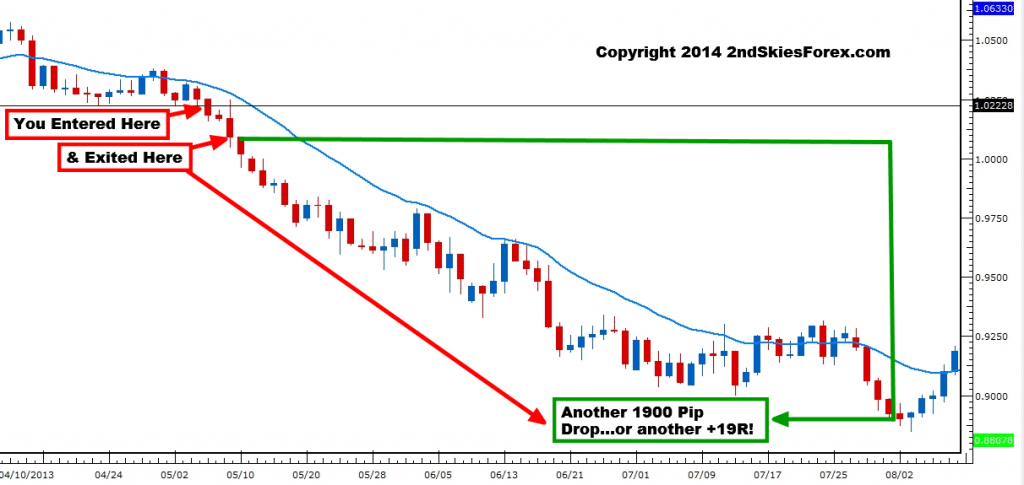

It is the first week in May, 2013. You have just entered short on the AUDUSD on a break below the key support level around 1.0225. Your stop loss is just above the daily 20 EMA, so -100 pips, and your ‘set and forget‘ target is +200 pips, or +2R.

About a day later, it comes out on the news that George Soros has sold over $1 billion of the AUD. Considering Soros’s history, and that he doesn’t just get in and out in a day (along with the glaring fact other professional traders will likely pile on this trade), chances are this trade is going to run.

Yet…here you are, just a couple days later, saying ‘nope, I only set and forget because I ignore everything and cannot manage my trades responsibly, so I have this curfew on profits‘.

About a day later, you hit your +2R profit, thinking you are a darn good trader. This is your chart below.

Looks great eh?

Keep in mind, this situation above happens on a micro-scale almost every day, sometimes many times per week.

So when you consider employing a forex set and forget trading strategy, realize there are other options, and this should only be used in very specific circumstances.

Also understand, if you choose to use this method while you have other options, you are a) putting a cap on your upside profits, and more importantly b) putting a limit on your growth and development as a trader.

There are many other methods for managing your trades regardless of what time frame you trade. For those wanting to learn more about these methods and how to leverage them in your trading, learn about my Trading Masterclass Course where you get access to our daily trade setups commentary, trader quizzes, private member webinars, live trade setups forum, and more.

Great analogy with the car.

Set and forget tends to have this easy money idea around it. Just enter in the trade and the profits start rolling in automaticly, no skills needed. It´s just laziness actually. I know I fell in this trap before going trough the price action course…

So great article Chris, thanks 🙂

Hello JP,

Yes, it does tend to create a false picture there is easy money, that just sit back and watch the dough roll in, no price action context skills required. Laziness, but also treats the trader like an infantile, as if they cannot manage their trades, emotions, or ever grow, so don’t bother, just put on your trade and don’t do anything, because you are too irresponsible and will screw it up. So hands off. A very ridiculous idea indeed, and only for a select amount of people who have very special circumstances.

So glad you noticed and have now graduated beyond that.

Kind Regards,

Chris Capre

Hello Chris.

What would the best approach be for someone trying to hold down a regular day job. with1 to 2 hours a day set aside in the evenings for trading?

Would your price action course and methods be suitable for this type of trader ?

Regards Cliff

Hello Cliff,

I’d probably recommend a set and forget style of trading with 1-2hrs per day after your work. It’s what most of my traders/students do since they’re in a similar boat.

We cover this extensively in our price action course and work with you in improving this performance over time through our trading analytics session.

Hopefully this answers your questions.

Thoughts?

Great article Chris, the only path to become a successful trader is to work hard at sharpening our trading skills and that comes with education, practice and enhancing our abilities to concentrate in what we do. Set and forget is just one way to approach a trade and it has its limitations.

Thanks you for all the hard work,

Carlos

Hello Carlos,

Yes, we have to keep sharpening our skills, enhance our abilities and get past our limitations. This is the downside (amongst many more) of using set and forget, so glad you noticed.

Kind Regards,

Chris Capre

Hi Chris

Perfect article. great insight to fear and our relation to threat.

thanks for the article

sahaj

I understand this completely, it’s just putting it to good use. Very clear explanation which is never told anywhere else. I am PROUD to be your student, like many others, I just need more time to be more profitable not using the reptilian brain. It is a great course and you have to spend time to learn, put it this way, fail to plan and then plan to fail, this is something you have to put the correct amount of time in to understand Chris’ way of thinking. Enough said Bravo to you Chris!!!!

Thank you for an excellent article, I am still learning, I love to see more of your set ups and the way you go about it , when to enter , stop loss, take profit.

I am finding it overwhelming at the moment , there is so much to read and learn. more screen time , and interacting with experienced traders like yourself.

cheers

Ben D’limi

Hello Ben D’limi,

Thanks for the positive comments.

It’s not overwhelming when you learn the key variables and methods to break them down.

You can always see more of my setups and take things to the next level by joining my Price Action Course and getting daily access to my trade ideas and setups.

Email me via info@2ndskies.com if you have any questions.

Kind Regards,

Chris Capre

Hi, A good summary indeed. Helped me a lot.

One thing I can add (maybe mentioned elsewhere), Set&Forget can be a psychological burden as well.

Usually, when you build a strategy, you have to obay it. If it uses S&F, it is pretty obvious you have to obay that rule you created for yourself. Seeing a market move against you is frustrating, no matter how many times you repeat to yourself “But I’m a set&forget person, it’ll come around and I’m not supposed to touch it”

And there is almost nothing more dangerous thatn built up frustration

Hello Asen,

Glad it helps.

RE: Set & Forget = Psychological Burden

Yes, if your brain is wired to stress about the trade, the time frame or set and forget style wont matter. You’ll still worry. And indeed – frustration will set in if that is your habit.

So very good points here.

When belief on market is beyond our control then set and forget is a good act on the belief. I think it’s a matter of skill and experience that a trader will improve his RR from time to time. I agree in your back test sample that placing longer and longer TP at a logical exit point by trailing stop looks good, but in reality it’s not as simple as like that.

Hello Rahmat Hidymat,

I’m not sure I fully understand what you’re communicating with the first sentence here.

But yes, over time a trader with more experience should be able to increase their +R per trade. This can be done through several mechanisms.

RE: Placing Longer TP @ Logical Exit Point

I don’t see myself as communicating it’s something ‘simple’. It is is concept, but takes experience and data mining to fully work with.

I’m simply introducing the concept to increase people’s awareness here, and give them some guides to focus on.

When people want to go more in-depth on this, you’ll need the right tools, training and skills to do this.

Hopefully this provides some clarity on it.