Is it too Late to Buy Facebook?

With a YTD stock-performance of 38+%, a market capitalization of $1.067 trillion and a cumulative user base of 3.5 billion users across their product portfolio, it’s easy to think it’s way too late to invest in Facebook (NASDAQ: FB).

Taking a closer look however, there are multiple reasons we might see Facebook continuing to outperform the market in the upcoming years.

Undeniably, one of Facebook’s strongest competitive advantages is its massive user base, allowing advertisers to reach into every corner of the world whilst making it very difficult for smaller competitors to catch up.

After all, selling advertisement space is Facebook’s main source of income and as long as the company is able to maintain its dominant market position and the userbase doesn’t take a serious hit, it’s unlikely advertisement sales will dry up anytime soon.

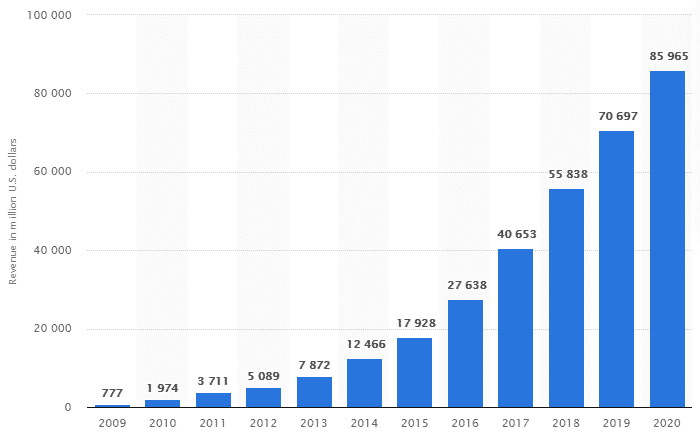

Looking at the annual revenue growth, the numbers are impressive to say the least and show no signs of slowing down, rather the opposite.

Facebook also generates a whooping $33 billion of free cash flow on an annual basis, which also is steadily increasing year-over-year.

Despite the stocks strong performance, revenue growth is keeping up, which gives the stock of Facebook an attractive valuation, trading at 28 times forward earnings. Amazon as a comparison is trading at 61 times forward earnings.

From a risk/challenge perspective, the main risk for Facebook remains regulatory challenges due to hate speech, fake news and controversial political stories that have been plaguing the platform in recent years. However, for now, Facebook has done a good job at addressing these problems or at least avoiding heavy regulatory penalties. After all, the company is sitting on a monster pile of cash and tremendous legal resources which definitely isn’t a disadvantage in this regard.

In conclusion, whilst it at a first glance might seem there’s little upside left for this $1 trillion company, raw numbers in terms company and revenue growth suggest otherwise which is why we like Facebook as a long-term investment.

Technical Analysis

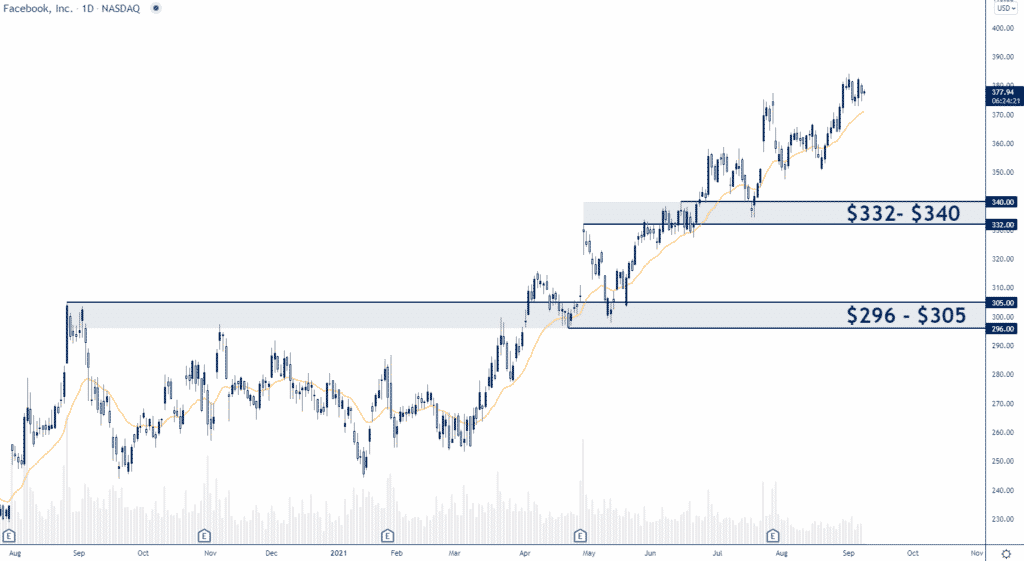

After being stuck within a range between September 2020 and April 2021, once the stock broke out to new highs, bulls were not late to push the pedal to the metal, resulting in a strong directional follow through.

For long-term investments, we do not recommend getting in at or close to all-time highs, but rather wait for a solid pullback as this allows you as an investor to get in at a better price. In terms of where to get in, we do like the support zone at $332-340 as our first potential buy zone, followed by $296-$305 which we think would be a great discount on the stock if we do get a major correction.

Option Positioning

Currently there are about 990K calls and 813K puts out there. We don’t have a lot of short dated options rolling off till the Oct EXP (15th) so no short term pressure up/down on the stock via options. The options positioning suggests support should start to come in around till the low 300’s, which lines up with our deeper support zone on the tech stock.

FULL DISCLOSURE: Chris Capre currently has no stock or option position in FB. If you’d like to learn more about Chris’s trades and positions, you can get access via the Trading Masterclass where he shares his live trades, further investment ideas and daily market analysis.