This Once Expensive Stock Now Sells For A Scarce Discount!

We might have in our hands an opportunity that only presents itself once in a while, thanks to this massive dip in the stock price of Meta Platforms, Inc (Nasdaq: FB).

What Happened

Source: Brett Jordan

Following the release of the company’s quarterly reports on the third of February, Meta stock dipped by 30%.

So What?

Fears have grown about the dwindling popularity of Meta platforms, WhatsApp, Instagram, and Facebook, among the younger generation. The reduction in the number of daily active users on Facebook in that quarter served to confirm those fears, and the stock dipped accordingly.

The guidance for the next quarter was also weaker than what analysts expected from the hugely successful company. Apple’s latest ad policy also had an impact on the company’s stock price.

Now What?

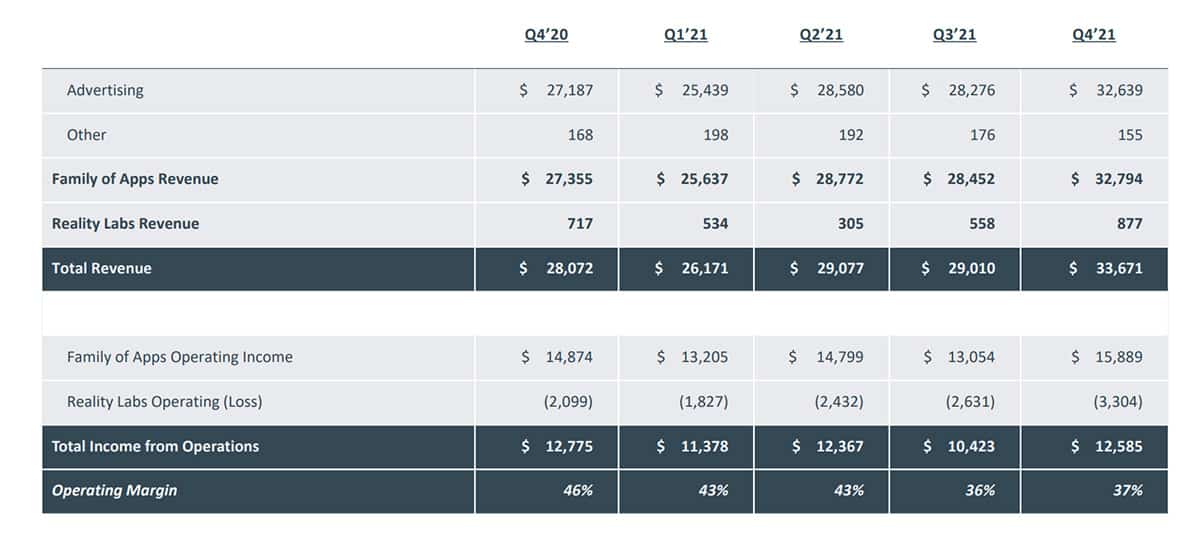

Meta is a company that has proven it can always make money. Despite that dip, the company still recorded $12.5 billion in net income and revenues still went up by 20% to $33 billion year-on-year.

Going forward, the company has its eyes set on the metaverse, a future where everything goes virtual. In fact, this goal inspired the company to change its name from Facebook to Meta to better accommodate its ambitions. While that future is still some decades away, it is a relatively safe bet that Meta would be a part of that future.

Overall, this dip presents investors with the opportunity to get in on Meta for growth and for value. This dip brought the company’s price-to-earnings ratio 16.4x to its lowest since it went public in 2012, trailing the Interactive Media and Services industry by 9.3x. In other words, the stock is at its cheapest.

Technical Analysis

Slightly over four months ago, we did a review of the Meta stock (then, Facebook), and we recommended our first buy level of $332 – 340. We said if the stock had a major correction, we recommended a buy level of $296 – $305.

In the past week, our major correction happened. What’s more, the major correction places us at an even bigger discount than we anticipated. FB has dropped by 30% so far, bringing the stock price to $226 as we speak. The closest support level at $214 – $222 may serve as the resting place for the price if the sock doesn’t dip further down to the $164 – $172 level.

This is good news for potential growth investors who thought buying at $332 – 340 or $296 – $305 was too expensive. And for value investors who are scouting for undervalued stocks, Meta fits.

As for when to buy the dip for all investors, the time is now. However, you may wait until the stock finds a support level to settle before you click the “buy” button.