Professional trading and training can be like a marathon that never seems to end. Simply trading each and every of the +225 trading days a year isn’t actually healthy for the learning process and skill development.

There are times when we have to spend more time reviewing and less time trading. There are also times when we need to do more study and training than trading.

Traders often tend to be a passionate bunch and love to digest good reading material.

As someone who consistently reads 1-2+ books per week, I’ve built up a decent library, particularly around trading and the trading mindset.

In today’s article, I’m going to share half a dozen forex trading books, centered around the trading mindset and building a successful traders mindset. I’ll give a brief description of each one, plus a link to the book on Amazon so you can order whichever you feel most drawn to.

It should be noted, most trading lists like these will typically share some of the staples, such as Market Wizards or Trading in the Zone. Since these have been done and done time and time again, I’ll be sharing some alternative forex trading psychology books which share a unique perspective on trading, mindset, success and training.

Enjoy.

#1 The Playbook by Mike Bellafiore

I’ve talked personally with Mike before. He’s one of the good guys in the industry doing some unique work for traders, training traders and the industry. He runs SMB which is part prop desk, part training program. With decades of experience in trading and running a trading desk, Mike has a unique perspective on trading, training traders and what it takes to become successful.

If I was ever to work/trade for a team, I’d probably work with them.

This is probably the longest forex trading book review of them all since I have personal experience with Mike, but his unique approach to trading also applies to the mindset. In The Playbook, he shares a lot about working with his trading team, getting them through the same obstacles we all experience.

He shares his insights into working with traders who aren’t cutting it vs. the ones who show potential, guiding them towards success.

He puts a tremendous focus and effort on mindset. Two quotes that stick out from the book are;

1) “You do not become a great trader by being shown cookie cutter technical setups and then soon become successful. That is a myth from what I call Trader Disneyland. It would be wonderful if Trader Disneyland existed, but it is marketed and spun that it does, yet it doesn’t.” (That means you Nial Fuller & Jonathan Fox)

and

2) “Many novice pedestrian traders focus on the next position. Consistently successful traders focus on the process and care little about the outcome of the next trade. The distinction is enormous.”

There are many gems in this book, including the actual ‘Playbook‘ idea he shares, but definitely a top read in my library for a traders mindset.

#2 The Way of the Fight by Georges St. Pierre

The Way of the Fight? What does this have to do with trading?

Yah good question. Georges St. Pierre is a Mixed Martial Artist. He is a former 2x World Welterweight Champion in the UFC and holds several records that still stand to this day.

Not only being one of the good guys of the world of mixed martial arts, Georges is a trailblazer in terms of training, preparation, mindset, and integrating many styles seamlessly.

In his book The Way of The Fight, he shares his experiences, challenges, training methods, and how he personally and mentally approaches mixed martial arts at the highest level.

Two gems that stand out from this book are;

1) “Almost anybody can be greatly successful. However most are not willing to go through the process and just want the result. It’s having to go through the process that stops people, not their limited potential.”

and

2) “If your enthusiasm is continually diminished by defeat, you will not have enough mental fuel to survive the learning curve.”

Definitely worth a read. Inspiring, challenging and clarifying.

#3 The Hour Between Dog & Wolf

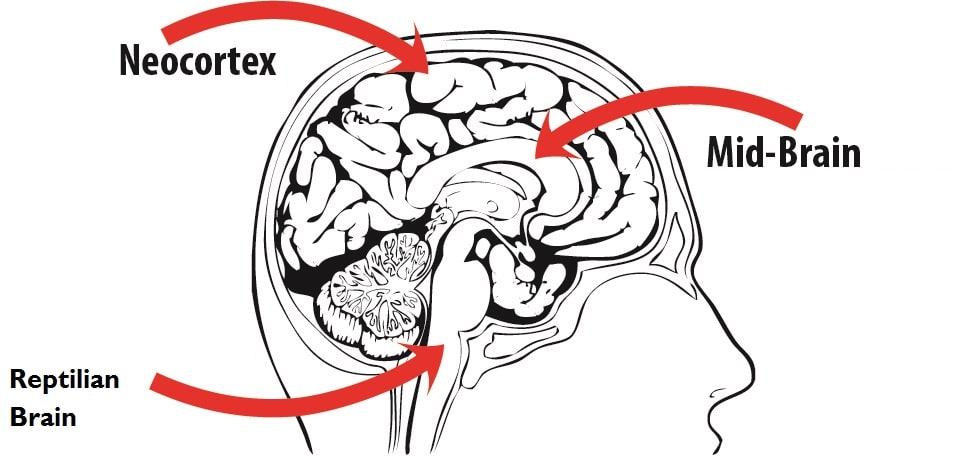

Former trader turned Neuroscientist, John Coates spent almost a year studying an entire trading floor of institutional traders. With his training as a Neuroscientist, he shares some amazing information about how the brain and body works through the typical days of trading for professional traders at the highest level throughout an entire year.

In The Hour Between Dog & Wolf, you’ll learn more about your brain and body than any book I’ve seen out to date.

Ever had that ‘gut feeling’? You’ll learn about that. Want to know what stress hormones do to the brain, body and performance? You’ll find out in here.

A must read for traders wanting to learn about their brain, body and how trading affects them both.

#4 Cultures of Expertise in the Global Currency Markets by Leon Wansleben

This is a advanced forex trading book I covered in an article before (click here to read the full article and review), but had to mention it again.

Leon Wansleben is a sociologist by trade who also gets to spend time watching an entire FX trading desk. You’ll learn about how the traders work with the analysts, how they trade on all time frames, including intra-day lower time frames (Sorry Nial Fuller & Johnathan Fox for being flat out wrong again), what the bulk of their trading day is like, and more.

He covers how the top traders manage risk with exceptional skill while building emotional courage and stamina to survive the learning curve. He also goes in depth how they are trading price action and order flow, often in combination with fundamental analysis.

Another must read for getting a unique perspective on the trading mindset.

#5 Earn the Right to Win

After losing a coaching job, Tom Coughlin was found sitting at the NFL combine, which is where the potential new college grads will show off their skills and physical traits, hoping to get noticed by coaches and scouts for standing out.

While taking detailed notes on every player there, Tom was greeted by a friend in the industry who said this to him:

“Tom, what are you doing here? You don’t have a coaching job.”

Tom’s response says it all, “Not now I don’t.”

Tom has won two Super Bowls with the NY Giants. He is the oldest coach to ever win one, and has done an impressive job, often times taking the teams with the lowest winning records into the playoffs, and coming out champions.

When you finish this book, you’ll see the value of preparation, how managing one’s time and maintaining discipline leads to success. A great book from a great guy in the NFL.

#6 How to Be Like Mike by Pat Williams

Anyone who has been a follower of this blog and forex training site would already know I’m a big Michael Jordan fan. In this book Pat Williams goes through the many phases of Michael Jordan’s career, from his early failures in High School, to coming back stronger, to his winning the NCAA championship at UNC, to his early struggles at the bulls, and onto his 6 NBA titles.

You’ll learn more about MJ, and all the amazing little things he did in this book than any documentary I’ve seen yet. Sharing perspectives from players and coaches around him or against him, along with other greats in sports, you’ll see why MJ is and continues to be an inspiration, sharing a unique mindset on success.

Three quotes of the hundreds I’d like to share are below:

1) “Success isn’t something you chase. It is something you have to put forth the effort for constantly; then maybe it’ll come when you least expect it. Most people don’t understand that.”

2) “I was sitting on the bench and MJ came dribbling past us at full speed. Then he shifted into another gear and went to the hoop. I’ll never forget that fire in his eyes, that look of determination. It scared me to see that look. I’ve never seen it before. I’ve never seen it since.”

3) “You can’t turn it on and off like a faucet. I couldn’t dog it during practice and then, when I needed that extra push late in the game, expect it to be there. But that’s how a lot of people approach things. And that’s why a lot of people fail. They sound like they’re committed to being the best they can be. But when it comes right down to it, they’re looking for reasons instead of answers.”

A treasure trove of a book, and something I continually go back to.

In Closing

Whether these advanced forex trading books were from traders directly, or from high performers in other fields, you’ll notice several patterns in their thinking and mindset.

Most focus on training, preparation and process more than result. Most struggling traders have this equation reversed.

Most have a highly evolved training routine, and work at their chosen skill every single day. There are no lazy traders or examples of success from being lazy (sorry again Nial).

And most consistently, they realize having skills is one thing, but having a stronger mindset is far more powerful.

Food for thought, but I hope this gives you some enjoyable reads.