There seems to be a ton of confusion on both sides regarding the Quality vs Quantity Argument when it comes to trading. Being such an important subject for a trader, I have been wanting to write about this for some time so it’s time to put some of the myths, mis-information and confusion to bed here.

One of the big forex trading arguments going around has to do with ‘Quality vs Quantity‘, and it is often masked in the typical;

-Trading Higher Time Frames = More Accuracy

-Trading Smaller Time Frames Carry More Risk

-Anything Below The 1HR Charts is Just Noise

-Quality Trades Make More Money Than Quantity

In regards to the above statements, only one of them is true, but it is incomplete by itself and does not paint the whole picture.

Today’s article is here to dive into this subject, explore both sides of it, and talk about which of the two competing theories is correct.

Quality Is Better Than Quantity When It Comes To Trading

I know two groups of billion dollar business entities that would completely disagree with this argument. They would be Casino’s and HFT shops (High Frequency Trading).

Casinos often times (in the various games you can play there), only have a slight edge, often times 1-4%, meaning they are 51-56% likely to win at every play, with a 49-44% chance to lose. This small edge might not seem like a lot, but played out over 1000’s of times a day, and it all adds up.

HFT algos also take a similar approach. They are not trying to make huge winners and let trades run for days. They are in anywhere from hours to minutes, perhaps seconds, or even nan0-seconds. They make small trades for ultra small profit, but they do this hundreds of times a day, and make money year in year out.

These two things alone debunk the whole quality is better than quantity argument, as they are highly successful at what they do. In 2011 alone, HFT firms made over $1.2B (yes, billion) in profits. Not bad for having such an inferior trading style!

HFT methods simply use the mathematics and repetition of the edge to make profit. It’s an edge – maybe not the easiest for a human trader, but an edge nonetheless, and it makes money.

The bottom line is, if you have an edge, the more times you can apply it with the same level of accuracy, the more the edge will play out in your favor. And that leads to more profits.

A Comparison Approach

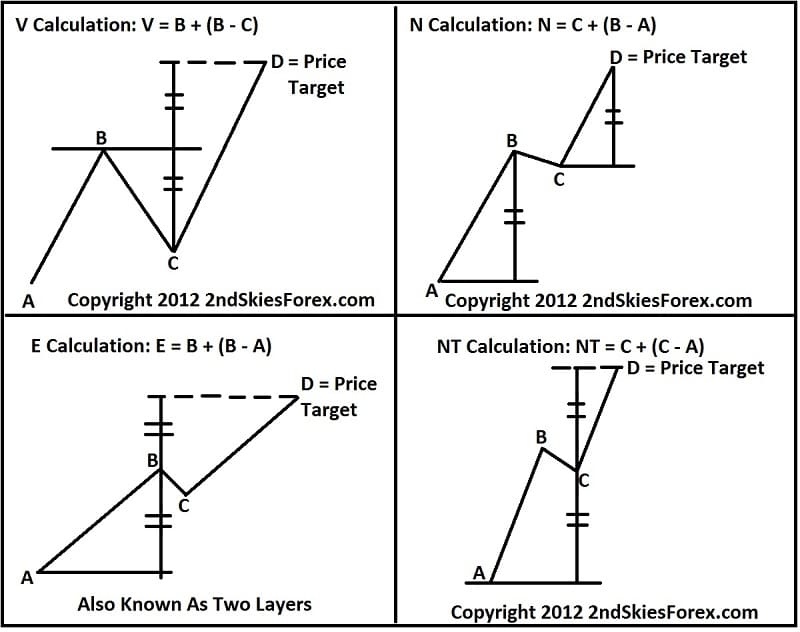

To really see the numbers and a comparison approach, let’s take System A with 60% accuracy, trading 5x a month, risking 100 pips and targeting 200 pips. Below is how the math works out;

5 trades over 12 months = 60 trades per year

60 trades x 60% accuracy = 36 winners and 24 losers

36 winners at 200 pips gained = 7200 pips gained

24 losers at 100 pips lost = 2400 pips lost

Total Profit = +4800 pips

Now, lets take System B, which is the same as System A, but bring down the accuracy just 5%, assuming you will be less accurate trading the same system on a lower time frame. Let’s have you trading 20x a month (~5x per week), risking 50 pips and targeting 100 pips (same ratio of risk to reward). Here is how the math plays out below;

20 trades a month = 240 trades per year

240 trades at 55% accuracy = 132 winners and 108 losers

132 winners at 100 pips gained per trade = 13200 pips gained

108 losers at 50 pips lost per trade = 5400 pips lost

Total Profit = +7800 pips

Assuming you risked the same equity % per trade using System B – trading quantity over quality made more pips and profit. Even if I make System A 15 % more accurate than System B, here is how the math plays out;

60 trades at 70% accuracy = 42 winners and 18 losers

42 winners at 200 pips gained per trade = 8400 pips gained

18 losers at 100 pips lost per trade = 1800 pips lost

Total Profit = +6600 pips

As you can see, even being 15% more accurate, System A still under-performs System B. Only until you get to 77% accuracy will System A outperform System B.

So this whole argument that Quality over Quantity is mathematically false.

One of the key questions you should be asking yourself then is;

Can I be 77% accurate trading my system on the higher time frames?

If not, you may want to reconsider how to maximize your edge, which is all you are really doing in trading. But the fact is that trading on higher time frames will take longer to make money as you will have less signals in the market.

Key Points

A few of the typical or vanilla counter-arguments to the quantity makes more than quality statements are;

1) Trading higher time frames is less stressful and is More Accurate

2) Anything below 1hr charts is just noise

3) Trading lower time frames causes you to over-trade and over-analyze

Of the above statements, only one is true to some degree (#1) , but again it is incomplete by itself and needs to be fully understood. Let me break down each one so you can fully understand the differences.

Trading Higher Time Frames is Less Stressful and More Accurate:

Of all the statements, this is really the only one with some truth, and it has to do with the second part (being more accurate).

I have quantitatively tested various 1, 2 and 3 bar price action signals (over 24 in total), such as pin bars, inside bars, engulfing bars, 2-bar reversals, outside bars, and more across every time frame from the 1m to weekly. Statistically, if you are just trading these patterns by themselves, they tend to be more accurate on time frames such as daily and 4hr strategies (along with the 1hr), then they do on say the 5m.

The reason for this is, a daily candle includes 24hrs of price action, therefore 24hrs of market sentiment and order flow, which is three sessions total. This can have a lot of info as to how players are positioning themselves both intraday and daily.

Thus, with a greater amount of market sentiment over a longer period of time, you can trade some of these patterns with greater accuracy.

However, as we have seen above, greater accuracy does not always = more profits. One thing should be noted though accuracy is not the same trading the often promoted NY Daily Close.

I have one system that on the NY Daily Close, on one pair, trades highly accurate, but another pair quite poorly. If you have an idea as to why, write in a comment below, but the statistics and profitability are night and day, so NY Daily Close is not ideal for all systems, pairs and time frames, and in many cases, under-performs massively.

Thus to sum it up, trading the higher time frame ‘can’ lead to more accuracy.

However, the notion of trading the higher time frame is less stressful is not true, and really a matter of having a successful trading mindset. Some people are more naturally wired to have a set and forget style of trading. Others are better at managing small details, so trading a higher time frame would actually work against their natural mindset.

There is no one-size fits all, thus the key is to find what is most natural to you.

I would like to state generally, if I was starting with a new student, I would start them on a higher time frame as accuracy in the beginning is critical to the learning process. This is exactly how it is in my archery training – in the beginning you start with a target close by, say 3-6 meters, and only after time do you move to targets farther away.

But the idea of lower time frames being more stressful is a matter of mindset, training and practice. Stress is based on how one perceives information and reacts to stimuli. To some people, being bored is more stressful, and there are tons of studies that boredom can hugely interfere with the trading and learning process. For an F1 driver, being stuck in traffic may feel like torture, but doing 150MPH may be joyful. Food for thought.

Anything below 1hr charts is just noise:

First off, this argument often comes from daily chart traders saying price action below the 1hr is just noise. Ironically, this same argument comes from 1hr chart traders who say the 1m time frame is just noise. Who is right, and is it just a matter of perspective?

The truth of the matter is, although there is a greater possibility to witness ‘noise‘ (price action that is the result of non-directional interest and order flow), on lower time frames, support and resistance levels work just the same. They simply require a little tweaking. But the bottom line is, order flow creates price action, and price action is simply information.

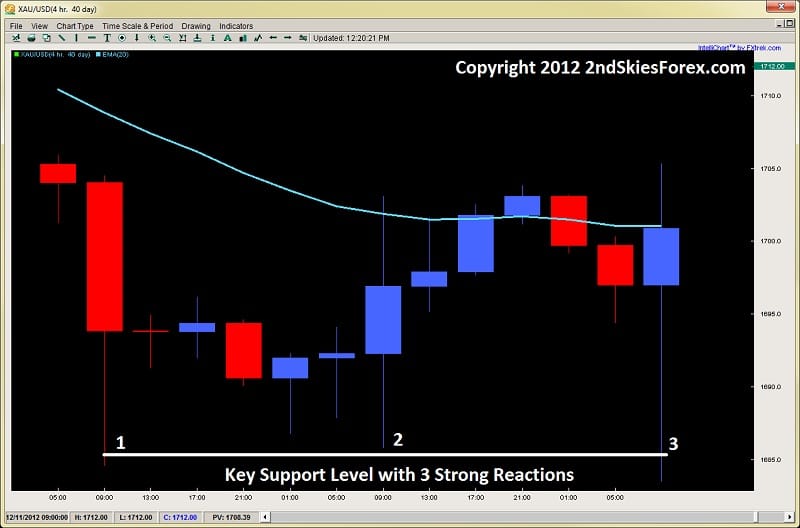

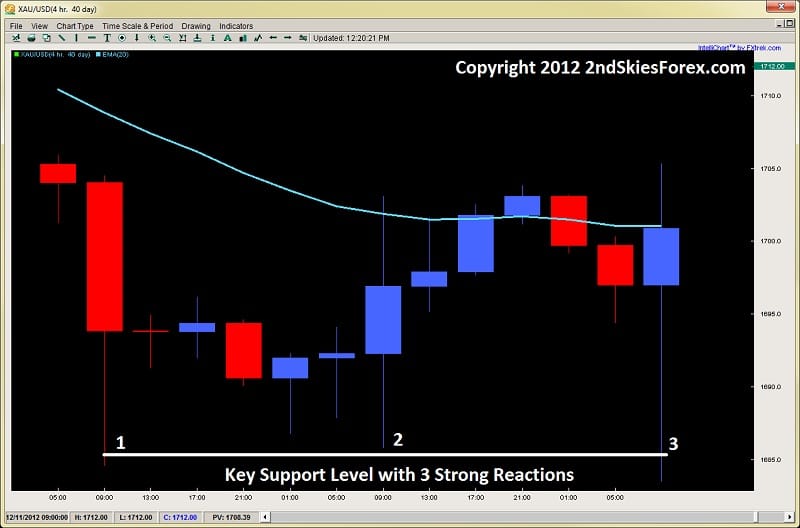

Using a recent example of a live intraday price action trade I did on Gold, take a look at the two charts below;

Exhibit A (4hr Time Frame Gold/USD)

Looking at the chart above, we can see three strong reactions to the $1685 level on Gold, all communicating strong buying interest at this level.

Now look at the chart below which is the third rejection on the 5m time frame.

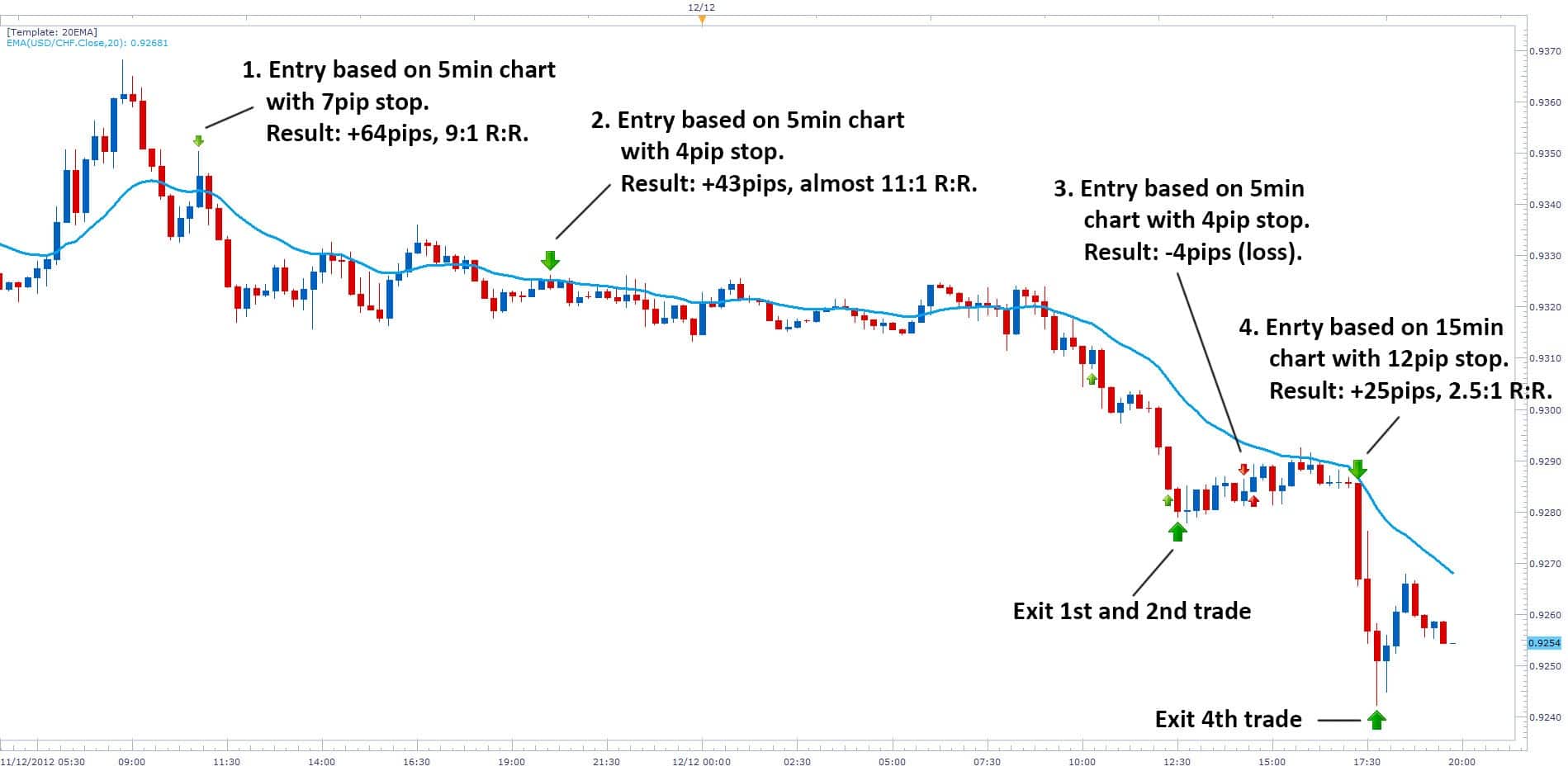

Exhibit B (5m Time Frame Gold/USD)

Looking at the chart above, we can see the same strong reaction and buying interest off this level in the first wick. But we can also see there are two high quality price action signals off this level, with a pin bar false break, along with an inside bar + pin bar combo.

I actually got long on this trade, and made over +1415 pips of profit just using pure price action on the 5m chart.

Does the price action at the bottom of this chart look like ‘noise‘ to you?

I don’t think so, and it shouldn’t.

Learning to filter out useful information and helpful information is just a matter of training and time. But the idea anything below the 1hr chart is just ‘noise‘ is ridiculous and really a freshman understanding of price action.

Trading Lower Time Frames Causes You To Over-Trade and is Greater Risk:

Although there is some truth to this, it really is misleading. If you analyze each bar, sure, you will be over-analyzing the charts, but this applies to any time frame. In a choppy range, you are not watching every bar for clues, especially the bars in the middle of the range.

However, if you are marking your key levels on a higher time frame, and simply looking for signals at those levels, then the chances of you over-analyzing are slim. It is really a question of trading and preparation- not a fact that you will over-analyze.

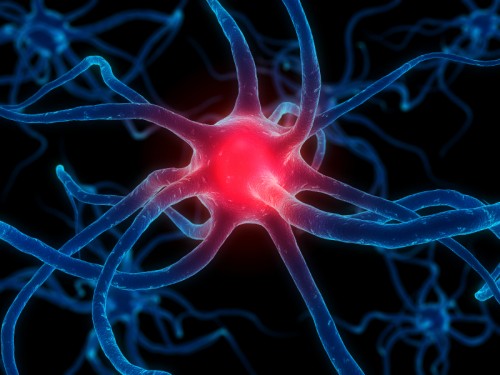

The mind has neuro-plasticity to it and can learn almost any skill. You can learn to filter out unimportant bars and price action on the chart – all it takes is a little practice. Once you do, you wait for your key levels and signals, and get in without any extra analysis or stress.

The whole idea of doing less is better for you (or being lazy), I have already demonstrated, doesn’t make you more profitable. Try this same logic to exercising, playing piano or hitting a golf ball, and tell me how that works out!

As to trading the lower time frames or intraday trading equaling greater risk, is a confusion. Risk has nothing to do with the time frame. Risk has to do with three things;

1) Position Sizing

2) Size of Stop Loss in Relation to Target

3) Accuracy

I can have a 3 pip stop (via position sizing) = more risk than a 500 pip stop. I can also make more money with a 50 pip target and 20 pip stop (2.5:1 reward-risk ratio) than a 500 pip target and 250 pip stop (2:1 reward to risk ratio), with the same equity % at risk per trade. So this notion that risk is > on lower time frames is mis-informed.

Does This Mean Quantity Is Better Than Quality?

This is the real question, and it comes down to edge, personality and availability. If you are not available to trade more throughout the day, and have a full time job with only a few hours to view the charts, then I’d suggest trading the higher time frames. However, if your personality is more suited to being more active, then trading 4-5x a month could be harmful to your learning process. So remember trading rule # 1 – know thyself when it comes to trading, and find a system, time frame and style that best suits you.

And we always have to consider our edge. If we trade the daily time frame at 60% accuracy, and the 4hr or 1hr time frames more often with slightly less accurately, do the math and see how it works out. If it’s more profitable trading more often with slightly less accuracy, then do it, as long as it doesn’t throw off your life or health.

But the bottom line is, the whole argument quality is better than quantity doesn’t always hold up, and you need to do the research and the numbers to determine which has a greater edge. And without a doubt, it is a fact if you can take your same edge, and apply it more often than you are now, you will make more money and be more profitable.

Thus, in regards to the question as to which is forex trading method is better, the answer is neither one is better, but both!

Quality matters, but can under-perform. Quantity repeats the process faster of making profit, but has to be considered in the larger scheme and what is most natural for you. However neither forex trading method is better, and the best edge lies somewhere in between the two.

So don’t be fooled by any freshman arguments stating one is better than the other – because they are simply not true, highly inaccurate and misleading.

Hopefully this quality vs quantity forex trading article will put a lot of the mis-information to rest, and give you a new perspective on this critical subject. In a follow up article, I will talk about how I approach this subject in my personal trading, and what I think is the ‘Ideal Trader‘ in relationship to these two.

Kind Regards,

Chris Capre