To be successful at anything, it requires work and sometimes the work you have to do to build your skillset is not entirely glamorous, sexy or fun. For example, I am doing competitive archery, and some of my training actually has to do without shooting an actual bow, but working with an elastic band to help work on a specific technique. Sometimes, I am firing the bow, but with no target, and at a distance of 3meters.

Yes, it’s true…my favorite part of the training is shooting from the 18m distance, but I know that all of my training in the other exercises is critical to how I shoot when it really counts. It is the exact same for trading. There are many things one has to work on to be a successful trader besides just making trading decisions. Enter Patricia –

Just the other day, I did a follow up session with Patricia. She is from China and wanting to live off of just trading. She has impressed me as she had very little experience in this market before she took my Price Action Course. But since she has taken the course, she has been one of the most diligent students, working very hard at every aspect needed to be a successful trader.

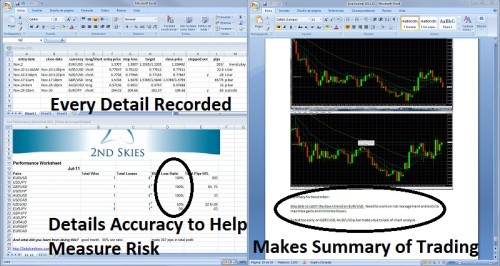

Every month, she emails me all her reports and has worked on them to absolute perfection. Below is a screenshot of her first month of live trading.

This is contrary to many students who when I do the follow up session with them, and ask for their reports, I get the ‘yeah, I never filled those out’. This tells me how serious they are (or are not) about trading.

To be a professional at anything, there is no cutting corners. There is no ‘Ill skip practice, or doing free throws, or working on my conditioning for some other day‘. The path of being a professional is not about skipping anything or putting things off till tomorrow. What you do today either moves your forward, backward, or keeps you treading water, and treading water is really going backwards.

Patricia has discipline, diligence and the right mindset towards trading, and I expect her to be successful at this in a short period of time. In fact, after a few months of study, she just went live and did quite well as you saw from the image above. 6 trades, 4 profitable, largest winner was over 3x larger than her biggest loser and +307pips of profit. Not bad for her first month of live trading.

She only wants to trade on the daily time frames so she is not active, but she is effective, and my guess is many of you would be happy with +307pips of profit in November, especially considering how crazy it was, along with a holiday week, so less trading.

Maybe trading off the daily chart is for you – fine. No problem. The key is to find out what works best for you, what kind of lifestyle you want to live and what is most natural to your mentality.

There have been some people which have stated you are only a pro if you trade the lower time frames. That you are only pro if you make 4-15 trades a day, sit at your computer and crank out trades. This is ridiculous.

What time frame you trade does not make you a professional trader. What makes you a professional trader is if you make your living off of trading, not what time frame you trade, how many trades you make per day, or how many hours you spend at the computer. Tell that to Jesse Livermore who made over $100million dollars mostly viewing the daily closes to make his big trading decisions.

Try telling that to my friend George who only spends 2hrs a day max trading, and does 60% a year. Why 2hrs a day? Because he spent almost 2yrs studying and programming his system that now does most of the work for him, which means he does not have to be at the computer pushing buttons all day to make money. He can be at the beach or playing golf.

If a short term trader does 60% a year, and so does George, while George makes say 100 trades a year, and the other 500, and George spends only 200hrs at the computer, while the other does 500hrs, does this make the short term trader a professional and George just an amateur? Obviously not, so don’t be poisoned with some idiotic belief you have to trade a certain time frame to be a professional – that is just stupid. Again, what makes you a professional is if this is how you make your main bread and butter and can repeat your successful performance year in-year out. But I digress.

With all that said, we want to list 3 tools you can use to improve your trading. True, they are not sexy – but they are critical towards your development and success. Many of you have heard them before, but I’m going to talk about why you need to do them.

The Performance Worksheet

This worksheet has your entire month’s trading on it. It has all the pairs you traded, your accuracy per pair, your accuracy per system, and total pips gained (or lost) for each pair. We always recommend doing this at the end of each month. What does this do for you?

1) Knowing how you did on a pair can tell you a lot of information. You may be good at some pairs you think you are bad at, and bad at some you think you are good at. One year when analyzing my trading, I had traded 9 pairs, but over 80% of my profits came from 2 pairs. So the next year I traded just those two pairs. And what happened? I almost doubled the amount of pips I made.

By trading the pairs you are most successful at, while eliminating the ones you don’t seem to have a rhythm with, you increase the chances you’ll be most profitable. Each pair has its own patterns and behaviors, and some will simply match with your style and talents better than others, so once a month, I recommend making a worksheet to look at all this data and see where you are with each pair. My guess is the data will likely surprise you.

Trading Journal

If I had to guess, this is the one thing every trader dreads doing. Yet it is the one thing which could give the greatest insight into you, your tendencies (good and bad) and help you become your own teacher. Having a trade journal can help you see your own mistakes and learn to correct them. Early on in my career, I noticed a pattern in my trade journal of not letting the trade run to its full target.

Honestly, it took me a while to first find this, and then months to correct it as I was generally going for targets of 100+pips. I would typically take profits on what I thought was an exit signal and really had nothing to do with my system. Once I corrected this, the result was undeniable; 8+years of profitable trading without one losing year. Yes, I had my losing months, but the things which were holding me back were being corrected because of what I learned in my trading journal.

If your not filling out a journal, ask yourself this, ‘how many trades did I make last year, or the last 6mos?‘ What would you say? 100, 500, 1000? Now ask yourself, ‘what are the chances I remember every one of my mistakes, say over 100, 500 or 1000 trades?‘ Not going to happen. So this translates into mistakes and habits which get swept under the rug and never dealt with. They become the weak links in your trading.

Remember, the weakest links in your trading set the height of your success. Whether it is risk management, trading psychology, your equity threshold or trading discipline, any weak links will separate you from your goal of trading successfully month in-month out, year in-year out. Having a journal helps you to be accountable while being your own teacher.

Screen-Recording

This can be a substitute or stand-alone for the journal but it is a highly effective tool. Reviewing your trades via video can reveal all kinds of information about what you saw in the market, how you traded the last play, how you executed your system, and what the price action looked like when you made your trade.

One software program good for this is Camtasia which you can use to record all your trades, make comments, follow the trade, and study how the market looked when you made your trade. I had one student Marius who not only recorded all his trades, but also took screenshots of every winning and losing trade right at the time of entry. He then studied all the screenshots to see if there were patterns behind the successful and not successful trades. What was the result?

He increased his accuracy on the system from 64% (which was the base performance of the system) to 78%. How? He actually found a pattern/qualifier which would improve the overall system. Very clever on his part and something he would have never found if he wasn’t screen recording his trades. Well played Marius.

For those of you who are active day traders, I’d recommend this over a typical trading journal as you might not have enough time in between trades to fill your journal out. Or for the tech lovers, this is also an option.

I use this for all my trades and then review them at the end of each week before I start my next trading week.

Summary

Like all endeavors, trading requires one to be good at many skills. I cannot imagine my archery abilities if I only worked on distance, or only worked on my power, or only worked on my release, or only worked on my stance, or my concentration, or any one thing. Trading is not just making trades, it’s managing risk, it’s being highly focused, it’s being aware of one’s emotions and not letting them interfere with your trading, it’s finding patterns in the market and then building a system, it’s learning from your mistakes and becoming your own teacher.

If you just focus on your system and making trades, it is highly unlikely you will become a successful trader because there will always be mistakes you will repeat. Mistakes unchecked become habits, and habits are like holes in a bathtub. You cannot fill a bathtub with water while there holes in it as the water will continually leak out. The more bad habits you have, the more holes in the bathtub. In the beginning and developing stages of your learning process, trading is about plugging the holes. Once you have them taken care of, then we work on building more profits, but you cannot skip a step, and you have to do the work.

Please remember to leave your comments below and to ‘Like’ / ‘Tweet’ to share the article.

For another great article on trading psychology, check out Trading Analysis and Gary Kasparov.