What You’ll Learn In This Trading Article

-What is psychophysiology?

-How does your biology + psychophysiology make trading hard

-How does your biology + psychophysiology make trading easy

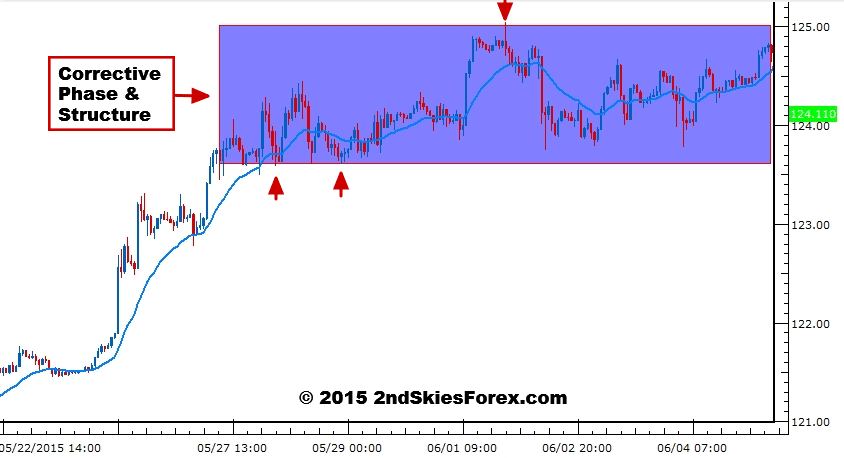

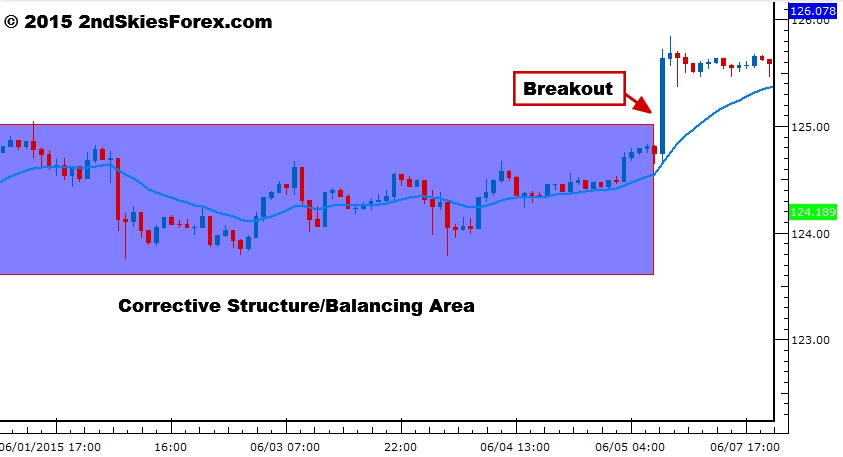

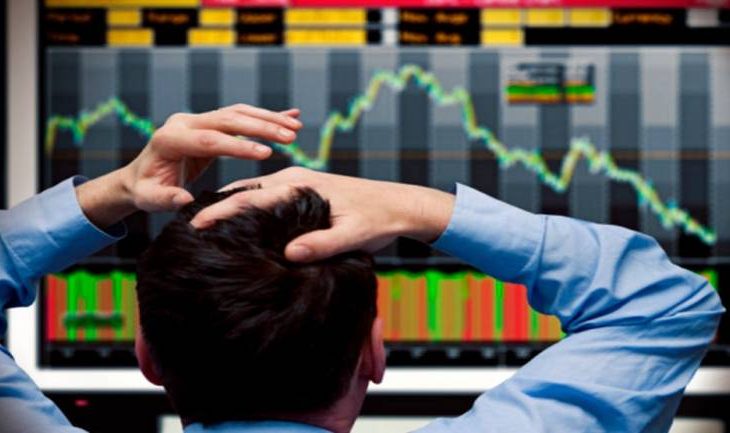

Ever felt really nervous making a trade to the point where you passed on it, even though it was a perfectly good trading setup according to your plan? What about being so angry/upset/frustrated at a prior loss that you revenge trade on the next setup?

On the flip side, how about having a ‘gut feel‘ that your current trade is going to get stopped out, or perhaps a really good setup is forming and you have to jump in? If you’ve experienced these things (I have 1000’s of times), then welcome to how your biology and psychophysiology affects your trading.

In today’s trading article, I’m going to first define what psychophysiology is.

Then I’m going to talk about the ways your biology and psychophysiology make trading hard for you and how it affects your day to day performance.

After that, I’ll talk about how you actually have various biological or psychophysiological traits which can help you become a profitable trader, and how to use them to your advantage.

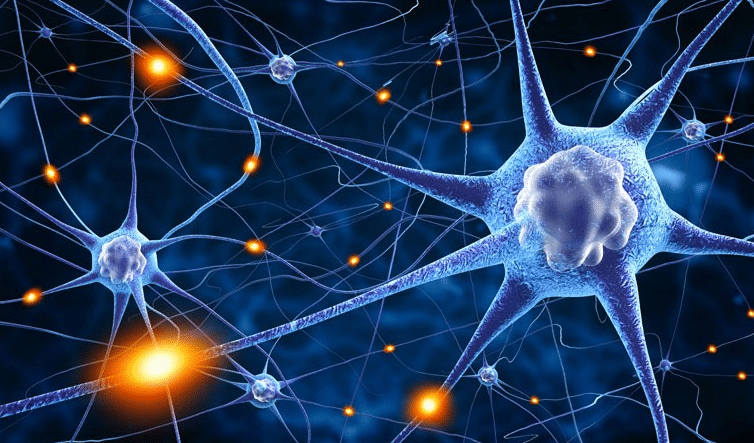

What Is Psychophysiology?

Psychophysiology is a branch of neuroscience (science of the brain and central nervous system) which shows you how your mental states and biological + physiological responses can affect your mood, higher cognitive skills, analytical abilities, perception, decision making and mental states.

In simple words: the current state of your body + brain affect your mental abilities – abilities which are crucial to making profitable trades and trading decisions.

Think of it as the biology of why you are losing money in forex trading.

This is critical to understand because once you know the various biological/psychophysiological mechanisms, and how they affect your mental abilities, you can employ methods to counteract their negative effects so you don’t make really bad trading decisions.

How Your Biology + Psychophysiology Make Trading Hard

I’m going to start off with an easy one here as it relates to my situation right now. I was having a jolly good time with my friends last night and was up later than usual, which cut my sleep time by 2 hours.

Sleep is incredibly important to your brain and body as it a) allows your brain to detox, rest and cleanse itself, while b) allowing your body to rest/relax while your internal organs are cleaning, and resetting themselves for the next day’s work.

Did you know that in a study by Dr. Walker at the Sleep & Neuroimaging Lab @ UC Berkeley shown how subjects that had less than normal sleep (6hrs) remembered 81% of the words they were exposed to with a negative connotation to them (i.e. anger, fear, loss), while only 31% of the words with a positive connotation to them.

Translation: Getting less sleep than needed triggers a massive bias in your brain towards the negative.

Now with your mind primed to see the negative more than the positive, do you think this will affect your trading decisions and performance? I hope so.

Ever had that experience of a winning trading starting to against you and it immediately feels ‘threatening‘? That’s your biology + psychophysiology working against you and making trading hard. It’s why we are afraid to lose money trading.

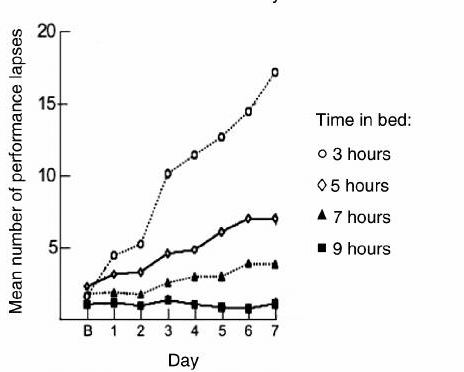

FYI…sleep debt is cumulative…so less sleep over an extended period of time really affects your mental capacities and states.

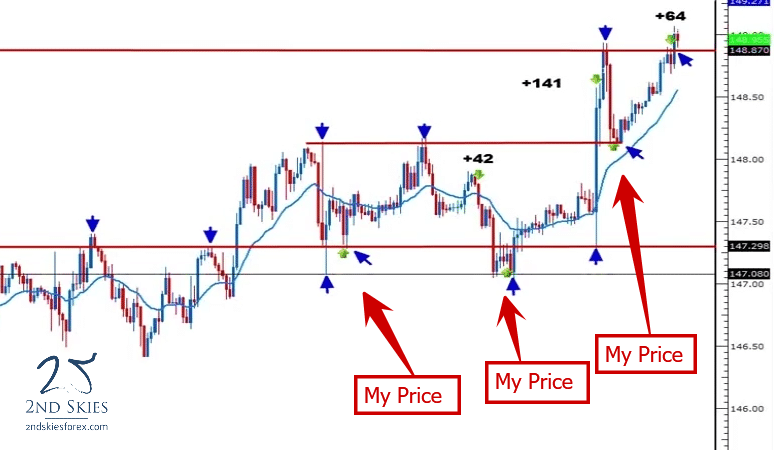

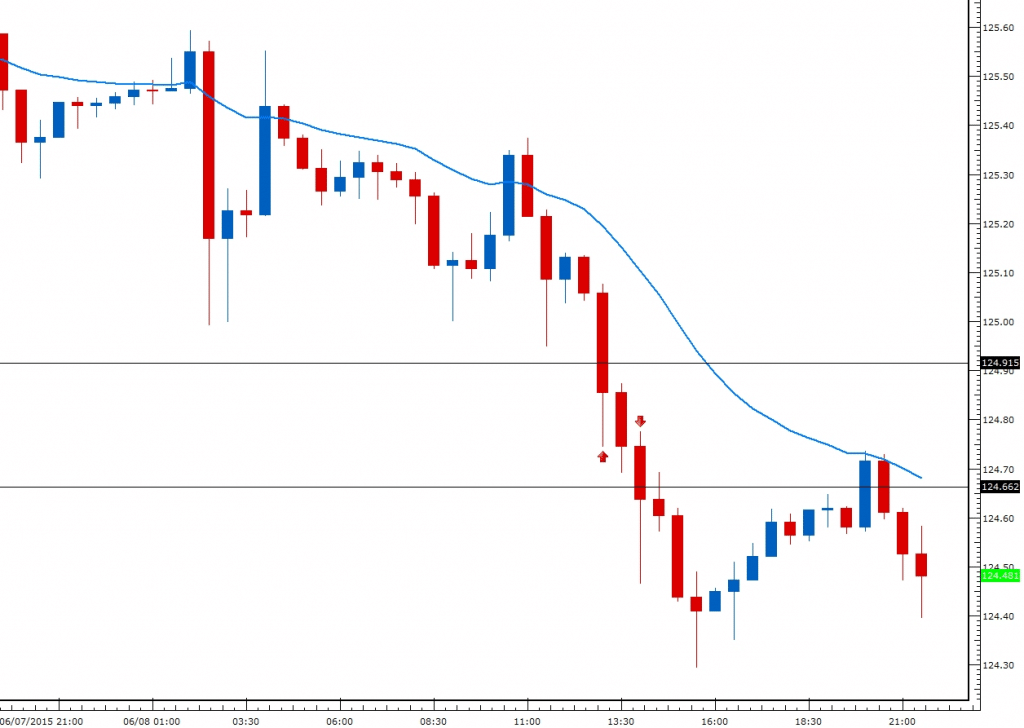

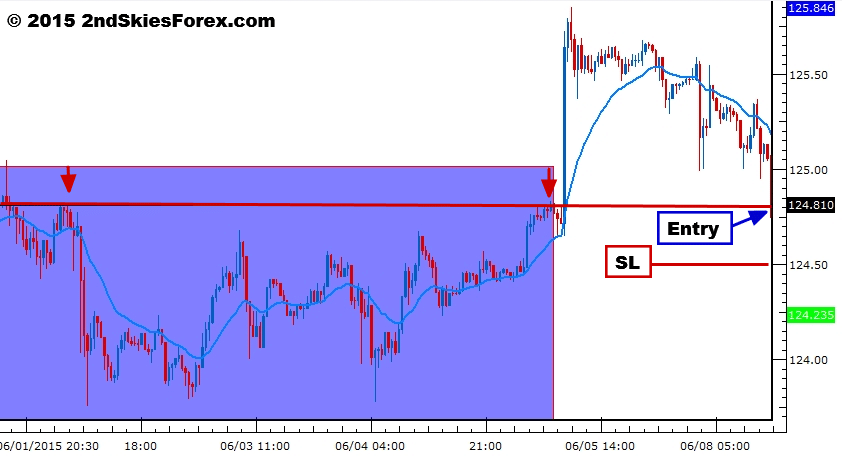

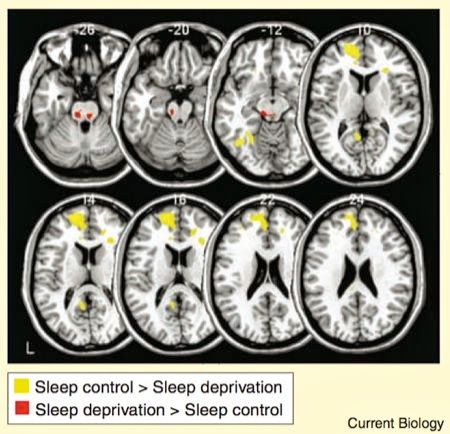

Below are two charts/images showing how sleep debt affects your brain + performance over time.

Image 1: How Less Sleep Leads to Performance Lapses

Image 2: Your Brain on More/Less Sleep

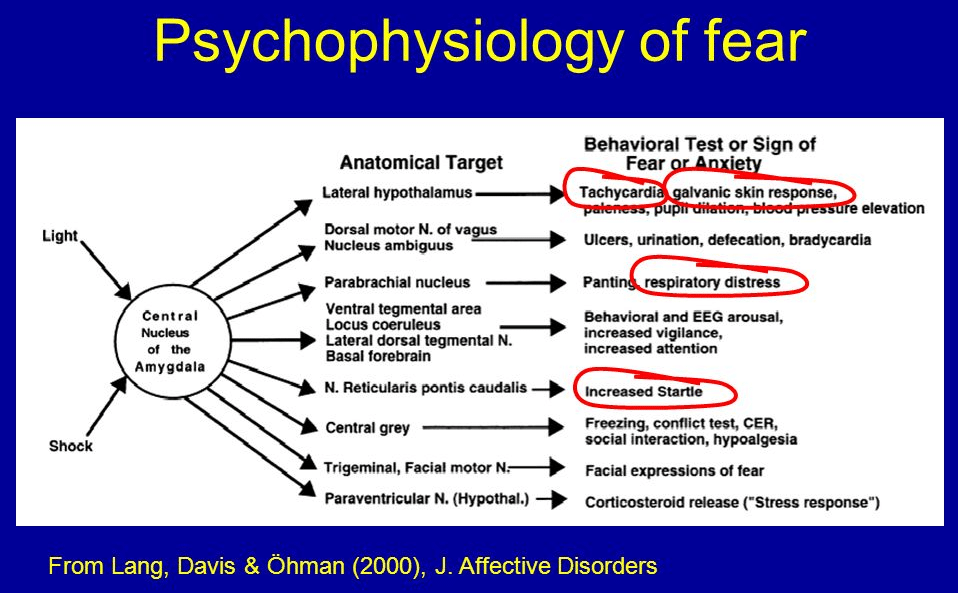

Another example of how your biology + psychophysiology makes trading hard is a fear of a loss. This ‘fear‘ is so ingrained in us it dates back 1000’s of years to our ancestors where survival was a daily fight for food, shelter and safety and a life or death struggle.

The rule was ‘eat lunch, don’t be lunch‘.

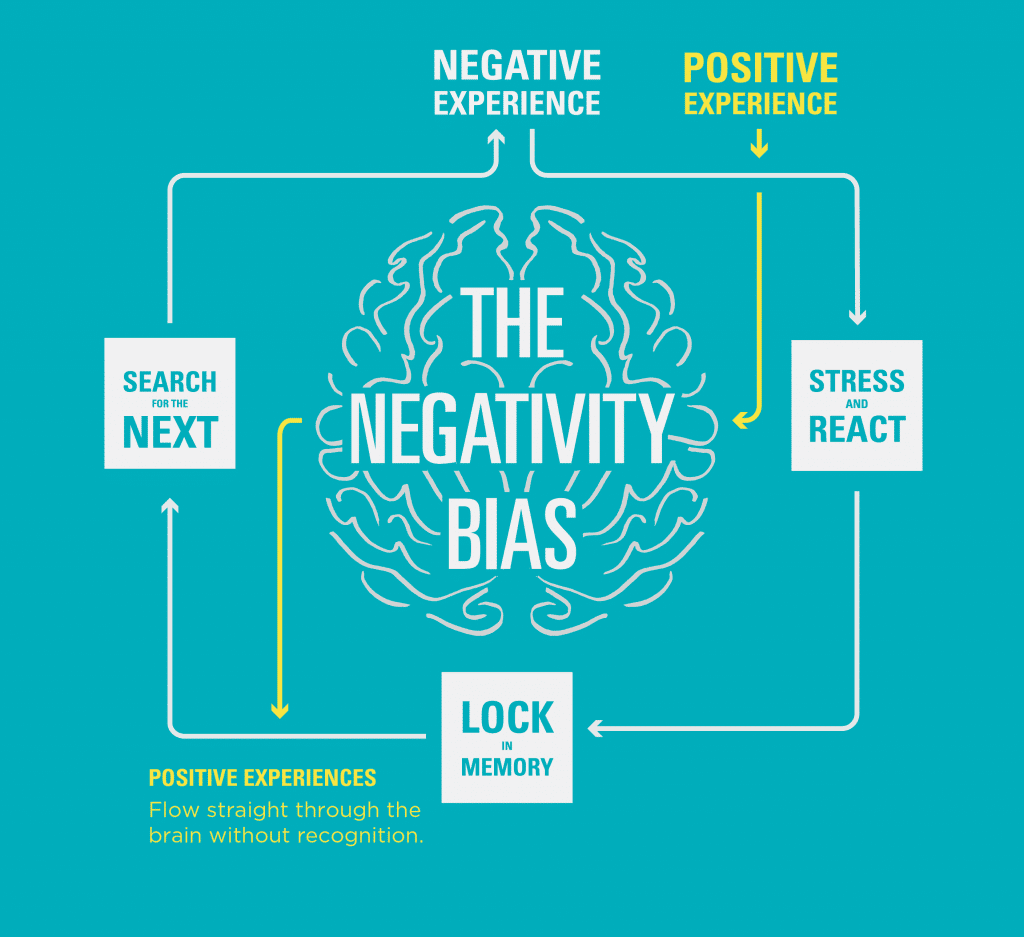

Sadly, our ancestors ‘experience‘ was encoded in our DNA, particularly in the DNA of our brains and nervous systems. 10,000 years ago, 1 in every 8 people died from protecting their families. This made us more ‘fearful‘ of ‘threats‘ and created this a ‘negativity bias‘ along with activated our ‘fight, flight or freeze responses’.

NEWS FLASH: Even though it’s the 21st century, and our chances of dying before old age are 1 in 100, we still experience this fight/flight/freeze response to stimuli which are not threatening. Your fear of a loss is an example of it.

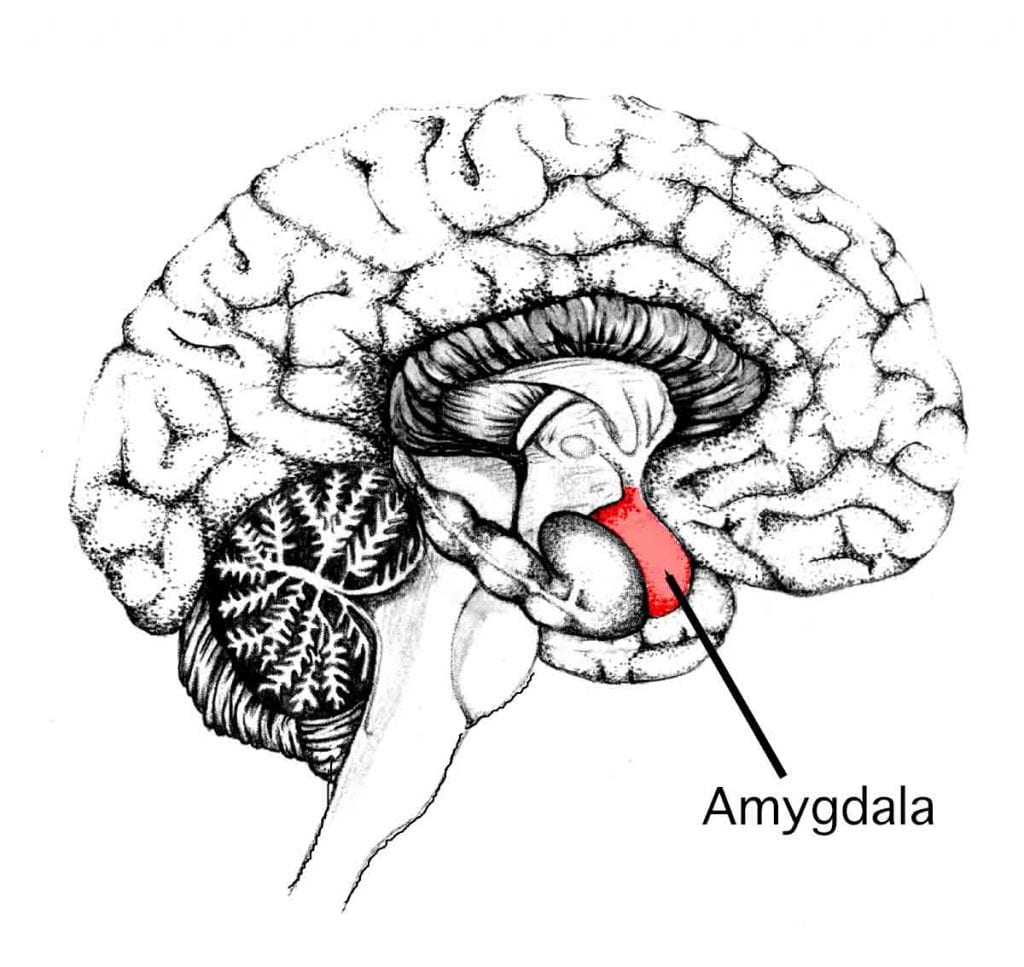

In fact, this negativity bias (fear of that which is negative to our life/survival) is so strong in us, we have %500 more neural real estate towards spotting the negative vs the positive!

Do you think that will affect your trading mindset if for every 6 stimuli you receive from the market, 5 of them will be perceived as ‘negative/threatening/harmful‘ vs ‘positive/beneficial’? What do you think that will do to how you perceive changes in the price action context which go against your trade?

Ever had a day/week/month where you crushed it for most of that time period, and went on a winning streak, but then one loss killed all your profits? Now, of those many trades you took, with the majority of them being winners, which trade do you remember the most? The big loss, or the several wins in a row? My guess is the big loss is what you remember the most.

Another example how this negativity bias can kill your trading performance has to do with neural real estate (how regions of your brain are wired).

Did you know it can take you 5-7 seconds to notice anything positive in your environment vs <.1 seconds to perceive a negative/threatening stimuli? Do you think that will really affect your trading mindset, perceptions and decisions about what is happening with your current open trades? I hope so.

There are 100’s of examples I could get into here, however it should be pretty clear how our biology and psychophysiology make trading hard. Now it’s not all bad, and there is a silver lining in all this.

How Your Biology + Psychophysiology Make Trading Easy

Ironically, even though you have about 5x more neural cells dedicated to finding the negative vs the positive, you also have some aces up your neurological & biological sleeves.

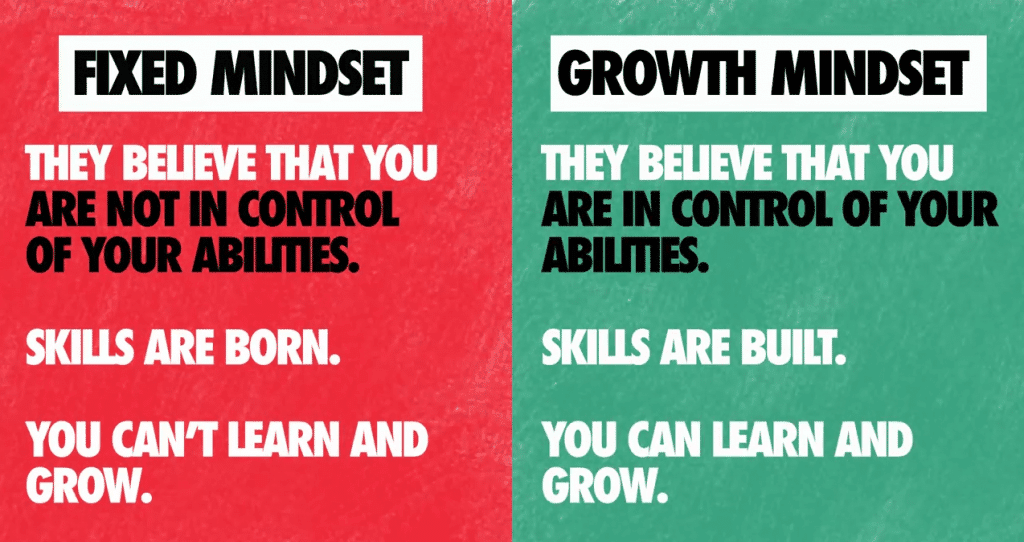

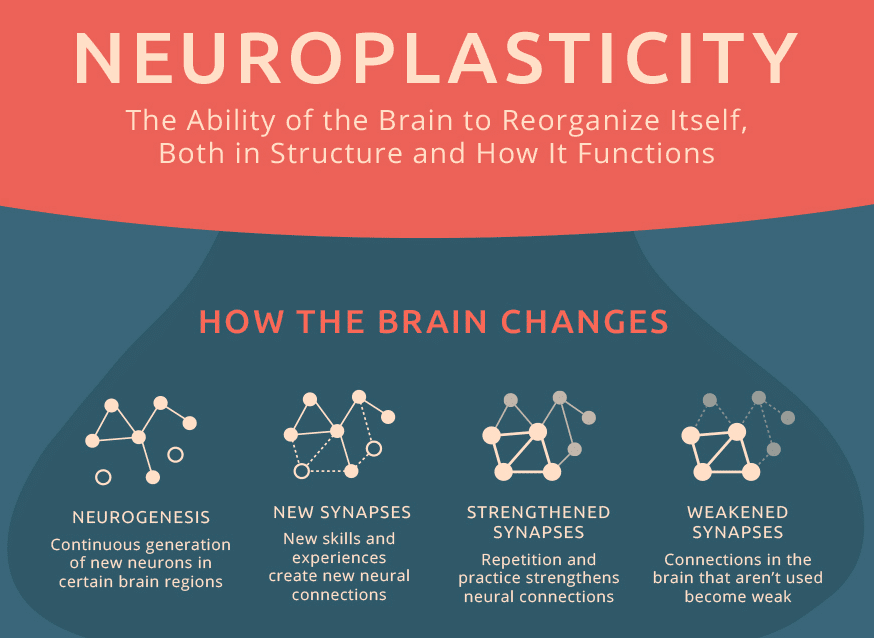

Case in point, your brain has this amazing trait called ‘neuroplasticity‘ which basically means your brain can adapt its wiring based upon your experiences, environment, what you focus on, and what little thoughts you have going through your head.

Experience Dependent Neuroplasticity (EDN) is the ability to wire new habits into your brain through two main factors:

1) neurons that fire together, wire together

2) consistent passing mental states create lasting neural traits

Translation: you can correct your mental errors/decisions/processes which are affecting your trading mindset and performance by firing new neurons in your brain (e.g. changing the thoughts/emotions/mindset you experience day to day). This is a real thing that we’ve taught members of our traders mindset course to do.

Imagine getting over the mental mistakes/hurdles you experience day in-day out of your trading?

Imagine not being afraid to pull the trigger, or fearing a loss, or worrying about a winning trade that’s starting to pullback against you.

You can learn to change these experiences which are holding you back from making money trading.

Regardless, neuroplasticity is one example of how your biology + psychophysiology can make trading easier. You have another tool in your biological belt which can make trading easier. You’re already familiar with it – it’s called your ‘gut feel‘.

While this term ‘gut feel‘ may seem wishy-washy, it actually has its roots in science.

You Have A Second Brain?

Did you know you that your gut actually sends more signals to your brain than your brain does to your gut?

Did you know you have an entire nervous system which has 5x more neurons than in your own spinal cord?

Welcome to your enteric nervous system which is embedded in the lining of your gut, starting at the esophagus and going down to your ‘dairy-aire‘ 🙂

It’s often called your ‘second brain‘ because it a) can operate independently of your brain, and b) uses the same neurotransmitters as your brain, such as dopamine (i.e. reward experiences) and serotonin. In fact, more than 90% of your bodies seratonin is found in your gut. Seratonin is an essential neurotransmitter because it’s critical for feeling happy, affecting memory, learning, mood and sleep. Can you start to see how your ‘gut‘ can affect your trading performance?

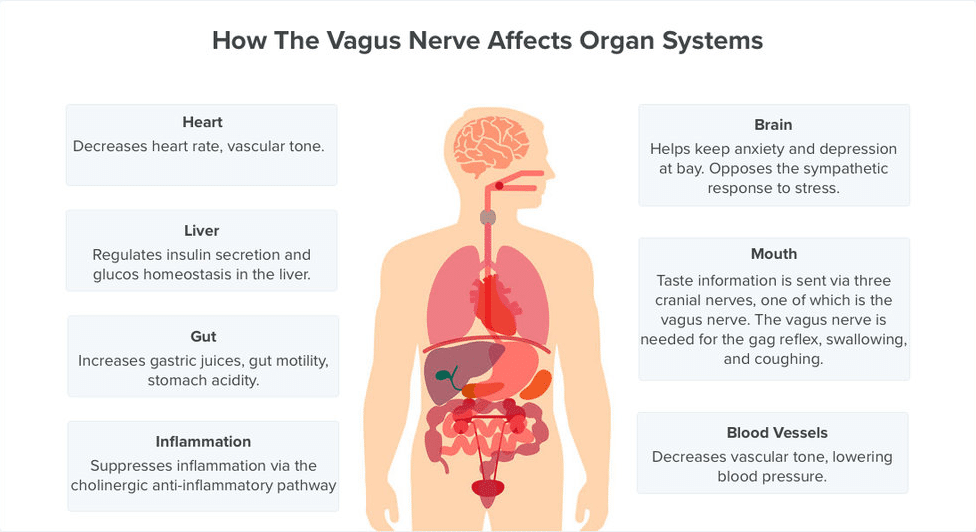

And this is where the vagus nerve comes into play.

The Vagus Nerve

You have many cranial nerves in your brain (12 total), but the 10th one is of great importance to you. It’s called the Vagus Nerve and it’s connected from your brain (medulla oblongata) down to your stomach, innervating itself to most of your major organs along the way.

It is the longest nerve of the ANS (autonomic nervous system) in your entire body and can affect heart rate, lungs, sweating, muscle movements, digestion, etc. The vagus nerve conveys sensory information about the state of the body’s organs to your CNS (central nervous system).

Now the vagus nerve can become heavily agitated due to stress or emotional responses to trading. These can either be good signals, or bad ones. But our experiences of the vagus nerve + enteric nervous system comprise what is often referred to as ‘gut feel‘.

This is because your gut might actually be getting signals from your brain or body that something is really right, or something is really wrong with your current trades. Often times these signals go unnoticed on an unconscious level, but can also manifest because you’ve treated your gut poorly (bad diet/food intake/etc).

When tuned right, your ‘gut feel‘ can be a warning signal something is about to go awry, or a spotlight that you need to jump into this trade before it takes off.

Have you ever had any of the above experiences? If so, then you’re seeing how your biology + psychophysiology can really affect your trading performance.

In Closing

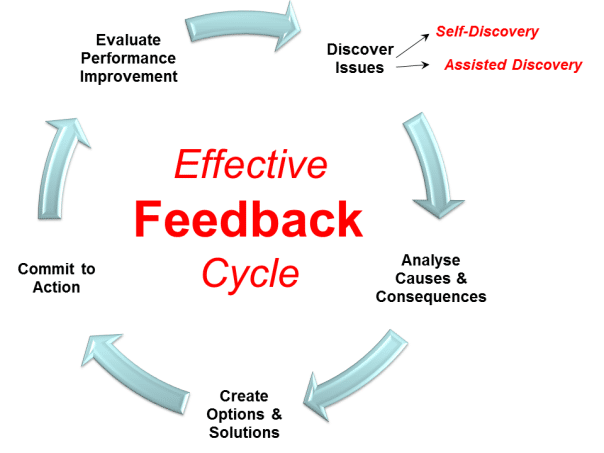

There are many ways your biology + psychophysiology can make trading hard (and easy). It is critical for you as a trader to learn how to spot these reactions/responses, and learn to change them, or use them to make better trading decisions and thus more profitable trades.

I feel the trading education industry + trading mentors are just waking up to this and how powerful your body + brain can/will affect your trading performance (for the good, or bad).

I also feel the trading education industry can/should make a concerted push to use these things to our advantage so you can become a better trader and make less trading mistakes.

We’ve covered this extensively in our traders mindset course, along with practices and methods to help you use these biological and neurological reactions/responses to your advantage.

Now Your Turn

Did you learn anything about how your body and brain can affect your trading mindset and decisions? Have you ever had these ‘gut feel’ experiences? What about a fear of a loss even though you’re in a winning trade?

Make sure to leave a comment about this important trading subject as I really want to hear your feedback on this.