This is the third installment introducing details to subjects which are not really discussed or talked about when it comes to Ichimoku Trading, that of using Ichimoku Time Theory and Ichimoku Wave Theory. Remember, according to Goichi Hosada (the creator of the Ichimoku Cloud), the Ichimoku trading system is based upon three pillars, and they are;

1) Ichimoku Time Theory

2) Ichimoku Wave Theory

3) Ichimoku Price Theory

This Ichimoku trading system article will be focused on introducing the key principles to Ichimoku Price Theory. For those wanting a review of the other two, you can find those articles by clicking on the links above.

It should be noted to really understand and apply Ichimoku Price Theory, you will need an understanding of the prior two, particularly a good grasp of the Time Theory which is used quite extensively with the Price Theory.

The goal of this article will be to introduce the most basic components of the Price Theory, which may be considered the most complicated of the three. I will discuss the main price calculations, how to formulate them, give examples of each one and some helpful tips when applying the Price Theory to Ichimoku trading.

Introduction To Ichimoku Price Theory

First, it should be noted we do not want to see these price targets as absolutes. They are really guides to give us highly probable approximations as to where the market is likely headed during a particular wave or move. These methods take practice to learn how to use, so take your time with them, but never look at this as an absolute target.

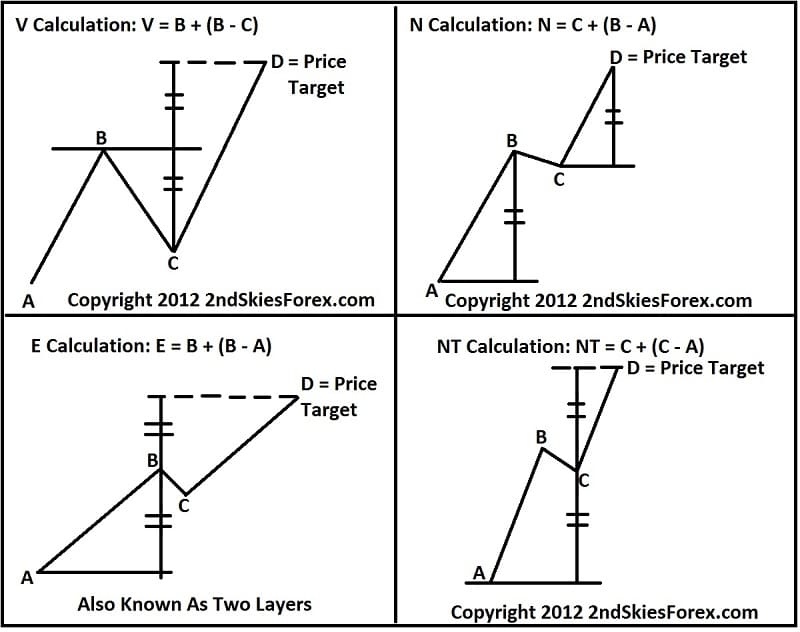

In reality, there are 4 basic price measurement methods according to the theory, however the 4th is generally regarded as a low probability event and takes a considerable amount of skill to spot and use. So for our purposes, we will only use the basic three which are the most common and critical to learn.

The three main price measurements are known as;

1) The V Calculation = B + (B – C)

2) The N Calculation = C + (B – A)

3) The E Calculation = B + (B – A)

The formulas for them are listed above, but I will show you a diagram to better understand them which is below.

Although I listed the NT Calculation, for now just spend time understanding and practicing the first three price measurements.

The V Calculation

Looking at this general structure, we have a bullish move from A – B – C. You will notice the depth of the retracement of C in relationship to the A – B move, which is about a 61.8% retracement. If we were using Ichimoku Wave Theory, this would correlate to an N Wave.

The way to use this as a price measurement method is when price breaks the horizontal line at B for that is only when the V Calculation and pattern would be active. Of course we can make the calculation ahead of time, and that is the point of the price measurement methods (or ichimoku price theory in general). But the calculation actually does not become ‘active’ till the line at B is broken.

Once this does, we can expect an upside price target of D to be achieved (within a handful of pips) based on the V Calculation. An example is below.

V Calculation Using the NZDUSD 4hr Chart

So using this chart and running through the math of the V Calculation, we take .8202 + (.8202 – .8110 = 92), or .8202 + 92 pips = .8294. As you can see, this matches up nicely with a current swing high and natural target for an upside continuation in the Kiwi (should it continue). This is a basic example of how you can use the V Calculation to gauge a potential target for the pair. An ichimoku trader using this calculation along with the swing high would only bolster their confidence in the upside target being hit.

Keep in mind this is a live chart and I have no idea how this will play out, but wanted to show it as an example.

Lets run through examples of the N and E calculations so you can see how they operate.

N Calculation = C + (B – A) Using the Dow Jones Index 4hr Chart

Now using this chart above and the numbers for the N Calculation, C (12698) + (12794 – 12463 = 331), or 12698 + 331 = 13029. So we would have a general target of 13029. Now if you remember, these numbers are not meant to be absolutes, only highly probably approximations of upside or downside targets. Considering the major role reversal level was at 13003, we can consider this to be a good target for D using the N calculation.

E Calculation = B + (B – A) Using GBPJPY 4hr Chart

Using this chart above on the GBPJPY and the E Calculation, B (12897) + (12897 – 12566 = 331), so 12897 + 331 = 132.28. In this case, the market actually only got one pip higher than the D price measurement or target, showing a fine example of how the E calculation and price measurement theory can work.

Some Additional Notes

As I said before, ichimoku price theory should be combined with ichimoku time theory as they work in tandem. But the scope of this is for another article and far too large for an introduction to ichimoku price theory.

Another note in terms of deciding which price measurement to use is based on the price action of the actual moves you want to measure. You will notice all of the calculations have certain levels of impulsivity and correctiveness to the A, B and C moves. On a basic level, what you are doing is gauging the level of the retracement from B – C, along with the correctiveness of the pullback from B-C to determine which calculation you will use. Thus in essence, you need the A, B and C components to really apply any calculation at all. But how you read these moves and waves will determine which calculation you use.

A critical note as well, is when measuring bull or bear runs. The calculations you see in the first diagram are for bullish runs. For bearish runs, you will substitute the + for a – between the first variable and the set. Thus, using the V Calculation, instead of it being V = B + (B-C), it would be V = B – (B – C).

In Summary

This was an introduction into Ichimoku Price Theory which is by far the most complex and intricate of the three pillars of The Ichimoku trading system. The three basic calculations are critical and the foundation of the entire price theory, thus the most important formulas for you to learn. Eventually you will combine price theory with time theory, but for now, just practice the basics here. These price measurements are not to be considered absolute values, and Ichimoku was always meant to be used in combination with price action. In fact, many aspects of ichimoku and the formulas are interpretations and patterns often found within price action, so the two are really intertwined.

For a more in depth study and training on Ichimoku Price, Time, Wave Theory, and Ichimoku Trading, make sure to visit my Advanced Ichimoku Course where we explore these methods in great depth, along with giving rule based systems to trade ichimoku both intraday and a trending/momentum basis.

Now that I have outlined the major components to Ichimoku Time Theory (ichimoku numbers), I want to talk about the 2nd pillar of Ichimok which is the Wave Theory.

Remember, the main pillars of Ichimoku are not the Tenkan, Kijun, Chikou and Kumo. These are components of Ichimoku to help you read the main aspects of what is going on with the trend, support and resistance, and price action – all within a glance.

But…..these are NOT the pillars of Ichimoku. This led Hosada to state the following when he realized everyone was getting stuck believing the Tenkan, Kijun, Chikou and Kumo were all Ichimoku was about;

“Of the 10,000 or so people who are practicing and trading ichimoku, only about 10 really understand it.”

The 3 main pillars of Ichimoku are;

1) Ichimoku Time Theory

2) Ichimoku Wave Theory

3) Ichimoku Price Theory

I have discussed Ichimoku time theory which is the basis for all the other pillars and all of the ichimoku components you use when you look at any ichimoku chart. Now I would like to get into the 2nd pillar which is Ichimoku Wave Theory. I will get into the basic components or waves only as there are several types of waves (basic, mid-term, etc.) so to give an introduction without confusing anyone, I will write about the basic waves in today’s article.

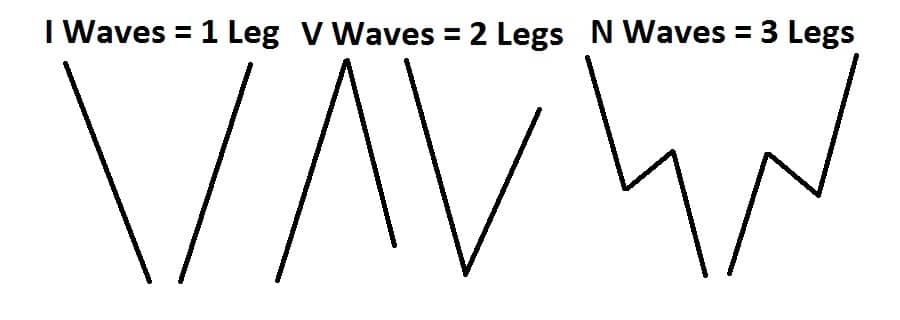

3 Basic Waves

There are 3 basic waves which are the most important ones to learn because they are the basis of the ichimoku wave theory and will always be a part of your wave counts. They are;

1) I Wave

2) V Wave

3) N Wave

Ironically, an I Wave is 1 leg, a V Wave is 2 legs and a N Wave is 3 legs. Just like all the basic ichimoku numbers are building blocks for all the other numbers, it is the same with the waves. But let me show you a picture below to help give you a needed visual.

Looking at the image above, you can see how the one, two and three legs form the individual waves. I, V and N waves can all be up or down so that does not matter. Generally, I waves are impulsive price action moves, but they can be corrective. V waves are usually one impulsive and one corrective move, but can be two impulsive moves back to back. Whereas an N wave is usually an impulsive leg, followed by a corrective leg, and then another impulsive leg in the same direction as the original leg.

Being the most complex of the three, the N wave can have variations of this, but the first leg of the N wave should be impulsive with the other two having variations between them. Generally, most N waves will end with a higher high for an up wave, and a lower low on a down wave.

So the wave should end up lower or higher than where it started. If this is not the case, then it usually means a breakdown of the wave structure, but lets look at a few examples.

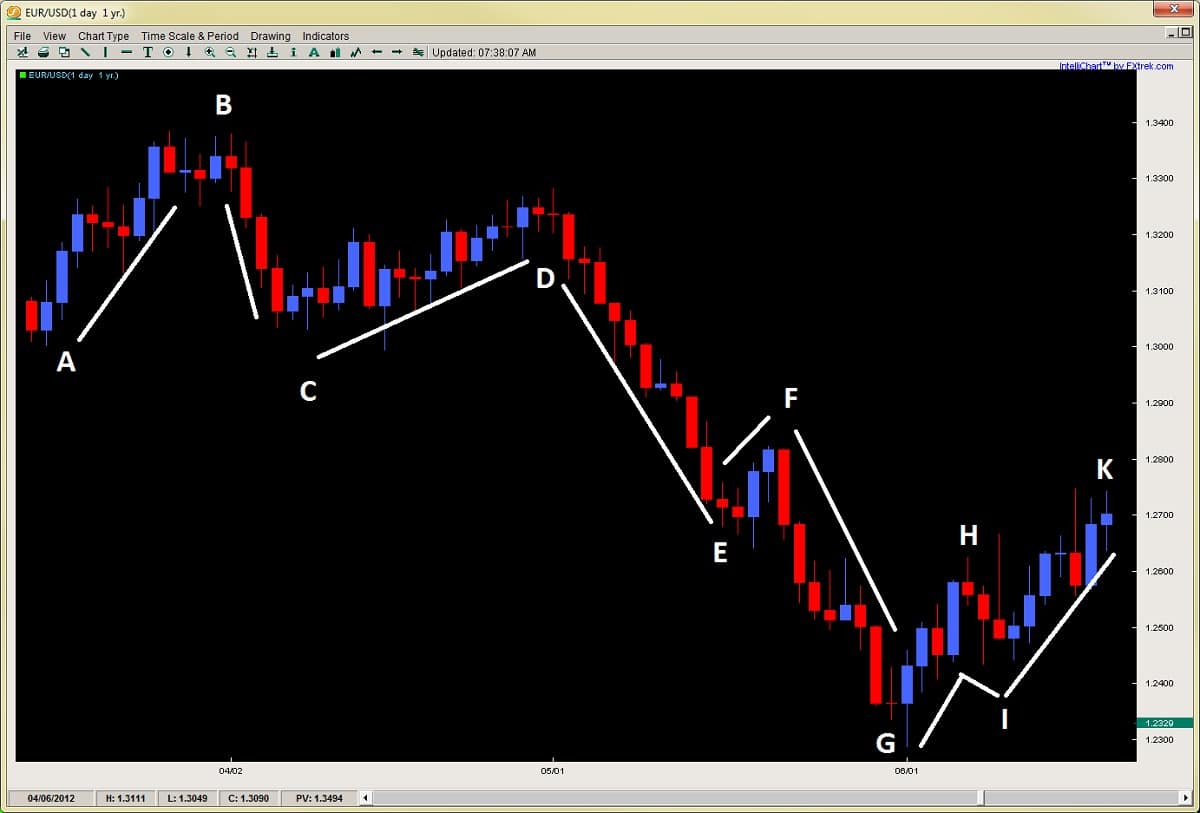

Using the chart above, I have labeled several lines, all of which individually are I Waves. As I said before, they all are components of each other, so a V Wave is really two I Waves put together, while an N Wave is either three I Waves, or one V Wave and one I Wave. But lets break this down in the chart above.

Starting at the top left of the chart, the first movement from A-B is an I Wave. Now by that token, the move from A-B-C is a downward V Wave. A-B-C-D would be therefore an N Wave, but also composed of two V waves (one up and one down). As a general rule, it’s better to look at the wave structure from a macro perspective then a micro one, so breaking say four N Waves up into 16 I waves is unnecessary. Look for the larger macro structure (gestalt) of the wave structure and you got the trick.

Now, as I stated, even though A-B-C-D is an N Wave, it doesn’t end with D being higher than B. When this happens, it generally means a range bound market at a minimum or a breakdown into a downward N wave, but rarely ever do these end up with higher prices above B, especially if C is breached.

Since this did happen, we actually have an downward N Wave starting at B-C-D-E. We can also count a downward N Wave from D-E-F-G. This brings me to the point that N Waves generally continue in their original direction until the ideal structure of the waves gets broken or disrupted. It also means N Waves can continue and parts or legs (ends) of them can start new N Waves in the same direction.

So if we were counting a new N Wave from F-G-H-I, since the wave structure is being disrupted, we would expect a likely reversal, and this is supported by the upward N Wave starting at G-H-I-K. This may seem like a lot, but this should give you some starting ideas of how to use these basic waves when reading an ichimoku cloud chart and will get easier with practice.

Usage in Trading

There are many ichimoku trading strategies we can use with these basic waves in trading, and if you were paying attention, I already gave away one idea. One example is how the wave structure generally performs (particularly N Waves). If the structure breaks down from its ideal formation, then watch for trend change – minimally a consolidation, but definitely not a trend continuation.

Another way this can be useful is if the number count (using ichimoku numbers) in a particular move is getting long, such as a two section, one period or a combined-6 move. These common turning points, combined with wave structure changes often bring a confluence of signals together which can mark major turning points in a move.

For example, in the chart above, the move from D-G is actually 1 day short of a one period move (a common turning point).

Additionally, you can combine forex price action strategies with these moves, especially reversal setups, so when you see (for example) pin bar setup happening at a major resistance, along with an N Wave structural change, this can increase the probability of a reversal.

Other ways to do this is if the V Wave is not a traditional impulsive move followed by a corrective move. For example, if it is an impulsive move followed by another one counter-direction, this could also be suggesting trend change or a range bound market, depending upon how it started the V Wave.

As you can see, there are many ways, too many to discuss here, but hopefully this gives you something to work with.

In Summary

Although there are other waves that we have not discussed, this is a good introduction and start to understanding Ichimoku Wave Theory and gives you the foundational theory to start practicing with the basic waves. But it is important to understand this is one of the key pillars underlying all of Ichimoku Kinko Hyo theory, so understanding the basic waves is a gate towards understanding ichimoku trading strategy as a whole.

Best is to practice forex wave theory by itself so you learn it as an individual component. Then after building some experience, combining it with ichimoku time theory. But hopefully for now, this gives you a nice introduction to Ichimoku Wave Theory as there is very little information about it available, nor discussed openly.

For those wanting to learn how to trade the Ichimoku Cloud, time, wave and price theory, along with lifetime access to the Ichimoku traders forum, discussing ichimoku setups using rule-based systems, make sure to visit my Advanced Ichimoku Course.

For all those traders interested or currently trading Ichimoku, you will not want to miss this article.

Although I am heading out in a few hours with my girlfriend to Harbin Hot Springs, I wanted to write a brief introduction to Ichimoku Number Theory as there has been a lot of questions (and confusion) about Ichimoku settings, time frames, etc.

The basis of Ichimoku as known to most is the 5 lines;

- Tenkan Line

- Kijun Line

- Senkou Span A (part of the Kumo)

- Senkou Span B (other part of the Kumo)

- Chikou Line

Almost 95% of the commentary, traders, educators and understanding of the ichimoku kinko hyo view this as the basis of Ichimoku.

This is actually incorrect.

The basis of Ichimoku are the three pillars which are listed below;

- Ichimoku Number Theory (also has to do with time)

- Ichimoku Wave Theory

- Ichimoku Price Theory

These are the three pillars of Ichimoku, but the root of all them is based on the Ichimokunumber theory.

4.5yrs

Goichi Hosada (founder of Ichimoku) in his development of Ichimoku, spent 4.5yrs of his study just on number theory. He studied pretty much every Eastern and Western theory under the sun, and eventually settled upon 3 basis numbers that he not only made the basis of Ichimoku theory, but underlined all of reality.

NOTE: I have an interesting follow up story to tell about this so remind me to discuss it later.

The three numbers he made as the basis for Ichimoku were 9, 17 and 26.

So the idea that the reason why the Kijun was set to 26 periods had to do with the former 6 day Japanese trading week is false.

The kijun was set to this measurement, along with the tenkan – based on his findings.

What this means is, for those who are asking the question about should we adjust the settings since we are not working with a full trading week, or are trading an intraday time frame, is in effect answered. Regardless of the trading week or time frame, we are best served from an Ichimoku perspective keeping the original settings. So hopefully this puts that one to rest and the kabbash on all the alternative theories.

The 10 Numbers

Although there were 3 basic numbers which underlie the entire set of Ichimoku numbers, there were 10 in all. They are listed below;

9

17

26

*These three represent the basic or simple numbers

33

42

65

76

129

172

200-257

Now if you do a quick calculation, 9+17 = 26. 26+17 = 42+1. 33+9 = 42. 33×2 = 65+1. 42+33 = 76-1. 65×2 = 129+1. 129+42 = 172-1. So all these numbers are interrelated and all comprised of the basic numbers in some way.

There are names for these numbers like one section, two sections, one period, etc. which I will get into a later date, but the basic three names are;

one section (9)

two sections (17)

1 period (26)

So if you see me using this terminology in my future Ichimoku posts, you will know what I am talking about.

Use in Practice

Ideally, Ichimoku number/time theory should be used in combination with the price and wave theories. So by itself, it is limited. But we can start the introduction with the basic concept. This is, the market is more likely to have a turning point or strong price action reaction around these numbers. They are not meant to be treated as fixed in stone numbers, but moreso higher probability turning or reaction points. An example of this is below;

AUDUSD Daily Chart

Now using the chart above, lets make some observations:

A-B = 41 (1 short of 42 bar move)

B-C = 16 (1 short of two section move/17)

C-D = 26 bars exactly or one period

D-E = 18 bars (1 short of two sections move)

E-F = 26 bars exactly or one period

Now this is just one chart and there will be many that are not so accurate upon first glance, and others that are. JPY pairs tend to move and respond more to the Ichimoku paramters and numbers since a great amount of Japanese traders are primarily trading Ichimoku strategies, and therefore are making trades based on it.

However, from my experience, this works on most pairs, commodities, and indices across the board, so quite potent and relevant. Keep in mind, it is important to understand we do not just apply the Ichimoku number/time theory in isolation, but mate it with Ichimoku price and wave theory. When combined, they become very highly predictive tools for catching major turning points, finding precise targets and determining future support and resistance levels, so powerful tools when yielded properly.

In Summary

Although this is just an introduction, I hope this gives you a better understanding of Ichimoku and how not to relate to it in just its basic form, but understand there is more going on than just the 5 lines. Anyone just teaching and professing the 5 lines as the be all end all of Ichimoku have very little understanding of it.

Goichi Hosada once said about this in the mid 80’s;

“Of the 10,000 or so people who are practicing and trading Ichimoku, only about 10 really understand it.”

Keep in mind, when he was saying it, he was including himself and his grandson, so not many. This is because people get too fascinated with the 5 lines and relate to that only without ever taking the time to understand what it is all about. Although the 5 lines are potent and informative by themselves, they are a small fraction of the Ichimoku picture and information contained in the Ichimokukinko hyo chart, so keep this in perspective.

I’ll be doing further introductory articles about these additional elements in the future over the next several months, but hopefully this sparks your curiosity and imagination for now.

For those wanting to learn how to trade the Ichimoku Cloud, Ichimoku time, Ichimoku price and Ichimoku wave theory, along with lifetime access to the Ichimoku traders forum, using rule-based systems, make sure to check out my Advanced Ichimoku Course.

One of the amazing things about the Ichimoku Cloud trading strategy is the actual Cloud or ‘Kumo’ which is something unique wherein nothing like it was created before and nothing sense has come after. The Ichimoku Cloud or Kumo is designed to represent support or resistance but in a different form the western world has seen – to view support and resistance as evolving or dynamic and not static like pivot lines, Fibonacci lines, support lines or trend lines.

To the creator (Goichi Hosada), support and resistance was evolving and really based upon previous price action.Particularly, the highs and lows of previous price action was of great concern to Hosada (along with the opens and closes) which showed levels of rejection where the market would not accept price.The previous highs and lows would also give traders the range where the market was accepting price.

So the real question is ‘how’ does the Ichimoku Cloud or Kumo represent support and resistance?The answer lies in the construction of the Cloud or Kumo.

Kumo Composition

There are two main lines of the Kumo which are referred to as Senkou Span A and Senkou Span B. For the purposes of efficiency, we will refer to them as Span A and Span B. The space or value in between these two lines is what forms the Kumo.

Span A is formed by taking the Tenkan Line and adding it to the Kijun Line (white and red lines respectively from chart above), then dividing that value by 2 and plotting it 26 periods ahead. The formula is;

(Tenkan Line + Kijun Line) / 2 placed 26 periods ahead

Span B is formed by taking the highest high (over the last 52 periods), adding to it the lowest low (over the last 52 periods), dividing that by 2 and plotting that 26 time periods ahead. The formula is;

(Highest High + Lowest Low for the last 52 periods) / 2 and plotted 26 time periods ahead.

Now, before we fully get into the construction of the Kumo, we have to talk about what the Tenkan and Kijun lines are which help to form the ever changing Senkou Span A.

The Tenkan Line or Tenkan Sen (Sen means line in Japanese) is known as the conversion line or turning line is similar to a 9SMA but actually is quite different. Remember a SMA (simple moving average) will smooth out all the data and make it equal but the Tenkan Line will take the highest high and lowest low over the last 9 periods. The explanation for this is Hosada felt price action and its extremes were more important than smoothing any data because price action represented where buyers/sellers entered and directed the market, thus being more important than averaging or smoothing the data out. As you can see by the chart below, the Tenkan Line is quite different than a 9SMA. Because the TL (Tenkan Line) uses price instead of an averaging or the closing prices, it mirrors price better and is more representative of it. You can see this when the TL flattens in small portions to move with price and its moments of ranging.

The Kijun Line (or Kijun Sen) is known as the datum line, standard line or trend line designed to indicate the overall trend for the instrument or pair. The formula behind it is the same as the Tenkan line using price action and the highest high + lowest low with the only change being in the periods as it does it over the last 26 periods.

Why 26 periods? The answer to that is a matter of history. When the Ichimoku was first created, the Japanese markets were open 6 days a week on Saturdays. If the markets are open 6 days a week, this generally results in 26 trading days for the month – hence 26 periods for the Kijun. In essence, what it was meant to be was a measure of the highest high + lowest low for the last month of price action. If the Kijun has been climbing – it means price has been gaining ground for the last month. If it is flat, then it will be the midpoint of the range of price for the last month of price action (or representative of the price equilibrium).

Now that we have uncovered the composition of the Tenkan and the Kijun lines, lets talk about how they form the Senkou Span A.

Going back to its construction:

Span A is formed by taking the Tenkan Line and adding it to the Kijun Line (white and red lines respectively from chart above), then dividing that value by 2 and plotting it 26 periods ahead. The formula is;

(Tenkan Line + Kijun Line) / 2 placed 26 periods ahead

So the Tenkan line (which is the momentum line) and the Kijun line (which is the trend line) that are based upon price action are moving.Their valued added together, divided by 2 and sent 26periods ahead is what forms the Senkou Span A or Span A.So the first portion of the Ichimoku Cloud or Kumo is based upon evolving price action lines which are half momentum, half trend monitoring.When you put these two together, you get the Span A which is always changing based upon the acceleration or deceleration of price based upon how they effect the Tenkan/Kijun lines (and in turn, the Senkou Span A).

The second line is the Senkou Span B which is a little different.Its based solely upon price action, particularly the last 52 candles of whatever time period you are on.If you are working with a daily chart, we are talking about the last 52 days, for a 1hr chart, the last 52 hours of price action.After taking the high and low for the last 52 candle range, it takes their values, divides them in half, and shoots them 26 time periods ahead.

The shading in between is called the Cloud or Kumo.

Why 26 periods?

The answer to that is a question of history.Originally, when the Ichimoku Cloud was built, Hosada was mostly using it off of daily charts.The Japanese were trading 6 days a week so 26 days would represent a full month of trading.Hence 26 time periods to see where future support and resistance would be one month out.

This is where we can use the Ichimoku Cloud for reversals.

If the Ichimoku Cloud or Kumo represents support and resistance, then the thicker the Cloud, the thicker the S/R it offers.If price is below the Kumo, it will act as resistance, if price is above the Kumo, it will act as support.The Cloud can take many forms and shapes (virtually infinite) which is what makes it tricky but thick Kumo’s often will reject price and the longer the time frame (4hr, Daily, Weekly), the more powerful the Kumo will act as support or resistance.

Take a look at some Ichimoku cloud trading strategy examples below.

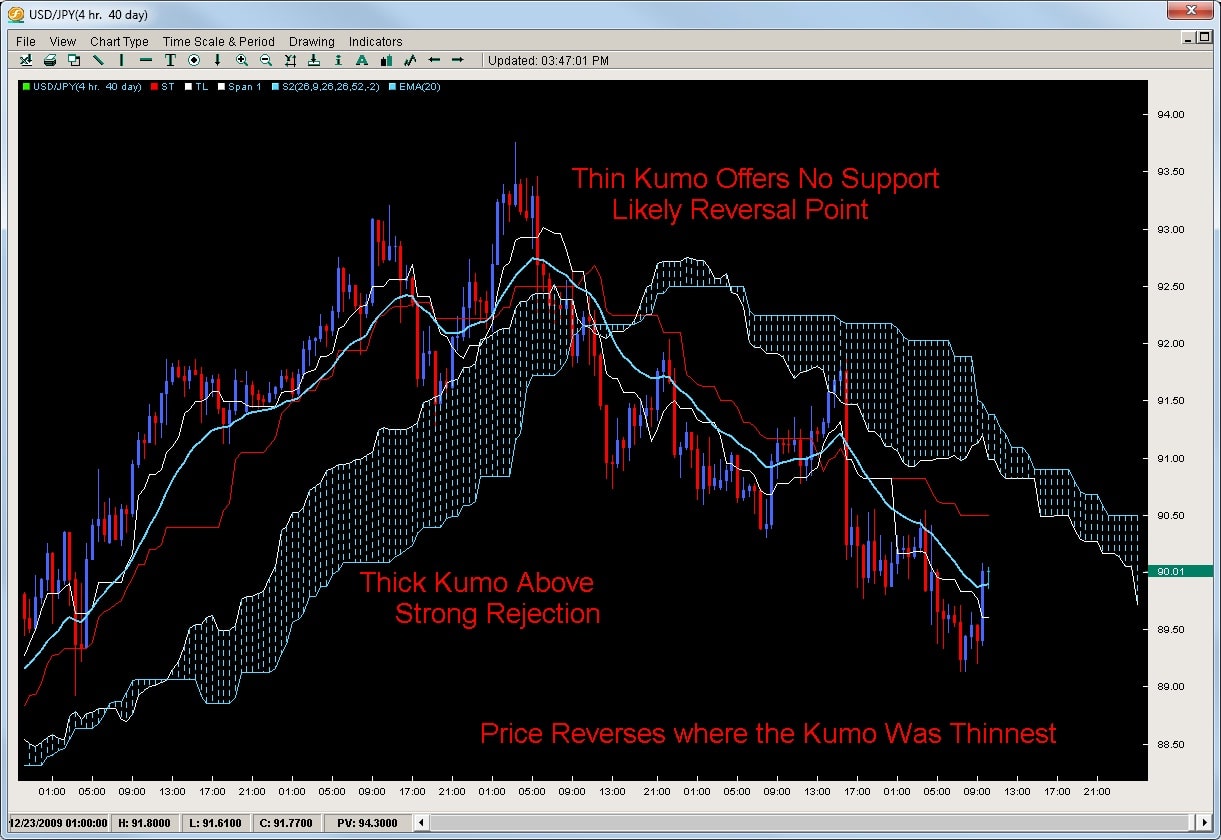

USDJPY 4hr Charts

Notice how the pair rejects off the really thick Cloud but when it reverses is where the Cloud was the weakest or most thin.

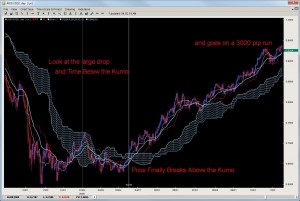

USDCAD 4HR Charts

Taking a look at another example, the USDCAD after its initial fall, rejected off a really thick Kumo twice telling us a reversal was less likely.However the Kumo starts to thin out giving us a window to break through the Kumo and likely reversal point.

So the key tactic in both is to look for thinner Cloud formations which offer a window or glimpse into an upcoming reversal.Remember the Kumo is sent 26time periods ahead so you have plenty of warning when the window is opening.If you are in the current trend, the window in the Kumo could be a warning to take some profits or if you are looking for a reversal, then the Cloud offers you a good location and method to time a reversal which is one of the hardest things to do in trading.

Another clue hidden in the Cloud can be the flipping of the Senkou Span A and B which can indicate a reversal but do not always.The other main point is price does not always reject off a thick Kumo so its important to watch price action as well but the Ichimoku Cloud is excellent at spotting and timing reversals.

To learn more about Ichimoku Cloud trading strategies, or proprietary quantitative based strategies on the Ichimoku Cloud, check out the Advanced Ichimoku Course.

Using the Ichimoku Cloud to discover Reversals

One of the amazing things about the Ichimoku Cloud is the actual Cloud or ‘Kumo’ which is something unique wherein nothing like it was created before and nothing sense has come after.The Ichimoku Cloud or Kumo is designed to represent support or resistance but in a different form the western world has seen – to view support and resistance as evolving or dynamic and not static like pivot lines, Fibonacci lines, support lines or trend lines.

To the creator (Goichi Hosada), support and resistance was evolving and really based upon previous price action.Particularly, the highs and lows of previous price action was of great concern to Hosada (along with the opens and closes) which showed levels of rejection where the market would not accept price.The previous highs and lows would also give traders the range where the market was accepting price.

So the real question is ‘how’ does the Forex Ichimoku Cloud or Kumo represent support and resistance? The answer lies in the construction of the forex Ichimoku Cloud or Kumo.

Kumo Composition

There are two main lines of the Kumo which are referred to as Senkou Span A and Senkou Span B. For the purposes of efficiency, we will refer to them as Span A and Span B. The space or value in between these two lines is what forms the Kumo.

Span A is formed by taking the Tenkan Line and adding it to the Kijun Line (white and red lines respectively from chart above), then dividing that value by 2 and plotting it 26 periods ahead. The formula is;

(Tenkan Line + Kijun Line) / 2 placed 26 periods ahead

Span B is formed by taking the highest high (over the last 52 periods), adding to it the lowest low (over the last 52 periods), dividing that by 2 and plotting that 26 time periods ahead. The formula is;

(Highest High + Lowest Low for the last 52 periods) / 2 and plotted 26 time periods ahead.

Now, before we fully get into the construction of the Kumo, we have to talk about what the Tenkan and Kijun lines are which help to form the ever changing Senkou Span A.

The Tenkan Line or Tenkan Sen (Sen means line in Japanese) is known as the conversion line or turning line is similar to a 9SMA but actually is quite different. Remember a SMA (simple moving average) will smooth out all the data and make it equal but the Tenkan Line will take the highest high and lowest low over the last 9 periods. The explanation for this is Hosada felt price action and its extremes were more important than smoothing any data because price action represented where buyers/sellers entered and directed the market, thus being more important than averaging or smoothing the data out.

As you can see by the chart below, the Tenkan Line is quite different than a 9SMA. Because the TL (Tenkan Line) uses price instead of an averaging or the closing prices, it mirrors price better and is more representative of it. You can see this when the TL flattens in small portions to move with price and its moments of ranging.

The Kijun Line (or Kijun Sen) is known as the datum line, standard line or trend line designed to indicate the overall trend for the instrument or pair. The formula behind it is the same as the Tenkan line using price action and the highest high + lowest low with the only change being in the periods as it does it over the last 26 periods.

Other Notes About the Tenkan and Kijun

As a whole, if the Kijun has been climbing – it means price has been gaining ground for the last month. If it is flat, then it will be the midpoint of the range of price for the last month of price action (or representative of the price equilibrium).

Now that we have uncovered the composition of the Tenkan and the Kijun lines, lets talk about how they form the Senkou Span A.

Going back to its construction:

Span A is formed by taking the Tenkan Line and adding it to the Kijun Line (white and red lines respectively from chart above), then dividing that value by 2 and plotting it 26 periods ahead. The formula is;

(Tenkan Line + Kijun Line) / 2 placed 26 periods ahead

So the Tenkan line (which is the momentum line) and the Kijun line (which is the trend line) that are based upon price action are moving.Their valued added together, divided by 2 and sent 26periods ahead is what forms the Senkou Span A or Span A.So the first portion of the Ichimoku Cloud or Kumo is based upon evolving price action lines which are half momentum, half trend monitoring.When you put these two together, you get the Span A which is always changing based upon the acceleration or deceleration of price based upon how they effect the Tenkan/Kijun lines (and in turn, the Senkou Span A).

The second line is the Senkou Span B which is a little different.Its based solely upon price action, particularly the last 52 candles of whatever time period you are on.If you are working with a daily chart, we are talking about the last 52 days, for a 1hr chart, the last 52 hours of price action.After taking the high and low for the last 52 candle range, it takes their values, divides them in half, and shoots them 26 time periods ahead.

The shading in between is called the Cloud or Kumo.

If the Ichimoku Cloud or Kumo represents support and resistance, then the thicker the Cloud, the thicker the S/R it offers.If price is below the Kumo, it will act as resistance, if price is above the Kumo, it will act as support.The Cloud can take many forms and shapes (virtually infinite) which is what makes it tricky but thick Kumo’s often will reject price and the longer the time frame (4hr, Daily, Weekly), the more powerful the Kumo will act as support or resistance.

Take a look at some examples below.

USDJPY 4hr Charts

Notice how the pair rejects off the really thick Cloud but when it reverses is where the Cloud was the weakest or most thin.

USDCAD 4HR Charts

Taking a look at another example, the USDCAD after its initial fall, rejected off a really thick Kumo twice telling us a reversal was less likely.However the Kumo starts to thin out giving us a window to break through the Kumo and likely reversal point.

So the key tactic in both is to look for thinner Cloud formations which offer a window or glimpse into an upcoming reversal.Remember the Kumo is sent 26time periods ahead so you have plenty of warning when the window is opening.If you are in the current trend, the window in the Kumo could be a warning to take some profits or if you are looking for a reversal, then the Cloud offers you a good location and method to time a reversal which is one of the hardest things to do in trading.

Another clue hidden in the Cloud can be the flipping of the Senkou Span A and B which can indicate a reversal but do not always.The other main point is price does not always reject off a thick Kumo so its important to watch price action as well but the Ichimoku Cloud is excellent at spotting and timing reversals.

To learn more about the Ichimoku Cloud for reversals, or proprietary quantitative based strategies on the Ichimoku Cloud, check out the Advanced Ichimoku Course.

Traditionally, the Ichimoku Cloud is known for its ability to pick up trends and keep traders in them until they are over.It should be noted that any system or method which is good at finding trends is also good at finding reversals because if you are finding the times/locations when trends are ending, then you are finding consequently a reversal.

There are several components inside the Ichimoku Cloud which give it a unique capacity to find trends, establish if we are in a trend, which direction and when it is over.One of them is the Kumo or Cloud which is one of the most unique technical indicators out there.

Kumo Composition

There are two main lines of the Kumo which are referred to as Senkou Span A and Senkou Span B. For the purposes of efficiency, we will refer to them as Span A and Span B. The space or value in between these two lines is what forms the Kumo.

Span A is formed by taking the Tenkan Line and adding it to the Kijun Line (white and red lines respectively from chart above), then dividing that value by 2 and plotting it 26 periods ahead. The formula is;

(Tenkan Line + Kijun Line) / 2 placed 26 periods ahead

Span B is formed by taking the highest high (over the last 52 periods), adding to it the lowest low (over the last 52 periods), dividing that by 2 and plotting that 26 time periods ahead. The formula is;

(Highest High + Lowest Low for the last 52 periods) / 2 and plotted 26 time periods ahead.

What is it used for?

The most important way to look at the Kumo is as support and resistance – meaning if it is thick, then the support/resistance (depending upon where price is in relationship to the cloud) is strong. If price is above the Kumo, we are in a general uptrend or would want to look for more buying opportunities. If price is below the cloud, it is below resistance (the Kumo) and we want to be searching for more shorts than longs. The longer price stays below/above the cloud, the stronger the trend we are in and the more support/resistance the Kumo will offer.

These are generic ways to look at it but effective.What is important to note is in trends, price will stay on one side of the Kumo.The farther price is from it, the stronger the trend and more volatile it is.Thus, the Kumo can be a very effective tool for option traders as well as trend/momentum traders.

How can we use it for Reversals?

Because the Kumo will often hold price on one side of it, when price breaks it, such a move can often signal a reversal.There are various factors which will increase the likelihood of a reversal such as:

- Thickness of the kumo when broken

- How long price has been on one side of it

- How far price has moved before touching/piercing the kumo

- What time frame you are working on

These are all critical when assessing whether a Kumo break is signifying a reversal or not.

A few examples

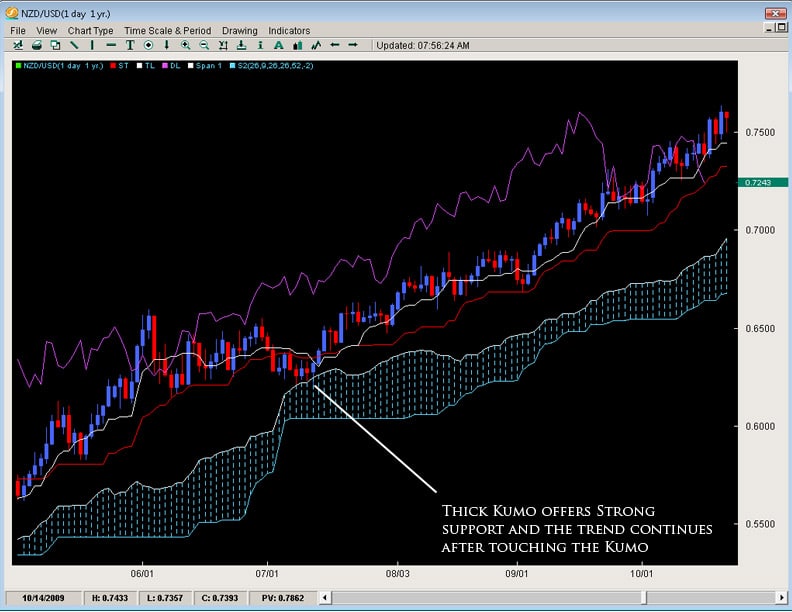

Take a look a the AUDUSD below.It was below the Kumo for a long period of time and had a massive fall.Then after a couple of attempts on the daily chart, broke above the Kumo.Now remember the Kumo represents support and resistance so the pair breaking above it, then coming back to the Kumo to treat it as support was a great role-reversal play.After retouching the Kumo, it went on a 3000 pip run!

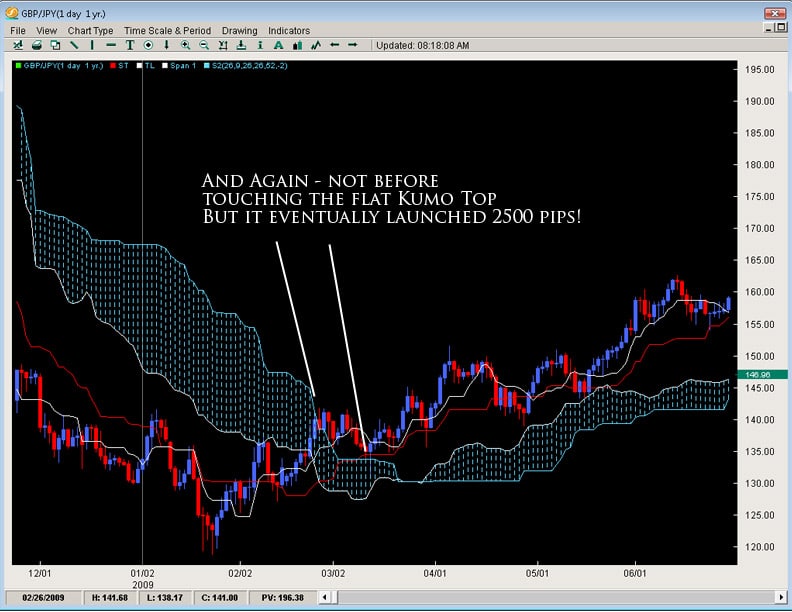

Another example is on the AUDJPY on the daily chart which was on a smooth consistent uptrend.Look what happened when it broke the kumo.It took a few days, but then after attempting to break back above, treated the Kumo as resistance, and the pair then fell over 1300 pips in a few months.

Final Notes

The Kumo breakout strategy is one of the key systems used by Ichimoku traders for spotting key reversals, qualifying them and giving traders a unique opportunity to either take profits or reverse positions.Its great for timing trends, reversals and trading key reversals when they are in play.Because of its unique ability to measure support and resistance, the Ichimoku Cloud and its Kumo construction offer the trader some unique trade opportunities.

It should be noted there are other key elements needed to trade the Kumo Breaks with precision.We have analyzed Kumo breaks on Forex, Futures, Commodities and Indices over the last 10 years and with our proprietary indicators and analytical programs, are able to give precise measurements for how far and long a Kumo break should travel which gives you a precision edge when trading them.

To learn more about our proprietary Ichimoku trading strategies and systems, visit our Advanced Ichimoku Course where you will get access to 10 years of proprietary quantitative data on how to trade Ichimoku Clouds.

This is by far the most popular of the trading methods in the Ichimoku Cloud trading arsenal.

It is simple, elegant and great at picking up trends and trend reversals. If you like trading trends or momentum trading, the Tenkan/Kijun cross is a great method to use.

What is the Tenkan?

The Tenkan Line or Tenkan Sen (Sen means line in Japanese) is known as the conversion line or turning line is similar to a 9SMA but actually is quite different. An SMA (simple moving average) will smooth out all the data and make it equal, but the Tenkan Line will take the highest high and lowest low over the last 9 periods.

The explanation for this is Hosada felt price action and its extremes were more important than smoothing any data. This is because price action represented where buyers/sellers entered and directed the market, thus being more important than averaging or smoothing the data out.

As you can see by the chart below, the Tenkan Line is quite different than a 9SMA. Because the TL (Tenkan Line) uses price instead of an averaging or the closing prices, it mirrors price better and is more representative of it. You can see this when the TL flattens in small portions to move with price and its moments of ranging.

Akin to all moving averages, the angle of the Tenkan line is very important as the sharper the angle, the stronger the trend while the flatter the Tenkan, the flatter or lesser the momentum of the move is. However, it is important to not use the Tenkan line as a gauge of the trend but more so the momentum of the move. However, it can act as the first line of defense in a trend and a breaking of it in the opposite direction of the move can often be a sign of the defenses weakening.

The Kijun Line (or Kijun Sen) is known as the datum line, standard line or trend line designed to indicate the overall trend for the instrument or pair. The formula behind it is the same as the Tenkan line using price action and the highest high + lowest low with the only change being in the periods as it does it over the last 26 periods.

Why 26 periods? The answer to that is a matter of history. When the Ichimoku was first created, the Japanese markets were open 6 days a week on Saturdays. If the markets are open 6 days a week, this generally results in 26 trading days for the month – hence 26 periods for the Kijun.

In essence, what it was meant to be was a measure of the highest high + lowest low for the last month of price action. If the Kijun has been climbing – it means price has been gaining ground for the last month. If it is flat, then it will be the midpoint of the range of price for the last month of price action (or representative of the price equilibrium).

Also like the Tenkan Line, the angle of the Kijun is reflective of the overall trend in place. Price breaking the Kijun after being in an up/down trend often has serious consequences for that trend and can many times lead to a reversal of sorts. Ultimately because it uses a longer period to measure price action, its a more stable method for determining the direction of the trend than the Tenkan Line.

Because of price to respect this line during a strong trend, it can potentially be used as a stop loss for traders already in the correct direction of the trend. Hence, when price breaks or closes below it by a significant amount, the trend is often over.

Applications for the Tenkan and Kijun

The most common usage of the Tenkan and Kijun are the ‘cross’ or what we call the TKx (Tenkan-Kijun Cross). Similar to how a MACD uses a cross of its two lines, the Ichimoku Cloud does the same. It is interesting to note that the Ichimoku uses the same periods as the MACD, however it was created over a decade earlier.

One of the main signals for Ichimoku traders, the TKx can often indicate when a trend is about to begin by forming a cross (upward cross = possible upward trend while downward cross = possible down trend). A generic upward cross can be used as a bullish signal (or exit for people already short) and a generic downward cross can be used as a generic bearish signal (and vice versa for current bulls). However, notice we used the term ‘generic’ meaning there is more to the cross.

Hosada was able to give a further definition to the cross based upon its position to the Kumo or cloud. If the cross was below the Kumo, then it was considered a ‘weak’ signal since the cross was below the Kumo or below resistance. A medium signal was when a cross happened inside the Kumo as it was occurring within the field of support/resistance. A strong signal was when the bullish cross happened above the Kumo as it was happening after clearing resistance. The opposite is true for bearish signals whereby a weak signal is a cross above the Kumo, while a medium signal is inside the Kumo and a strong signal below the Kumo.

One important reminder to all this is to make sure you reference the Chikou Span to see how current price is in relationship to previous price action.

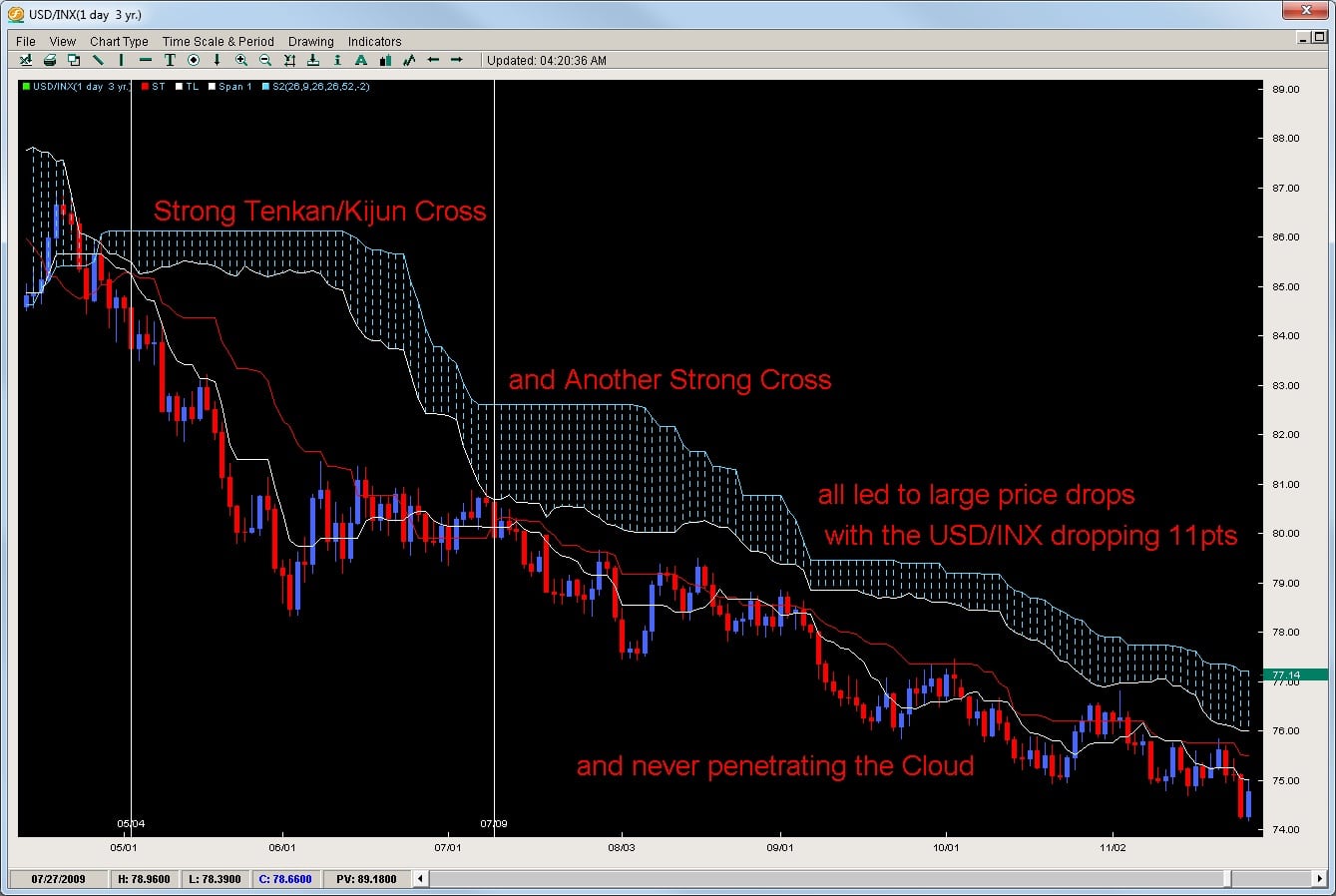

Exhibit A – Tenkan / Kijun Crosses

Take a look at how the USD/INX gave 3 strong downward crosses with each move selling off nicely and never penetrating the Kumo highlighting the downtrend.

In another example, the AUDUSD gives a nice upward cross in an already established uptrend. First it entered the Kumo but had a very shallow penetration leading to a strong upmove over 1300pips from the Tenkan/Kijun cross.

Closing

There are many important factors to consider when trading the Tenkan/Kijun cross such as time frame, kumo shape/configuration, previous moves-series of crosses, angle/shape of the cross, etc.

We have proprietary quantitative data on all pairs for the last 10 years to give you an edge when trading the Tenkan/Kijun cross. To get access to this data, or learn how to trade the Ichimoku on an advanced level, check out the Advanced Ichimoku Course.

Introduction

Still growing amongst the Western and European traders, the Ichimoku Cloud (or Ichimoku Kinko Hyo = One Glance Balance Cloud Chart) was originally developed pre-WWII by a man named Goichi Hosada. Because of the war, his research was halted and then later finished in 1968 whereby he published a 1,000 page, 4 volume body of work releasing the Ichimoku Cloud to the world under the pen-name Ichimoku Sanjin.

Originally built for the Japanese stock markets, the Ichimoku cloud indicator has made its way out of the land of the Eastern sun and into the trading world at large, being applied and used widely in the Commodities, Futures, Options and Forex markets. Part of the Ichimoku Cloud trading system’s success is its ability to find trends and reversals well before they begin.

The Indicator

The Ichimoku Cloud has several components which give it a lot of versatility and uses. The most unique aspect of the indicator is its ‘Kumo’ or cloud which offers a unique perspective of support and resistance. Most western methods look at support and resistance in a linear fashion or as straight lines in the sand (e.g. Fibonacci, Pivots, Channel Lines, Trend Lines). However the Kumo or cloud is an ever evolving object which was designed to represent support and resistance based upon price action. Generally, when you are in a strong upward trend, the support is strong as the price levels below have been accepted. The same goes for a strong downtrend and having more layers of resistance. Below are two examples of up and downtrends – showing how the Kumo was quite thick in nature.

The most important way to look at the Kumo is as support and resistance – meaning if it is thick, then the support/resistance (depending upon where price is in relationship to the cloud) is strong. If price is above the Kumo, we are in a general uptrend or would want to look for more buying opportunities. If price is below the cloud, it is below resistance (the Kumo) and we want to be searching for more shorts than longs. The longer price stays below/above the cloud, the stronger the trend we are in and the more support/resistance the Kumo will offer.

Kumo Composition

There are two main lines of the Kumo which are referred to as Senkou Span A and Senkou Span B. For the purposes of efficiency, we will refer to them as Span A and Span B. The space or value in between these two lines is what forms the Kumo.

Span A is formed by taking the Tenkan Line and adding it to the Kijun Line (white and red lines respectively from chart above), then dividing that value by 2 and plotting it 26 periods ahead. The formula is;

(Tenkan Line + Kijun Line) / 2 placed 26 periods ahead

Span B is formed by taking the highest high (over the last 52 periods), adding to it the lowest low (over the last 52 periods), dividing that by 2 and plotting that 26 time periods ahead. The formula is;

(Highest High + Lowest Low for the last 52 periods) / 2 and plotted 26 time periods ahead.

We will talk about some important points regarding the construction of the Kumo later.

Other Ichimoku Components

(Tenkan, Kijun and Chikou Span Lines)

The Tenkan Line or Tenkan Sen (Sen means line in Japanese) is known as the conversion line or turning line is similar to a 9SMA but actually is quite different. Remember a SMA (simple moving average) will smooth out all the data and make it equal but the Tenkan Line will take the highest high and lowest low over the last 9 periods. The explanation for this is Hosada felt price action and its extremes were more important than smoothing any data because price action represented where buyers/sellers entered and directed the market, thus being more important than averaging or smoothing the data out. As you can see by the chart below, the Tenkan Line is quite different than a 9SMA. Because the TL (Tenkan Line) uses price instead of an averaging or the closing prices, it mirrors price better and is more representative of it. You can see this when the TL flattens in small portions to move with price and its moments of ranging.

Akin to all moving averages, the angle of the Tenkan line is very important as the sharper the angle, the stronger the trend while the flatter the Tenkan, the flatter or lesser the momentum of the move is. However, it is important to not use the Tenkan line as a gauge of the trend but more so the momentum of the move. However, it can act as the first line of defense in a trend and a breaking of it in the opposite direction of the move can often be a sign of the defenses weakening.

The Kijun Line (or Kijun Sen) is known as the datum line, standard line or trend line designed to indicate the overall trend for the instrument or pair. The formula behind it is the same as the Tenkan line using price action and the highest high + lowest low with the only change being in the periods as it does it over the last 26 periods.

Why 26 periods? The answer to that is a matter of history. When the Ichimoku cloud was first created, the Japanese markets were open 6 days a week on Saturdays. If the markets are open 6 days a week, this generally results in 26 trading days for the month – hence 26 periods for the Kijun. In essence, what it was meant to be was a measure of the highest high + lowest low for the last month of price action. If the Kijun has been climbing – it means price has been gaining ground for the last month. If it is flat, then it will be the midpoint of the range of price for the last month of price action (or representative of the price equilibrium).

Also like the Tenkan Line, the angle of the Kijun is reflective of the overall trend in place. Price breaking the Kijun after being in an up/down trend often has serious consequences for that trend and can many times lead to a reversal of sorts. Ultimately because it uses a longer period to measure price action, its a more stable method for determining the direction of the trend than the Tenkan Line. Because of price to respect this line during a strong trend, it can potentially be used as a stop loss for traders already in the correct direction of the trend. Hence, when price breaks or closes below it by a significant amount, the trend is often over.

The Chikou Span or lagging line is created by taking the current closing price for the instrument and shifted 26 time periods back, hence why it is a lagging line. This is a strange concept and not something usually seen in technical indicators which makes the Ichimoku Cloud even more unique. The purpose is simply to gain perspective in regards to how the current price action is in relationship to previous price action.

The main application for giving perspective to the trader is how does the Chikou Span relate to price 26 periods ago. If the Chikou Span is lower than price 26 periods ago, then there is resistance for the current upmove or pressure which could force price down into a bearish move. However if the Chikou Span is above price from 26 periods ago, then it would mean there is little or no resistance ahead since price is in the process of making new highs and there is no recent price above it – thus paving the way for a strong trend.

Applications for the Tenkan and Kijun

The most common usage of the Tenkan and Kijun are the ‘cross’ or what we call the TKx (Tenkan-Kijun Cross). Similar to how a MACD uses a cross of its two lines, the Ichimoku Cloud does the same. It is interesting to note that the Ichimoku cloud uses the same periods as the MACD, however it was created over a decade earlier.

One of the main signals for Ichimoku cloud traders, the TKx can often indicate when a trend is about to begin by forming a cross (upward cross = possible upward trend while downward cross = possible down trend). A generic upward cross can be used as a bullish signal (or exit for people already short) and a generic downward cross can be used as a generic bearish signal (and vice versa for current bulls). However, notice we used the term ‘generic’ meaning there is more to the cross.

Hosada was able to give a further definition to the cross based upon its position to the Kumo or cloud. If the cross was below the Kumo, then it was considered a ‘weak’ signal since the cross was below the Kumo or below resistance. A medium signal was when a cross happened inside the Kumo as it was occurring within the field of support/resistance. A strong signal was when the bullish cross happened above the Kumo as it was happening after clearing resistance. The opposite is true for bearish signals whereby a weak signal is a cross above the Kumo, while a medium signal is inside the Kumo and a strong signal below the Kumo. One important reminder to all this is to make sure you reference the Chikou Span to see how current price is in relationship to previous price action.

The nature of the cross usually indicates the overall strength or potential for the move but it should be noted strong trends have developed from weak crosses. It is always also important you reference the construction of the Kumo when trading the typical TKx signals.

Some Important Final Notes on the Kumo

As we talked about before, the Kumo is designed to represent support and resistance but it has a host of implications in doing such. To review, the thicker the Kumo, the stronger the support/resistance it will offer. Price will often reject off of the Kumo only to resume the current trend as depicted below by a few examples.

What this also means is if the Kumo is exceptionally thin, in a ranging market it likely means the range will continue as their is neither enough support or resistance to hold a single direction for the pair. What it also means is if we are in a current trend and price is approaching a thin Kumo, the chances increase for a trend reversal since the support/resistance offered by the Kumo is not significant. This is why Kumo analysis is important as it can often lead to reversals and inform us in the future of pending trend changes.

Also, there is a common formation in the Kumo called the ‘flat top or bottom’. This refers to when the Span B becomes flat. Remember the Span B is composed of the last 52 candles absolute highest high and lowest low – thus referring to price action over the last 52 periods. If Span B is flat, the only way it can do that is if price has not extended to make any new significant highs or lows. This means we are in a range and the tendency of a range is to move towards equilibrium or towards the center of the range – also known as the value area for price. The end result is during a ranging environment, the Span B is the virtual 50% fibonacci retracement level for that range and is the ever changing 50% fib level for a trending environment, dividing the last 52 candles into two halves, the upper and lower half.

What does this mean for traders? If price is inside the Kumo, it will have a tendency to gravitate towards the flat top/bottom. If price is above it, the tendency of price will be to gravitate towards the flat top/bottom, often using it as a springboard for a rejection off of it.

Lastly, one of the most important things about the Kumo is what happens when price breaks it. If we have been in a strong trend for sometime and price then breaks the Kumo, it usually represents a trend change and the likelihood of a large move about to begin in the direction of the break as you can see by the examples below.

It is because the Kumo is always changing shape that it can represent a much better perspective of support and resistance. It is essentially based upon price action and changing shape based upon previous price moves. This makes it a little more sensitive and representational to price unlike static forms of support and resistance (fibonacci retracement levels, pivots, trend lines, etc) which do not move at all once they are in place. It is its unique construction which allows the Kumo to be both Static and Dynamic in giving support/resistance levels to the trader.

In Closing

This is just the beginning of the Ichimoku Cloud and designed to give the trader an introduction to the key elements around such a fascinating indicator and method for trading the markets. The Ichimoku Cloud has the ability to detect trends, reversals, support/resistance levels, trend strength/weakness and momentum for a pair. It is due to its ability to be used in multiple environments, along with its unique perspective upon price and support/resistance levels that Institutional and retail traders have gravitated towards using this method.

EURUSD

Finally breaking stride, the EURUSD has done something it has not been able to do for the last 7 months…have a weekly close below the Tenkan line. This line has held on dips and been quite a play in terms of getting into this trend. With the line being broken, there are two likely scenarios and a third unlikely one.

Scenario 1: The pair goes sideways into a consolidation or channel holding between 1.4615 (20EMA) and 1.5130 (basically the yearly high). This is the least exciting scenario but probably the most likely as heavy positions are probably not coming into the pair anytime soon. The pair simply struggled to make any new ground above 1.5000 and failed every time to have a weekly close above it. Does this mean the bulls are headed for the exit? No – but they are less confident in the short term and will likely not consider adding positions until the pair touches the 20ema.

Scenario 2: The pair starts a sell off as bulls take profits for the year and exit out of the pair. The failure to close on a weekly basis above 1.51 caused them to lose confidence short term and look for a lower/cheaper entry. If this plays out, the pair should move within 1-2 weeks towards the 20ema. However with liquidity drying up by the end of next week, unless the pair starts getting aggressive today or tomorrow, this scenario fades in likelihood as santa comes closer to visiting us through our chimneys.

Scenario 3: The least likely is the pair gets really bullish and makes new highs. We feel this is rather unlikely so if you are thinking of throwing on massive longs, caution is advised as we do not feel this is the time, environment or overall location to be putting on heavy longs. Best to wait till new year with fresh eyes and hopefully a lower price.

GBPUSD

Failing once again to make a run for the Kumo Flat top and break it, the pair has now posted 3 straight weekly closes and is threatening an important base in price at the 6300 region along with the Kijun, Tenkan and 20ema. If we were to get a weekly close below this, we feel the pair would make a strong move towards 1.5700 which was the October low and launching pad for a 1300pip run. Keep in mind this was a perfect bounce off the Kijun which is not as stable now so any breakdowns this week likely lead to strong price moves once clear of 1.6200. It is becoming more likely GBPUSD will remain between 1.5700 and 1.6827 which is the flat Kumo top for the rest of the year so do not expect wild upside thrusts to end the year.

AUDUSD

Virtually but a cigar short of closing below the weekly Tenkan, the pair is threatening a break below the white line which has held since July (only below for 1 week) and essentially since March. A weekly close below this will likely target the 20ema which is down at 8800 where the longer term bulls will be tested and tempted to add positions. Keep in mind a break of this line would likely start a drop towards 8500 and perhaps down to 8200 where there is a good price base and likely where the kumo would be in such a venture. Overall, we feel the pair is showing signs of being over-valued and may need to unwind a bit before another push up towards parity is attempted but its unlikely bulls have the gusto right now for an attack on the yearly highs or 9500 so we expect at best a sideways consolidation between 9000 and 9400 but would not be surprised if a strong sell-off occurs as there is not much to prop the pair up except for a small 3 week price base at 9000.

USDCAD

The drifter of the pairs, price action is getting less enticing every week as we are seeing multiple inside bars with little breakouts and a lot of wicks on the weekly charts communicating a lot of rejections and un-clarity about where price should be for this pair. Its forming a wedge and a rather small one so these are generally environments to be avoided. There is a small base which we mentioned last week in the 1.04’s and we mentioned if you wanted to get long, that was the place to do it. It definitely yielded some profit bouncing about 100+pips off that figure but each week such a move becomes more dangerous and less recommended. The only other base to go long is at 1.0200 (yearly low). Beyond this, we do not feel any other longs will enter until a break of the 20ema which has not happened since April.

NZDUSD

The underperformer of the trend pairs against the greenback, the pair has now formed a short term range of price action between the Tenkan and 20ema with two rejections at the Tenkan and one at the 20ema. The good thing about this price action is it gives us clear plays on both sides of the market and out of all the pairs, we feel this is one of the better ones to trade with the established rejections. The lines in the sand are more clear here than any of the others so plays (light ones) could be made on both sides. With all the lines starting to go flat, the chances of this range holding (at least to the upside) are solid. A downside break is the more likely scenario but the jury is still out on that one. Any aggressive selling today or tomorrow would bolster the downside argument. Ultimately, we feel any strong dips will likely lead to price basing around 6500 which we feel is a good value area to establish longs for another run up to 7500.

Chris Capre specializes in using Ichimoku, Momentum, Bollinger Band, Pivot and Price Action models to trade the markets. He is considered to be at the cutting edge of Ichimoku analysis along with building trading systems and Risk Reduction in trading applications. For more information about his services or his company, visit https://2ndskiestrading.com