In this forex order flow video I discuss how to read the price action, order flow and the transitions behind trends or reversals.

Today’s article is going to discuss and dispel the 50% retracement entry myth on the pin bar strategy. The goal today is to talk about why this entry by itself is a complete misunderstanding of price action, order flow, and the pattern itself.

During this article, I will share two key points on why this is a sophomore entry on this commonly used pattern, how you can find a more optimum entry, and what you should be looking for.

Key Pin Bar Point #1

By itself – the 50% retracement entry is a completely arbitrary method. For those of you unfamiliar with this pin bar forex trading strategy, the idea is to take a fib-retracement of the pinbar itself, and enter on a 50% pullback into it.

Pin bars do not have some magical retracement level institutions and bank traders are looking at for getting into the pattern. The real power of the pattern is in both the trap and rejection of the price action.

Looking at the chart below on the 4hr Gold chart, we can the pin bar at the top of the chart marked A, and how its body and tail stick out of the prior bars (A’) high & close. When the price breaks the high of the first bar (A’), this brings in new intra-day breakout trend traders to get long.

Now the tail and wick of the pin is formed by sellers rejecting the bulls advance, and reversing their gains intra-day.

Once the market breaks below the highs of A’, this “traps” and stops out those bulls who got long on a breakout of A’. This trap forces them to cover their longs with shorts, thus fueling the sell side even further. But a few details have to be pulled out of this chart first.

- The highs of A’ are at the open of the next candle

- The close of the pin bar A is parked on a 38.2% fib retracement

- Neither of the above line up with a 50% retracement, so taking a long at the 50% retracement is completely arbitrary, and ignores the most recent price action

Now in relation to the first bar after the pin (B), we can see it never makes it to the 50% retracement, and stops right on the 38.2% level which was the most logical conclusion, as that is where the more active order flow was.

Taking a more detailed look with the 1hr chart below, we are looking at the same intra-day price action from the chart above, but with a little more detail using the 1hr chart.

Now the numbers 1-4, represent the 4hrs in the pin bar from the first chart. Even looking at this chart, do you see where the more dominant price action formed? You should be seeing it at the 38.2% fib retracement.

We can easily see this as the high of 1, the open and close of 2 and 3, the entire body of 4, along with the highs of 5, 6 and 7.

So as you can see, the 50% level has no meaning here, and is thus irrelevant as it ignores the most recent (and thus most important) price action.

Even the bars 9 and 10, blow right past the 50% retracement without even looking, and touch the close/open of bars 2 and 3.

This illustrates why the 50% retracement entry is a complete myth, and a sophomore understanding of both the pin bar, and how price action works. Thus, basing your entry on such an arbitrary play makes no sense and at all, and completely ignores what price action is about.

Key Pin Bar Point #2

If it’s not obvious by now, what you should be doing is basing your pin bar entry on the most recent price action around the pin bar.

This would mean using the prior bar at a minimum, along with the pins high, low, open and close.

The most ideal entry is not some arbitrary 50% retracement, but the actual high/low of the pin bar, or where the nearest key level comes in at.

Before all this, you need to understand price action context first.

Are we in a trend, or in a range? The difference between the two can have a significant impact on your entry.

From here, after you have assessed all this, you can see get a good gauge of where to place your entry.

Using another example from a proponent of the 50% retracement entry, the EURUSD recently formed a pin bar on the daily chart. The suggestion was to get short on a 50% retracement. Below is the daily chart of the EURUSD, and the projected entry.

Now first thing we have to do is ask ourselves what kind of price action environment are we in?

Are we in a trend or a range? It should be obvious we are in a range. Thus the golden rules apply, that when in a trend, trade it like a trend, and when in a range, trade it like a range.

Now using this chart above, we can see the range outlined by the box.

The pin bar is marked A, and the fib levels are 1, 2 and 3, for 38.2, 50, and 61.8% retracement levels. Now, although there is some decent price action around both the 38.2%, and the 50% retracement levels, the bottom line is we are in a range – so selling at the arbitrary 50% level is selling in the middle of a range!

Do you really want to sell in the middle of a range? I didn’t think so.

If you really look at this chart, you will notice a ton of rejections around the key resistance level line at B, so your minimal entry should be to get short at B. But, since its a range, we don’t want to consider getting short till the upper regions of the range.

This would mean the pin bar high at a minimum. The more premium entries would be above this in the last 10-15 pips (i.e. upper end of the range).

So hopefully you can see how the 50% retracement entry is not only arbitrary, but a complete myth, and a huge misunderstanding of price action and the pin bar.

Going for a 50% retrace entry each time will get you a retail traders entry, not a professional one.

What we need to be doing as traders is

- Knowing what environment we are in

- Looking at the most recent price action, and

- Then determining our entry and how to trade the price action.

But, it has to be asked what was the end result of this 50% play?

The Euro naturally went above the pin bars top, stopping just under the range high, and thus stopping out those who entered on the 50% entry.

In Summary

When you breakdown this arbitrary entry method to trading the pin bar, and start really paying attention to the most recent price action context, along with how PA really works, you will begin get a better understanding of how to trade both pin bars, and price action as a whole.

This skill works for any pattern, environment, pair, time frame, or instrument.

Thus, I hope you found this article both challenging & provocative, but more importantly – insightful on how to trade pin bars, and price action as a whole.

Today’s forex strategy article is not going to be your typical ‘how to do trend trading‘ article, where you see the perfect pullback setups, hear about ‘trading from value‘ , or ‘1, 2, 3 reversal patterns‘, or about ‘naturally occurring swing points‘. These “How to Trade Trends” articles paint a one sided picture on how trends work, but really fails to give you the underlying models and mechanics to trade trends profitably.

I’m guessing many of you have tried utilizing trend trading strategies, but either;

- a) got stopped out trading the breakout, or

- b) waited for a pullback that never came as the pair falls 100’s of pips flying to your target & no profits

- c) maybe you got into the trend, only to find it to all of a sudden reverse on you

Has this happened to you before?

I’m guessing it has, so I’m going to share with you what you’ve been missing regarding trend trading, how to understand it, and when to know what strategies to trade and what to avoid.

The Most Critical Point to Know When Trading Trends: Learn to Identify the Type of Trend You Are In

Before you can decide what forex trend trading strategy to use, you have to understand the type of trend you are in. If you don’t understand the trend and price action underlying it, you’ll be looking to ‘trade from value‘ in a pullback when a breakout strategy is what you need to get in and profit.

On the flip side of this, you may be looking to trade a breakout, only to find yourself getting stopped out when you should have been looking for a pullback setup.

How do you avoid this?

Identify the price action and order flow underlying the trend correctly. A simple way to do this is to look at the number of counter trend players in the market, or “level of imbalance“. For example, a trend that is highly “imbalanced“, is either heavily bullish or bearish, and this will reflect in the price action. I like to look at it as either strong participation from the counter-trend players, or very little at all. Two charts below will give you a good idea what the two look like.

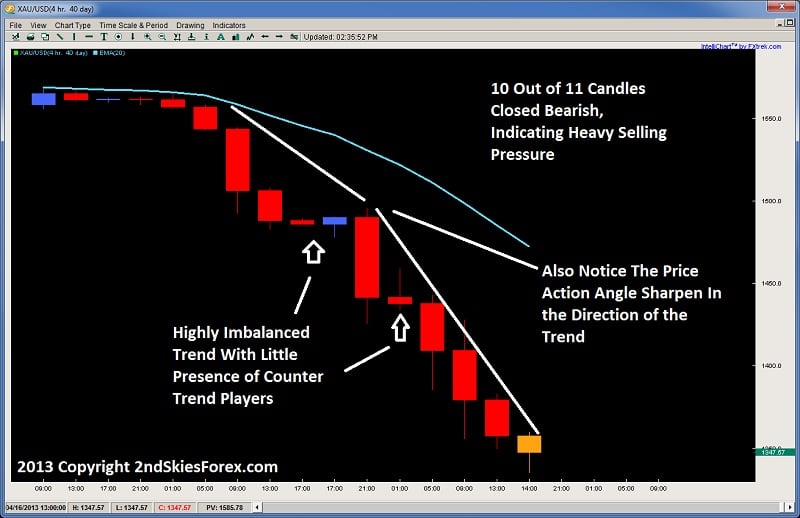

A Highly Imbalanced Trend With Few Counter-Trend Players Gold 4hr Chart

Looking at the chart above, we can see from the consolidation breakdout at the top left, the selling was quite impulsive and highly imbalanced in favor of the bears. 10 out of 11 candles closed bearish, or 40 out of 44hrs. This kind of price action trend shows very little presence of the bulls – so little they can only muster a single 4hr bull candle.

Looking for pullbacks in this type of trend trading will leave you missing the majority of the trend, while watching thousands of pips go by and no profits in your account.

Thus, in these types of trends, you want to be trading breakout strategies which will be highly effective since the momentum and order flow is behind you. Strong trends like these tend to support your breakout trade, and push the price action heavily in your favor.

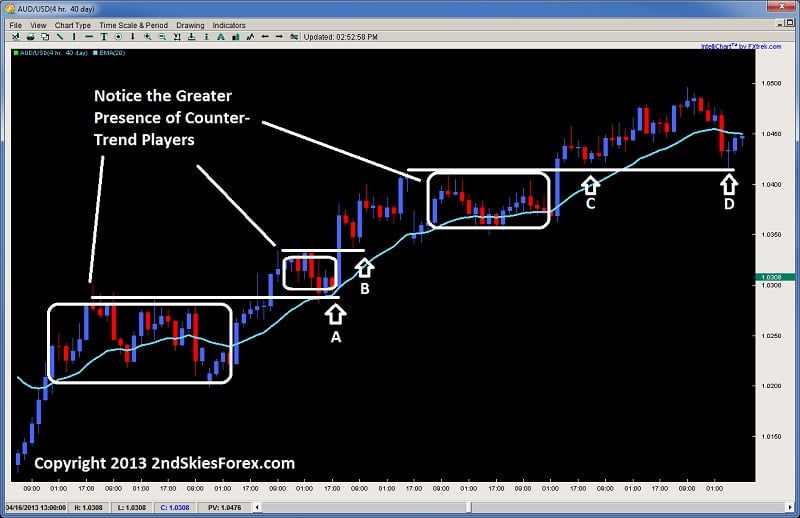

Now take a look at a different example below, using the AUDUSD on the 4hr chart. You will notice in this chart, there is a much greater presence of counter-trend players, thus a less “imbalanced” trend. Although the bulls have control of this trend, there are a fair amount of sellers present as they are able to a) take control of an almost even mix of candles and b) push back much further on the price action.

AUDUSD 4hr Chart with Stronger Counter-Trend Players

During trends like these, breakout strategies will likely fail, and you’ll find yourself getting stopped out, only to find the trend resume shortly after.

Has this happened to any of you before?

It has to me, and I’m guessing you as well.

Along those lines, this would be an ideal order flow and price action trend structure to take a with trend pullback. This is same as trading from a ‘swing point’ or ‘value area’. Here is where this strategy flourishes, usually offering a clear pullback to either

- a) role reversal level,

- b) dynamic support/resistance 20ema, or

- c) a price action signal.

Does this make sense why your trend trades have not worked out before?

Can you see why you missed out on so many trends that kept on running like Forest without you?

Now you know why.

In Summary

Understanding ‘value areas’, ‘1, 2, 3 patterns’, or ‘naturally occurring swing points’ is not going to give you the tools needed to understand how to trade trends in forex, or any market for that matter.

All of those are are “reactive” models – and essentially fail to give you the most important tool – that of understanding why type of trend you are in, and what is the order flow behind it. When you can understand what type of trend you are in, then you can correctly apply the strategy, price action setup, or proper tool trade that trend. Otherwise, you may be using a hammer when you need a saw, and thus either stopped out, or missing most of the trend.

It should be noted, that although trends are ‘relatively’ the same between markets, they are not the same between bullish and bearish moves. Bearish trends as a whole (across all markets) are generally much more impulsive and imbalanced then bullish trends.

Why?

This is mostly due to the emotions behind bull and bear trends

Generally bullish markets are much more euphoric and take more time to form or bottom, while bearish trends are typically characterized by fear, and are much more rapid and forceful. Take a look at any major sell-off on the daily/weekly chart on any pair or instrument, and you will see this clearly in the price action.

There is more to this, such as the order flow behind bear/bull trends, but the volatility, impulsiveness and level of imbalance is usually far greater in bear trends than in bull trends. A great example of this is in the weekly chart below on Gold.

While your at it, look at any weekly chart on the Dow, and major Index, or currency pair, and you will see bull and bear trends are completely different from an order flow perspective.

Another thing to point out is trading pullback setups, or from ‘value areas‘ (also trading from key levels) really only offers you one tool to trade trends, which by itself is very limited. Thus, beware of people painting a rosy picture when it comes to trends, as often times the clear pullbacks to role reversals aren’t there. Yet while you are waiting for one, you are missing out on a highly profitable trend right in front of you.

Thus, learn how to trade and read the order flow behind the price action, so you can understand what type of trend you are in, and what kind of participation is happening from both sides. When you have this information, then decide if you need to use missiles or guns. When you do, you’ll find yourself missing less of the moves, having more winners, and profiting heavily from these great trending plays.

Today’s article will focus on forex trading support and resistance key levels as this seems to challenge many developing traders. Learning how to trade support and resistance key levels is critical, because in essence, this is where;

a) you will be placing your stops and targets, and

b) this is where the institutional traders are getting in

In reality, forex support and resistance trading levels are like ‘doors’ or ‘walls’, either they will be open or closed – either they will break or they will hold shut. Your success in support and resistance trading will be in determining when they will hold, and when they will break.

Thus, it becomes essential to learn how to read key levels so you can have a well defended stop, a highly efficient entry, and also have proper timing. In this resistance and support trading strategy article, I will cover two powerful tips for finding these key support and resistance levels.

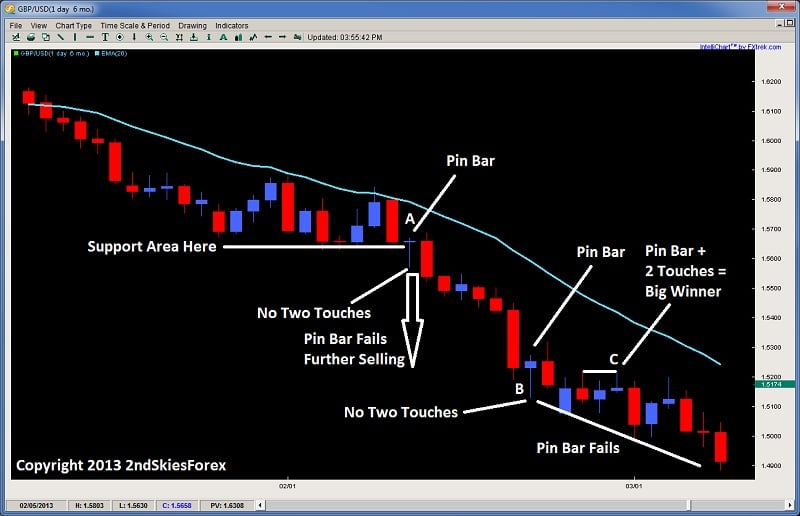

#1: Minimum of Two Touches

Before you can consider a level to be used as support or resistance, you will want a minimum of two touches.

Why?

Imagine you are in a strong downtrend, and the pair rejects off a particular price heavily – perhaps via a long tailed pin bar. You have to consider, with trend traders are just going to see this as a test. The bears know there are buyers off the price where the bottom of the pin bar formed, but they are not going to give up control of the trend just from a simple pin bar.

They are going to retest this level to see if the buyers there are strong enough. If they break it, then the trend and profits will continue. If not, then they will take profit, but it’s unlikely a reversal will start immediately. A good example of this is in the chart below.

Looking at the chart above, we can see the pair is in a strong downtrend. In the middle of the chart at A, it forms a counter-trend pin bar. Now although the pin bar body is at the prior support area, the tail is way below, and its the bottom of the tail where the buyers entered in, not at the support area.

Thus, the bulls at the support area were likely stopped out when price dipped 100 pips below, & the rejection from the pin bar occurred at a place with no two touches. So this would not be a pin bar to buy as you can see failed whether or not you used a 50% retrace entry (which can be quite inefficient).

You will also see the same later on with the pin bar at B, which also had a low at no known support area or formed a second touch. This also would have been a loser.

Now notice the pin bar at C which is with trend. You will notice the pin bar formed a second touch off the level two candles back. This would have been a good price action setup to get in because the second rejection would have confirmed the level. And you will notice, it turned out to be a winner.

So the main takeaway from here is look for the two touches, because with a one touch, the with trend traders will re-attack that level. And it should be noted there is a far more efficient entry than the 50% retrace entry which I will discuss in next week’s article, but keep in mind, after long tailed pin bars, you don’t have to worry about missing the entry.

Why?

Because if it is going to reverse, the greater probability is that a re-balancing, or ‘re-distribution‘ of the order flow will begin. This mostly likely will creating a range, or a corrective pullback. This is also why when you have an impulsive price action move, followed by a corrective price action move, it is more often followed by another impulsive price action move.

This is also the reason why an impulsive price action move is rarely followed by a counter-trend impulsive price action move. From an order flow perspective, this is because if the sellers are heavily in control, the buyers will have to overwhelm the sellers, and this requires a lot more money and orders then the current bears in control. This is the reason why V-bottoms are more rare than common.

#2: Trading With Trend Increases the Probabilities

You might have noticed with the chart above, that trading with trend was more powerful than trading counter-trend. As a whole, counter-trend trades are a lesser probability trade, so they take more skill, experience, and precision. This is simply because you are trading against the majority of the order flow, so the odds are already stacked against you. For those still having trouble getting consistency, I’d recommend trading with trend as much as possible.

Now if you are in a range, then there is no dominant trend, so trading reversal type plays are suggested, particularly at the tops and bottoms of the range. But when a strong trend is in play like the one above, you will find greater profit potential and accuracy trading with trend instead of counter trend.

This also holds true for trading support and resistance levels.

Why?

In a strong trend, the larger players are just looking for key levels as areas they can get in with trend. This is traditionally known as a breakout pullback setup, and generally does not need two touches off the level to confirm its effectiveness.

Why?

Because likely, in a trend, there will be a support or resistance level that is already being challenged, which would confirm there are buyers or sellers at the level trying to defend it, while the other side is attacking it. Once it breaks, the with trend traders often look for a pullback towards this level to get back in with trend. A great example of this is in the chart below.

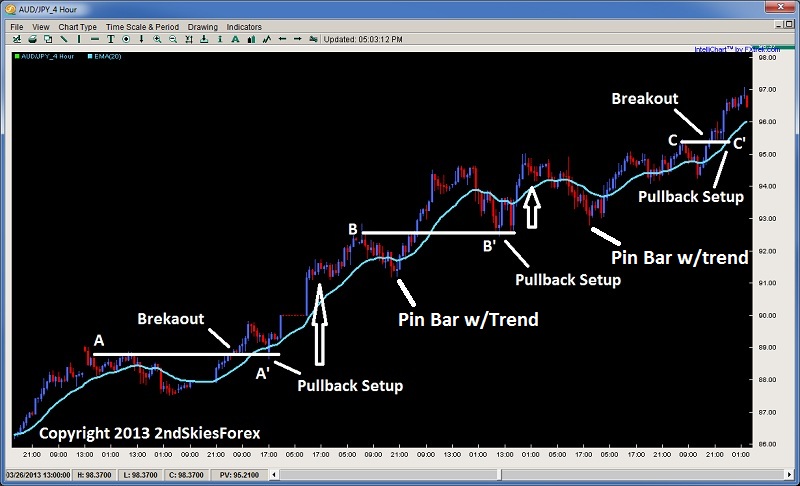

AUDJPY With Trend Setups 4hr Chart

Using the chart above, starting with the bottom left, price climbs consistently, gapping up, but then forming a resistance area at A. After a brief pullback, we can see price breaks through forming a new SH (swing high). The market then pulls back to the level at A, and at A’, forms an aggressive engulfing bar which starts the next up leg for over 400+ pips before forming a pullback.

The pullback at B which forms the next resistance high, dips just below the 20ema and forms a with trend pin bar. This marks the new impulsive leg up towards 95.00. Then price pulls back towards the level at B, and at B’, double bottoms (two touches) and starts another leg up and a nice with trend entry.

After a marginal break higher, price pulls back and forms another with trend pin bar below the 20ema, which starts another up leg towards a resistance at C. Sellers enter at C, and after a short pullback, break above it, with a brief consolidation at C’, offering a great breakout pullback setup to get in with trend.

Keep in mind, in all of these with trend pullbacks, the market pulled back towards the levle that it hat the strongest rejection from at A, B and C. The strong rejections at those levels are counter-trend players, trying to stop the trend. But when the bears tried to get past the last major resistance, now turned support (forming a role reversal level), the bulls used this as an opportunity to get long.

Yet in almost every case where the market formed a resistance, when the market attacked that level again, the sellers failed to hold the level. This is because they were going against the major order flow, which highlights how much easier it is to find key support and resistance levels that work when you are trading with trend, and not counter trend. So hopefully this highlights the difference.

In Summary

Finding key levels, and major support and resistance trading levels is not some Da Vinci code type endeavor. Two key things which really help this are using the two touch rule, along with trading more with trend than counter trend. Of course, there are other key clues to understanding support and resistance, but if you can employ these two techniques, they will greatly enhance your ability to find key levels, and make highly effective trades around them.

I had an interesting conversation with a developing trader about avoiding losses in forex trading. After discussing the subject with them for a few mins, I realized there seems to be a great misunderstanding about trading and losses. This is not surprising as there is a lot of sophomore information out there about these A+ setups, that good setups only occur on higher time frames, that you should only take these high quality signals. But this misses an essential point of trading and something that all professional traders understand.

The A+ Setups Myth

Beginning traders try to ‘avoid losses’ by waiting for these ‘A+ setups, trading like a sniper stuff‘. This is a big reason why they fail to make money. To trade successfully, you have to trade and think in probabilities. You cannot ‘avoid’ losses in forex trading. This fear, this rationalization & desire to avoid the inevitable, actually takes you away from a system that has an edge and understanding what is a high quality signal.

A great example of this is how a beginning trader wants to ‘avoid’ a loss by waiting for some perfect setup, as if trading is a fashion contest. They fear losing and thus rationalize not trading this setup which may have a lesser probability hit rate. But here is where so many beginning traders go wrong and what you want to avoid.

Understand What An Edge Is

If a system has a 33% win rate, this may seem low, but if it always hits a 4x target, (e.g. you risk 50 pips to get 200), then this system has an ‘edge’ and makes money over time. By waiting for these ‘A+ setups‘ and trying to ‘trade like a sniper‘, you avoid the trade because it is not A+ or high probability.

What this actually does is separate you from a system that is profitable over time, that has a mathematical edge, and makes money. Yet if you ‘avoid’ this trade because you want to ‘avoid losses’, then you are passing up a profitable equity curve which could provide consistent profits over time. It is critical to understand your edge, and trade it when it presents an opportunity.

But here is another crucial point about this topic.

You cannot ‘avoid’ losses at all in trading. Losses are part of the forex trading game. They are something you will have to get comfortable with, and not identify with, or value yourself based on the latest win or loss. Trading is really about getting comfortable with yourself, and getting comfortable with losses. They are going to happen just like the sun will rise and set.

Avoid the Misconception, Not Losses

Trying to ‘avoid’ that which is unavoidable will create a limiting belief in your head that only interferes with your trading. Understand that in reality, losses get you closer to your next win as you let the edge play out.

Don’t pass up an edge/system which makes money, simply to avoid the fear and psychological discomfort of the loss (which is really up to you how you experience them). Don’t fall for this ‘A+ setup, trade like a sniper motto‘, which is really a misunderstanding of trading professionally, and a sophomore understanding of it at best. So time to start thinking about trading on a new level, and avoiding the misconceptions about trading, not the losses.

If anything, you should avoid the mistake of thinking you can avoid losses, by only waiting for these magical A+ setups.

There is really nothing to avoid in trading, which is more about getting comfortable with uncertainty, and understanding losses are part of the game. When you start to do this, you will find yourself taking trades less personally, and executing with greater discipline, lesser emotions, and a clearer perspective on the what it is to trade professionally.

Today I am writing a potent article about pre-qualifying forex breakouts, particularly understanding them from a price action & order flow perspective. When you pre-qualify a breakout, you put yourself in a position to identify it as a high or low probability breakout. To do this however, you have to understand what makes a successful forex breakout trade both from a price action and order flow perspective.

In my prior article 3 Keys for Identifying Breakouts, I talk about 3 such parameters for pre-qualifying forex breakouts. They are;

1) Well Defined Support/Resistance Level

2) Pre-Breakout Squeeze/Pressure/Tension

3) 20ema Carry

When you can identify these prior to a potential breakout, you highly increase the probabilities of trading a successful breakout. But let’s dig into this a little deeper as to why from a price action and order flow perspective.

Order Flow Behind Breakouts

From an order flow perspective, breakouts generally start with an initial balance between buyers and sellers. This usually results in a range of sorts, with two clearly defined support and resistance levels. When you get several touches on these levels, this clearly communicates where both sides of the players are parked (and likely their stops as well). The more touches on these barriers, the more players are brought in.

Those who are bullish will get in on the bounces off support, while bearish players on rejections off resistance.

However as time goes on, tension starts to build between the two camps as someone will eventually want to take control. In almost all cases, the side with the largest number of orders and money behind their camp, will win this tug of war.

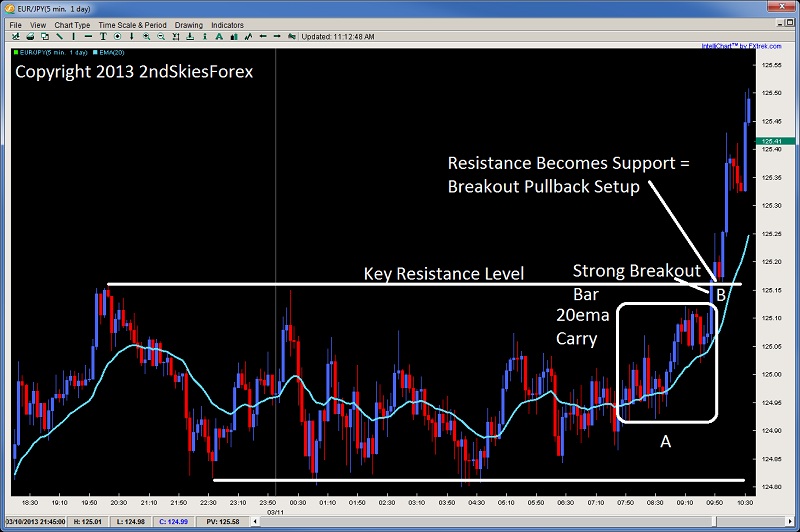

This usually manifests in a higher low (HL) or lower high (LH) being formed inside the range, and more aggressive pushes towards the other line in the sand, while less or no touches on the other side, almost as if the sellers or buyers could not reach the other support or resistance level. It usually looks something like the chart below.

Looking at the chart above, you’ll see a clearly defined support and resistance level with a minimum of two touches on each side. This tips us off to where the bears and bulls are parked on the chart with stops just above/below the levels.

Now you will notice each rejection at A & B minimally went up to 125.05 before coming back down and touching the same support level at 124.80.

C pushes price back up to 125.05, but this time the rejection fails to reach 124.80, and can only make it to 124.85. From an order flow perspective, the buyers are starting to get more aggressive and confident their level will hold, so they are buying up higher (at a more expensive price).

The next pullback at E is also higher, so we are seeing a continual change of hands by the bulls buying higher from support (and their defenses at 124.80).

Now notice every push up from B, C, D, and E only makes it to a maximum price of 125.05. But with F, it goes to 125.10. There were probably some intraday bears shorting at 125.05 (now stopped out), while the rest were still short at 125.15.

Now that price is pushing up towards the resistance without ever touching the support, this communicates the bulls are taking control of the price action with more orders and money, and will likely continue to squeeze the bears out.

This price action squeeze takes out smart sellers early as they recognize they are about to get stopped out if they stay in. The slower players stay in until they are at breakeven, while the slowest and most stubborn bears stay in till they are stopped out.

Using the chart above, we see the final stage of the breakout which is the 20ema carry in Box A. This “20ema carry” is a common price action formation prior to a good breakout, as it shows;

a) the mathematical representation of price gaining

and

b) gives bulls who haven’t entered a chance to get in prior to the breakout

This is followed by a strong breakout bar at B. This large bar should be curious, for why would bulls buy up so strongly heading into a resistance level if they were worried about sellers parked there. Usually, institutional traders can smell an upcoming breakout like this, so will push really hard to take out any stops as they go after the barrier.

A “strong breakout bar” is usually a really good sign the breakout will continue as it means stops were tripped above the resistance level, and price jumped aggressively in one bar. More ideal is if it has a good “clearing distance“, for if it does, then it increases the chances all the stops were tripped by going further away from the resistance level where most of the stops were near.

Tripping The Stops

It is this latter part – the stops getting tripped, which helps fuel the breakout even further, because those bears who were short now have to buy back, and this buying back to exit out helps further fuel the upside breakout. This is why if you ever watch the prices on your actual platform during a breakout like this, it generally reads (using 4 decimal places);

1.2999

1.3000

1.3001

1.3002

1.3003 (stops tripped)

1.3006!

You can always tell where the stops were parked and tripped, because price then jumps a few pips in a shot. The reason for this is – there were no sellers between 1.3003 and 1.3006, meaning the brokers could not print a price there since there were not enough orders there to hold that price. The stops being tripped at 1.3003 were sellers who now had to buy back, and when they did, they helped to push the next market price up 3 pips in a single tick or print.

When you see this, it usually means the breakout will likely continue – as long as you have done your pre-qualifying ahead of time.

One Final Note

Like all things, we have to pre-qualify a forex breakout using several price action characteristics ahead of time. The ones listed above are just a few of the ones we use in my Course, and there are several others which will clue you off and enhance the probability of the breakout being successful or not.

When you can pre-qualify them correctly, you will find breakouts quite easy to trade and accuracy levels around 60-70% as this is what my more profitable students are doing consistently just trading breakouts.

But, you have to pre-qualify them, like any price action setup. We never just trade them in isolation, as we are not pattern traders. We are price action traders, and we always trade setups & price action in context.

Any good system can perform badly without the proper context. Pin bars can be a highly effective system, if traded in context. But without understanding the type of trend, or volatility levels, you will likely lose money trading pin bars in isolation, even if you trade them at key chart levels.

Thus, we are never just trading patterns on a chart. We are always trading them in context, and this is exactly the same for breakouts, so always pre-qualify them ahead of time.

Look for the three characteristics above, try to trade them with trend more often then counter-trend, and you’ll find they can offer highly profitable trades, with some of the better reward to risk ratios out there, such as 3, 4, 5, or many reaching 7 or 9:1 reward to risk ratios.

One of the more difficult aspects for traders is placing highly effective stops. Either most beginning traders place stops too tight or too far away. Place stops too close to your entry and they are likely to get hit. Too loose and they unbalance your risk/reward ratios.

In today’s article, I’m going to share 2 tips for placing highly effective stops and how these can help you increase your accuracy and profit potential.

1) The Reason You Entered the Market

You should always have a reason to enter the market. Ideally it based on a price action pattern that has repeated itself in the past, and will likely do so again. All patterns have variables that repeat themselves, and it is this ‘repeating‘ we want to happen again, thus allowing us to profit from a predictable event.

If the reason you bought a pair was because the dynamic support and 20ema was holding on the 4hr chart several times, then your reason to exit should be a violation of this.

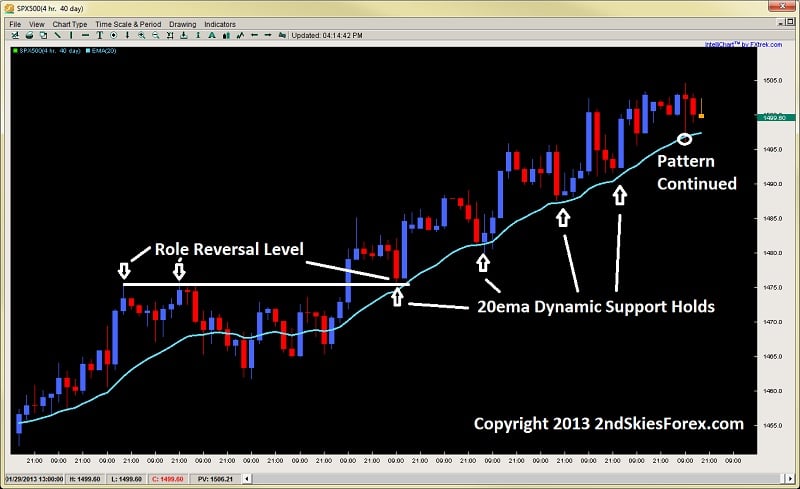

I recently wrote in my market commentary how the S&P 500 bounced 4x off the 20ema. If the reason for buying was the anticipation price would bounce off the 20ema again, then my reason for exiting would be the opposite of this happening. Today this is exactly how it played out, bouncing for a 5th time, and offering a trader to profit from it greatly (see chart below).

Now if the price action breaks and closes below the 20ema (something it has not done in 11 days), then the pattern has broken down, and it is no longer a tradable event.

But in terms of placing a stop with this trade setup, we could have looked for the largest breach below the 20ema over the last 11 days, and placed our stop just below this upon entry. Had you done so, you could have easily grabbed a 3x reward play on the last 20ema touch.

2) Stops Are Best Placed Above/Below Support & Resistance Levels

Institutional traders place their orders around levels more than anything else. When many orders from a lot of players with a lot of money, occur at a particular price, it often creates a strong reaction at a level. And when price ‘reacts‘ to this level more than once, it often becomes a key support or resistance level.

Thus, stops are best placed above or below key support and resistance levels. It is here that the larger players are placing their orders, and thus likely to defend your entry and stop.

If you do, then in following the logic of rule #1, we should be getting out of the trade if the level is clearly breached.

Lets take both sides of a potential trade below and see how we could have placed our stops effectively buying or selling.

EURUSD 4HR Chart

Starting with the left side of the chart above, we have a strong impulsive price action bull run, that finds sellers just below 1.3400 , or point 1. This selling pulls back to A where it finds support around 1.3250, and then re-attacks the sellers just below 1.3400 again at point 2. Now if you were a seller, and had seen price hold just below 1.3400 2x, and sold at pt 2, the logical place would be to put it about 10 pips above the round number, while targeting the buyers around 1.3250.

Why 10 pips above 1.3400?

Because this is a round number, statistics show typical stops for selling orders placed at round numbers are often within the first 9 pips above (so 1.3400-1.3409). Of course, always make sure price action confirms this, but this is a general rule you can use.

Now if you want to be a buyer in this case – taking a with trend continuation play, then buying at B or C, with a stop 10-15 pips below 1.3250 would have also worked out, targeting the resistance at 1.3400.

Now trades will not always be this clean in terms of support and resistance levels, which leaves you two options;

1) Only trade when the price action is really clean

or

2) Learn to place really efficient stops

I understand the latter may be more difficult to do, but you can find more high probability setups by adding a key component.

Impulsive Moves

One way to increase your chance of having a profitable trade, and placing an efficient stop, is to trade with trend more than counter-trend. When trading with trend, the majority of the order flow is already on your side, so look to consistently trade with impulsive price action moves, not corrective ones. If you can do this, then you will build your confidence in placing efficient stops, because you are getting in with the larger players.

A great example of impulsive and corrective moves is in the chart below.

You will clearly see how much more profitable one would be selling the impulsive moves (white boxes), and not the corrective moves (green ones). When you can learn to spot and trade with these moves, you will find your stops tend to get hit less, and your full profit targets achieved.

One Final Note

It should always be noted, when a beginning trader looks at a trade, they see profit first, and risk second. A professional on the other hand, looks at controlling risk first, then profit second. So once you have a trade idea and potential entry, figure out your stop – which should be placed where the market should not go if you are correct.

From here, calculate your risk in pips, and then find a target which can be easily achieved with consistency. If the math works, then pull the trigger, and let the trade play out.

In Summary

Placing stops tends to be one of the more confusing things for beginning traders, as they are often placed too far or too close to your entry. By learning to place stops close to key support and resistance levels, you will find they are more well defended than it no-mans land.

Also, by placing stops based on what the market should not do if you are correct, then you will find your stops get hit a lot less.

Lastly, when trading with impulsive moves, you increase the probability your trade will be profitable since you are trading with the flow of the larger players.

To learn rule based systems for placing effective stops, limits, entries and exits – make sure to check out my Price Action Course.

Kind Regards,

Chris Capre

Today’s price action tip article is designed to give any beginning, or non-profitable trader, 2 critical tips to help accelerate your learning curve and avoid the pitfalls almost everyone falls into. If you can learn to follow these two beginner forex trading tips, then you will find yourself making more winning trades, along with less mistakes that tend to get you in trouble.

Trading is already hard enough, regardless of your level, so integrating these two tips will help you to make more winning trades.

Tip #1: Trade Only When The Price Action & Direction Is Clear

Although this may seem confusing for the beginner, as price action rarely seems clear, there is actually a simple model to determine whether the price action and direction is clear.

The model I use daily to determine the direction/clarity of the market is looking for impulsive price action moves. To briefly sum it up, impulsive price action is when the institutional players (those that move the market) are either heavily buying or heavily selling the market. You can spot these moves by three simple characteristics;

1) The bars are quite large

2) They are mostly one color

3) They have closes towards the highs or lows (in the direction of the move)

When you see these three things, you almost always have an impulsive move. And when you have an impulsive move, those that move the market are predominantly pushing it in one direction, which is the direction you want to trade with. When you can find the correct direction, and trade it, you give yourself the greatest probability of making money.

An example of some impulsive moves are below, and you will see when looking at the chart, you will definitely want to be trading in that direction.

Looking at the chart above, you will see two colors of boxes; White and Green. If you look at all the white boxes above, you will all notice they have the three characteristics of impulsive moves described above.

Compare them to the green boxes – these have the opposite of the 3 characteristics of impulsive moves. These are called corrective moves, and for beginning traders, they should be avoided as a whole. When in doubt, if you do not have a clear market or impulsive moves, avoid trading.

Often times for beginning traders, finding the right direction is difficult, and it seems like you tend to find the opposite side of the move. By learning to only trade with impulsive moves and the price action is clear, you are saying to yourself, ‘I’m only going to fish when the easy fish are around’.

Tip #2: When Trend Trading – Best to Buy or Sell When the Prior Bar Closes in Your Direction

This is a general rule I suggest to use until you get really good at trading trends. The reason for this is simple;

a) If you are looking to buy in an uptrend, you have a greater chance of being correct when the last bar to close, closed bullish.

b) If you are looking to sell in a downtrend, you have the greater chance of being correct when the last bar to close, closed bearish

If you think about it – when looking to buy in an uptrend and the last bar closed bullish, it is a confirmation for the last candle (and time), the bulls were in control. This bullish close is more likely to inspire bulls the trend is still alive.

Contrast this to buying when the bears demonstrated control on the last bar. This means they dominated the order flow for that bar, and may be pushing against your orders. This increases the chance the bulls will take profit after seeing a bear bar as opposed to a bull bar (continuation).

However, if the bulls demonstrated control on the last bar, then they are likely still present pushing the market in your favor, so this gives you a greater probability to have follow through on your trade when you enter the market.

Two examples are below.

In this chart, we clearly have an uptrend, which offers a couple of with trend pullbacks. In these pullbacks, you will see two PBL’s (Pullback Lows), which led to a breakout of the prior SH (Swing High) for the trend. You will notice in both of them, the low for the pullback was a bull candle, and the follow up price action was a strong series of bull candles to follow.

Another example is in the chart below on the EURJPY 4hr Chart

In this chart, we have 3 major with trend pullbacks, and in two out of three of them, the PBL’s had a bull bar at the bottom, also demonstrating this principle. As a general rule, bulls will feel more confident buying a pullback (or breakout) in a trend, when the last bar closed bullish. This is a stronger communication the bulls have been able to take control of the price action and order flow for the last bar.

In Summary

Trading is already challenging enough, and finding the right direction is one of the most crucial aspects to making good trades. In the beginning, you already have enough to think about, so try to keep it simple, and trade when the direction is clear. Look for impulsive price action moves as much as possible, and when you find them, trade in that direction.

However, when the price action is not clear, try to stay out until a clear signal and market emerges.

When trend trading, you have a much better chance in the beginning, if you buy/sell when the last bar closes in your direction. This closing in your direction is a clearer communication from the market, the bulls/bears are more likely in control, and in your favor.

I hope these two beginner forex trading tips help you.

To learn more price action techniques and systems, make sure to check out my price action course where I have a large community of traders, posting live trade setups daily, and I teach them how to read and trade price action.

The learning process never ends for a trader. The market is always evolving and you have to adapt. Algorithmic trading was about 3% of the FX market in 04′. Now 28% of it is just HFT’s alone! Think that has changed the intraday price action? Absolutely!

Thus, you must always be learning, evolving and challenging yourself. There are always refinements and greater depths to what you are doing, whether you are trading price action, ichimoku or other rule based systems.

Regardless of your skill level in trading, you are going to make mistakes. I make mistakes, but I learn from them with alacrity. I quickly analyze what I did wrong, visualize what I would do differently, clear my mindset and get back to business. The difference between a professional & beginning trader is usually two-fold;

1) they make less of the typical mistakes beginners do

and

2) they rebound much faster, control the damage quicker and get back to business

Analyze your last year of trading in your journal. I’m willing to bet if you eliminated just one or two mistakes you continually repeat, your current losing year would have been a profitable one. If you ended the year break-even, then it likely would have been highly profitable.

Eliminating mistakes is one of the fastest ways to profitability. The sooner you discover, eliminate and transform them, the faster your equity curve will climb.

Thus, in the spirit of this, I will share my top trading mistakes for 2012 in the hopes you can learn from them.

1) Trading and Investing are Two Different Things

I am a trader first and foremost, but I also am invested long term in physical gold.

To ‘invest’ in physical gold, you constantly have to understand what is happening in the physical AND paper market. It helps to study central bank buying of gold, physical supply, how it is used as a safe haven against bad governments, etc.

However, I also trade gold using intraday price action strategies, and sometimes my methods/opinions on one get mixed with another. Long term I am a bull on gold, and have been since 2004/05 back at the $400 levels.

Many times in the last 3 months, I was long paper gold. Yet intraday price action would be screaming for me to get short. My broker allows hedging – so why wasn’t I shorting physical? Because my long term investing bias was interfering with my short term trading methods.

One of my top trading mistakes for 2012 was forgetting that I am a trader first and foremost, and to not let my bullish bias or investing strategies interfere with an obvious price action setup.

A good example is I bought paper gold at $1633, which I blogged about as a high probability breakout. At one point I was up 51x my risk, meaning for the 300 pips I was risking, I was up about 15200 pips.

By the time I walked away from the trade, I was only up 6500 pips. I didn’t follow exit rules because of my long term investment bias.

Remember, a trader and investor are two different things, and you must understand the difference.

2) Trading Against Impulsive Price Action

One of the base models I use for trading is understanding impulsive and corrective price action.

To sum it up briefly, impulsive price action moves are when the institutional market is heavily buying or selling and driving the price action directionally. With training and practice, you can learn to read the order flow behind price action, particularly by identifying these impulsive price action moves.

A few times this year I traded completely against these moves. Case in point – meet exhibit A, ironically on……wait for it……Gold!

Gold 4hr Charts

Looking at the chart above, you will notice on the bottom left points A and B which showed strong price action rejections. Buyers stepped in at this level, driving prices almost $50 higher in about 6 days.

At C you will notice the pin bar at C which was the second sign the bullish move was ending. Any idea what the first was?

Regardless, after the pin bar, price action failed to make a HH (higher high) and started with selling off impulsively at D, then more sellers came in at E, and by F, once it broke the role reversal level, price got monkey-hammered dropping $30 in 4 hours.

I had a buy order at the support level at G, so made some profit on the bounce, but missed the fact the market was still showing impulsive price action selling.

So at H what did I do? I bought some again, hoping for a similar move. The result is below, but you get the idea.

Gold 4hr Chart Exhibit B

At the support level where my first long worked out, I went long again at H and the same level. Shortly after I was stopped out.

Instead of realizing I was trading against the trend and impulsive price action, I was looking for a reversal. I consequently missed the obvious breakout pullback setup at the same level I was looking to get long, which then became a role reversal level. This is what happens when you trade against the trend and your system.

Not only do you miss several good with trend setups, but after you get stopped out, you usually miss the follow up trade from your price action system to take advantage of the move.

3) Let Your Trade Run Until Your System Tells You To Exit

Barring any extreme or black swan event, I usually just let my trade run until my rule based system tells me to exit.

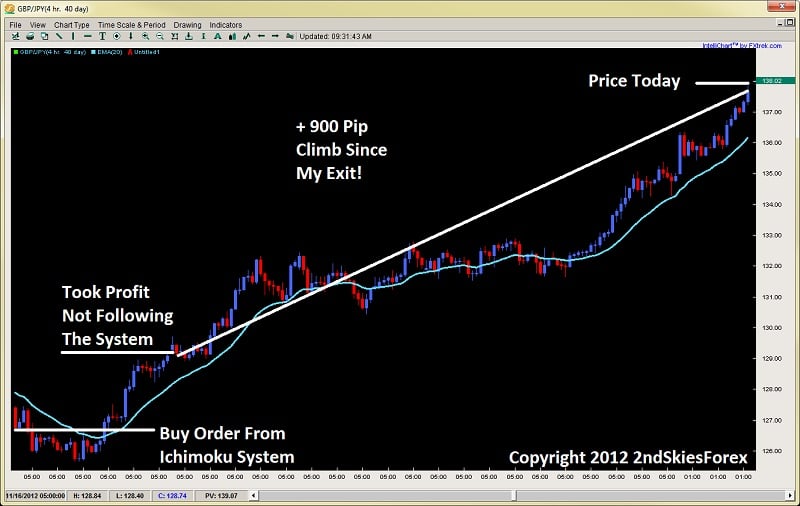

However on a recent buy on the GBPJPY, after getting a great entry and banking about +300 pips, I exited the trade, even though my system was still telling me to hold long and hadn’t given an exit signal.

Looking at the chart below, you can see on the top left at B a critical resistance level which started the massive 300 pip sell off.

Price started to show signs of exhaustion, and started a reversal. My ichimoku strategy picked up a buy order just above 126.60. Shortly after, price climbed rapidly gunning it for the same resistance level at 129.50. After the weekend gap rejected, I took profit banking about +300 pips.

Not so bad you say…until you look at the chart below.

Not only did my system hold on for another + 300 pips, but it gave me a re-buy signal around 132 and is still currently long today. I missed that one as well from being ‘upset’ about exiting early. Needless to say this would have over tripled my profits. Even though my system never gave me an exit, I got out of the position.

Not letting runners run is one of the most costly mistakes a trader can make. Yes, it is important to understand what is a high quality signal, but I’m guessing if you let just 10 of your trades run until the system gave you an exit, you would have made almost double your profits on those 10 trades. For me, it was actually 2.4x more. Food for thought.

In Closing

Part of trading is making mistakes, but a key component of your success is learning from your mistakes and making less of them over time. Regardless of your skill level or how long you have been trading, you will make mistakes. Anyone who only posts their successes and doesn’t admit to their failures is hiding behind a wall of fear and a false reality.

I make mistakes and I’ve been doing this for 12 years. But I learn from them continually and make less of them as time goes on. This translates into more profits, smaller drawdowns, less emotions, and a smoother equity curve.

Eliminating mistakes is the fastest path to making more profits. But the first step is becoming aware of them. This is where the trading journal comes in handy. If you’ve made 300 trades last year, are you really going to remember every mistake you ever made? Unlikely, this is why you have a journal, to help you become aware of your mistakes.

The second step is to actively work on eliminating and transforming them. If you repeat a mistake over and over again, then the cause is likely psychologically, and something that can be re-wired through ERT training and developing a successful trader mindset.

But the bottom line is you can transform your mistakes into strengths, and most definitely into greater profits. In almost all cases, making less mistakes can be the difference between a winning and losing day, month or year. And in almost all cases – will lead to significantly greater profits.

Kind Regards,

Chris Capre

I recently wrote a controversial article dispelling some of the misconceptions about the ‘Quality vs Quantity‘ argument, the ‘Less is More‘ being better for your trading. It has already garnered a lot of questions and responses on the web, which was its purpose.

But there are still some lingering and freshman ideas floating around there. Thus, I wanted to write a brief article to end the week highlighting some of the key takeaways, and what not to be fooled by.

High Quality Signals Only Come From Higher Time Frames

The idea that high quality trades, setups and signals only come from higher time frames really comes from an inability to see and read price action.

Ask yourself – what constitutes a high quality forex signal?

Some of the main components (regardless of time frame) should be;

1) a pattern that repeats itself with consistency and accuracy

2) a signal that offers low risk and high reward potential

3) a pattern that offers a clear entry and exit pattern

Let’s break down each one here so you fully understand them;

1) A pattern that repeats itself with consistency and accuracy

If you haven’t noticed, the markets are changing with daily ranges contracting massively and currently at 5 year lows. HFT algos now comprise 28% of the daily volume, but 3 years ago were 10%. So this would change how the price action unfolds considerably as they are using different techniques, technology, and patterns than traditional human traders would (or could).

Even though the patterns are changing, they are patterns that repeat themselves nonetheless, and for someone who is a real student of price action, you will be able to see these patterns on all time frames.

As long as the price action pattern is relatively consistent with both the formation and outcome, this is a key ingredient for a high quality signal, and thus a tradable event.

2) A signal that offers low risk and high reward potential

The size of my stop in relationship to my target is what constitutes a high quality signal. The greater this is above 2x reward v. risk, the better the quality of the signal. I still have to figure accuracy into the equation, as profit is really a measurement of risk, reward and accuracy.

Regardless, a 200 pip winner with a 100 pip stop offers the exact same profit potential as an 60 pip winner with a 30 pip stop. Assuming you risk the same on each trade in terms of % equity, they offer the exact same profit potential.

Now one thing should be pointed out;

Risking 100 pips, how many times would I be able to grab a 9x, or 11x reward play, meaning I could grab 900 or 1100 pips from that trade? I’m assuming not many at all, and something you’ve likely never done just risking 100 pips.

But what about risking say 10 pips and gaining 90? Since 900 pip straight moves are not common on a daily chart (maybe 5-6x a year), but 90 pip moves occur everyday, the latter once again offers more profit potential.

Just the other day, one of my price action course students did just that, snagging 128 pips on the day, grabbing a 9x reward play, an 11x reward play, and a 2+x reward play.

So you trading the daily charts only risking say 100 pips, would have needed to bank a 900 pip runner, an 1100 pip runner, and a 250 pip runner, just to equal what my student did in < 24hrs!

Ask yourself Mr. (or Mrs.) Daily Chart Trader Only, how many times will you be able to do that in one single day, let alone a year?

If you are on avg. banking 2x reward plays, and trading 3x per week, you would need an entire month of perfect trading just to equal his half day of trading. Add 3-4 losses in there, and you are talking 1.5-2 months to achieve what my student did in 24hrs.

Which would you rather do? Work for an entire month to make what you could in a day? Wait for months on end to find something you could achieve almost daily?

Food for thought, but high quality signals happen everyday. If you are not seeing it, you just haven’t learned how to yet, but with proper training in price action or ichimoku, you could.

3) A pattern that offers itself a clear entry and exit pattern

For any signal to be high quality, as discussed earlier, it has to be 1) repeatable and solidly accurate, 2) offer low risk/high reward potential, and 3) offer a clear entry and exit pattern.

For those that have read my article on understanding impulsive and corrective price action, you will remember my key model is to find impulsive moves and trade in that direction, as the next legs are likely to be a corrective move, followed by another impulsive move in the same direction.

Now using the same chart from my student below, look at the 4th trade which is the last one on the day (chart below).

Notice how he was using my model of following the impulsive and corrective price action, looking to short with trend on a corrective pullback and trade with the institutional money.

His first attempt failed for a small 4pip loss, but his second attempt caught a really opportune moment to get in, and immediately after his entry, the sellers came in with force, bottoming out with a pin bar setup that he recognized as a likely bottom, along with a few other clues from my price action course.

He ended up banking +25 pips on a 12 pip stop for a 2x+ reward to risk play, all in 15 mins.

Notice how he controlled the risk exceptionally well with precision and confidence, almost like a sniper would taking out his targets. For those with eyes, he had a clear entry and exit pattern, which is needed to have a high quality signal.

This was a high quality A+ setup that was obvious and was begging to be shorted. You will also notice he had a good strike rate, hitting 3 out of 4 trades for 75% accuracy, all while trading < 1hr charts.

To do this he had to be patient and disciplined. You don’t have to wait for days to find these trades, as they come daily. You just need to learn how to spot these high quality intraday price action setups.

He was looking for easy opportunities, acted with complete confidence, swiftness, precision and without hesitation.

He also avoided any risky situations, and used highly effective risk management, never risking too much per trade or more than necessary. He never interfered with his trades as you can see on trade 2, he had to be patient for the trade to mature. When it did, he took profit, but he never exited early.

And if you look at the 2nd and 4th trades, he was looking for the easy prey – the most obvious setups out there.

In Summary

As I stated in my prior article on quality vs. quantity – which is better for trading?, the ‘less is more‘ doesn’t apply mathematically and always hold up, as I’ve already demonstrated. Unless your accuracy is significantly higher, your ‘less is more‘ theory is actually a lot less profit mathematically.

Food for thought.

Now it should be stated I am not saying you should trade intraday only, or abandon the 4hr and daily charts. For those of you with full time jobs, families, and busy lives (many of you), I recommend trading the daily and 4hr strategies as these will be most suited to your situation and availability.

I always advocate finding what is most natural to you, your mindset and situation. This will always be the most profitable strategy you could engage in. For some that will be on the higher time frames and the ‘less is more‘ approach which has some advantages.

But for others, it will not be, as you have the skill set, mental aptitude, and availability to trade intraday. The key is to finding what would work best for you, and then learning that to the best of your abilities.

Just don’t fall prey to the ‘one size fits all‘ or ‘less is more‘ approach, because it may actually be ‘less’ for you.

To argue high quality forex trading setups only manifest on higher time frames is a sophomore understanding of trading price action, or trading as a whole. They manifest on all time frames, you just have to learn how to see them. That does not mean you should trade them all – just find a method of trading that fits you best.

Make sure though, you don’t fall for any one sided arguments saying quality is better than quantity, or vice versa, as the answer lies somewhere in between, and in reality – a balance of both!

Kind Regards,

Chris Capre