Today had produced some interesting price action plays, so I wanted to share with you two trades that I took today. I am going to break down exactly what I was reading from a forex price action perspective, what my analysis was, how I took each trade, including the entries, stops and limits, and why I chose them based on what I was seeing in the price action.

While the NZDUSD has been stuck in a range for the last two days, I have been playing the consolidation range which has held up nicely. Being that the Kiwi tends to be a little slow at times moving at a tortuga pace, I noticed a few price action setups in Silver (XAGUSD) and took a couple of intraday plays. It is these two intraday trades I am going to be dissecting for you from a forex price action perspective. I am also going to be sharing how I used quantitative price action data on the intraday volatility for Silver to aid my trades.

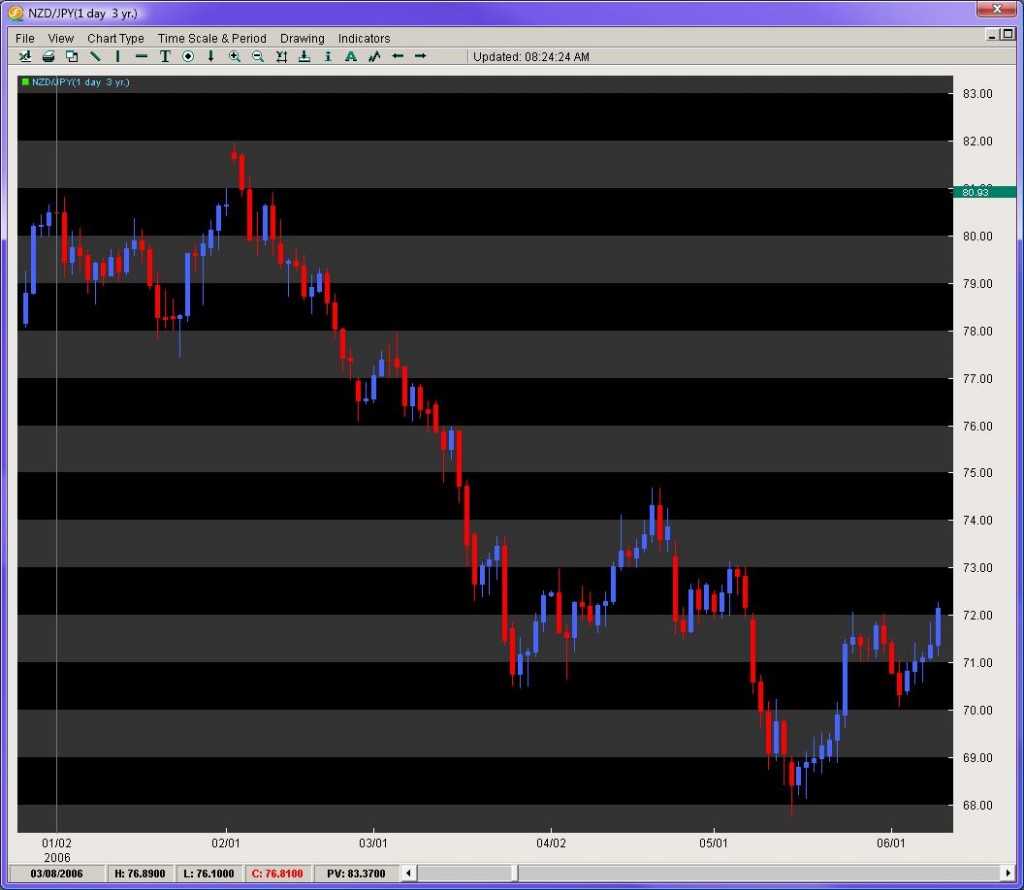

Taking a look at the chart below (3min on silver), following the grey vertical line which represents the London open, we can see price starts out a little choppy. For the first hour, price action stays within a $.20 range which is actually less than the normal volatility for this pair of $.30 for the first hour of the London session. This communicates to me there is actually very little directional dominance being a 33% lower range of volatility. If this continues, then I will look for a reversion to the mean play.

Why? Since no one dominant player is directing the market, there is still a tug of war going on with both sides being relatively equal. This means price will continue to revert back to the mean until someone takes control. Thus, I will look for reversal plays. As you can see by the price action, the small swing down was about the same strength as the small swing up.

At about the 2.30 mark (2.3hrs into London session), I got a pinbar formation. This is a reversal signal and definitely leaves me the chance to make my reversal play. However, I hold on the trade for two reasons;

1) If I took the trade on the open of the next candle, my stop would have needed to be about $.10 and my target to the last swing high would have only been about $.15 for a 1.5:1 Reward to Risk ratio.

2) The market structure has not given me a HL (higher low) which would have confirmed to me the market structure was changing and that I had a reversal buy in play.

These two things combined told me to put the trade on hold so I passed. Look at the chart below to see the resulting price action.

Initially, when the price action hit the prior SH (swing high), it sold off at a steady pace. But noticed how it picked up with a very large red bar toward the end, making a quick rejection low. This increase in the size of the bar communicated stronger selling participation. But it also had a small rejection to the downside followed by a gentle pullback (perhaps exhaustion). This was a small clue there might be orders close to the lows of the prior pinbar, so I watched for the price action to give me a lower low.

As you can see at the very end of the chart, it did, forming a double-pinbar. This double-pinbar formation communicated to me from a price action perspective two things;

1) not only was the first pinbar rejection a likely higher low offering me a good R:R play, but…

2) the second rejection was telling me after price made the first pinbar rejection, the market tried a second attempt to make a new low and failed. It failed at exactly the same price yet this time closed up on the bar.

Combine this with the fact price was still staying below its normal intraday volatility levels, and I had all the ingredients for a nice reversal play. All these together suggested a high-probability buy on the open of the next candle with a tight stop of less than $.10 while targeting the major swing high for the day at $33.85 (over $.33 away for a +3:1 Reward to Risk ratio).

Below is how the trade played out. It broke the prior swing highs, made a HL (higher low) and then shortly after went on to its target at $33.85. Keep in mind my entry was $33.51 with a target of $33.85 ($.34) and a stop of less than $.10 so over 3.4:1 R:R ratio.

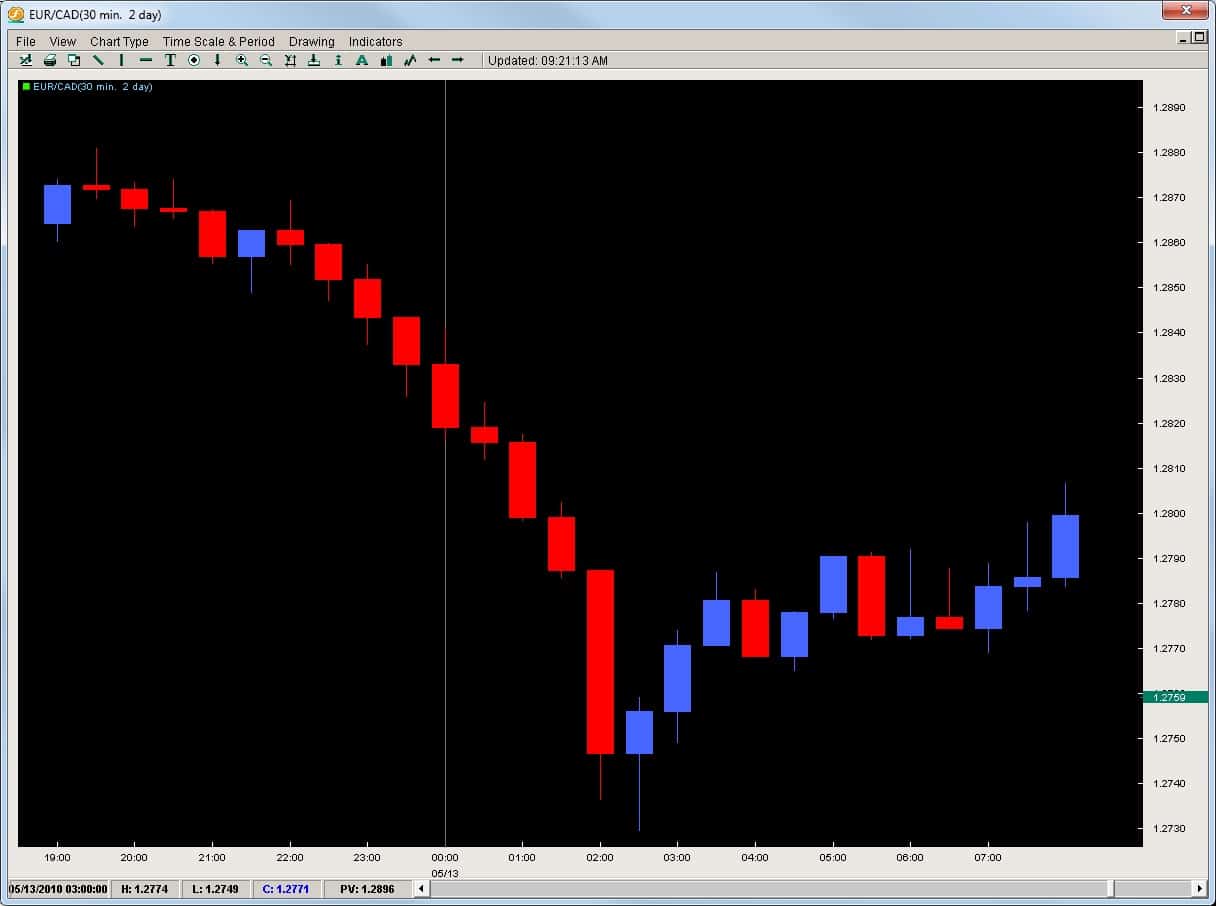

After hitting the first play on silver, it started to go on a run as it broke the SH (swing high). After breaking the $33.85 swing high, the market climbed over $.50 in less than an hour. Using my quantitative data on intraday volatility, this was approximately 20+% higher than the normal volatility ranges for this hour of trading. I’ll confess, I did not catch this upmove, but looking at it, I had two choices:

1) look for a market structure change to reverse the pair short as it may revert to the mean after the larger than normal surge in volatility, or…

2) look for a pullback to a prior value/support area and look for an entry to get back long.

I honestly didn’t know which of the two was a better play, so I watched the price action for clues. I want you to take a look at the next chart which shows the rise and fall of the shiny metal and take a look at the key difference between the two moves. See if you can spot the two subtle clues which communicated to me what I wanted to play.

First, notice how the angle of the two moves and the subtle difference. The buy up was a pretty sharp angle, while the sell-off, although impulsive in nature, had a flatter angle. This flatter angle communicated to me there was less strength in the selling then there was in the buying.

Secondly, look at the nature of the buying and selling. The buying was almost straight up with very small pullbacks telling me the buyers were quite dominant. While in the pullback, there was a see-saw type action, telling me the sellers were a) less dominant, and b) there was a fight going on between the buyers and the sellers unlike in the upmove. This all communicated to me via price action the market was likely going to reverse back up so I should look for a long after seeing a market structure change.

On the next chart below, shortly after the bottom, I got my market structure change. After bouncing off the low, the price actually bounced back into the prior range of the last pullback suggesting the buyers were starting to wrestle control from the sellers. Looking at the major swing low at $33.94 in the downtrend, if you look at the last two bars in the chart, you can see there was a rejection to the downside, followed by buying on the open of the next candle which went up to this key $33.94 level.

This rejection + the buying from the open was communicating to me the buyers were likely making their move. When I see that, I am going to buy that. I took a buy 1pip above this swing point at $33.95 with my stop below the low of the rejection candle prior, while targeting the SH for the day. This gave me a $.35 target and a $.15 stop for 2.33:1 R:R which was fine with me.

The market then climbed for the next 5 out of 6 candles suggesting the buyers had come in just before my move and I was riding the momentum of their buying. After a small rejection, the market went sideways, so since the bulls were still in control and had not conceded it, I stayed in.

Shortly, after a little further buying and small pullback, the target was achieved taking out the Swing High for the day as you can see in the chart below.

This is exactly how I took each trade, found my entry, stop, and limits – all using pure price action analysis, combined with favorable R:R ratios. This should give you an insight of how you can trade price action. By learning to read the market structure, looking for changes and subtle clues, then taking the most favorable plays that present themselves.

I would like to add that even though I am trading on a smaller time frame, I am not necessarily looking to be significantly more active. I am exploiting the same price action setups I see on the 1hr, 4hr and daily time frames. In fact, my methodology is really the same – wherein I am looking for a couple really high quality setups with very favorable R:R’s. These can be found every day, whether you are trading the 3min time frame, or the 1hr, 4hr and dailies. Your ability to read price action and all the clues will help you to spot the best opportunities, where the big players are driving the market, and how to find high quality setups.

For those of you looking to trade price action, visit our Advanced Price Action Course where we teach rule-based systems for trading Price Action.

If you appreciate our price action commentary and insights, please make sure to click the ‘Like’ button at the top of the page.