Watch as I execute two live price action trades on USDJPY & USDCAD, up +250 pips in total.

In this live trading video, I go through the price action context, explain my trade location, stop loss placement, my final target, and why I did not use a confirmation price action signal.

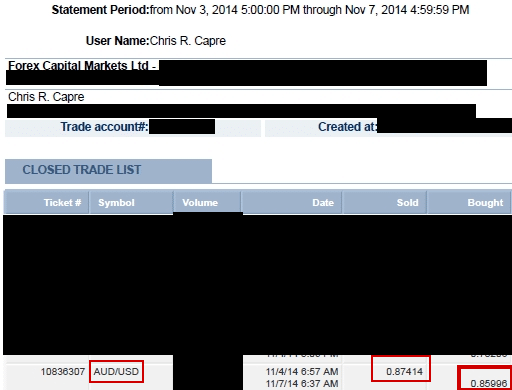

Here’s the transcription for the video (and just below is the follow up screenshot of how I traded it and closed it near the top when the price action changed in my mind and the breakout became less likely).

“Hello traders here. Chris Capre. 2ndskiestrading.com.

I have a few live price action trades that are running right now so I wanted to share with you a couple of them, my entry, my method for getting in, my stop loss placement, my take profit, why I chose these things, to give you an idea how I trade and how I teach my members to trade in the Advanced Price Action course.

So before we get into the trades, I just want to show you right here this is a live account, I’m trading with my own money right now. This says real, if it was a fake account or demo account it would say demo. So just to let you know I am trading with my own money. As you can see, these are moving in real time, everything matches here: 109 pips, 109 pips so it all matches.

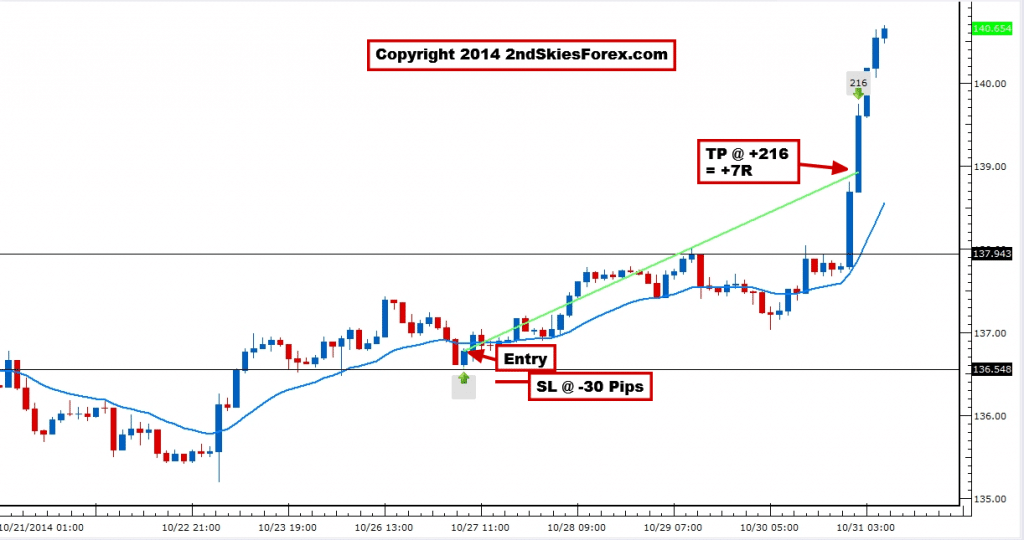

And so I’m in the market live right now. I’ve been in since December 3rd, late last week. This one is actually a relatively straightforward trade. USD/JPY has been in a bullish run as of late, after it broke out of a large range structure. Formed a nice impulsive leg up and then it formed a corrective structure which is outlined in this blue box here.

Now these structures are very important and this is important for understanding price action context. Generally when an impulsive move happens, like we have here, the next move is for the market to form a corrective structure which is like a balancing phase. And as long as the price action context and the bulls are still in control, then I’m expecting this to play out with an eventual move to the upside.

The great thing about corrective structures, especially in bull trends, is that they offer you with trend opportunities to get long at the base of the corrective structure. I actually had a trade setup right here before but I missed by a couple of points ’cause I was basing it off these lows here.

So when the market came back again I lifted it to just at the bottom of this low right over here to get myself into the market. I did not wait for a price action confirmation signal. Even though this formed a pin bar, if you waited for a 50% retrace tweak entry you would’ve missed it.

And so I didn’t wait for one here, and I just placed a limit order to get long at this level, assuming that the price action was gonna hold, the context was correct, and that my trade location was good. Even in this one here, this did form a pin bar, the thing about it is is that if I did wait for a 50% retrace tweak entry, my entry would’ve been poor. It would’ve been higher up and now I had less profit available to me.

This is important to understand, this is part of the reason why I don’t trade with confirmation price action signals. They give you worse entries, they give you retail entries. Sometimes you’ll miss the same move completely, a perfectly legitimate move. And they also give you lesser profitability.

Now, in terms of my stop loss placement on this one here, this is very straightforward. In this recent run up we had a move up here, it paused back and then a big breakout bar. My real reason for getting in the market was the base of this structure holding.

So I wanna place my stop loss below this here. How much? That kinda depends because I was getting in before NFP, I had to expect some volatility so I didn’t wanna keep it too tight. So I put it just below this here, a little bit below that. It’s about a 51 pip stop and I’m in here at 123.32 and the stop is at 121.81 so I have about a 50 pip stop and I’m currently about up about 109 pips. So I’m up a little over +2R.

And as you can see the trade never really went into the negative. It just happened to be a really good trade location. Does this happen all the time? No, it doesn’t. Sometimes trades are not ideal. In fact, I’m gonna get into one just shortly after this.

Real briefly though, in terms of my take profit, if I was trading this range structure, I should be getting out right about here with a nice +2R profit and that would be it. But I’m anticipating a breakout. If I’m wrong, I’m willing to take some profit off the board, bringing my stop to breakeven and hope for a breakout. And if it comes back down here again, I’ll buy it again assuming the range sructure’s gonna hold.

My target is actually a little bit higher here, just above 125 and a quarter. So with a 50 pip stop and a 300 pip target, that’s a +6R potential on the board.

Now, the next trade I’d like to show you here is one that’s not a perfect entry. It’s the kind of trade that wasn’t textbook and I’m not saying it’s easy. A lot of trades are more like this one right here.

This is the USD/CAD. So USD/CAD also in a nice bull run. We have an impulsive/corrective slightly choppy move up and we form a double tap here. So I’m looking to get long and I can either get long on a pullback but I miss this one here. Once we broke out I was expecting this resistance to hold.

So I just bought on a pullback, I didn’t wait for a signal. I just bought on the level assuming it would hold. It didn’t. Luckily I was right on two accounts.

One, I was right that the bulls were still in control and so I wanna be more long than short. Two, I was right on my stop loss placement. Which was below this swing here. So I placed it below this swing because I felt like if the bulls were in control, they shouldn’t make it back into the range too far and they shouldn’t make it below where this swing had started.

So with that being said, it turns out I was right. And what eneded up happening was the pair ended up forming kind of a channel like structure. An ascending channel. I didn’t see this at that time and it wasn’t fully formed at that time but as I re-evaluated, I realized “ok, this is actually what’s really happening out here”. So, if I’m correct, the channel structure should hold, it should continue to drift higher and if I’m right it should break out.

And that’s what it did here recently. I could’ve bought on the bottom of the channel but considering that I spent a huge majority of the time in the negative and only a decent amount of time in the positive, maybe 40% of the time, I really didn’t feel like adding on to a loser. I generally like to add on to winners, not adding on to losers.

With that being said, it turns I was right on this. It turns out my bullish price action context read was correct and that my stop loss placement was correct. And so in terms of the trade right now, it’s up 132-134 pips. My total stop loss on this one was about 110 pips. So with a 110 pips, I’m up about +1.25R right now.

In terms of where my take profit is, that is way up here. It’s at 1.38 and 1.38 is about a 450 pip target with about a 110 pip stop. So it’s about a +4R on this one here.

The reason why I’m showing this one is I wanna show you an example of a trade that’s not textbook and that’s not a perfect entry. The bottom line is that the majority of your trades will actually be more like this than the USD/JPY trade and these are the trades that challenge you the most mentally and psychologically.

But I trust my price action context, I trust my skillset, I trust my mindset and I trust my read on the market. I was willing to let this trade play out. So I wasn’t sitting there worried about “am I gonna get stopped out? what did I do wrong?” or anything like that. I just let the trade run, I held my stop loss as is and either I’m getting stopped out or I’m gonna make some money on this one.

And right now I’m making some money on this one.

I’ll probably start neutralizing the risk very shortly and I’ll probably bring it up either under one of these swings here, maybe even into some profit since we’ve broken out of this strucutre.

This is how I trade. This is how I trade with my own money and this is what I teach in my Advanced Price Action course.

So, with that being said, if you are interested in trading like this, then make sure to come check out my Advanced Price Action course where I give trade recommendations like this several times a week. I teach you the same methods I use, I teach you the same entry techniques and strategies. How I place my stops, how I choose my targets and how to build your price action skills.

I’m not just teaching strategies, I’m teaching you how to build your own price action skillset. So that you can learn to make your decisions yourself, find these trades yourself and make money trading.

So if that sounds interesting to you, make sure to check us out. Also come by 2ndskiestrading.com and take a look at all the other videos and articles we have on trading.

With that being said, I bid you all adieu. I wish you good health and good luck trading and I hope to see you in the course. Take care everyone!”