With the threats of war between Russia and Ukraine echoing through the world, countries are paying more attention to defense companies to boost their armories. Many stock traders have also remembered their defense stocks. Unsurprisingly, General Dynamics Corporation (Nasdaq: GD) stock has responded well.

Source: Konrad Ciężki

General Dynamics operates two major segments: aerospace and defense. On the aerospace arm, the company designs, manufactures, maintains, and repairs business jets. And on the defense front, General Dynamics offers marine, combat, and defense tech services.

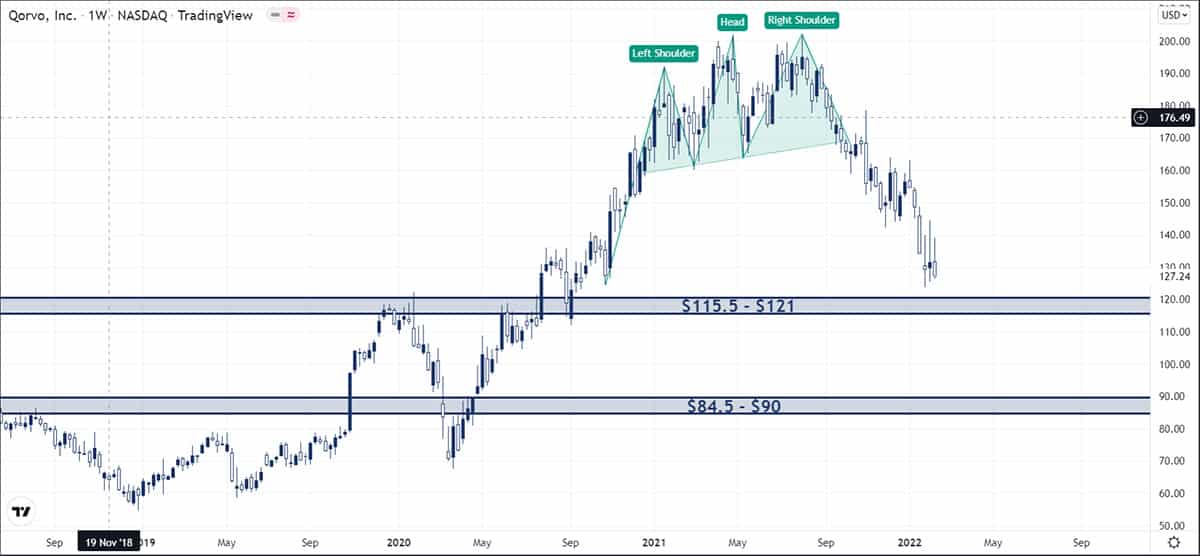

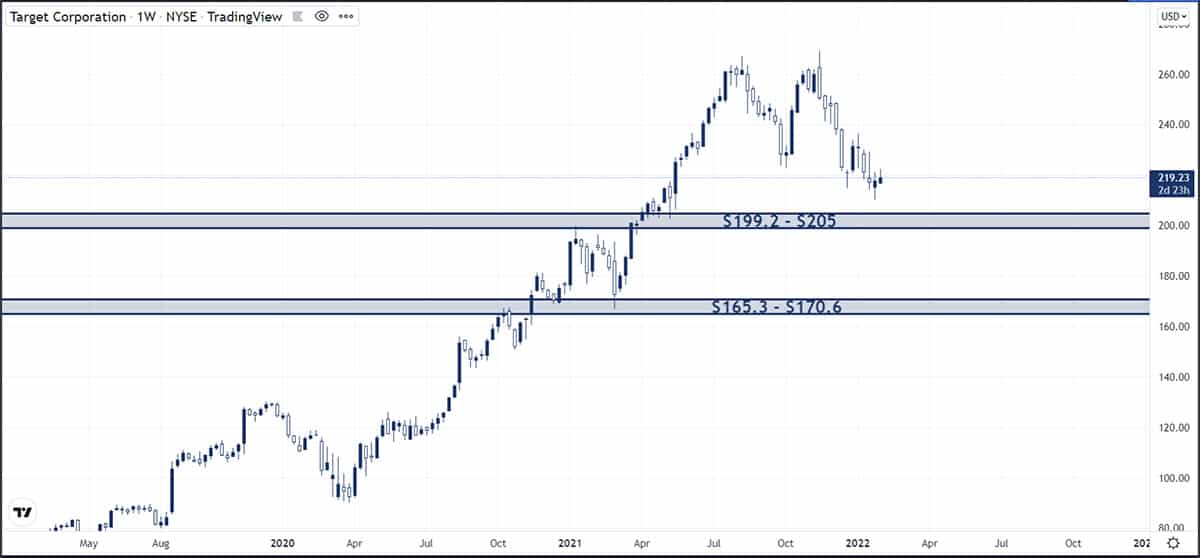

Signals and Forecast

Although the MACD signals that the General Dynamics Corporation stock is bullish with the appearance of a green bar, MACD divergence signals a potential reversal. And having touched the resistance line of its price channel at $218.8, there may be some downside soon.

However, GD stock has built up a steady upward trend since late 2020, and there’s nothing to suggest that the uptrend is ending time anytime soon.

Supports, Resistances, and Other Important Levels

GD is right in the middle of the $213 – $216 resistance level as we speak. The price temporarily broke out of this level on Friday the 18th, February, but quickly made a return to the middle of the support level on the same day.

While the breakout attempt on that day was unsuccessful, volume was on the rise in the previous 3 days. This suggests that there may be a successful breakout of this resistance level sometime this week. And if the stock breaks out of that level, there’s another hurdle awaiting it at the resistance trendline. GD would have to summon another breakout of this level to remain bullish.

Otherwise, we could have a short-term bearish move that brings the stock down to the $209.85 level. And in the worst case, the price could further fall to the middle of the price channel as it has constantly done in the past.

Is General Dynamics Corporation stock a buy?

We believe GD stock is a buy for the long term. There may be a temporary bearish move that brings the stock lower in the short term, though. But there are good positive signals for the stock, including a healthy up price channel.