Real Estate Investment Trusts (REITs) are one of the biggest hotspots for dividend investors, because they are mandated to pay out dividends. Yet, Realty Income Corporation (NYSE: O) still manages to stand out among many others for its dividend-paying exploits.

Source: Pixabay

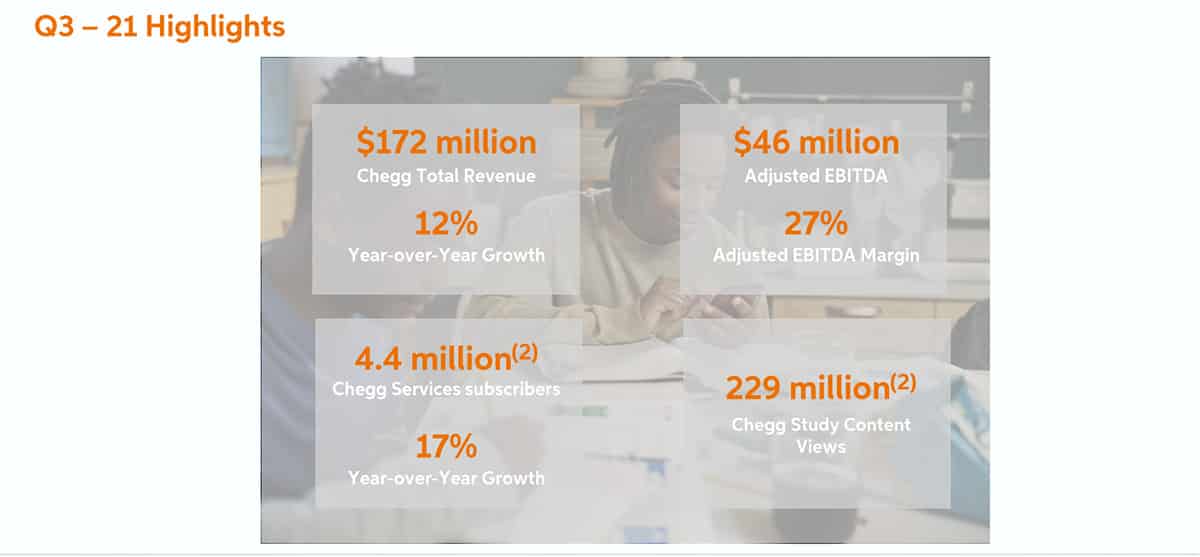

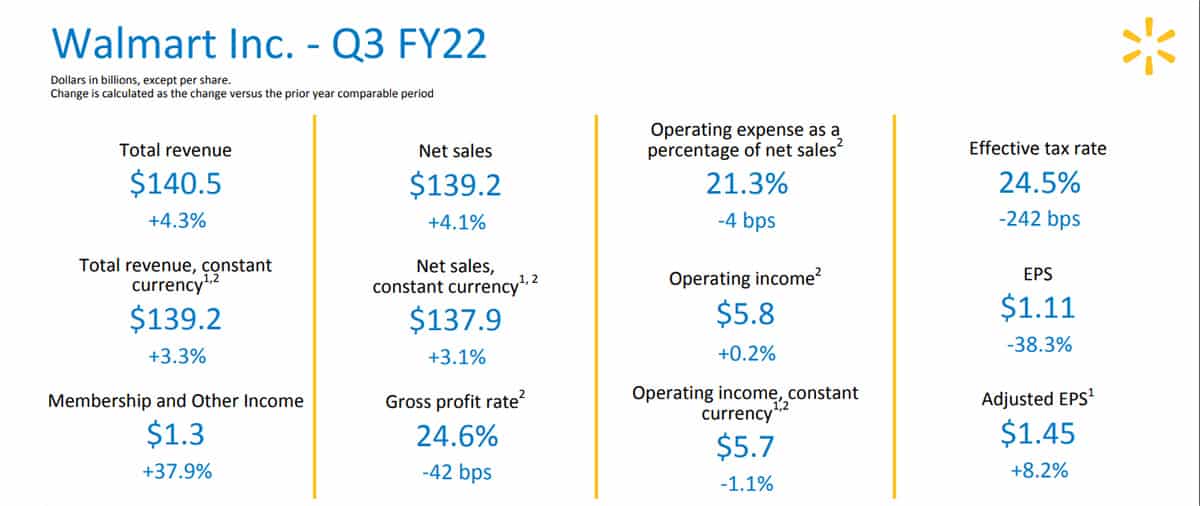

Realty Income is a REIT with a portfolio of over 7,000 properties. It rents these properties to commercial establishments on long-term lease agreements. The REIT, which is among the top 10 in the world, has big-name clients such as Walmart, Walgreens and Starbucks as some of its tenants.

As a REIT, Realty Income Corporation is required by law to pay dividends. The company has, however, put a nice spin on this, which has set them apart from all other REITs. Unlike many other companies that pay out dividends quarterly or biannually, Realty Income pays out every single month. The company gladly takes it as a selling point, hence dubbing itself “the monthly dividend company”.

In addition, Realty Income is one of the highly revered Dividend Aristocrats, a title reserved for companies that have been able to consistently raise their dividend yields every year for at least 25 years. This feat is tough enough for any company to achieve, but Realty Income makes it look easy by maintaining the standard, even in the generally difficult pandemic times. As I write this, Realty Income boasts of a 4.32% dividend yield, leaving S&P500 dividend yield in its wake at 1.27%. This figure makes it one of the top 25% dividend payers in the US.

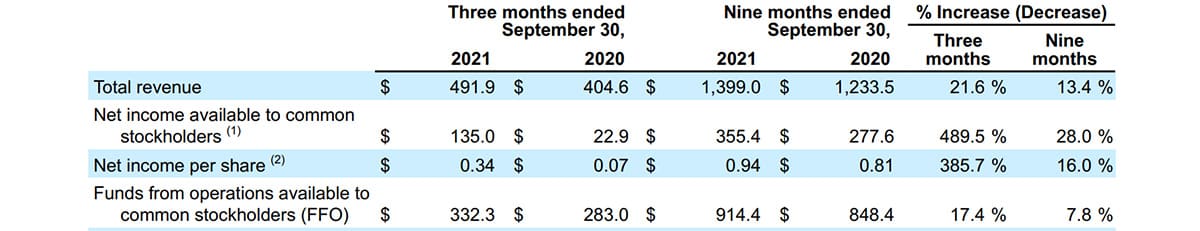

Source: Realty Income

Investors can also be rest assured that Realty Income is not struggling to keep up with its self-proclaimed “monthly dividend company”. Even after paying out shareholders, the company still has more than enough to keep its business running smoothly. In its most recent quarterly result, revenues increased by 21% to $491.9 million year-on-year. Similarly, the company’s fund from operations (FFO) was $332 million, out of which it paid $273 million to shareholders.

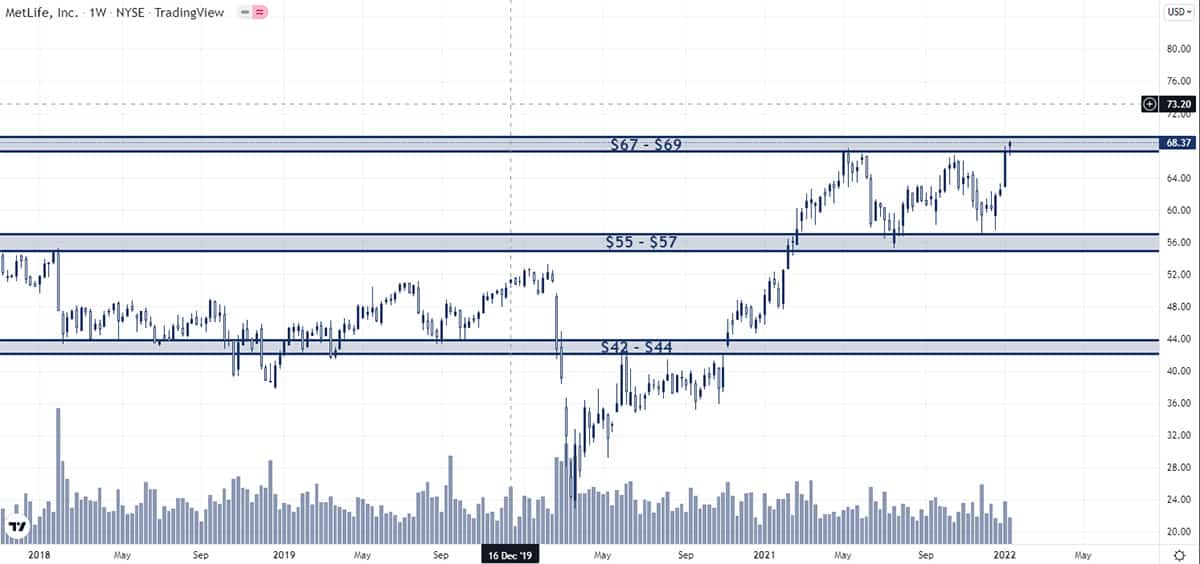

Technical Analysis

Three levels have proven again and again to be important in the Realty Income price action landscape since 2020:

- $53 – $55

- $63 – $65

- $70 – $72

As long as these levels continue to hold, there’s no way to tell for sure when and in what direction a breakout will happen. As such, we don’t recommend buying this stock for anything other than its dividends.

Long-term growth can’t be completely ruled out. But if the history of the stock is enough reference, long-term growth may be sluggish.