A video on how to build your emotional IQ in 4 easy steps

Free infographic on a practice to build your emotional IQ

Read more

Learn 5 simple steps on how to prepare for your trading day.

Here is a link to a meditation practice for traders

Learn the base model for understanding price action context

How to improve focus, emotional IQ and your trading psychology.

Read more

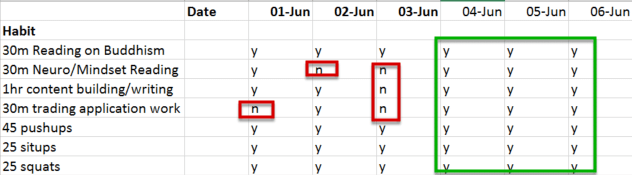

As promised, I have a 30 day challenge update for the first week.

Below is the table of the habits and dates up till June 6th (as I’m still completing today’s work).

So what you are seeing above is an excel sheet I keep open all day every day to track my progress. The results are below:

Day 1 (Jun 1) = 6/7 habits completed

Day 2 = 6/7 habits completed

Day 3 = 4/7 completed (no bueno)

Days 4 = 7/7 habits completed per day

Day 5 = 7/7 habits completed per day

Day 6 = 7/7 habits completed per day

My sentiments on the first week?

I feel the first two days were an adjustment of integrating such a large group of new habits into my day. The 3rd day started off bad and I have no excuses for not doing them. I take full responsibility for this low performance day.

So what happens after I make a mistake or have a bad day? I rally!

I’ve learned a far more effective response to failure is to use the frustration, pain, disappointment, etc. and leverage that emotion and feeling into performing better.

Instead of beating myself up and shrinking my self-image through negative self-talk, I’ve learned it’s far better to use the pain of what I’m feeling as motivation to work harder and do better the next time.

NOTE – It took me personally a long time to come to this place of rallying after mistakes instead beating myself up or engaging in negative self-talk. I learned this not when things were easy, but when they were most challenging and finding a new way to relate to these situations.

For you, perhaps the next time you feel down about your trading, challenged or frustrated with your results, try rallying your forces and see how you feel + perform. My guess is the results will surprise you.

What Did I Learn From Week 1?

1) doing the physical exercise feels great and I can feel my muscles getting stronger each time. My fatigue comes later in the series than before and my body is almost craving the feeling of doing these exercises.

2) It’s best to do the physical exercises first thing in the morning as it energizes me for the day. That + the fact I’m less interested in exercising after a long day where I feel drained. So perhaps a useful tip there for you.

3) I’ve missed 2 days of out 6 on the trading application work. Part of this is I didn’t plan out my work ahead of time, set clear goals of what I wanted to accomplish and create a plan of action for them. I did this on Jun 4th and it’s focused my sub-conscious and conscious mind to prioritize this work more effectively since.

4) I do better with the content building work before the afternoon (morning/mid-day) as my creative energy is still strong then. Evenings I seem to have less creativity so best to knock this one off early.

5) Working on form is always easier than working on the ethereal. What do I mean by this?

As I’m doing the pushups, situps, and squats, because I’m working on my muscles and body (form), it’s easy for me to see the results quick and feel them in my body fast. Contrast this to working on my trading application or my content building and I won’t likely see the rewards till later.

I think this is a major reason why trading is hard because it’s not based on the body or form where we can see steady results building right in front of our eyes. It takes more work and sometimes you lift the weights and do the hard work in trading, but don’t get the result.

And that experience can/will tug at your mind because trading doesn’t work the same way you normally experience results and progress in most of your life. If I had to guess, you’ve experienced this to some degree in your trading process.

This is why you need mental toughness for trading. This is why you need a successful mindset.

That is all for now. I hope you enjoyed this update and look forward to your comments on how your 30 day challenge is going.

We are on the heels of June and I’ve decided to take on a new challenge.

For the entire month of June (30 days), I’ll be taking on not 1, not 2, but 7 new habits.

I definitely like a challenge, and for me – a successful mindset requires successful habits.

Hence I decided to announce this challenge openly to you and others, sharing all the details along the way.

But before I get into the nitty-gritty details, I need to talk about habits and why they are key to your brain & success.

Why Habits Are Key To Your Success

For you to make money trading and achieve your goals, you’ll have to wire in successful habits.

But you currently have a problem. Your brain will do what it is wired to do most of the time (think 90+% on avg).

And your brain is not programmed to make money trading. So you’ll need to un/re-wire your current programming while creating a successful trading mindset.

Now how your brain is wired (wiring = habits) can be explained by one principle – neuroplasticity.

What Is Neuroplastcity?

Neuroplasticity is your brain’s ability to wire and make new connections. Its also the reason why you can unwire connections and bad habits.

There are two key terms for understanding neuroplasticity. They are:

1) SDN = self directed neuroplasticity

and

2) EDN= experience dependent neuroplasticity

To help you understand the above, just memorize the following statements:

1) Neurons that fire together wire together

and

2) Passing mental states = lasting neural traits

Now one thing that is implicit in the first statement is the following:

Neurons that fire apart wire apart

You’ve probably heard something similar in pop culture, such as the ‘use it or lose it‘ phrase. This statement is completely valid regarding your brain.

Habits are what you create by repetitive actions over a consistent period of time. Creating successful habits requires mental toughness because you’re fighting against your brain’s conditioning.

Once you’ve created a habit, your cognitive bandwidth is now available for other important activities.

Think of what your trading would be like if every time you spot a great trade setup – you pull the trigger without worrying about a loss. How would that help your performance on a day to day basis?

Hence your direct path to successful trading is to build successful trading habits.

NOTE: If you want to learn my personal methods for wiring successful habits into your brain fast – check out my Advanced Traders Mindset Course.

Front End Work For Long Term Benefits

Building successful habits requires most of the work to be done on the front end. What do I mean by front end?

To wire in a new habit, you have to physically (and chemically) create a new series of connections. This takes (at a minimum) consistent repetition over time.

How long? For the expert at this – about 21 days is the fastest you can do this. 30 days would be more reasonable.

What if you are not working 4-8 hours per day trading at least 5 days per week?

You’ll need about 90-180 days.

From my experience as a trading mentor who’s turned many traders profitable, this is one of the biggest reasons why many never succeed. The habit wiring curve takes just a tad longer than most are willing to do consistently over time.

Do you change your pair, price action strategy or time frames if you don’t get the results you want in a few weeks or a couple of months? Do you just jump from mentor to mentor and course to course as you continue to struggle?

If so, then you have a problem because you’re changing critical behaviors before you’ve fully wired in the habit.

Hence you never get the benefits of wiring successful habits into your brain. And then you eventually wonder why you cannot trade consistently.

Sound familiar?

Thus most of the work in building successful habits for you will come in the front end. The good thing is once you’ve wired them in, the rewards (and potential upside) are unlimited.

That sounds like a pretty good trade to me now doesn’t it?

Why Delayed Gratification Is Key

In your journey to create new habits, you’ll be fighting against a primal instinct. This is via instant gratification and one reason why our brains work against us in trading.

The key is to flip the script and opt for delayed gratification. The problem for you is – in a time of instant gratification, most of what you are exposed to works against this.

So you have to go against the grains of every day society and culture.

The bottom line is – if you want ot succeed in trading or life, you’ll need to seek out delayed gratification. This will direct your mindset towards building successful habits over time.

As you begin to add positive habits into your life, you’l build up your self-image along the way.

Having a positive self-image will increase your confidence. Eventually you’ll start to think and believe it is ‘like you’ to succeed.

You’ll believe it is ‘like you’ to accomplish what you set out to do. This is one of the most important things you can build for your mindset.

“The habits you wire in today will become the vehicle for your success tomorrow.”

In the spirit of wanting to build my self-image, habits and mindset, I’m taking on these 7 habits for the month of June.

The 30 Day Mindset Challenge: Will You Succeed?

For the next 30 days (without breaks), I’ll be adding the following habits to my daily routine.

Here they 7 new habits below:

1) 1hr of writing/producing new trading content per day

2) 45 pushups

3) 25 situps

4) 25 squats

5) 30 mins reading a book or article about buddhism

6) 30 minutes reading a book or article on neuroscience and/or mindset

7) 30 mins – 1hr work on the new trading applications I’m creating (will announce at a later date)

Looking at the list above, that is a lot of new habits to take on. We’re talking about adding 3-3.5hrs of work to my day every day for the next 30 days.

Normally I do not recommend taking on such a big load of new habits or hours to your daily schedule. However I have confidence in my ability to manage my time and get this done.

Will you take on this 30 day mindset challenge?

If so, I’d recommend starting with 1 habit to begin with.

Start small and work your way up. There is no point setting yourself up for failure, so work on something you can achieve. Just make it stretch your comfort zone a bit.

NOTE: For a great article about the comfort zone and how it determines your success in trading, click here.

BTW – if some of you are thinking ‘only 25 situps per day?’, my apologies as a) I’m getting older and b) I’ve spent far too much time in the seat lately 😮

All kidding aside (partially kidding…), what new habit will you challenge yourself for the next 30 days?

Write it below along with why you want to work on this.

IMPORTANT: Make sure to work on a habit that you can control the execution of.

For example – you cannot control the market and profits. Hence creating a habit like ‘I’m going to make $5000 per day trading’ will fail because it’s based on something you cannot control (markets).

This is why you only work on habits that you can control.

Now make sure to share below what one habit you’ll be working on for the next 30 days. Be specific along with sharing what it will mean to you to build this new habit.

I’ll be posting updates on this once per week every Tuesday at 930am so make sure to check back regularly.

I’m looking forward to hearing from you. And I’m willing to bet you’ll feel like a more confident version of yourself for completing such a challenge.

Until then – good health and trading to you.

UPDATE: Click here to see my analysis of Nial’s Fuller’s trades in the AxiTrader Million Dollar Trading Competition – it’s more shocking than I originally thought.

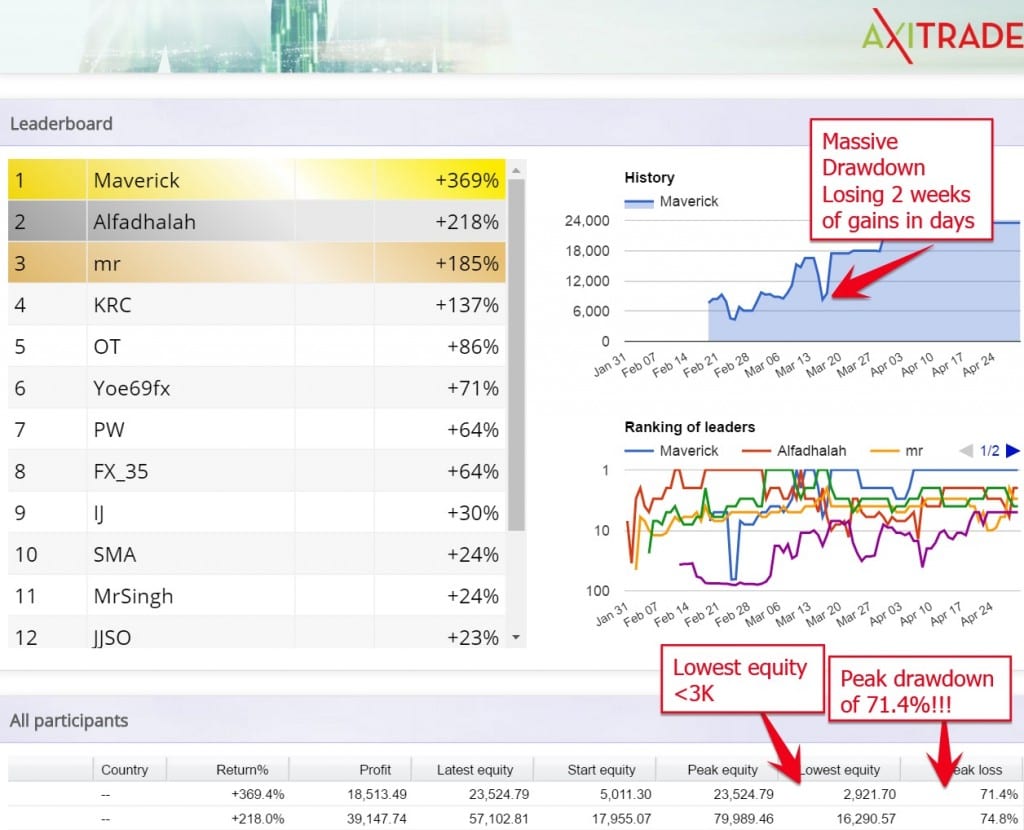

A former student of Nial Fuller who is now in my price action course asked me about Nial winning the AxiTrader competition.

Of course Nial Fuller talked about how he used “sophisticated money management strategies” and “wasn’t day trading“, but it turns out he lied – he was day trading, and was using horrible risk management.

With all things Nial Fuller, once you dig into the details, a completely different picture emerges from what he says.

So make sure to read this article about why Nial Fuller lied about his price action trading in the million dollar trading competition.

Now I’m not going to talk about the fact he and AxiTrader are business partners, or the fact AxiTrader actually allowed their business partners to join vs. pure clients. I’ll leave that to y’all to decide on.

But here is my summary of why Nial Fuller & AxiTrader represent everything bad about the trading industry below.

Only Nial Fuller would:

- Enter a trading competition with the absolute smallest acct possible (5k)

- Trade less than 10 times (by his own admission) for 6 weeks

- Completely throw risk and money management out of the window by having a 71.4% drawdown over 3 days!

- Another 50+% drawdown over another 3 day period!

- Call his risk and money management system ‘sophisticated’ (see below)

- Brag about it

And for proof, below is an image which shows you the details Nial forgot to mention about his heavy 71+% and 50+% drawdowns.

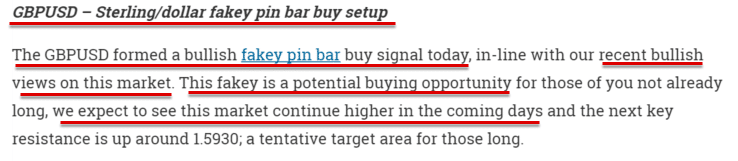

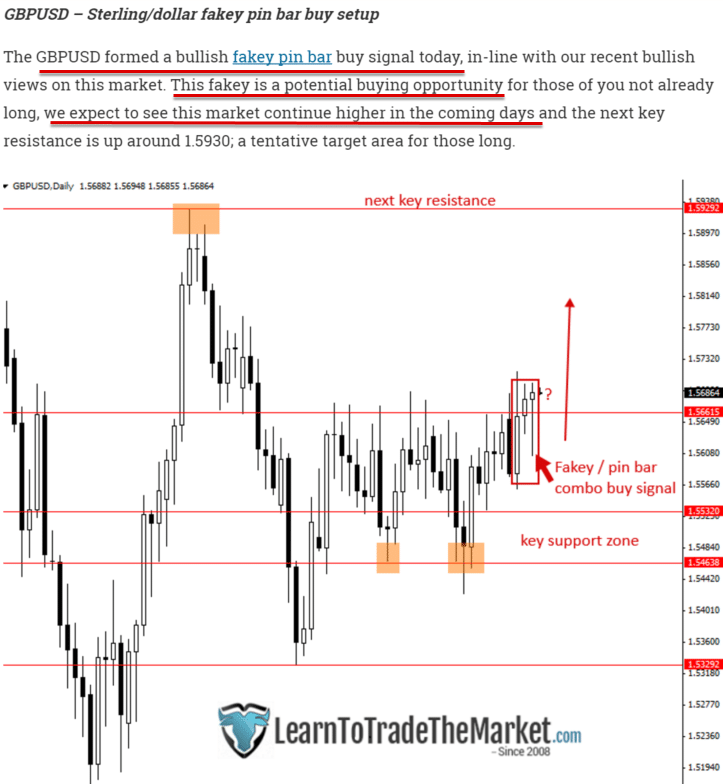

Keep in mind, this is the same guy who on Aug 20th, 2015 was bullish on the GBPUSD lauding his bullish fakey setup (commentary below).

Now make sure to remember the chart below & attached to this commentary.

Remember, this is a buy signal in line with his bullish views on the market.

Why am mentioning all this?

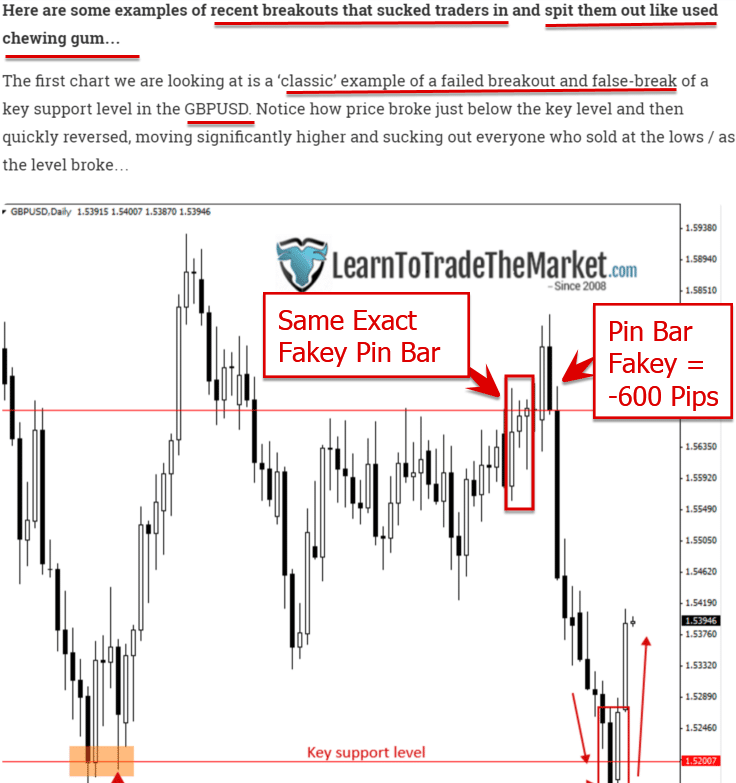

Because the same pin bar fakey setup Nial Fuller was lauding above, magically a few months later was a trade that “Sucked Traders in and spit them out like used chewing gum“ (in his own words – see below).

So which is it Nial?

Is this a great fakey pin bar trade that you were bullish on, or a ‘classic’ false break that ‘suckered traders’ (like yourself)?

And will you (ahem) Nial Fuller make some ‘editorial’ adjustments to your above article now that the hypocrisy is fully on display?

Inquiring minds want to know.

EDITORS NOTE (Jun 1 5.18pm EST)

After an editorial review, I realized I made a mistake. While Nial Fuller was bullish after the fakey pin bar combo that failed for 600 pips, the ‘false break that suckered traders in’ he was referring to was the break of the support level down below. My mistake and I apologize for the error.

BUT….

In a strange twist of irony, even when I’m wrong about Nial, I’m right. How so you say?

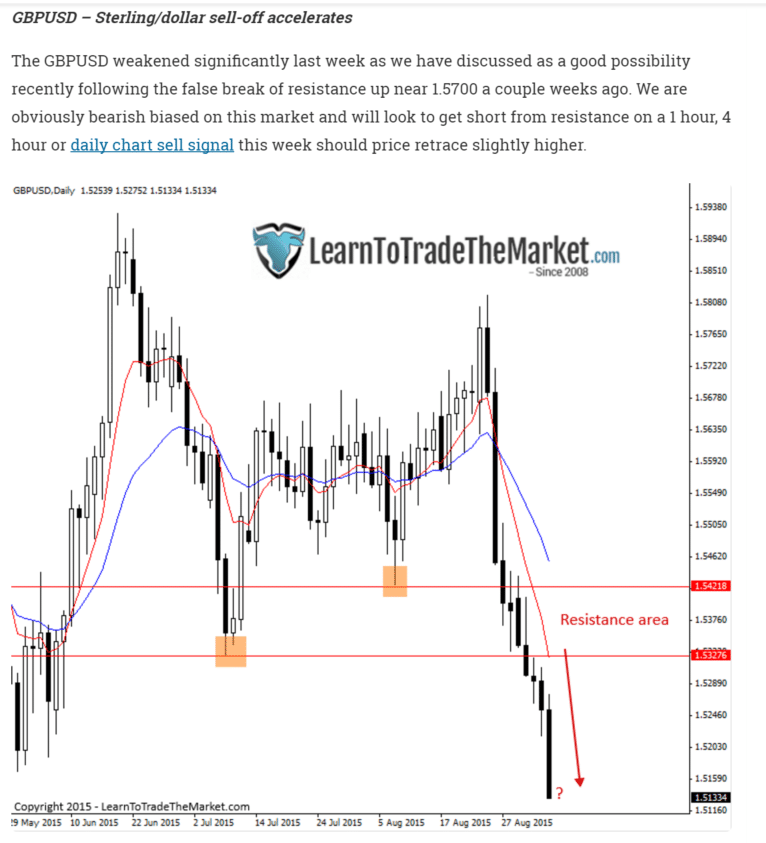

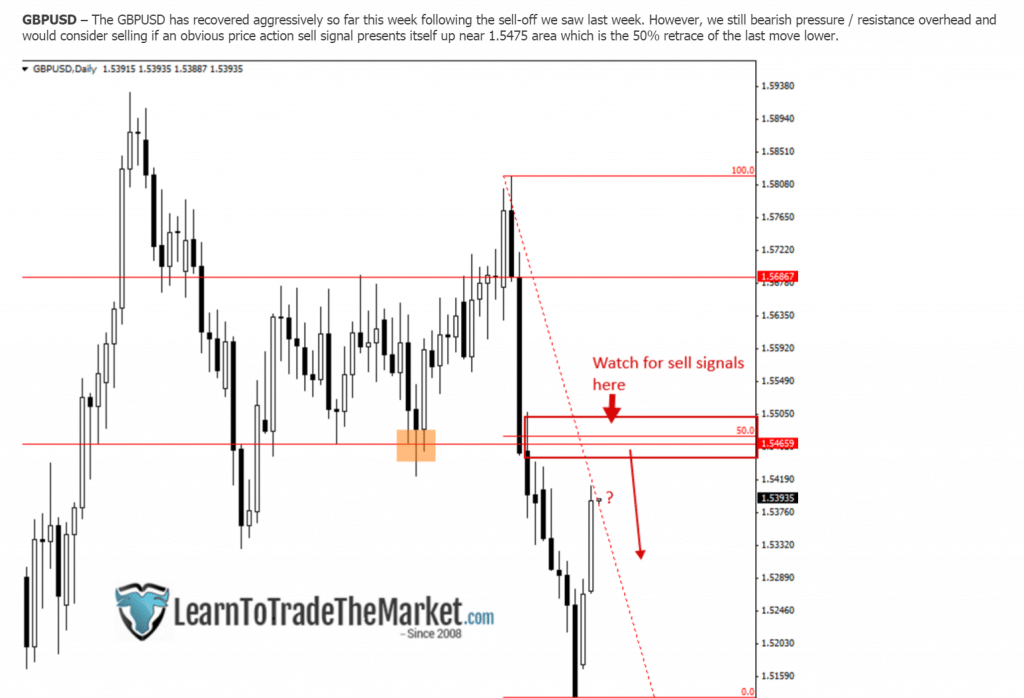

A look at this commentary of the false break that ‘suckered’ traders in ironically reveals the same thing. That he was ‘obviously bearish’ after the break of the key support level and looking to sell (see below – 3rd line).

To top this off with a cherry – after the market formed the famous false break, he was still bearish and would consider selling (see below as well).

So different trade – same result. He’s bearish, but later, he wants to point out any of you that were short were ‘suckers’.

Regardless, this should give you a good idea about Nial Fuller.

Along the lines of marketers and all things bad for the industry, only AxiTrader would:

- Invest $1MM in someone who threw money and risk management out the window

- With a 5K acct

- Over 6 weeks and do < 10 trades

- Produced a 71.4% drawdown + a 50+% drawdown

and say ‘YES, I WANT TO INVEST $1MM IN THAT GUY.”

Brilliant!

Now ask yourself the following question:

Who is Nial trying to attract with this promotion?

Is he going after the veteran trader? Is he going after someone who’s had a few years of experience and knows what is a reasonable return on risk?

Or is he going after the newbie trader who will only see the % gain and dream of tripling their account? And what kind of clients are AxiTrader going after by promoting results and performances like this?

I’m guessing you can figure out the answer (newbie traders who wouldn’t see the difference).

And this is why Nial Fuller and AxiTrader represent everything wrong with the industry. They talk about % gains, but fail to mention the risks it took to get said results.

In fact there was no mention of the risks or the downside. Only upside! Those don’t make for the best marketing materials. Nor do they make the return seem so impressive now do they?

They certainly don’t speak of a ‘sophisticated’ risk management system. But you won’t hear that from Nial Fuller or AxiTrader. And that is why they are bad for the industry (IMO).

Nial Fuller & AxiTrader are targeting newbie traders in the hopes they will open up an account playing on the idea ‘you too can triple your acct’.

But one last question naturally arises, which is:

When does making less than 10 trades over a 6 week period represent anything about one’s skill set or ability?

To put this in perspective:

- Would you understand a basketball player’s strengths and weaknesses over 10 shots sparsely taken over 6 weeks?

- Would you know what kind of golfer someone was by watching them hit the golf ball less than 10 times over 6 weeks?

- Would you feel comfortable putting $1MM behind a poker player whom has only played 10 hands over 6 weeks?

Let me know on which planet or universe you think this is a good idea. Yet this is what Nial Fuller & AxiTrader would want you to believe.

I know this article is controversial. I know it may irk some feathers. But I’m willing to bet many will cheer my sentiments/opinions on this as a key topic that has plagued the education industry.

Do you agree with what I’ve said above or not? If so, why not?

I’ll look forward to your comments below.

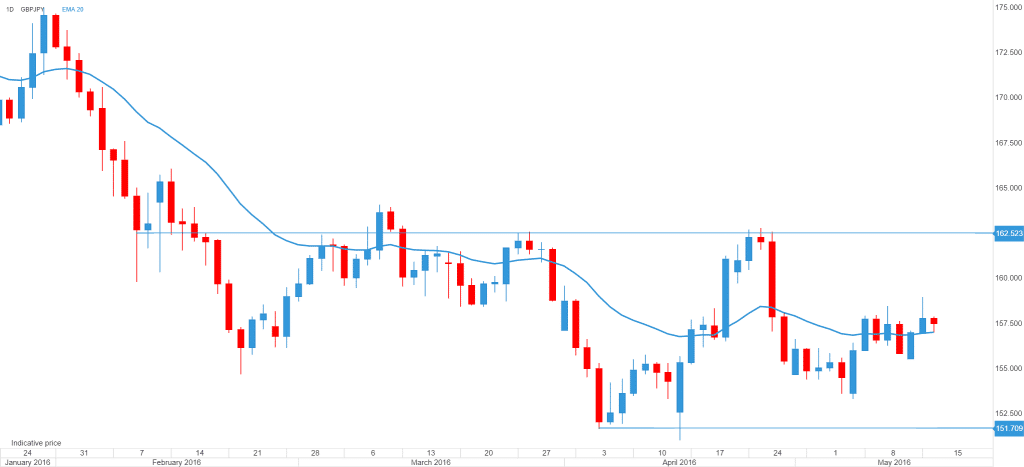

GBPJPY – Wide Volatile Range, Looking to Sell (daily chart)

For the month of May, the GBPJPY has been banging around a ~300 pip range between 157.50 and 154.50. Not much has technically changed as the volatile trend has produced a wide range at the moment.

For now my bias is bearish and I’m looking to sell on a rally into the key resistance zone around 162.50 – 164. Downside I’d be looking to target 157.50 and 155. Only a daily close above 165 would negate my bearish bias.

There you are, it’s your 6th, 7th, 8th, 9th or 10th loss in a row. It sucks, it doesn’t feel good, and you haven’t had a winner in a while.

Right now, all you want is a winner, yet you seem unable to get one.

After losing the umpteenth trade in a row, you are now actively asking yourself any one of the following questions:

1) What’s wrong with me?

2) What is wrong with my strategy?

3) Do I not know how to trade?

4) I can’t understand what I’m doing wrong. Why do I keep losing?

5) Should I do the opposite of my trade ideas?

Has this ever happened to you? It’s certainly happened to me.

Ironically, none of these are the correct questions, nor are they accurate reflections of your trading ability.

In fact, you could lose 20+ trades in a row, and still be a damn good trader who can make money that year.

The issue isn’t your strategy, or time frame, or instrument, or your ability.

The problem is your muscles are weak and they need to be developed.

No, I’m not talking about any physical muscle.

What I’m referring to is your trading mindset is lacking.

What it is lacking is the muscle (and skill) to understand and accept variance.

What is Variance?

In poker, there is a concept called variance. What variance describes is the mathematical possibilities about how you can win and lose.

For example, assume I’m playing Texas Hold’ Em poker. I have pocket kings, while one other opponent has pocket 2’s. Statistically over 1000 flops, I should win 79% of the time.

Now this is where understanding variance is helpful. Just because I should win 79% of the time, doesn’t mean I’m going to win the next 79 out of 100 hands, or roughly 8 out of 10.

I could lose the next 30 of the next 100 hands, or even 50, or 21 in a row.

On a basic level, ‘variance’ means that any combination of wins and losses within the statistical norm can and will happen. So when we have a baseline expectancy or win rate, anything above or below this would be a representation of variance.

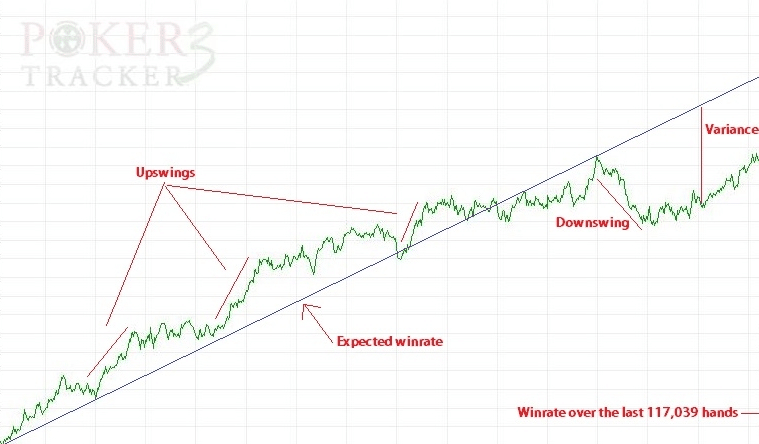

A good example of this is in a poker equity curve below.

It is this ‘variance’ and statistics that allows me to profit. It is also this variance which allows me to go on win streaks.

And it is also the same variable behind me going on a losing streak.

The ironic thing is no trader or poker player complains about variance when they are on a winning streak.

But god forbid we go on a losing streak, and our world + trading mindset crumble on the quick.

How Does This Relate to Trading?

Tying it all back, variance is how trading works. There is another name for this in trading called ‘random distribution’. This describes how your wins and losses will be randomly distributed.

The reason why this is such an issue for traders is threefold:

1) most struggling traders don’t understand or accept how variance works

2) most of you haven’t built the muscle (or skill) to accept variance

3) most of you haven’t learned how to detect whether your losses are due to variance (or something actualy ‘wrong’ with you)

Do you have any of the above? If so, it will negatively effect your trading mindset and hurt your performance.

In today’s article, I’m going to show you how the first point is killing your profits and why. I’ll also share how you can build your muscles to accept variance and detect if you are experiencing variance or a problem with your strategy.

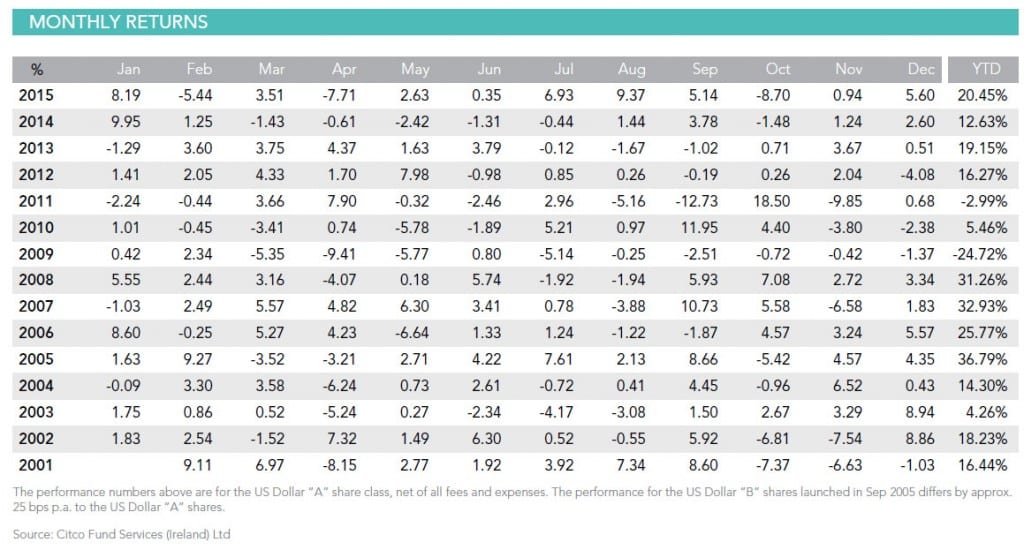

How Variance Works (example from a top hedge fund)

Have you ever heard of Horseman Capital? Probably not. Yet they are one of the top performing hedge funds over the last 15 years.

Since 2001, they’ve beat out about 95% of all hedge funds on the planet averaging about 15% per year.

Here is their performance since 2001 below (source: Horseman Capital).

$1 million invested with them at the start of 2001 would be almost $7 million today.

One would think with an almost 695% return, they’d never have a losing month, a losing quarter, and certainly not a losing year.

You’d be wrong on all accounts!

How many losing months did they have during this time? 64 total

How many losing quarters did they have? 17 total

How many losing years did they have? 2

What was there longest losing streak (in months)? 6

Now here are a few questions that have to be asked in light of this

How many losing months would you go before you change your strategy, try something new, or question your abilities as a trader?

Could you make it 6 months before you changed things up or questioned your ability? I’m guessing few if any.

And herein lies the proof in the chocolate pudding…that you’re not accepting variance or fully relating to how it works.

If you change your strategy, time frame or instrument too soon, you’ll never see the profit side of an equity curve.

But there is an even far more grave issue with constantly changing your strategy, instrument or trading plan.

And that has to do with one word.

Consistency

If you are going to succeed at trading, you’ll need to execute consistently on a mental level.

Thus to trade consistently, you’ll need to develop consistency in your mind.

“You cannot be consistent in trading without consistency in your mind.”

This is how your brain works. Most of the time, you’ll execute the way your brain is most dominantly wired to do so.

If you are not executing the way you want to now – you simply haven’t wired your brain to do so.

The good thing is your brain has a key trait which allows you to wire and build the habits you need to trade successfully.

This trait is neuroplasticity.

There are two types (SDN & EDN). These stand for Self-Directed Neuroplasticity and Experience Dependent Neuroplasticity.

To read more about Using Neuroplasticity to Wire Your Brain For Success – click on the link.

Variance & Your Trading Mindset

Now let’s circle back to variance. If every time you experience a losing streak you change your strategy, you’ll wire inconsistency in your brain.

Again – you cannot have consistency in your trading with inconsistency in your mindset.

Have you changed your strategy after a 1-3 month losing streak? Have you completely doubted yourself after 10 losses in a row?

If so, it means you need to build your muscles. It means you need to develop your skill to understand and accept variance. And make no mistake, this is a skill in and of itself.

Hence before you go changing everything under the sun after a losing streak or drawdown, ask yourself if you are accepting variance.

Before You Can Accept Variance, You Must Be Able to Do This

Without a doubt, being able to accept variance will be critical to your survival.

It will mean not tossing out a perfectly good strategy just because you’ve lost 10 in a row.

It will also mean learning to deal with losses while focusing on process and execution, not results.

This will lead to building consistent mental habits to make money trading.

But there is a step before you can learn to accept variance and build up your muscles here. And that is, you’ll need to be able to understand the difference between variance and a problem with your actual trading or strategy.

What if there is nothing wrong with your strategy, but there is something wrong with your mental execution?

Or on the flip side of this, what if there is something wrong with your strategy, but you don’t know if it’s you or not?

How do you know? How could you know?

How Can I Learn These 4 Criteria & Build A Winning Mindset?

Luckily we’ve developed 4 criteria to help you with this. Using these you can know if your losses have to do with variance, or signal a problem with your strategy.

For those of you that want to learn more about these 4 criteria, then check out my ATM course.

This could mean the difference between winning and losing. It could mean the difference between you making money trading and giving up before turning profitable.

It could also mean the difference between a winning mindset and one that panics when things go south.

If you want to learn more about this critical subject, then check out my Advanced Traders Mindset Course. There are 20 total lessons like this which will change the way you think, trade and perform.

Now Your Turn

Have you had issues with consistency after a losing period?

Do you constantly change your strategy after a drawdown?

Do you doubt yourself or fail to pull the trigger after a few losses?

How many of these situations have happened to you?

Make sure to comment along with sharing any ‘aha’ moments you got from this article.

Until then, may you find consistency in your trading mindset which leads to confidence in your abilities.

Without a doubt, this was a successful year at 2ndSkiesForex. As a team – our staff grew, we got smarter and accomplished many goals.

While this type of success is ‘satiating’, what really floated my boat was the students and traders. Many this year after hard work and lots of practice + training broke through.

One student got funded $100,000. Another finally broke through to profitability after blowing up several accounts. And one student did +25% over a 6 month period.

There are many more successful trader stories like this at 2ndSkiesForex. While I’d like to share all our forex success stories, we’ll share a few to start the year on a good note and hopefully inspire you.

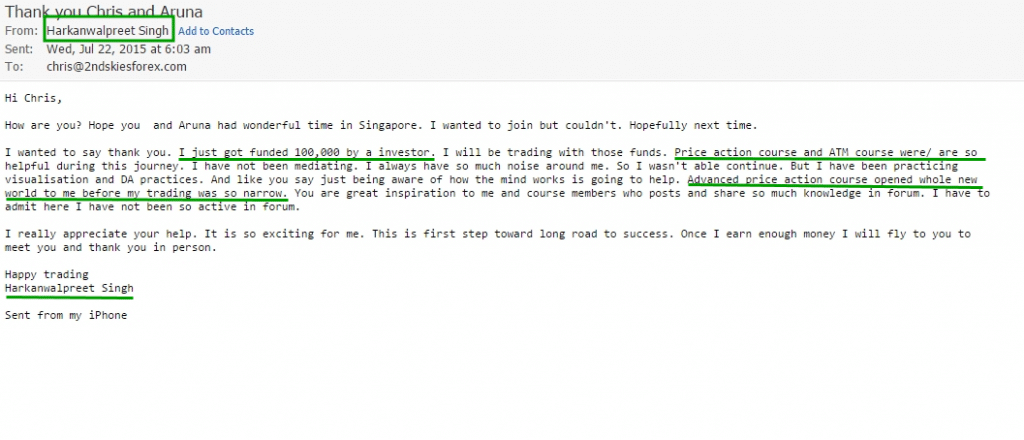

Getting Funded $100K after 8 Months

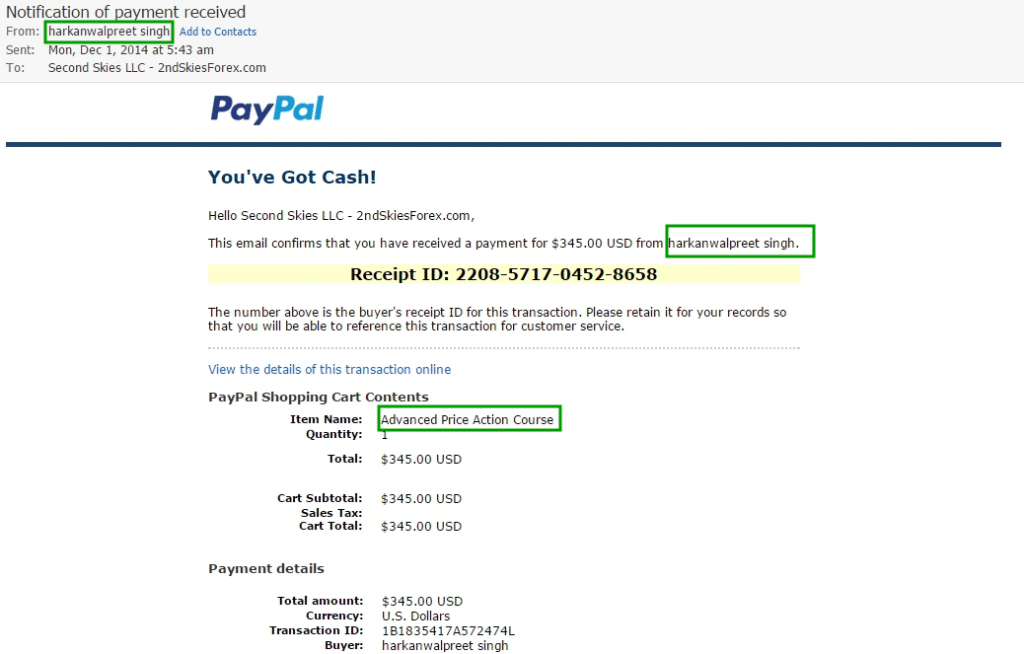

Harkanwalpreet Singh joined 2ndskiesforex in December 2014. You can see his payment receipt + account with us below.

He is a member of our Price Action Course & in February joined our Advanced Traders Mindset Course.

After 2 months of training diligently, he funded an account for $10K with the AxiTrader Select program.

5 months later he got funded $100K by the AxiTrader program. You can read the article about him getting funded here.

Note how they state he ‘performed consistently during volatile markets and complex trading environments‘

Below is his email to me about getting funded (click image to enlarge).

Mr. Singh is not a common forex trading success story by getting funded within 8 months. Normally it takes 1-2 years of hard work before you see this kind of result.

Instead of just learning price action strategies and trading techniques, he worked on his trading mindset.

Many struggling traders fall into the trap of just working on one skill – learning price action and making trades.

He realized how important a successful mindset is and did our core mindset techniques for months.

The result is consistent performance, handling volatility, and getting funded $100K.

What I think is unique about Harkanwalpreet is his maturity. Not long after getting funded, some personal family issues came up. He decided to suspend trading till the situation would pass realizing how is mindset was affected.

Instead of just hammering on, he knew when to take a break and not trade. This shows awareness, discipline and maturity.

If he asks, I’ll be there at every step of the way, and may even fund him myself if he continues to perform.

To me his forex story is a great marker of success and I’ll look forward to watching him grow.

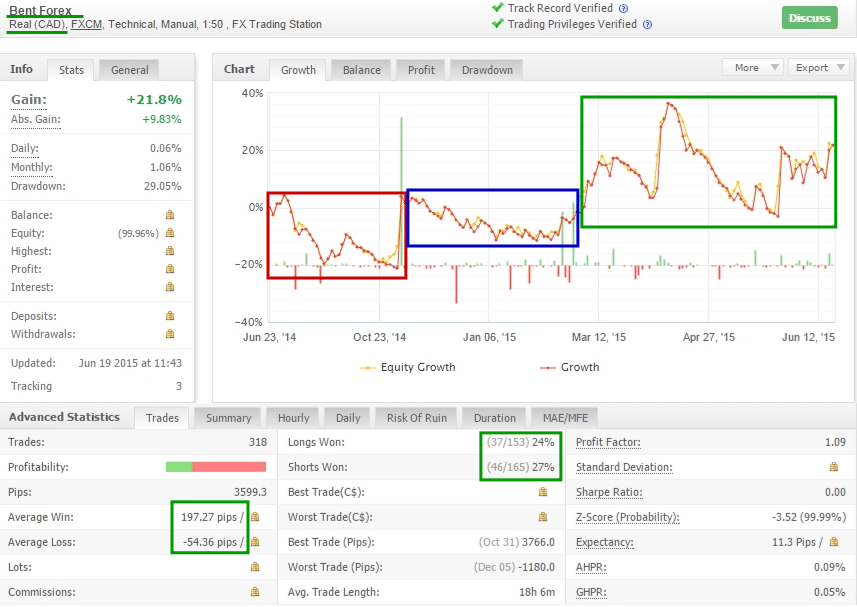

Gaining +25% in 6 Months

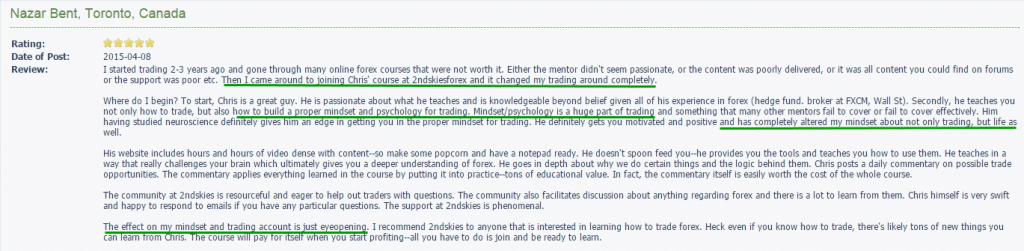

Nazar Bent is from Canada and joined 2ndSkiesForex back in the summer of 2014. You can see his receipt of our price action course from June that year below.

As a student unhappy with his college studies, Nazar knew from the moment he started trading this is what he wanted to do full time.

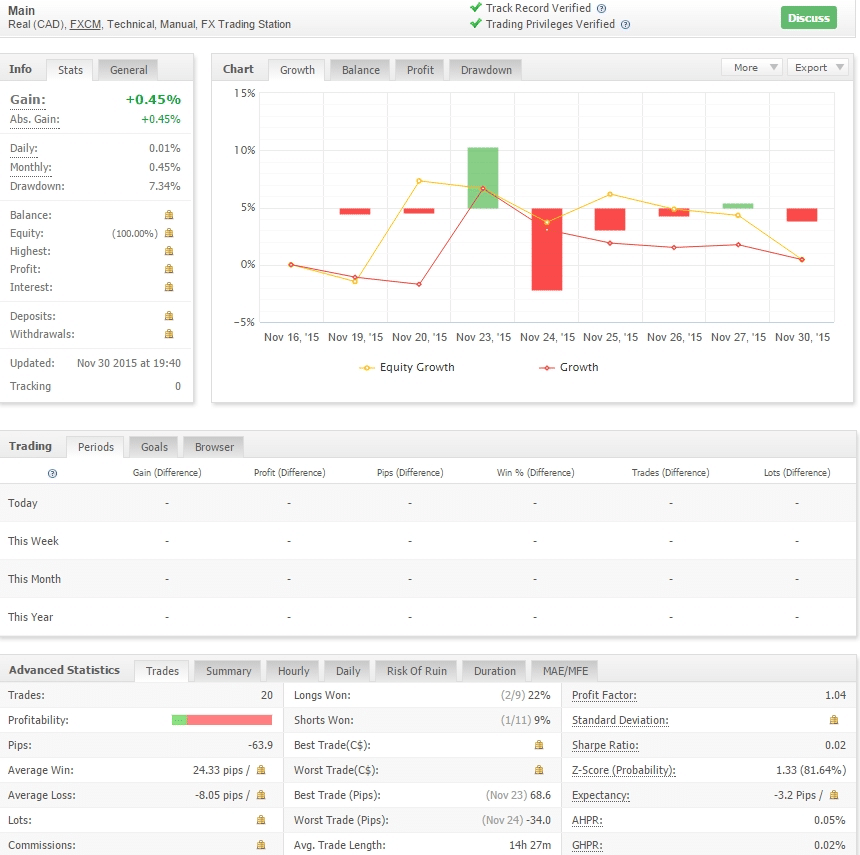

Below is his myfxbook account since he started with us.

To summarize:

1) in the beginning, he struggled like most traders (red box), but he kept working at it

2) after finding a groove, he started to stabilize (blue box)

3) since February 2015, he’s gained +25% over 6 months (green box)

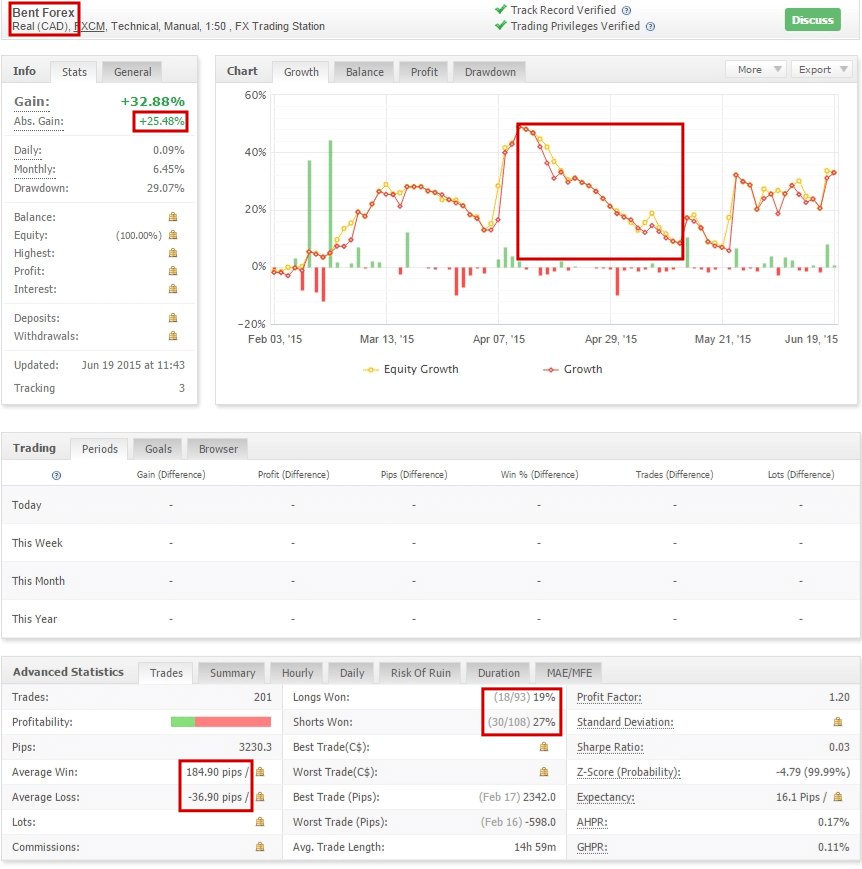

Below is a zoomed in screenshot from his Feb. trading on.

Notice the red box in the middle? This is what happened when trying a new strategy. After giving that up, his gains returned and trading stabilized.

What should be noted is his accuracy + risk to reward numbers. He’s only averaging about 23% for his accuracy, yet is still making money.

Why? Because he’s crushing his +R per trade with his avg. win 184 pips and avg. loss 36.9 pips. This goes to show you don’t need large stops when trading price action.

And his average trade length is < 1 day also demonstrating you don’t need to hold trades for weeks to make good money.

I’ll talk more about accuracy later, but below is his review of us on forexpeacearmy (click image to enlarge).

Notice how he mentions his trading changed when joining us. Also key is how he zero’s in on building a proper mindset and trading psychology.

I feel this is something we excel in with our heavy focus on building a successful mindset and unique approach.

Nazar is one of most dedicated students to becoming a professional trader. I’ve told him if he keeps it up, I’ll fund him personally.

What is interesting to note is his performance when he opened up a new account for me to monitor. His trading has been mostly flat (see below).

He’s openly admitted the psychological pressure of trading for me has affected him. This shows honesty and self-awareness which I appreciate in his candor.

My guess is he’ll break through come 2016 and get back to his typical winning ways.

From Blowing Up Several Accounts to +23% in 4 Months

Shahab might just be the most interesting student & character I have. Before coming to trading, he sold expensive cars to high profile clients around the world.

We’re talking Ferrari’s, Lambo’s, you name it. He’s used to dealing with decent sized numbers of $250K+.

He’s also a risk taker, meaning he’s completely comfortable taking massive risks. This definitely translated into his trading as his swings were massive when he first came to me.

He wasn’t taking trading or training seriously and within 1.5 years blew up several accounts. Trust me – he deserved every dollar he lost during this time and he knows it.

Then he contacted me about really digging in. So in the summer of 2015, we started doing 1-1 mentoring (which is not cheap at $10K per month).

He also lives in Canada and we often go out for tea or lunch, talking trading, mindset and success.

Shortly after, he found a groove trading some of our advanced price action models + his own system.

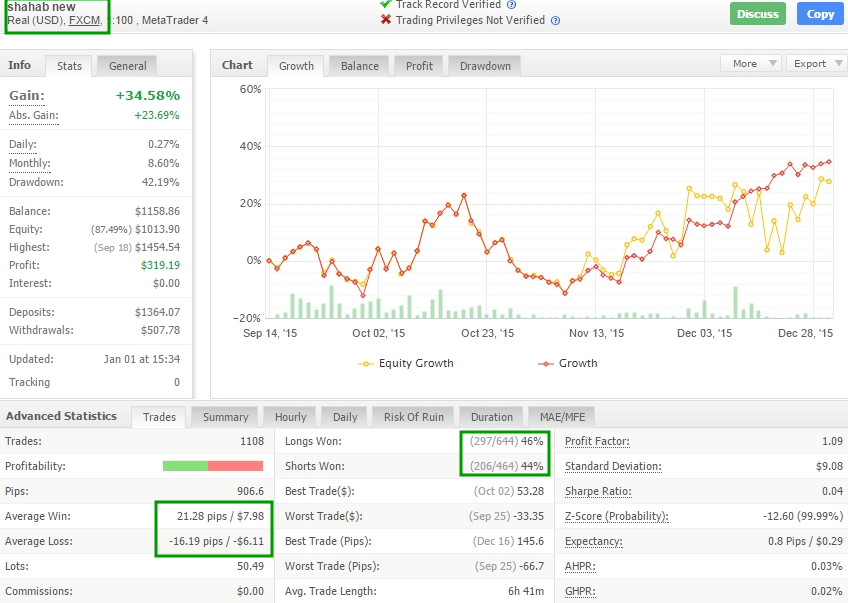

Here is his myfxbook account below.

‘Shahab503‘ is the name of his myfxbook profile. It’s also the name of his account with us below:

Now, there are several things that should stand out here from his myfxbook account above:

- he’s day trading (done thousands of trades) & continues to have massive swings

- he still shows the tendency to go over risk parameters and isn’t as conservative as I’d like him to be. This is an improvement in the right direction from where he was though!

- he’s got a lot of open risk (yellow line) which is way outside my normal risk parameters. Again, the key issue of risk and money management keep coming up so this is something he needs to work on

- his risk of ruin is just below 1% meaning there is a small chance he can blow up his account at this rate

- accuracy is still under 45%, but his avg win vs. loss is balanced enough at +1.3 and he has a positive profit factor over +1

Hence I consider Shahab to be a work in progress. Considering he was blowing up accounts faster than you could drink a pint of cold beer, I’d consider his progression a success.

Do I think he’s in the clear? No, absolutely not as he still has unhealthy habits around risk. But what I’m focused on is his progression instead of just a static number.

He’s not just where he is now, but what he’s becoming. His trajectory is in the right direction and his trend is upward.

How he performs from here is up to him and how much he wants to engage his level of discomfort and discipline. But from where he was, I’m proud of his progress and have positive hopes for him.

A Common Thread

If you noticed, there are several common thread across these success stories. They are;

- They all had rough beginnings and losses (like most of you)

- They stuck through the hard times and showed mental toughness in trading. This eventually led to a change & breakout in their performance

- Accuracy – they all had accuracy levels below 50%.

This last point I want to touch on briefly as it’s a heavily misunderstood subject.

Beginning traders think you need a highly accurate system to make money, but this simply isn’t the truth. There are a million ways to make money with varying levels of accuracy.

Generally the lower the accuracy, the higher the durability of a system as it doesn’t need to consistently win to make money. And let’s be clear, you are going to have losing periods (perhaps months) where you aren’t making any money.

If you system is dependent upon high accuracy, during this losing period you’ll likely experience a massive drawdown. These large drawdowns are psychologically harder to overcome.

Most professionals are between 35-50% accurate throughout all their trades over a year.

My accuracy for 2015 was about 46% but my +R per trade was above 2, so this shows a positive expectancy with proper control of risk.

What Level of Accuracy Should You Expect As A Beginner?

As a beginning trader, you should expect your accuracy to be between 30-50% while learning the ropes (perhaps lower). This is because you are still building your skill set and not trading sub-consciously, so performance will be affected.

Think of it like learning how to shoot a bow and how seldom you’ll hit the center. Yet with practice + training, you can start to get 9 and 10 points more often.

Hence do not be discouraged if your accuracy is low. Accuracy is not static and fluctuates on a weekly, monthly and yearly basis.

There are days when I’m highly active intra-day and can lose my first 5-7+ trades before hitting my first winner.

Akin to trading, professional poker players can play 40,000 hands before making new equity highs.

What this tells you is drawdowns, losing periods and corrections are natural. The difference is most people do not endure these times and give up or change their strategy.

What they miss is the breakout which comes through training, experience and diligence. Hence try not to look at your current state as your overall numbers. Success is a moving target just like your accuracy.

Be more concerned with progression, trajectory and process.

In Closing

I hope you found these forex trading success stories above inspiring and what is possible. To be clear, these stories are not written in stone. They could go backwards and not make it to the next level.

But they show you what’s possible, why psychological endurance is needed, and how important proper price action training + a successful mindset are to making money trading.

With that being said, will you become the next successful trader story?

Will you get funded $100K this year and start making consistent profits?

If you are looking to be the next forex success story, then check out my price action course where we change the way you think, trade and perform.

Make sure to leave your comments below as I look forward to hearing your thoughts.

Until then, may this be a year filled with good health, abundance and success.

Learn a practice towards building a better brain for trading & life. A holiday message from Chris Capre & The 2ndSkiesForex Team.