This is part 1 of a 4 part forex price action strategy series. Read the next one here: The Blind Entry (How It Will Leave You Trading Blind)

I can always tell where people are in the trading process based on how they speak about confirmation. Why is that? Watch, and find out!

Here’s the transcription for the video:

“There’s a really big misunderstanding about confirmation.

When I hear people talk about confirmation and how they talk about confirmation, I can always tell where people are in the trading process based on how they speak about confirmation. Why is that?

Because there’s been this proliferated idea in the trading education world that to trade a setup or trend or something like that you need this thing called confirmation and the confirmation comes in the form of a pin bar, an engulfing bar, an inside bar or whatever.

So that’s the general idea that’s out there when it comes to trading price action.

The thing is, is that when I hear somebody talk about price action in this way, I know exactly what level of trader they are and what level of trader they’re not, because how somebody speaks about confirmation is very indicative of where they are in their trading process.

If a trader is looking for confirmation that a trade will work and they’re doing this because they’re saying “ok, we gotta wait for a price action confirmation signal from support or resistance“.

Well, where does this idea and need for confirmation come from? It comes from a beginner’s understanding of trading.

Why is that?

Because beginning traders are looking for certainty in the market. They’re looking for solidarity, they’re looking for something really really potent that says “I need confirmation”.

The reason why they need confirmation is because they don’t trust price action, they don’t trust their skillset.

They don’t trust trading as a whole. They don’t trust trading with trends, they don’t trust reversals. They don’t trust support and resistance, they don’t trust price action as a whole.

In the beginning, traders want solidarity, they want certainty. And because of that, they’re looking for confirmation in the form of a pin bar or something like that.

The pin bar ‘confirms’ that this trend is going to continue.

The thing about it i,s is that this is something that professional traders have let go of that a long time ago. And they have to let go of it to become a professional trader.

The reason why that is, is because that idea of certainty, of confirmation and the way that a beginning trader is looking for it, that wanting things to be really certain, that A++ setup.

Where that comes from is a beginning understanding of trading.

“Professional traders don’t look for certainty, because they’ve realized it’s an illusion.”

What professional traders are looking at, which is a different perspective, is trading and thinking probability.

So if you hear somebody talking about confirmation, “we wanna trade with the downtrend and we’re gonna wait for a pullback towards resistance and a pin bar off that resistance as confirmation that the trend is still in play and we can trade it“.

How many have heard that story before?

The reason why you’ve been told that is because the people who are teaching that aren’t trading professionally.

If they were you would know this, and all professional traders would know this because professionals aren’t looking for confirmation signals via a pin bar.

So if you hear somebody talking about that, you know where they are in terms of their level of trading.

They’re still a beginning trader themselves, and if you think about it, if somebody is talking about an A++ setup or they’re saying “hey, we’re waiting for a pin bar from resistance for confirmation“, besides the fact that I would suggest running from them as far as possible, because they’re still beginning traders.

You have to ask yourself “look, if you’re only willing to wait for a pin bar or an inside bar, or a false break, if you’re only willing to wait for those signals before you enter the market, well then you really don’t trust price action, do you?”

You don’t trust trends, you don’t trust price action context, impulsive vs. corrective, volatile vs. non-volatile trends, you don’t trust support and resistance, you don’t trust your own ability to trade.

You have to wait for all these other things to be in place and then this one final supposedly magical pattern and supposedly there’s only like 3 of them, which is amazing to me that this idea is actually out there, that there’s only 3 possible ways that the market is telling you a trend’s going to continue.

I don’t know about you but that seems kind of absurd to me. It seems a little insane to think that a market that is so complex, across so many players, across trends that continue.

Confirmation via a pinbar is an illusion, it’s a beginning way to look at trading.

So, your job as a professional trader… you know you’ve kinda crossed the Rubicon and made a big leap in your trading when you look at trading in terms of probabilities, not confirmation in the ordinary sense.

Confirmation, the way it’s normally talked about is a very dubious notion. It’s a very slippery idea that doesn’t really exist in the way you think it does.

If you’re constantly looking for those things you’re going to miss thousands and thousands of pips in a trend that is already well-esablished.

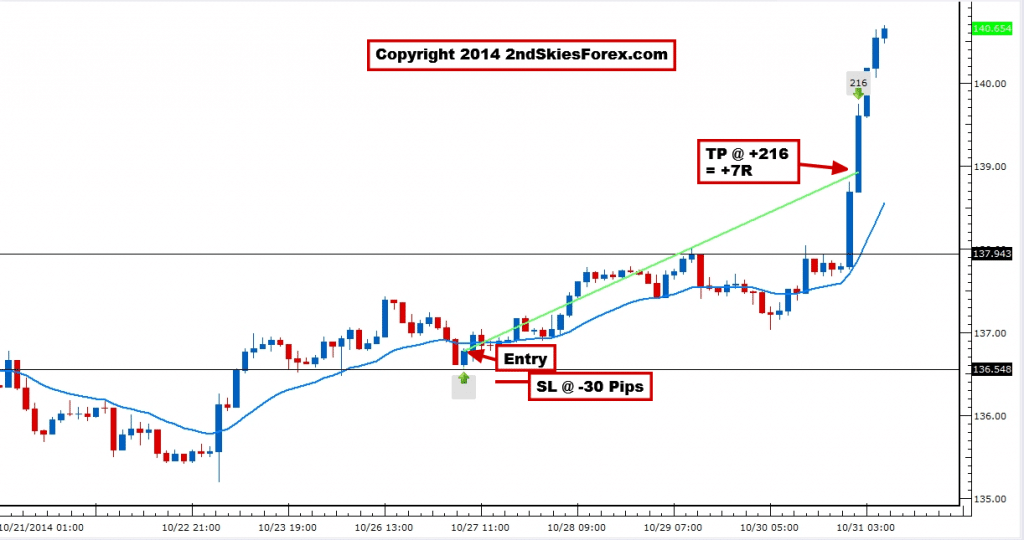

If you’re looking for confirmation, you won’t be able to make this trade and this trade and this trade and this trade. And that’s… what is that? +240-250 pips?

In a period of, what, 3 days? On one pair? You won’t be able to do that.”

This is part 1 of a 4 part series. Read the next one here: The Blind Entry (How It Will Leave You Trading Blind)

Have you been trading price action via ‘confirmation’? If so, I want to hear from you and what you see as the difference, so please make sure to comment below.

Was this article helpful? Please make sure to like, share and tweet it below to anyone you think can benefit from this.