Chris Capre’s current live open price action & ichimoku trades: AUDNZD, CORN, WTI, USDCHF, USDMXN

New to Forex? Then check out my FREE Learn Forex Trading Course with videos, quizzes and downloadable resources

Want to find unique trading opportunities? Check out my latest trading video on how to find dynamic support & resistance.

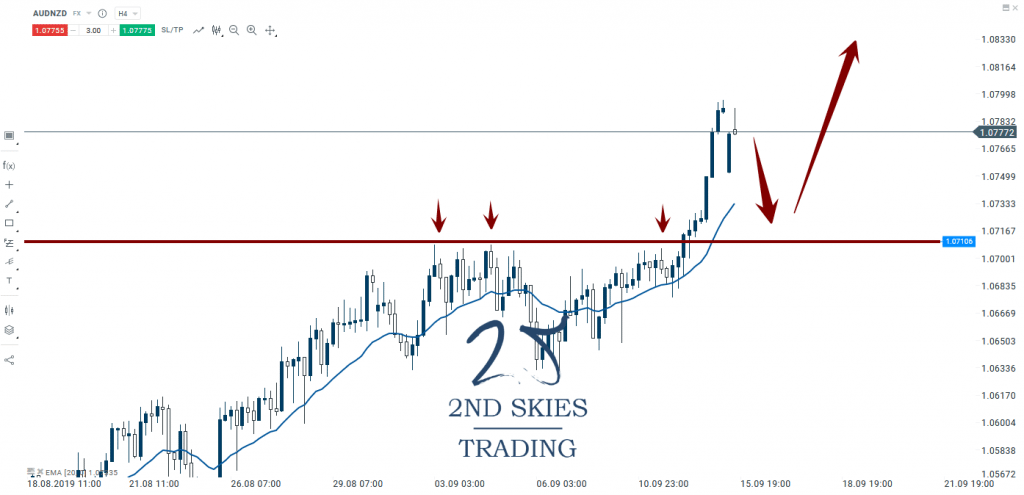

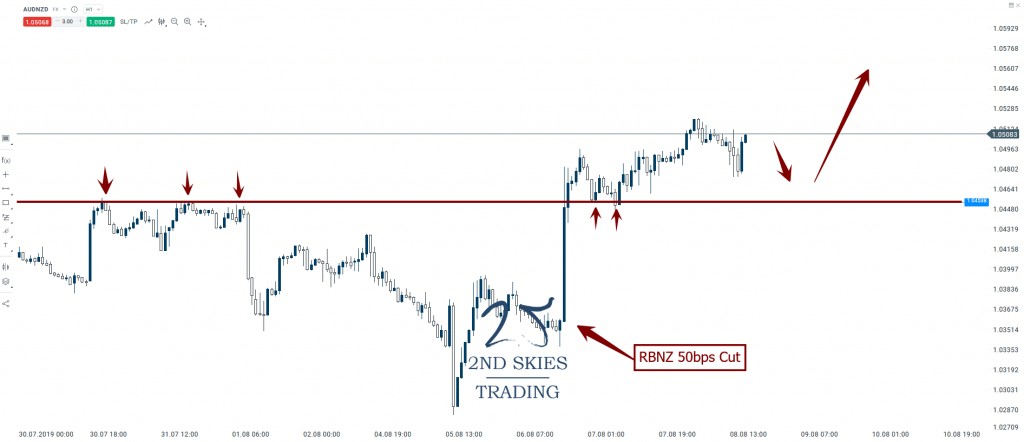

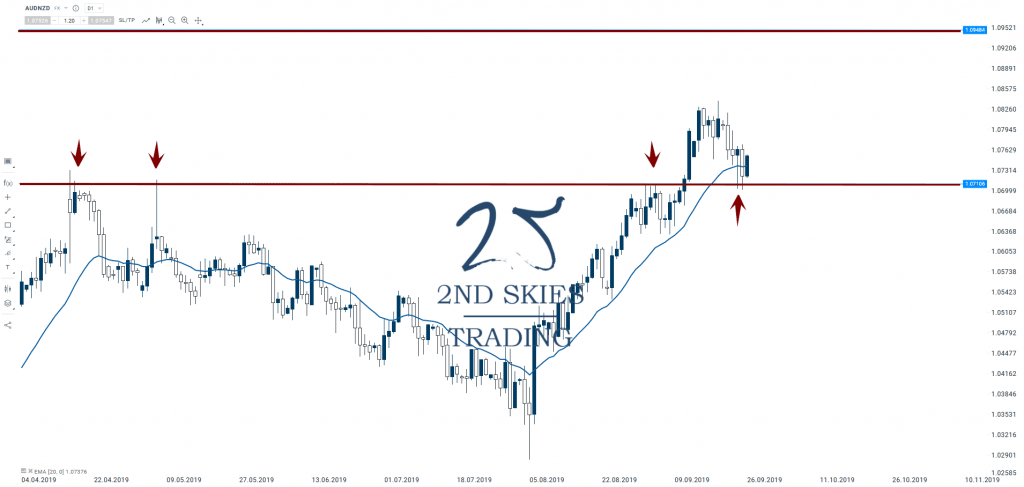

AUDNZD – Sitting On Top of Role Reversal Level (daily chart)

Price Action Context

The overall price action context on the AUDNZD has been bullish since the RBNZ rate cut. The forex pair recently broke through a key role reversal level around 1.0710 creating a great breakout pullback setup. ST bulls can watch this area for potential support. As long as this holds, the line of least resistance is up.

Trending Analysis

ST bullish while above 1.0710. MT bullish while above 1.0475.

Key Support & Resistance Levels

R: 1.0825, 1.0948

S: 1.0710, 1.0475

Stay tuned to the members market commentary for updates.

******

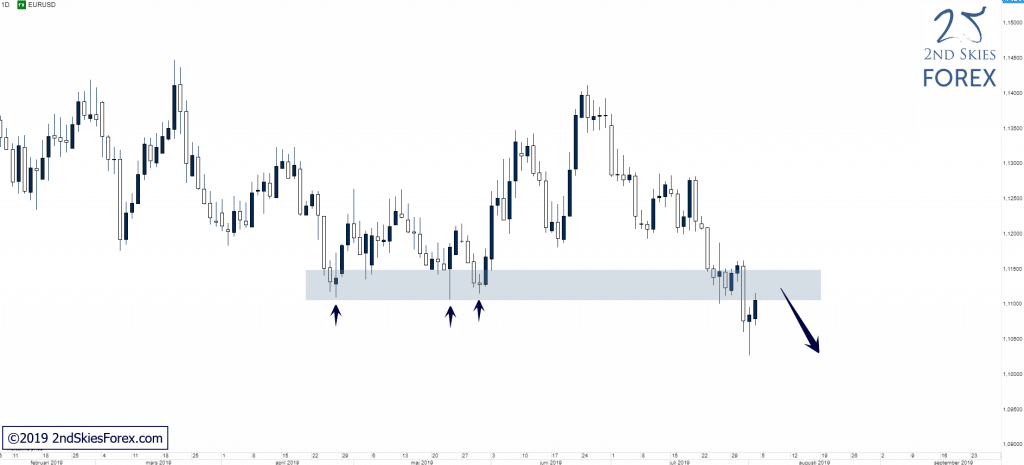

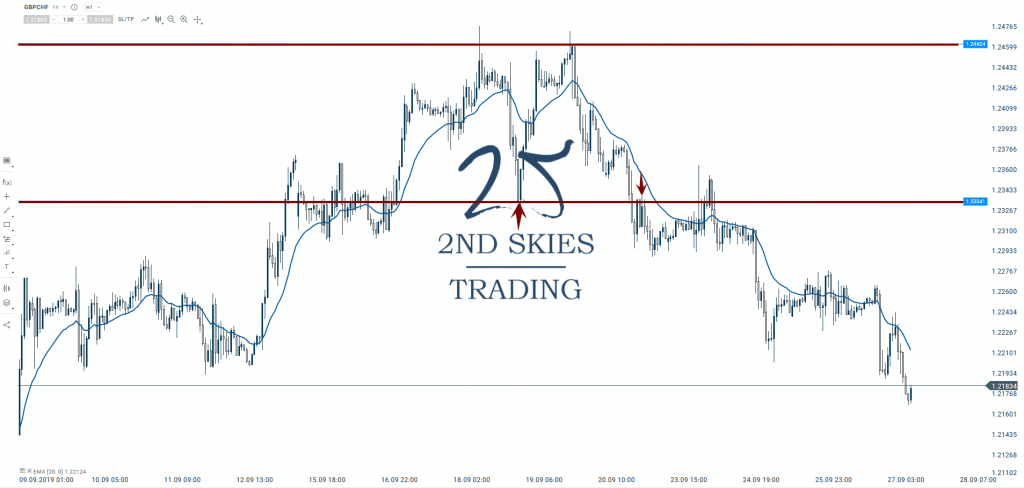

GBPCHF – Short Trade Idea on Break of CS Profits (1hr chart)

Price Action Context

In our recent market commentary, we talked about the ST corrective structure on the GBPCHF and intimated the bulls would start unwinding their longs and put bearish pressure on the pair.

We also suggested a break of the ST support level around 1.2334 would create a selling opportunity. As you can see from the chart below, this is exactly what happened.

Congrats to the members who profited from this trade setup.

Trending Analysis

ST & MT bearish while below 1.2334 on a weekly closing basis.

Key Support & Resistance Levels

R: 1.2334, 1.2260

S: 1.2184, 1.2012

******

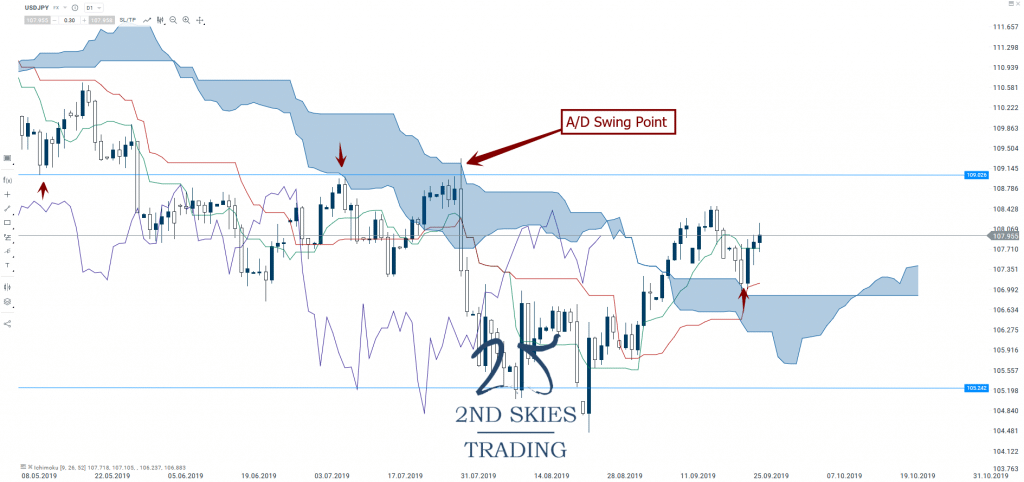

USDJPY – ST Bullish Ichimoku Structure, But MT Bearish (daily chart)

Ichimoku Context

ST the ichimoku structure on the USDJPY pair is bullish as the pair is currently above the daily kumo, and had recently pulled back to the flat bottom and bounced solidly.

Trending Analysis

ST bullish while above the daily kumo on a closing basis. MT still bearish while below the A or D swing point around 109.02

Key Support & Resistance Levels

R: 109.02, 110.57

S: 107.03, 105.24