Is It Time To Buy Airbnb?

While the Delta variant is making new ground, people are still traveling (or looking to travel). The key thing is, they’re not looking to stay at hotels. I’m sure you’ve already started thinking about which stocks that could benefit from this. This includes which ones you’d like to add to your long-term investment portfolio.

Airbnb (Nasdaq: ABNB) is one of those stocks. They are very well positioned for a strong rebound post-Covid.

Airbnb is the world’s biggest ‘anti-hotel’ travel company. With more than 7 million listings in 100,000 cities worldwide in 2021, it has a market cap bigger than Hilton and Marriot combined.

Impact of the Pandemic on Airbnb

Before covid-19, Airbnb grew aggressively. It experienced 38% revenue growth between 2017 and 2018, and 30% between 2018 and 2019. Even though the pandemic hit hard in 2020, Airbnb only saw their revenue decline by 27%. This is not that bad, compared to what other companies in the travel industry experienced. This is because Airbnb does not own the 7 million listings mentioned.

It’s the hosts using the Airbnb platform who are the ones carrying all the costs. This means Airbnb can keep costs to a minimum when market conditions are weak, and quickly scale up when market conditions improve. This has protected the company from the worst impact of the pandemic.

Now, after a long period of travel restrictions and lockdowns, there is pent-up demand for travel. The numbers have already started to reflect this. Airbnb’s revenue for Q1 this year is 6% higher, compared to the same quarter two years ago. That’s before the pandemic even hit. This is a strong ‘tell’, that unless something unexpected happens, Airbnb should be in for a record-breaking year revenue-wise.

Technical Analysis

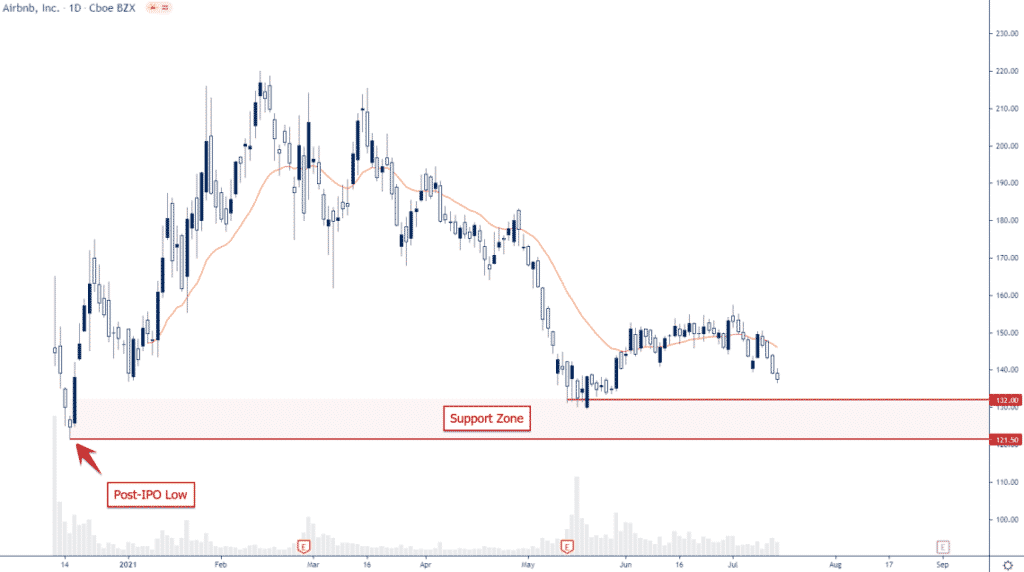

For now the positive developments on travel restrictions, lockdowns and vaccines have yet to be reflected in the price action of the stock, which is at break even for 2021.

This means it’s now a good opportunity to make a move, before the stock’s price starts to reflect the uptick in travel and accommodation bookings seen in many areas of the world such as Europe and US.

The stock is currently trading in a corrective structure. It’s right above a support zone between $121.50 and $132. We think this is a good location to look for potential opportunities for a long position.

Option Positioning

Currently there are about 267K calls and 275 puts, so option traders are slightly put heavy. About 25% of those options are rolling off this Friday, which should relieve some downside pressure on the stock.

Overall, the support zone below is looking like a strong location for a potential buy and add to your long term investment portfolio.

FULL DISCLOSURE: Chris Capre currently has no stock or option position in ABNB, but he does have pending limit orders on ABNB. If you’d like to learn more about Chris’s trades and positions, you can get access via the Trading Masterclass where he shares his live trades, further investment ideas and daily market analysis.