Your Investment Could Piggyback On This Steadily Growing Company

You may not be familiar with the company, but chances are that you’ve used its services at least once. If you’ve ever tried to chat up a business’ customer support or sent a message to a Lyft driver, then you’ve most likely been part of the business of Twilio Inc (NYSE: TWLO).

Source: Miguel Á Padriñán

Twilio provides cloud-based tools businesses can integrate into their systems to enable easy communications with their customers. The company also uses Segment, one of acquisitions, to analyze customer data to optimize interaction. Some companies in the customer books of Twilio include Dell, CocaCola, AirBnB, Glassdoor, Yelp, Twitter, and many more.

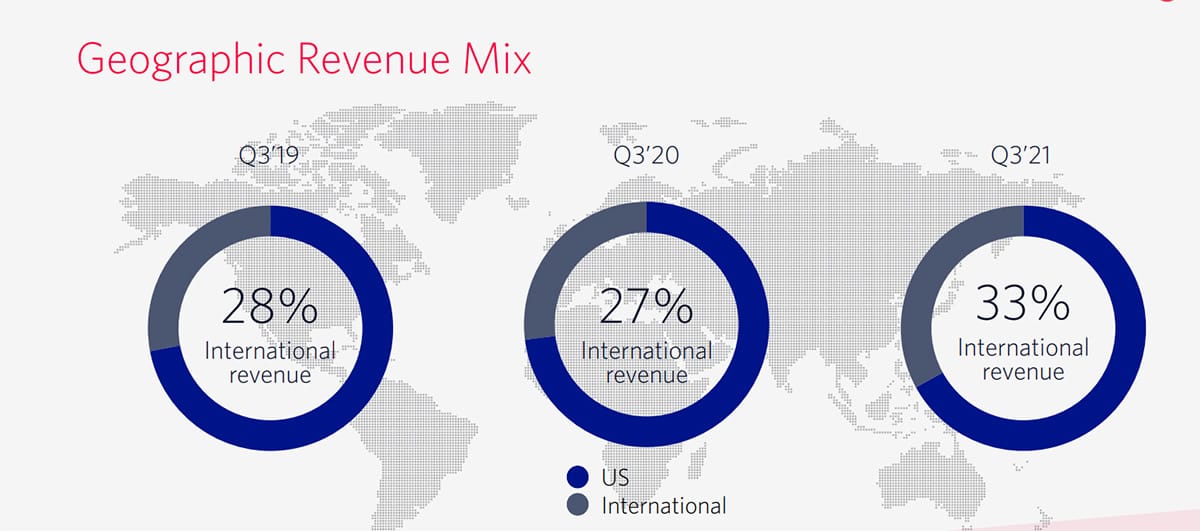

Source: Twilio

Twilio has maintained its status as a steadily growing company with a sustained year-on-year quarterly revenue increase of at least 46% FY2019. In the latest Q3 FY’21 report, it was a 65% year-on-year growth to $740 million. And with a consistently above 130% dollar-based net expansion since FY ’19, it’s obvious that clients are sticking and are willing to pay more after their first contact with the company.

Source: Twilio

The company is also looking to increase its reach beyond the U.S., as it now has 33% of its customers outside of the country. And the international market is still there for the taking, as the company has a market share of 38% among communications platform as a service (CPaaS) providers in the world. The company closest to it only has 11%.

Technical Analysis

The TWLO stock is trading below the peak price it hit earlier this year by 41%. And right now, it looks to have retraced to the $271 – $286 resistance level it recently broke as a support.

This is usually a bearish signal, and the price may further dip to the $208 – $220 support.

About when to buy the Twilio stock, we recommend patience. The price to sales ratio of the stock is close to the lowest it has been (17.84) since the beginning of this year, which is a positive signal for potential investors. But we believe you could wait till the stock falls even lower to the $208 – $220 support, as it is still quite expensive at the current price of $264.