I am going to start this article talking about one of the most important things developing traders will need to know – that is to ‘Know Thyself‘. This recently came up for me as a newer student sent me a few emails which made me realize how important this is for anyone starting on the learning process, but hasn’t found the right trading system to trade from every day.

First I will start off with the student of mine and how critical it is for the trading process. Then I will discuss the importance of this rule, how it relates to you, what system you decide to trade, whether it is price action strategies, or ichimoku cloud trading (or whatever), and how this applies to your trading.

I will end by giving the rule which should immediately follow this one, which, my guess is will surprise you.

How It Began

This student of mine (we’ll call him James), had signed up for my Price Action Course not too long ago and was definitely an eager beaver. He jumped right into the material, asked a ton of questions, and wanted to know the details of the systems inside and out so he could use them properly. So far so good.

He eventually decided on mastering one system which was an intraday price action system focused on the 5m time frame. For weeks, that was all he traded, asking questions each day, sending me screenshots of all his trades to make sure he did them correctly, etc. He decided to demo the system until he was sure he had it down. Again, so far so good.

However, this is where things got interesting. He was having trouble getting comfortable with the frequency of the system (active). After trading the system for a couple of months, he decided to move on to another system, this time on a slightly higher time frame (1hr).

Obviously it was less active, but still active enough throughout the week (on average – a trade a day). Again, he took the same approach – trade it on demo to learn it inside out. Interestingly though, the same thing happened again. He was making money with it, but still felt uncomfortable with it when it went for runners.

So what did he do?

He hired a programmer to write an algo for it. He thought maybe the problem lie in himself (it usually does) but that an algo would solve his problems. Remember his process which was the same at every turn;

1) choose a system

2) learn it inside and out

3) practice it on demo for a few months

4) makes money (key note), but was uncomfortable with the trading process

5) looks for another solution

It was the last two parts of his process where I started to question things. My golden rule is;

If it happens once, its an occurrence

If it happens twice, its a pattern

If it happens three times, its a program (or with humans, a conditioned response)

The Common Denominator

To me, something wasn’t quite right as he was making money with the systems (most people would be happy with this), but was still uncomfortable in the process and thus searched for another solution. I decided to see where this leads before making my suggestions.

After getting the system programmed, he decided to let it run. It started to lose money and he couldn’t figure out what was going on. He questioned himself, why he paid for the programmer, if he picked the wrong system to program, was it a bad time in the markets, etc. Turns out the programmer had made a mistake in the coding so the system wasn’t trading properly.

So what was his response? He emailed asking about my shadow system. This is the system I wrote about in Ode to The 4hr Charts.

Remember this one…whereby my student Tony traded one system, on one pair (AUD/USD) on one time frame (4hr charts – go figure). Tony did 110% on the year, was profitable on every trade for the last 2.5mos of the year, was about 60% accurate with his largest winner far larger than his largest loser.

It turns out James (looking for answers where to turn next) read this article and thought this was it. So he started asking me about it, emailing a ton of questions, a lot about performance, if he could learn it, what would it entail using this system, etc.

Now before we continue, lets map out his progression of the systems he has gone through;

-5m intraday reversal system

-1hr momentum trading system

and now, wants to learn the next one…

-4hr swing/trend trading system

Do you see the pattern here? Other than each system gets progressively higher on the time frames – there is no pattern. Its all over the place. There is no consistency in the style, type of system, time frame – nothing. The common denominator in this process is not the system, it is him.

Has this ever happened to you in your trading process, or is this happening to you now? Have you gone full polygamy on systems, that you’ve traded every time frame imaginable, every type of system imaginable, but still haven’t found your weapon of choice, one that performs the way you want it? What is the one root cause of all this?

Rule #1 – Know Thyself

As a trader, my job is to find opportunities in the market, exploiting my edge week in-week out, to make a living from this and profit for my clients.

However, as an educator, my job is not just to provide systems to students that make money. My job is to help them with the educational process (wherever they are at) and find a solution to help them turn the corner.

Considering very few students are the same, I have to find out what is their trigger, what is holding them back, and how they can correct their mistakes while strengthening their weaknesses. But, if there is one response I get a lot from developing students, it is this one to the following question:

‘What type of trading are you looking to do and what are you looking for in a system?‘

This is really a probing question to gauge where they are in the process and what will be their best path forward.

Can you guess what answer I get most often is?

‘I want a high probability system that consistently makes money every month with very low draw-downs‘

No shit, that’s what everyone wants. But here is the kicker…

What if I provided you with a system, which does virtually that, which made over 100% last year on one pair and one time frame.

But…(big but here), you had to hold a position for several days, perhaps over the weekend? What if that system only traded 8x in one month, or 18 the next, and you were not trading everyday? What if you had to go through a two month draw-down period, but would still do over 30-50% return on capital at the end of the year? Would you still want to learn that system?

If the answer is YES because all you care about is making money, then your not understanding rule #1 – Know Thyself.

If the answer is YES because you are comfortable holding positions for days, don’t want to trade every day, and are ok with having one or two months of draw-downs, then this would be a good system for you, because you understand who you are..

The same goes if your answer is NO because you want to trade everyday, and do not want to hold positions overnight, or over the weekend. That is being honest, and that is ‘knowing thyself’.

The Importance of It

Why is this rule so critical to your development and learning process?

Because your personality, style of thinking (left brain, right brain, whole brain, no brain, whatever), personal schedule, temperament, level of patience, etc. will all come into play when trading your system. If your allegiance is only to profit, this will become a problem.

Why?

If the system doesn’t match who you are as a person (style, temperament, schedule, etc), a tension will be there everyday which will eventually turn into a friction in your mind – like having a car which doesn’t fit your needs (2-Door Scion when you have 5 kids).

What good will it be, if you only have an hour to look at charts, and trading a system whereby you need to be at the computer for 3-4hrs at a time?

What good will it be to trade a system which requires you to wait for days to get a signal, when you have ADHD?

What good will it be if you do not want to be in front of the computer for hours, want more free time to enjoy life, yet have a system which you have to be there at certain times for hours on end?

It won’t.

By Knowing Thyself well, you can find a system and style of trading which matches best with you, your lifestyle and mentality. Perhaps you prefer trading with no indicators and want something simple and completely rule based? Then maybe you would want to learn how to read and trade price action.

Perhaps you are comfortable with more intricate systems, like ichimoku cloud trading. It doesn’t really matter what the system is, whether it has a 10%, 20% or 50% edge.

What matters more than anything else, is you find a system and style of trading that works best for you. And to do this, you have to start with rule #1 – Know Thyself.

Maybe it is not rule #1, which is certainly open for debate. But it is definitely up there in the top 5, and could be in a photo finish for first place. What matters is, unless you are totally settled into your system and consistently making money, you will need to start by knowing yourself – figuring out who that is, style of thinking, what is your current lifestyle, what kind of lifestyle do you want to have, and what systems will match up with this.

Once you have found this, then you can begin the journey by working with a mentor, and finding a system which suits you most.

I hope this helps and that you found it useful. I definitely look forward to your comments and wish you all the best in trading.

Kind Regards,

Chris Capre

Facebook: 2ndSkiesForex

P.S. Oh, I forgot to mention, the follow up rule which succeeds this one……is to ‘Forget Yourself‘. But this is a more advanced rule, which we will get into later.

I am going to start this article with a question which could signify a major portion of your current level of success or failure in trading.

The question is;

Do you believe willpower (and specifically – your willpower) is a limited resource, and if so, what do you think it limits you to learn, achieve and accomplish?

A follow up question to this is:

If you work on a difficult task, say learning to trade price action, will you need more energy and resources to accomplish an even harder task, especially one involving self-control, such as using proper risk-management, trading with discipline, following your rule-based systems or trading plan, etc.?

Take a moment to reflect on these questions, then write down the answers.

Before we get into the answers, we are going to talk about a recent experiment on doing difficult tasks and the Stroop test.

There has been a lot of testing on willpower lately and the general experiments went like this;

People were asked the question about willpower, how they felt about their willpower and what they could achieve and accomplish.

Their answers were noted and then divided into two groups, and then they were all given the same following two tasks.

They started off with an easy task which was to read a page of written text and cross out all the instances where they saw the letters ‘es‘ together.

Then they were given another page of written text where they started off crossing out all the instances where the letter ‘e‘ showed up, then midway, had to change to crossing out every ‘e‘ except when it was followed by another vowel. The second task was obviously more difficult then the first because they had already learned to cross out the ‘es‘ in the first version of the task, then cross out all the ‘e‘s regardless of how they occurred.

The reason why the last task was most difficult was a) the task was more specific, and much more importantly b) they had to prevent themselves from doing a behavior they had already built up a habit to perform.

After doing this set of tasks, they had to perform a ‘Stroop test‘. This is one test I do every day in my Lumosity training whereby you read various names of colors in a word on the left, and have to determine if the color on the right word matches up with the color on the left.

For example, you would see the following two words;

Yellow and then the word Red which would be colored any of the following possibilities (yellow, red, blue, green, black).

If the word on the left was yellow, but the word on the right, say ‘Red’ was colored red, blue, green, or black, you would have to quickly determine if they matched up or not (in this case not). If the word on the left was ‘yellow’ and the word on the right ‘red’ was actually colored yellow, then you selected ‘yes’, if not, you selected ‘no’ which is the Stroop test.

Here is the interesting part.

If the person’s response to the willpower questions (the same ones I started the article with) was they believed they had a limited willpower to accomplish any task they wanted to achieve, these people made far more mistakes on the harder tasks, especially the Stroop test, then those who believed they had unlimited willpower to achieve anything they set their minds out to. Even more importantly, those that believed they got energy from doing the more difficult tasks, tended to outperform those that felt taxed from them.

Why?

The answer lies in ego-depletion, which is whereby those who think their willpower can be used up based on the tasks they are doing on a regular basis. What this led to was a person having less access to their natural intelligence and resources, whereby doing one difficult task (especially a self-control one…i.e. trading, money management, following a trading plan, etc.) made it harder to do the second task which was more difficult and required more self-control.

In contrast, those who believed willpower is essentially unlimited did equally well regardless of the letter crossing task (easier or harder). They were not affected by this feeling of ego-depletion and therefore had the same amount of resources available for the easy or harder tasks.

Now one additional study was done in this experiment, which was to train people through various statements to either a) believe that ‘working on a strenuous task can make you feel tired and less able to accomplish more difficult tasks later or b) believe that working on a strenuous mental task can make you feel energized for further challenging activities.

These groups did the same tests (letter crossing, Stroop) as the first groups, and the results were as followed;

-The group that was taught to believe through statements that willpower is limited and they will need a break, or more energy to complete the more difficult task, performed much more poorly on the Stroop test after performing the most difficult letter crossing task

-On the other hand, the group trained to think willpower is unlimited, and that they will gain energy from each difficult task they accomplish, did just as well on the Stroop test regardless of whether they had an easy or difficult letter crossing task before.

So what does all this mean for you?

A simple translation is your beliefs about your own willpower is one critical factor that affects how effective your willpower will be, especially in trading, keeping to your money management, following a trading plan, being disciplined, patient, etc.

But more specifically, the more you believe your willpower can keep you from doing the things that you don’t want to do (write in your trade journal, keep using proper money management after a large series of wins or losses, etc), the more likely you will be to use your willpower successfully in trading.

Although positive statements are necessary, they are not sufficient by themselves. Only until you take the proper actions will those statements, beliefs and ideas start to change the grey matter in your brain, and construct the proper neural connections to trade successfully.

The good thing is if you currently have limiting beliefs about your willpower which are interfering with your trading process, whether you trade price action, or the ichimoku cloud, or whatever system you use, it does not matter. You can train your mind to build this willpower and relate to the difficult task of learning to trade successfully. That means almost every single person, with the right training, practice and diligence can learn the proper skills to trade successfully.

While it is true some people will have more natural abilities that will help them in their process, almost everyone can learn to trade successfully with the right effort, the right training and the right mindset.

In an upcoming webinar in about a month, I will talk about various methods to re-program your mind to remove those limiting beliefs which inhibit you in trading and cause you to repeat the same patterns again and again (in trading and in life).

Until then, stay tuned, but I welcome your comments and thoughts on this post.

Kind Regards,

Chris Capre

2ndskiestrading.com

Facebook: 2ndSkiesForex

Other Related Articles:

5 Mantras for The Developing Forex Trader

Your Brain, Trading and Finding The Zone

The Mindset of A Successful Forex Trader

In one of my most recent webinars on FXStreet, I talked about a key method for detecting when a trend is over-extended, which is to look for a climax or exhaustion reversal bar. I had mentioned how from an order flow perspective why these exhaustion and climax bars tend to represent a high probability reversal coming based on the various participants and how they tend to trade trends.

Before I get into today’s forex reversal pattern article which will be an expansion and amplification of this, to recap – the key things you want to be looking for in spotting these exhaustion and climax reversal bars are;

1) a bar that is much larger than the previous price action and ideally the largest bar in the move

2) it occurs at/near a key support or resistance level, or after breaking a key support/resistance level

3) it occurs after several bars have been trending in an impulsive fashion in one direction

Although there are other many subtle clues you can look for to amplify the possibility of these climax and exhaustion reversal bars, these are the three main ones you want to see in the price action to look for a trading opportunity.

The goal of this article will be to demonstrate a recent example of this, how you can trade these price action setups and what to look for from a price action perspective.

I will begin with an example of this in the DOW which gave a really good signal just the other day using this method. Then I will get into the anatomy from a price action perspective all the key characteristics to identify these bars. After this, I will discuss how you can trade these using price action with some simple rule based methods.

I will begin starting with the daily chart for the year in the DOW, the general uptrend, how it found a key resistance, and then look into the 4hr time frame to show how price action reacted after breaking the key level.

The DOW Hits Key Resistance

In the chart below, notice how price has a very stable relationship to the 20ema and dynamic support. It rejects off of it three times before finally breaking below it. But when it eventually does, it quickly jumps back above it, telling us buyers are still interested in driving this pair higher being happy to scoop this up on pullbacks.

Price action then forms a triple top just shy of 13300 which is the first time the entire year it needed three attempts to break a key level, suggesting there is possibly over-extension in the trend along with some sellers who are willing to hold a line the bulls cannot penetrate.

In the next chart below, starting with the top left of the chart, we can see how each pullback from the triple top (save the last one) created a pin bar off the 20ema (bars 1 and 2). This was suggesting the buyers were happy to get back in on the pullback, but still could not break the key resistance just shy of 13300. Price then sold off aggressively for the first time all year, dropping over 500pts in about 6 days.

After finding support at a prior pullback level, price resumed the uptrend. Notice how as it came up to the resistance level that formed the triple top, it formed a doji and inside bar suggesting hesitation for two bars in a row.

If the inside bar had formed after a strong bull bar, it would have suggested a little more strength and possible breakout. But the hesitation from the day before, combined with the inside bar communicated two days of hesitation and an inability of the bulls to take out a key level.

Now on the next day, price does break above the key level forming a new high. But this ends up failing intraday, then pulls back below the resistance level along with producing a range bar.

One should notice how the rejection to the topside is equal to the downside suggesting false break as a) price failed to hold the gains, and b) there is an equal balance between the buyers and sellers. Ideally, we’d have a very strong imbalance between the buyers and sellers when looking for a breakout, but we are not seeing that in the chart below.

Anatomy From a Price Action Perspective of Exhaustion/Climax Bars

Now that we have highlighted a potential area of contention, I am going to zoom into the 4hr chart to show the exhaustion or climax bar specifically, break down the anatomy of it from a price action perspective and then talk about how you can trade this setup.

Beginning with the next chart, the first bar to concentrate on (which should naturally stand out) is bar 1 – the breakout bar which is the largest bar in the entire series. Up to this point, we can see consistent buying all the way up to the resistance level with the bulls dominating price action winning 25 out of the 36 candles (69% bull-bear ratio) up to the breakout bar which is bar 1.

Now if you remember from the very beginning of the article, an exhaustion or climax bar will generally mark long or over-extended trends. These bars should have the following characteristics;

a) the largest bar in the series

b) occur near key support/resistance level or on the break of one

c) occur after several bars have

Why do these bars tend to be so large?

When trends are over-extended, they have had a lot of time to attract various players into the market, with the institutional players being first, the more advanced players who sniff out the new trend second, and the retail traders third. The retail traders tend to be last as a whole because they need the greatest confirmation to enter a trend (generally).

By the end of a trend, as the retail traders get in, you have the greatest imbalance between buyers and sellers. Those who have not profited from the trend will often chase it feeling like they have to make money on this move by buying breakouts instead of pullbacks. Additionally, the institutional players will try one last push to get as much out of the market as they can – thus producing a climax or exhaustion bar.

Sometimes, this has an additional purpose of not just squeezing out the most of the current trend, but trapping new traders long into the market so when they exit, they can also look at reversing the market using those trapped to fuel the upcoming sell-off.

This is why these bars tend to be larger than usual and the largest in the series. They will also occur at key levels, especially on breakouts which helps to further trap traders who bought on the break. So hopefully this explains the basic anatomy of these moves.

Now getting back to the chart, if price action had maintained the breakout and held above the key resistance level, along with extending the gains, then it would communicate the breakout will continue. But look at the next bar (bar 2) and how price action responded. Notice how it immediately reversed back below the resistance level which was definitely a warning sign the breakout could not hold the gains.

In these circumstances, you have to ask yourself;

if the bulls were in control, how come they could not extend the gains?

Where did they go?

How come such a strong bar did not extend price further?

Why did sellers immediately push back?

Why did the resistance level not hold as a breakout pullback level?

All of these questions should have immediately come into mind because they held the key to whether this was a legitimate breakout or a false break.

But even if you did not ask all these questions, all the ingredients for the exhaustion or climax bar was in play telling you this was likely the end of the move. Even after bar 2, notice how price then treated the resistance level not as support (continuation) but as resistance (false breakout). Again, go back to the questions and the breakout just doesn’t add up. So we have a textbook example of an exhaustion or climax bar.

How To Trade This Price Action Setup

Usually in an uptrend, I’ll look for a second attempt at the key level or a LH (lower high) before attempting to reverse a strong trend. For those wanting a secondary entry, you’d look for a pin bar, engulfing bar or outside bar, then consider taking it in combination with the exhaustion or climax bar. But the price action should already show weakening ahead of the exhaustion before letting you know the offers will hold.

Most often with exhaustion moves, there will be a second failed attempt either at the key level, or producing the lower high giving you the final confirmation the exhaustion bar is in place and it is time to reverse.

Depending upon which of these situations will present itself will determine how I get in, but if I see any of them and they have all the ingredients, then I’m going to sell that looking for the market to reverse heavily since the trend has become over-extended. Either it will retrace a good portion of the move, or it will consolidate before making a new leg (up or down).

Now looking at the chart below, although we had in bar 2 a solid bear bar, it barely took out 50% of the gains in the exhaustion bar. Generally I’d want to see 60+% of the prior bars gains taken out before feeling like the bears are mounting a good attack and thus look for a reversal. If I fail to see this minimum push-back, I will stand aside and wait for another trigger.

Even though this threshold was absent, if you notice bars 3, 4 and 5, they all were being held in check by the level which was the key breakout level, suggesting the market was using this as resistance. If it was a trap, price would not have made its way to the 20ema (so far away) nor kept producing small candles below this level (should have been above the level). However, none of these were in place.

The most aggressive entry would be to sell after candle 3 or 4 closed.

Why?

They were weak candles after a strong selling candle just below resistance telling us the buyers were not pushing back with enthusiasm. This would be one way to get in to this with a stop minimally above the highs of these candles and possible higher.

Another entry would have been to sell below the low of candle 3, or on a close below candle 3 with a stop above the high of candle 5 if it had made a break above the resistance level (which it did in this case, but will not always be the case).

The advantage of selling below the low of bar 4, or on a close below bar 4, is at this point, any traders who are trapped long are starting to exit their longs as the losses are starting to mount and increase since they are below their entry. If candle 5 does not have a wick above the breakout level, then the stop has to go above the level minimally, but better to have it above bars 3-5 or possibly higher.

One conservative entry would be to wait for a breakout pullback to the 20ema treating it as resistance (not support) suggesting a new relationship to the 20ema. There are also a few other methods to get into these reversal moves, but these are a few which should give you a good start to trade these setups on exhaustion or climax bars.

In Summary

The goal of this forex reversal pattern article was to demonstrate from a price action perspective how exhaustion or climax bars can and will often represent the end of a trend and what key characteristics you will want to find in these bars. We went over a really good example of this in the DOW showing how all the ingredients were present, what to look for and how you could identify them. Then we ended by giving you a few methods to trade these price action setups and find either an aggressive or conservative entry along with what to look for.

I hope you enjoyed this forex price action trading article and found it useful in helping to identify exhaustion and climax bars and how to trade them.

Please make sure to comment, along with sharing the article by liking and tweeting it to pass it on.

For those wanting to learn rule based price action systems and reversal bar trading techniques, access to the traders forum, lifetime membership & more, check out my Trading Masterclass Course.

Kind Regards,

Chris Capre

2ndskiestrading.com

Facebook; 2ndSkiesForex

Lately I have been spending a lot of time crunching data on some of the forex price action algorithms my programmer and I created, that the data can at times become overwhelming to digest. In times like these, in needing a break, I often enjoy reading something completely unrelated to forex so I can engage other aspects of my brain. Recently, the subject and person which has consumed my attention is Benjamin Franklin who is an impressive man to say the least.

He had such a wisdom into getting things done, the process of tackling something, understanding oneself and what it takes to succeed, that it immediately made me think of trading – particularly the developmental process many of my students are going through. I felt inspired to write an article based on some of the many gems of wisdom Benjamin has been sharing with me as of late and how they can help one in trading.

So here are 5 mantras for the developing trader:

#1 “By failing to prepare, you are preparing to fail.” – Benjamin Franklin

In trading, like all skill based endeavors we set out to learn, you need a plan to accomplish your goals of becoming a profitable trader. I hear stories all the time about traders reading a book or two, expecting to learn the markets in a weekend, and then jumping in, only to find out it’s more complicated and difficult then it appears.

You can start this process by first writing very clearly what your goals are, and have a reasonable timeline to get there (likely longer than you think). Then figure out what you need to do to get from here to there. You may need to find a mentor for this as most people who succeed in any skill or craft do. Then write down the steps and create a plan of attack to get from here to there.

At this point, it’s a question of starting with step one until you get to the end. One quote from Michael Jordan reminds me of this very point which was, “I never thought of the second step, only the first and worked to take that next step. Because of this, I never felt like I could not accomplish something because I had taken all the steps to get there.‘”

#2 “Never Leave that till tomorrow which you can do today.” – B.F.

Author, painter, politician, scientist, musician, inventor, diplomat are just a few of the things which are credited to Benjamin Franklin. How did he get time to do all these things is amazing, but there is only one way to accomplish all these things, and that is taking massive action while not wasting one’s time.

I am often perplexed at how many people waste time in chat rooms, idle conversations, or writing about silly blog posts. Don’t get me wrong, having fun is always important, but your actions will be a part of the legacy you leave, and will be the difference between whether you become a successful trader or not.

Having clear measurable goals was the lesson in the first mantra, but working hard to make them a reality is the next step. Ask yourself what are you putting your energy into today, and is it helping you with your goal or not. Is it learning your price action or ichimoku trading system, or talking about something ridiculous which builds nothing of value? I’m pretty sure Benjamin spent the majority of his day constantly working on things which helped take his work and inventions to the next level. And this is what he is remembered for.

Ask yourself if what you are doing is what you want to be remembered for. This will help you gauge your time and whether you are using it effectively towards becoming a successful trader.

#3 “You will know failure so do not fear mistakes as you continue to reach out.” – B.F.

Oh how true this is for trading, whereby all great careers (trading and otherwise) will be littered with mistakes. If you fear making mistakes, you will become fearful to trade when the best opportunities come up. Has it ever happened to you that you were hesitant to make a trade because of a recent loss you just had?

Fear has rarely ever lead to greatness and taking risks is part of what we do as traders. Give yourself permission to make mistakes without making it mean anything about you as a person or a trader. By doing this, you free yourself to put all of your natural intelligence into the process and build the mindset of a successful trader.

#4 “There are three things extremely hard: steel, a diamond and to know one’s self.” – B.F.

Understanding one’s self is probably the hardest thing we will ever do in our lifetimes, next to facing our death and loving someone completely. To embark on the trading process is to step in front of a mirror whether you realize it or not. The markets will constantly bring up the most unrefined parts of you, your self-image, your emotions, how you deal with uncertainty and how you deal with failure.

Knowing yourself is critical for the trading process and the best approach is to be brutally honest with yourself, particularly your weaknesses and limiting beliefs. Be brave to face them with understanding and acceptance. Once you do, you will begin to work on the areas which are most likely holding you back.

#5 “Energy and persistence conquer all things.” – B.F.

Learning to become a successful trader, or maintain it once you have gotten there can be downright exhausting. There will be days where nothing goes right, where you want to give up, where it is easier to not follow the discipline (part of the pyramid of trading) or do the things necessary to succeed.

It is in these moments that it is most important not to quit, not to take the easy road. Every time you push forward in those challenging moments, you build a reservoir of strength which will give you a confidence and energy that becomes the backbone of your process. This will allow you to eventually break through any obstacle in the trading process and will be the main fixture on the altar of your success. When quitting is no longer an option, forward is the only path that awaits.

So there you have 5 mantras for the developing forex trader. Whether you trade forex price action, ichimoku, are a scalper or trade the 4hr charts, we all have to go through a similar learning process, and all face similar challenges.

I hope this article has been helpful for your trading process and that you found it of value.

If you liked this article, feel free to like/tweet it and share to pass it on.

For those of you wanting to work with a mentor and help accelerate the learning process, feel free to check out my Trading Masterclass, Ichimoku Trading, or Advanced Traders Mindset course where every week, another trader turns the corner.

Kind Regards,

Chris Capre

Facebook: 2ndSkiesForex

I was talking with one of my price action course students today who in some sense, has a very typical story – they tried everything, from forex robots, signal services, listening to expert trade advice, reading all kinds of books, etc. but no matter what they did, they still were consistently losing. They are definitely dedicated and sincerely want to learn to trade the forex market successfully so it is not a question of effort.

Particularly, they seemed to have trouble dealing with losses and asked me how I dealt with them. I asked them how they dealt with them just to get an idea of what their forex trading mindset was and where he was coming from. After hearing his responses, I told him I would write an article on successful forex trader psychology and how a person with a successful mindset deals with losses and failures which can make all the difference in the world. So here is a short but sweet article describing 5 successful forex trader psychology tips that will help you deal with losses and have a successful mindset.

#1 Don’t Let Losses, Mistakes or Failures Determine Your Sense of Value

Successful people seem to have a completely different mindset around losses and failure because they think about it differently. In trading, this would translate to not letting every trade (win or lose) determine your sense of value because this will make you totally dependent upon the results in the beginning which is a precarious time. Instead, focus on what you need to do with the information being presented in the loss or mistake you made. This will keep you focused on moving forward instead of becoming judgmental about your process. Don’t let the pain of the loss color your experience. Use it as fuel to learn to trade better.

#2 Use Losses and Failures As An Opportunity To Become More Resilient

The greatest traders, basketball players, golfers, or any great in any field has losses and failures. They don’t look at this and become despondent or think their are a failure. They become humble, realize they have more to learn, and become sharper in how they look at things which helps the process become more informative.

But more importantly, they become more resilient and determined to become better. I really congratulate Tiger Woods who for almost 3 years had not had a major win. Keep in mind this was someone who was used to winning like it was breathing. In his last tournament, he was in the lead after having one of his best rounds ever in his life. What was he doing after playing 18 holes of golf after 3.5 hours of play? Right back at the driving range working with his coach to figure out what he could have done better.

He used these losses over the years to become more resilient and this is what you need to do. Imagine having a 3 year losing streak, and imagine what kind of resolve and resiliency it takes to keep fighting to get back to what you believe is possible. That is resiliency.

#3 Take Trading Seriously, Not Yourself

Successful forex traders (and for that matter, people across all fields) take the process seriously, but they do not take themselves that seriously. They know they are human, that they will make mistakes, that there is more to learn, that they will never be perfect. So don’t take your thoughts, judgments and emotions about losses too seriously or let them define you. But take the process of learning to trade forex seriously.

#4 A Loss, Mistake or Failure Informs Me What I’m Doing Wrong

Similar to #1, use those losses, failures and mistakes to be opportunities to correct your mistakes. I cannot tell you how many traders I have seen learning to trade forex price action would be great traders if they could correct their mistakes. Often times, mistakes mean the difference between a win and a loss, a winning month and a losing one, so use the information contained in each loss, failure or mistake as an opportunity to get closer to your dream of trading successfully.

#5 It Takes Courage To Fail

No currency trader ever became successful without taking risks, without going against their emotions, their sense of comfort, their desire to do it the easy way, or not put in the work. You have to get comfortable with losing as it will be part of the game. Be willing to fail and make mistakes. If you hide behind the comfort zone, you will never go to places you’ve never been before in your trading. You will never see the top of the mountain and the view from there. Learn to face the craziness of the markets, the unpredictability and the oncoming waves crashing into you with courage. You can learn from your failures as much as your successes, so just consider it part of the process of learning to trade and achieving your objective.

So there you have it, 5 key things which can help you develop a successful forex trading mindset and help you deal with losses so they become the fuel and building blocks of your successful trading, not an emotional vice grip which constrains your natural talents and intelligence from coming out. The mindset of a successful trader simply deals with the experience of losses and failures differently – but most importantly, realizes success starts with your mindset.

I welcome your feedback and thoughts on this so make sure to comment, like and share the article to pass it on.

Kind Regards,

Chris Capre

2ndskiestrading.com

Facebook: 2ndSkiesForex

Often times, we measure our success as a trader by our account value, whether it has grown, perhaps doubled in size, or whether we have lost and are under water. Unfortunately, this is really a myopic way of measuring our success in trading. If this was the true benchmark, then for my first 6 mos of trading, I must have been a rock star turning 3k into 83k. How did I do it? Over-leveraging to the hilt and having the most unbridled approach to the markets. If you measured success by my account,then no doubt after the first 6 mos, I was a successful and mature trader.

But then, if you looked at the next 6 mos, I would have been the biggest failure of a trader in history, losing almost all of the 83k (save for 12k) in a period half that time. What happened to that really mature, successful trader just a few months back. Where did he go? Which one was the true measure of me? Which one was the most accurate description of my success as a trader?

The answer is neither, and that is why I am writing this article which I think you will find informative about how your trading process is going, where you are at, and how you can gauge your development. So here are 7 signs you know your maturing as a trader.

#1 First You Manage Risk, Then You Manage Reward

The entire 2008 financial crisis was built upon the opposite of this principle, seeing reward while missing the inherent risks of one’s actions. Some people were smart and were able to see the upcoming cliff ahead – not by looking at what they can make, but by what they were risking by taking on such an investment. Don’t fall into this trap.

So many traders in the beginning stages of their trading process decide whether to get in a trade because of the ‘potential‘ profit. They think, ‘this trade has a huge profit potential and its going to win (optimism bias) so my risk doesn’t matter too much’.

The problem is when you see the end of the rainbow and chase after it, you often fail to see the cliff you are about to fall over. It causes you to miss things in the chart which may be alarm bells or subtle details this trade is going to fail. It causes you to have tunnel vision while crossing the street in rush hour traffic. It can also cause you to take trades outside your trading plan and deviate from your discipline – all of these are disastrous to your account, and to building discipline which is the foundation of successful trading.

You will know you are maturing as a forex price action or ichimoku trader when you first look at all aspects of risk, (% equity, time risk, event risk, etc.), then start looking at your upside.

#2 You Are Completely Relaxed When Making Trades

Good trades, bad trades, mistakes, perfect entries, eventually they all blend into the same thing and become just another trade. You don’t feel like it’s do or die with each trade. You do not feel like your entire success or failure as a trader is bound up in this one trade.

If you made a really good trade, sure your happy, but it’s nothing special and your still relaxed, calm and focused on the market.

If you make a bad trade, your not berating yourself, not labeling or defining yourself as a failure of a trader, not thinking this is the end.

Make a trading mistake? No worries since your as calm as a hindu cow and don’t panic at all – you’ve been there before. You simply analyze the situation and find the best solution out of it. Think of how an experienced war pilot would deal with challenges – they analyze the situation, assess the key difficulties, then find the best solution. This is what you do and your relaxed regardless of the trade.

On the flip side, you don’t feel the need to brag or inflate your ego after making a good trade. You don’t feel the need to show your friends, or make a video about it, you’ve been in the end zone before, and you know you’ll come back again. Shortly after you’ve made a big winner, you get back to business because you have more work to do and know the next danger could be right around the corner (or the next opportunity).

#3 You Don’t Force or Chase Trades

If you miss a trade, so what, you know there will be another around the corner and your not thinking ‘this is the big one‘ like Redd Foxx in Sanford and Son. You also don’t chase trades that you missed, getting a worse price. No, you wait for your price, and you’re willing to miss a trade to do this. This allows you to trade on your terms, not the market luring you into a position whereby you have to get a poorer entry or take on more risk just to get it.

You don’t force anything, and just wait for the trades that come to you. The market will be there tomorrow, another great trade will be there in a few hours, or the next session. You’re not feeling like you’ve lost the mother lode every time you miss a trade. If you see something that comes on your radar screen, you jump on it and don’t let it pass you by. If you happen to miss it for any reason, you let it go – your not a dog chasing a fire truck.

#4 Trading is Not Your Daily Adrenaline Fix or Entertainment

I cannot tell you how much I felt like a junkie every time I would trade the markets in my early days. It’s understandable – such a new thing, you can work from home, you can make more money then you are now (a lot more), you don’t have to wear some stupid outfit or do what some mediocre boss tells you to do. You can trade on the beach (although your battery might run out soon), you can make money real fast, basically…you can do a lot of things never possible with some ordinary job.

The markets are not for your entertainment – casinos, movies and sports are, not trading. The market is a very serious business and I guarantee you, your competitors who are making money day in day out are taking this very seriously. Trading successfully, especially after thousands of trades will almost become boring. Not that the markets don’t present a fresh challenge each time, it’s always something new, and always a puzzle.

But don’t make it your source of entertainment or adrenaline in life. You know you are doing this when you feel a huge loss of energy when the markets close on Friday, as if your being cut off from a life force. You know your doing this if making a trade with big lots feels like your jumping off a bridge.

Trading is an arena to make money, to face yourself in the mirror, to build a successful trading mentality, all while challenging your discipline and ability to find opportunities day in-day out. That is all. When you stop making it an emotional/adrenaline bungie-jump/daily entertainment, you’ve settled in the saddle.

#5 You Follow Your Trading Plan

Day in-day out, you follow your trading plan. Whether you’ve had a series of losses, or had a massive series of wins, your discipline remains the same. You trade like a sniper taking out one target after another. You don’t count your chickens because you know nothing is certain in this market and the winds can change on a dime. In as many situations as possible, you are patient, disciplined, and rely upon your trading plan.

Yes, your systems will not catch every opportunity out there – so what? No system ever will, and that is now what you are trying to do. You stay focused on your system, and learn how to leverage the edge and strengths of your system, like a driver that knows his race car – what are its limits, what are its weaknesses, and what are its strengths. Every time your discipline wavers, you put your trading and account at its greatest risk. Every time you follow your trading plan, you put a stone in the pillar of your success.

#6 You’ve Stopped Looking For The Holy Grail

It’s convenient to think there is one solution to all your money problems, one solution to your inability to follow a trading plan, one solution to your inability to deal with the uncertainty of the markets. How convenient, how rosy a world this would be. I cannot tell you how many times I hear from prospective students, ‘I just need a system that has an edge, that makes money…if I had this one system, I would be fine.‘

Sound familiar?

Anytime I hear this, I realize this person doesn’t realize what trading is about. So what do I do? I give them the same systems I have to other people who have made money from it day in-day out, month in-month out. And what do they do? They lose money while my other traders are making money.

These people have tried everything, looking for the holy grail, looking for that one thing that will solve all their problems. When you have spent as much time experimenting with systems as you have your own psychology, discipline, and trading plan, then you’ve matured as a trader, because you realize there is no holy grail. You realize your edge more often lies in risk management (the risk of ruin tables you should know), and a successful trading mentality. Once you’ve stopped looking for the easy way out, you start to do the real work.

#7 Your Worth as A Trader and Your Worth as A Person Are Two Separate Things

You know you have really matured as a trader when you realize your success or failure at trading has little to no reflection of your worth as a person. You do not tie your worth by how much you have in your account, and you do not accept yourself only if you are successful, while berate yourself for any failures. Trading will never be a reflection of who you are as a person, nor will the size of your bank account. There are many people with bank accounts to last them lifetimes while being the most empty beings in the world, bereft of any sensibility, humanity and kindness.

Because you do not tie your worth as a person to your trading, you are free to embark upon the adventure whole-heartedly. You’re willing to really risk free from all the psychological complications and emotions which bind you. You’re willing to fail, and because you are willing to fail (and you will), you are willing to learn, to not take it personally. When you stop making it personal, or are willing to fail, then you can really put all of you into the experience because nothing is holding you back. Then your trading can truly take flight.

I hope you enjoyed this article on 7 signs of a expert forex trader and found it a useful reflection of where you are in your trading process, how to avoid the mirage on the horizon that disappears once you approach it, and how to keep your eyes on the target, constantly looking for growth and development as a trader.

I welcome your comments and feedback.

Kind Regards,

Chris Capre

Facebook; 2ndSkiesForex

In a constant effort to refine the trading and educational process in helping traders become profitable, I have put together this FX trading tip article which will give you four keys to improving your trading and particularly help with the learning process to becoming a successful trader.

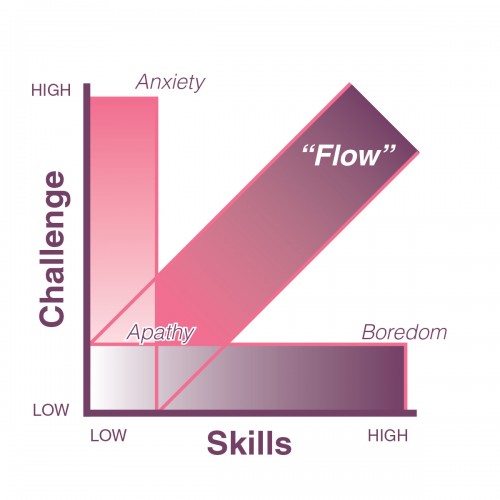

Key #1: The Zone of Proximal Development

This is the idea that learning works best when you the trader tackle something that is just beyond your current reach, but neither too hard, nor too easy. Ideally, this is setup so you are achieving an 80% success rate at whatever you are practicing. The reason for this is when something becomes too easy, you get bored, while when something becomes too hard, you get frustrated. Neither are ideal for the learning process. Video game manufacturers invest millions in testing just to make sure the level of challenge always lies in that sweet spot – neither too easy, nor too hard.

Since we are talking about trading, getting an 80% accuracy or success rate is not easy. It takes years and hundreds, if not thousands of trades along with thousands of hours behind the charts. But what if your still in the learning process and do not have hundreds of trades or thousands of hours behind the charts? What then?

This is where higher time frames come in, such as the 1hr, 4hr and daily time frames. By starting off on these, you increase the probability of getting cleaner signals, while also not having to rush to make a decision as you would say in a 5min time frame. In the beginning, things can seem overwhelming in terms of all the information you have to process, so overburdening yourself with a task too difficult can and often is frustrating which stunts the learning process and can affect one’s confidence. So this is why I recommend starting with the higher time frames as you have more time to process the information, read the price action, all while making a relaxed decision.

Statistically, I have tested now over three dozen price action patterns, systems, formations, etc., and go figure, all of them perform much better with greater accuracy on these higher time frames whereas on a 5min chart they perform no better than a coin flip. This does not mean you cannot trade them on those time frames, but they require more information, more moving parts and more things to amplify the signal. But on the higher time frames, they perform statistically better as is, which makes it easier to trade.

So to make sure you are in the Zone of Proximal Development with your trading, stick to the higher time frames to start, get your accuracy and confidence up which accelerates the learning process, then decide if you want to stay there or go to the lower time frames. But nothing is more crucial in the beginning or developing stages then this.

Key #2: Deliberate Practice

Many of you have heard me recently talk about Anders Ericsson, the famous Cognitive Psychologist (the expert on expertise) who is famous for the 10,000 hour rule. Everyone has been talking about this lately, especially in trading, but not many of you have heard about his lesser known pre-requisite to the 10,000 hr rule and to becoming an expert. This is the rule of ‘Deliberate Practice‘

What this describes is a constant sense of self-evaluation and consistent focus on one’s weaknesses rather than playing to one’s strengths. In fact, the practice of targeting your specific weaknesses is known as….The Zone of Proximal Development.

Many people have something they are really good at, perhaps doing Sudoku puzzles, playing Tetris or various cognitive exercises. But the problem is once you get really good at them, you’ve built up the neural connections to perform the task well so there is lesser growth in continually repeating these tasks. But where you are weakest at is where you need to spend the most time as that is where all the growth is.

The height of your success is limited by your weakest link, so first is to find out what that is. Perhaps its focus and concentration, or money management, or keeping a trading journal, or following your system. Whatever your weakest area is in trading, first find it, then spend most of your efforts trying to develop that as its most likely the one thing which is separating you from losing money/barely breaking even, to making money week in-week out.

Having a trading journal, filling this out constantly and reviewing it weekly is one way to make sure you are engaging in deliberate practice.

Key #3: Believe in the Learning Process

Did you know that having a fixed mindset neurologically affects your intelligence and neural connections? Brains of people with fixed mindsets actually act differently than those with an open mindset. If you believe you will not be able to trade successfully, then it is unlikely you will ever learn from your mistakes. But if you believe in the ability to learn how to trade successfully, that you can do this, then your brain will actually wire itself differently from the mistakes you make.

The stronger the belief in your ability to learn, the more pronounced the brain activity lends itself to more adaptive responses to mistakes, both behaviorally, but also neurally. Thus, if you really believe in the learning process, even after you have made a silly, ridiculous or just bad mistake, what will happen is your brain will produce a larger amplitude in the signals at that moment which reflects a conscious allocation of attention to mistakes.

The larger the neural signal, the better the performance. So its very critical to be relaxed and aware after you’ve made a mistake because how you think and feel energetically in that moment will determine how your brain and central nervous system wires itself in that moment. It is also critical to remove any limiting or unconscious beliefs as they could actually be sabotaging your learning process and how your brain wires itself when trading.

So having an open mindset, not just in trading, but in life will actually help wire your brain to build better neural connections in the learning process. Hence the great Hamlet quote and how insightful it was;

“Why then ’tis none for you; for there is nothing either good or bad, but thinking makes it so.” – Hamlet

Our beliefs and construals can actually alter our reality. What we believe can, quite literally, be what becomes true.

Key #4: Maintain a Healthy Brain

There are many ways to maintain an healthy brain, but we will limit it to 4 crucial things;

1) Get Proper Amounts of Sleep – one of the most damaging things to brain performance is not having enough sleep. It actually reduces and affects your neurotransmitters which are crucial for brain signals completing their process and sending information from brain cell to brain cell. It can also make you more emotional which is the last thing you want to be during trading.

If your tired and did not sleep properly, don’t trade that day. Your likely competing against people who have slept better, or even worse, a computer which does not need sleep and will execute just as good in the 8th hour of trading as in the 1st, so make sure your properly rested and if not – don’t trade. There will be another day and another trade, the market isn’t going anywhere.

2) Have a Healthy Diet – drinking massive amounts of coffee overstimulates the adrenals and causes hyperactivity in the brain, which can cause increased emotional responses, too much analytical thinking and overstress the thinking process. Drinking alcohol conversely surpresses the adrenals, then while you sleep, your body being dehydrated and having lesser adrenaline, will overcompensate by producing larger amounts then normal so if you’ve hit the pints or bottle too much the previous night, take a day off and get your mind right for trading. It is likely dehydrated which is what actually causes the ‘hangover’ feeling.

Also, avoid eating wheat or sugar which affects both IQ, along with being toxic and damaging to the brain. Wheat has WGA (Wheat Germ Agglutinin) which is a neuro-toxin that passes through the blood-brain barrier, attaches itself to the myelin sheath (protective coating around neurons) which both injures the growth and affects the health of brain cells. A 2011 study actually demonstrated how Japanese schoolchildren who ate wheat everyday had a lower IQ by 4pts on average than non-wheat eaters so lay off the pan (spanish for bread).

Sugar in higher levels has been known to damage the hippocampus (region largely responsible for memory and learning). It is also considered to be as toxic, addictive and dangerous as tobacco and alcohol so lay off the krispy kreme’s.

Lastly, Omega-3 fatty acids in particular have shown to be associated with improved mood and cognition. You can find a lot of Omega-3 in grass-fed meat, eggs, fish, and nuts. Another important feature of a healthy diet is protective antioxidants, which can be found in many fruits, vegetables, and green tea. Blueberries and strawberries, for example, have shown to improve memory and cognition by cleaning out toxins in the brain that cause age-related memory loss and mental decline.

So have a healthy diet to give your brain every edge it can get when trading.

3) Exercise also really helps to lubricate the brain and help keep the brain fit, healthy and strong so exercising regularly is critical to maintaining a healthy brain. It will help replenish oxygen levels to your brain along with stimulating the growth of new cells so step away from the charts at some point to get some exercise.

4) Challenge Your Brain – your brain needs exercise too and there are many ways to challenge your brain to build new connections, such as:

Learning a new hobby

Reading books

Yoga or Meditation

Using brain training programs such as Brain Workshop or Lumosity

Being more creative, such as playing music, painting, writing, or cooking

Solving puzzles, such as crosswords or Sudokus

Play strategy-based video games (my favorite 🙂

Learning a new language

All of these will build new connections and increase your grey matter in the brain which is critical for clear thinking, being creative, having a strong working memory along with good pattern recognition (key for traders).

So there you have it. Those are 4 keys to help improve your trading process which will give you a natural edge as you learn to trade profitably.

Other Related Articles:

Your Brain, Trading and Finding ‘The Zone’

Building a Successful Trading Mentality

Trading the 4hr Charts

For those of you wanting to learn how to prepare for your trading day, along with rule based systems, and get a private follow up session with me, then feel free to check out our Forex Trading Courses where you get lifetime membership, learn rule-based systems, access to the traders forum and a private follow up session with me.

What It Takes to Become A Master

Ever heard of the name Anders Ericsson? Perhaps not, but i’m guessing you heard of the name Malcolm Gladwell, author of the bestselling books Blink and Outliers. Gladwell in his last book Outliers was trying to figure out what separates highly successful people from the rest in any field. In it, he discussed the 10k hour rule, which was actually from the research of Anders Ericsson at Florida State University.

Anders conducted a critical research project whereby he found it normally takes 10,000 hours of practice at a skill to become an expert in any discipline. During this time, your central nervous system will string together new circuits and connections that eventually give you the tools and abilities to execute your skill with mastery. Ironically, he also found it was done without a conscious consideration of the action – the athlete or performer was just doing.

What he discovered in his research was a Zen-like intense concentration, whereby the experts completely focused on the activity. It was in these moments that the experts in their field were achieving peak performance by entering a state called ‘the flow‘, originally characterized by Csikszentmihalyi in the 1970’s.

10,000hrs to Become an Expert Trader?

I know, many of you are saying, ‘10,000 hours would take me years, perhaps a decade to get to that‘. In response to that, I have a few questions;

-What if you could accelerate your learning curve and learn how to enter that state before 10,000 hours?

-What if you could enter that state every day while trading?

-What do you think this would do to your trading?

-Would you put in the effort to develop this?

We are going to talk about what you can do to leap-frog the 10,000hr process in this article and take years of your learning curve.

Before we talk about what you need to do to enter the state of flow and effortless concentration, we are going to discuss the four key features that characterize the state of flow. They are;

1) An intense and focused absorption that makes you lose all sense of time

2) Autotelicity – a sense that the activity you are engaging in is rewarding for its own sake

3) The ‘Sweet Spot’ – this is where the task at hand in relationship to your skills are perfectly matched

4) Automaticity – the ability to do something automatically

Let’s get into each one and see how we can relate them to trading. Then we will talk about what you can do to shortcut this process and decrease the number of hours you need to be studying charts to become an expert in reading the charts.

#1 An Intense and Focused Absorption

One would almost think this would be enough to enter that flow, but all four are required to enter this zen-like state in trading. If you train in yoga and meditation consistently day in day out, then this will come a lot more naturally because you are already practicing the craft of focus and concentration. But if you are not, many things will come into play and affect your concentration.

For example;

-Did you have an argument with your partner, spouse or child lately?

-Did you completely process everything from yesterday and are totally present with what you are doing today?

-Did you wake up and properly stimulate your central nervous system to be prepared for your trading day?

-Are you still focused on a recent loss or mistake?

-Did you drink coffee earlier that morning, or alcohol the night before?

-Are you taking phone calls or talking with others while trading?

-Are you checking email or watching TV during the trading session?

If you answered yes to any of these, it’s highly likely your mind is not 100% absorbed in the markets as they will all inhibit your ability to concentrate.

But lets say you have not had any of these come up. Do you really think you are totally focused and absorbed in concentration? If so, then take a simple test:

Sit in a chair with your spine upright, in a very relaxed and quiet room, no music or tv or anything going on, just you sitting in a chair with your eyes gently focused forward, and try to concentrate solely on your breath. Just follow the inhales and exhales completely. Try and see if you can follow 20 breaths (one inhale and exhale = one breath) without having a single thought other than your breath. Try and see if you can follow them so perfectly you are never once taken off the focus of your breath, that you are so immersed in the experience of your breath, nothing diverts your attention.

Go ahead and try and let me know how far you got (take a moment here).

Finished? How did you do?

I would be willing to bet most of you did not get past 5 breaths. Yep, 5 breaths without;

a thought about your experience

without moving to scratch an itch

or have a question about whether you are doing it right

about whether you can do it or not

without hearing that song in your head

or thinking about the one thing that person said which bothered you

or that one thing you got to do later today

or that bill you have to pay

or the money you need

or whatever…

In fact, I’d be willing to bet many of you did not even make it to 20 without losing count, let alone make it to 5 breaths, perhaps even 2 or 3.

Remember, all you were asked to do is focus on your breath (inhales and exhales) solely for 20 breaths.

Now ask yourself the following questions;

-If you cannot focus on your breath while sitting in a quiet room by yourself with no noise or stimulation going on, how can you be absorbed or concentrated on the markets?

-How could you be totally focused and not let those emotions interfere with your trading?

-If you could not stop the radio of your mind and its constant stream of thinking while sitting still trying to do one task, how could you spot the subtleties in the price action communicating to you the market is going to turn or make a big move?

Of all the 4 characteristics, the first one is the hardest. The most common misconception of the whole 10,000hr rule is not just to absorb enough information so you become a master. It’s to develop the concentration needed, along with the repetition of a task that leads to confidence and allows one to relax their mind. All of this is to develop that zen-like absorption and penetrating concentration to achieve peak performance.

But what if you practiced something which solely focused on developing that concentration? What if you practiced yoga, meditation, or any activity which developed this skill set? Wouldn’t that cut down the time you needed since your concentration and awareness would be sharper?

Someone recently shared a great Abraham Lincoln quote where he said, ‘If I have 8hrs to chop down a tree, I’m spending 6hrs sharpening my axe‘.

If the markets are a tree, your mind is the axe, so sharpening this tool will help you reach your goal faster than anything else. In fact, awareness, focus and concentration are the three things which will accelerate any skill, task or endeavor you engage in. They will reveal information faster to you, help you take in more, focus on the key things and yield insight more naturally. To learn a few techniques which can help you with this, click on my article Building A Successful Trading Mentality.

#2 Autotelicity

This refers to doing something for its intrinsic value, and not so much for the external rewards it may provide. For example, do you play football so you can become a multi-millionaire, or do you play the game because you love it so much, you’d play it for free if you had all you needed to make a living? Simply put, if one pursues an action for intrinsic reasons, then one’s actions are intrinsically valuable because one is motivated to pursue the action as its own means to an end, or for its own enjoyment – not for what it brings.

To put this in a question – do you trade because you absolutely love it, that you really want to learn it inside and out? Or do you trade to become financially abundant and independent – who doesn’t? Therefore, the latter is an inferior motivation since it is something you’d want naturally (financial independence). Are you really wanting to be a professional trader, or are you trying to escape your financial situation and state of existence? The former is ideal, the later is less helpful, but still can be used.

Doing it for the latter reasons will translate into the experience, that when you run into obstacles or excuses why you did (or did not do something), you will accept those excuses as reality instead of doing something to change them.

It will mean your motivation for doing something is not the love of it, but hating (or disliking) something in your life you want to change, avoid or make sure doesn’t happen.

Ask yourself which of these two is why you are wanting to trade. Are you doing it because you really believe deep down inside you can do this, that you have to do this, regardless if you are successful or not? Think about which of the two you will put more focus, effort and attention to? Then ask yourself which of the two you are. Nothing will be more important than being honest with yourself here. If you find in all honesty the latter is your answer, you can still become successful, but either a) you will have to trade with that intention in your mind (via aversion to your current financial state) or b) your motivation will have to evolve into an more subtle appreciation for trading.

#3 The ‘Sweet Spot’

This comes out of the work by Csikszentmihalyi where he discovered a person was most likely to enter this state of ‘flow’ and masterful play if the task at hand was challenging enough in direct relation to their abilities. So, if the task is too hard for your current level, then it will be mentally frustrating and you will get emotional during the experience. If it is too easy, you will get bored and not stimulate your brain and potential fully.

This is actually critical in terms of your trading. If you are an absolute beginner, I do not recommend live trading, nor trading ultra short time frames (less than 15mins). Why? Because you will need to read subtle price action clues with very little time, make decisions really fast, have precision in your execution, while having little or no room for error. Sound like something a beginner should start with in any field or craft? I didn’t think so. Do you start learning how to be a professional archer by shooting at 18meters, 70meters, or 3? With that being said, I recommend starting at the 1hr, 4hr and daily time frames to hone your skill-set.

First things first – build your skillset, learn how to read price action, get hundreds of trades under your belt, then decide what type of trading you want to do. If you challenge yourself too hard in the beginning beyond your abilities, you will likely incur some big losses, or many in a row, then get frustrated, and be unable to enter any ‘sweet spot’. You want to be able to stretch yourself, but only in a controlled growth fashion. This will allow you to enter that flow as your concentration will be challenged, yet you will have the ability to do the task successfully.

#4 Automaticity

This is the ability to do something automatically, to the point where it requires none of your mental resources (or so little) that you can use the rest of your mind for finding the best trading opportunities. Your brain is like a computer processor, and if you are using resources for one or two other tasks, then you will have less processing speed for the task at hand. That is why multi-tasking is the worst thing you can do when trading as it actually reduces your overall IQ.

So shut off the email, turn off the cell-phone, unplug the landline, close your email program, and just focus on the markets when trading. Give all your energy and focus to that so you can have your full natural intelligence dedicated to trading. This will help you spot the best trading opportunities and make the best trading decisions.

What Else Can I Do?

If you have all four of these characteristics present, then you can more naturally enter the ‘zone’ or zen-like concentration. But there are some additional things which will help you get there.

While studying experts, Csikszentmihalyi found something unique in their brain activity. First, he noticed less activity in their pre-frontal cortex. This is the part of the brain typically associated with higher cognitive processes such as working memory and verbalization.

Although that may seem like something you want highly active, what it really pointed out was during their states of zen-like concentration, the experts across all fields were able to silence their self-critical thoughts which allowed automaticity to take hold and thus have more resources dedicated to their craft.

As traders, we have actually had this direct experience. Ever had the experience of ‘analysis paralysis‘? This is your pre-frontal cortex working overtime – criticizing every idea and thought to the point it paralyzes you. Ever had a perfect trade come up, but your mind came up with all kinds of ‘reasons‘ and ‘excuses‘ or ‘ideas from other experts‘ about how the market was going the other way? This is exactly that kind of pre-frontal activity which actually inhibits your trading.

Complimentary to this, Chris Berka looked at the brain-waves of olympic archers and professional golfers. What they noticed was a few seconds before the archer released the arrow, or the golfer hit the ball, they observed a small spike in the ‘Alpha Band‘ = 8-12hz frequencies, and ‘Theta Band‘ = 3-7hz frequencies.

Alpha band frequencies are linked to a lower heart rate and a greater sense of calmness and relaxation, while Theta band frequencies are associated with deeper levels of concentration, meditative absorption, a heightened awareness of the sensory field, and a shift in the relationship to thoughts, feelings and the experience of self.

As Berka noticed in her studies, the spike in the alpha waves represented more focused attention on the activity, while other sensory inputs are suppressed, accompanied by a slower breathing and lower pulse rate, all leading to greater concentration.

To compliment this, Gabriele Wulf (a kinesiologist at UNLV) examined the way athletes move. She noticed that if swimmers focused on an external stimuli, like how the water moves around them, instead of how their limbs are moving, their performance, speed and technique increased because the conscious thought of the pre-frontal cortex was turned down or off, and thus didn’t interfere with the process.

It allowed the automaticity to take over what it could so one could have more resources to doing the task with grace, effortlessness and creativity. It should be noted, that it takes time to produce consistent alpha waves in the brain. How much time? A lot less than the 10,000hours needed to achieve a sense of mastery and flow of your craft.

In fact, if you can learn how to develop consistently stable alpha waves, you simply short-circuit the need to have 10,000hrs of chart time. This is because your focus, concentration and awareness will all be sharper than usual. You will spot more details in the price action, find better opportunities out there, and be less inhibited by emotions and critical thoughts.