New to Forex? Then check out my FREE Learn Forex Trading Course with videos, quizzes and downloadable resources

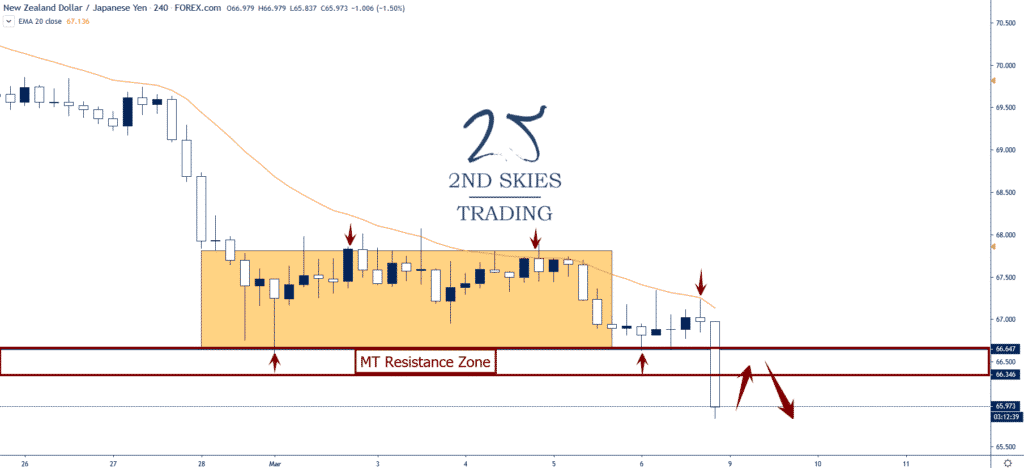

Top Trade Review: Check out this Top Forex Trade Review with Itayi profiting +1100 Pips on the NZDJPY (AMAZING PROFIT!)

Want FREE Forex Charts? Check out our top charting provider Trading View.

Did you read my ‘Is the Stock Market Going to Crash‘ article? If not, make sure to read it for trading tips.

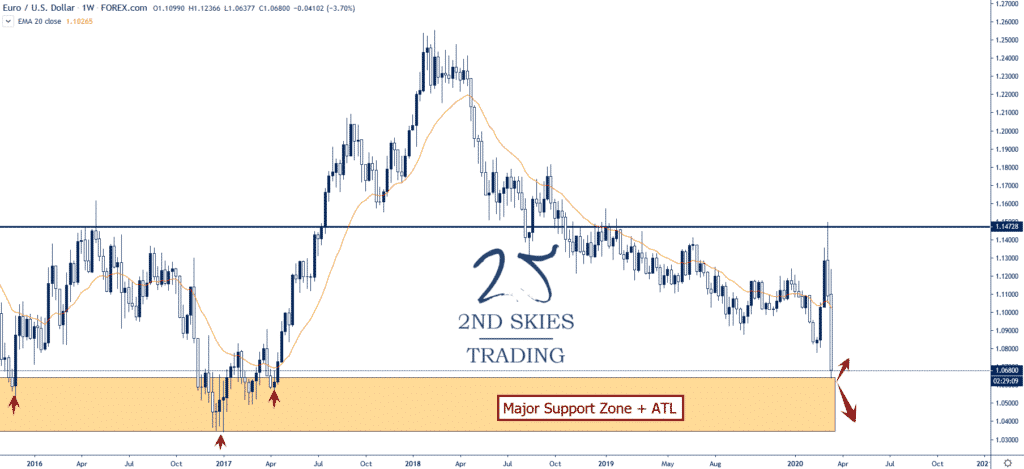

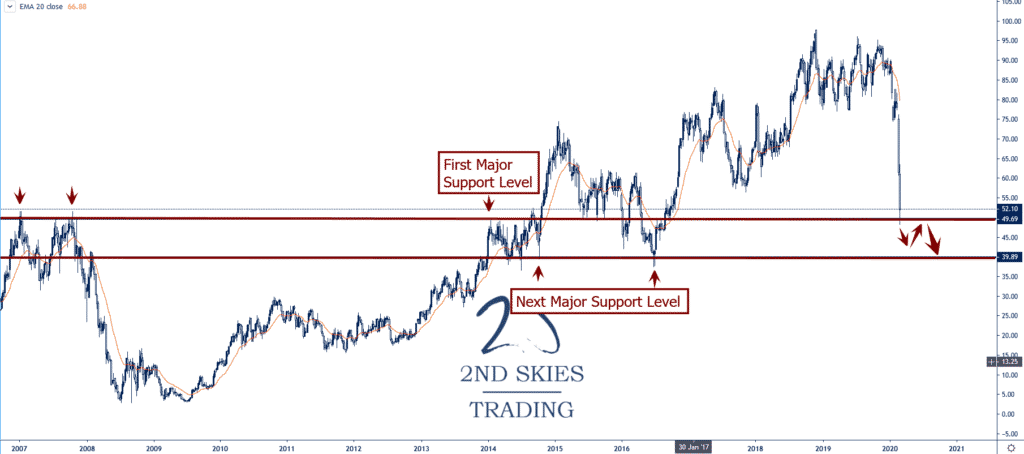

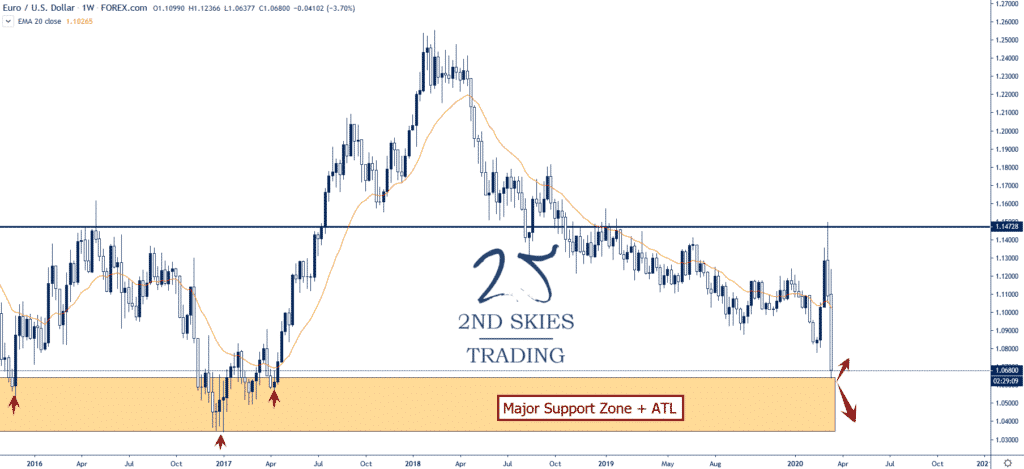

Forex Trade Idea: EURUSD – Approaching Base Of Support & ATL (weekly chart)

Price Action Context

After a brutal V-shaped sell off from the two week rip up, the Euro has been punished dropping almost 8 handles in the last two weeks.

The forex pair is currently approaching a large base of support and the all time lows (ATL) between 1.0680 and 1.0348.

Right now there is a shortage of USD’s out there and thus a major reason why the USD is performing well now, so I’m expecting this support zone to be penetrated and tested.

If we break the ATL mid 1.03’s, then I’m expecting some technical stops to be tripped at 1.01 and a potential attack on parity so look for a weekly close below.

Trending Analysis

ST bearish and MT neutral while above this zone.

Key Support & Resistance Levels

R: 1.12, 1.1472

S: 1.068, 1.0345

Stay tuned to our members market commentary for updates.

******

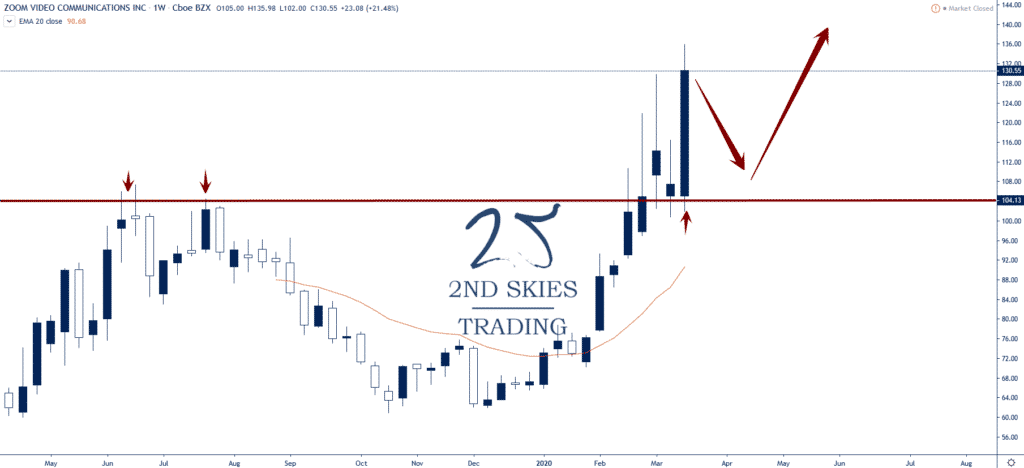

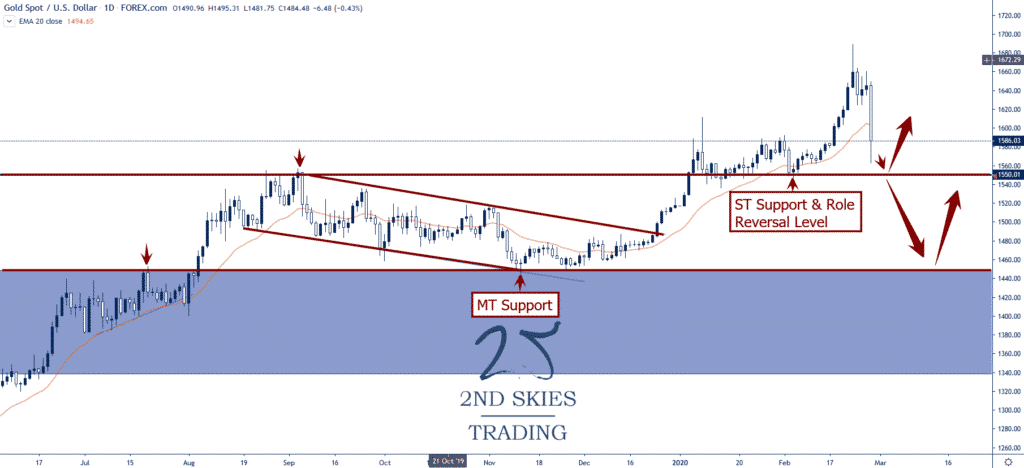

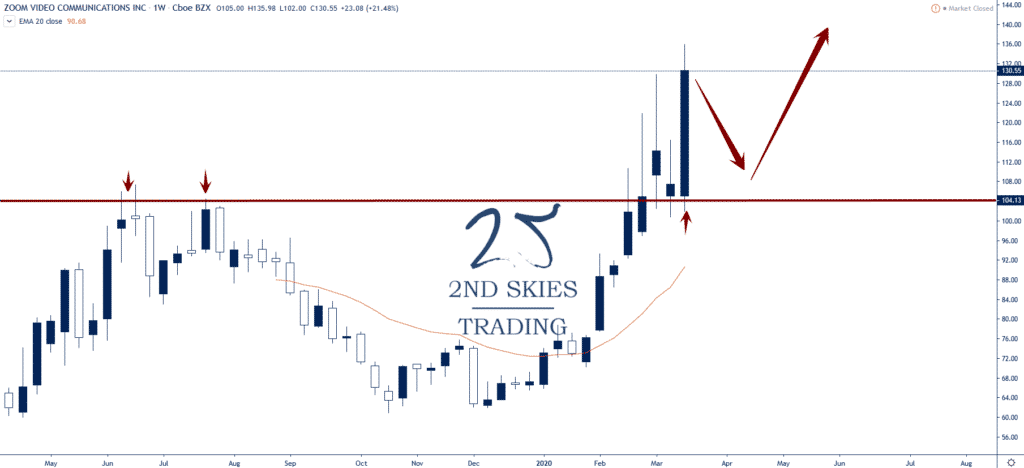

Stock Trade Idea: Zoom Video Communications ($ZM) – Should Benefit Long Term (weekly chart)

Price Action Context

With a lot of companies having their employees work from home, video conferencing is set to benefit.

Now while many of these companies are seeing their stocks surge, I don’t think its going to evaporate when the corona-virus subsides and life goes back to normal.

I am thinking many companies will be realizing they can function just fine with large portions of their workforce working from home.

Hence I’m suspecting that even when life normalizes after this virus, more and more companies will be embracing video conferencing.

Enter Zoom (which we use) whose stock is up an impressive 68% since the beginning of Feb.

I think if we get a decent pullback in the stock, I’m looking to go long for a long term bet video conferencing will thrive in the coming years and Zoom will be a big beneficiary of that.

Trending Analysis

I’m watching the role reversal level around 104 as a potential buy point, ideally on a corrective pullback.

Key Support & Resistance Levels

R: 135, 150

S: 104, 75.67

******

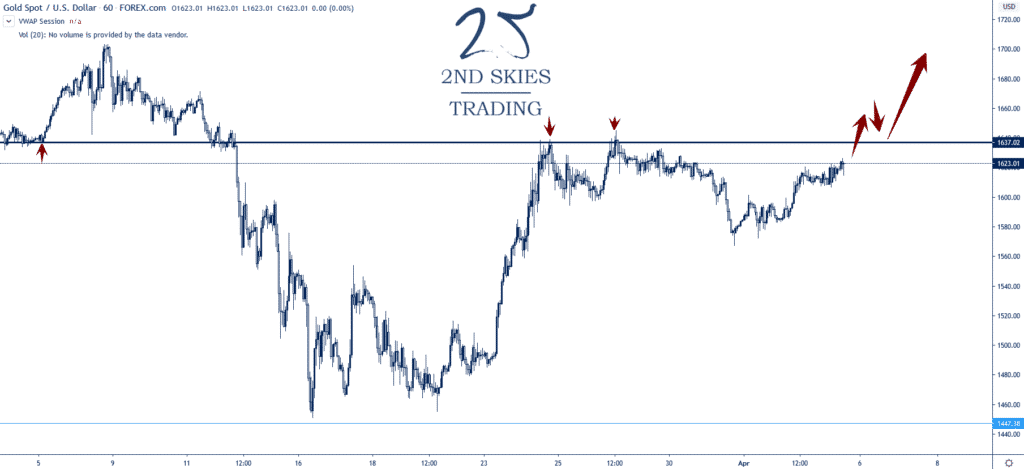

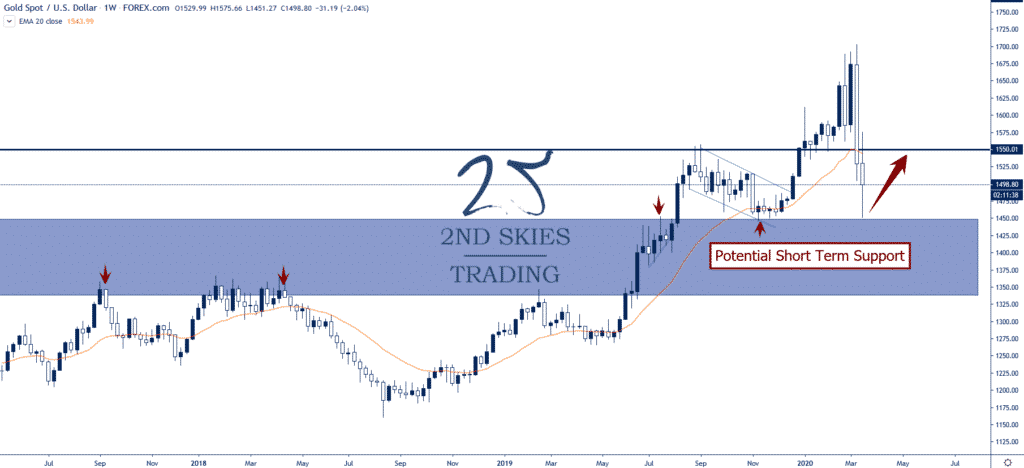

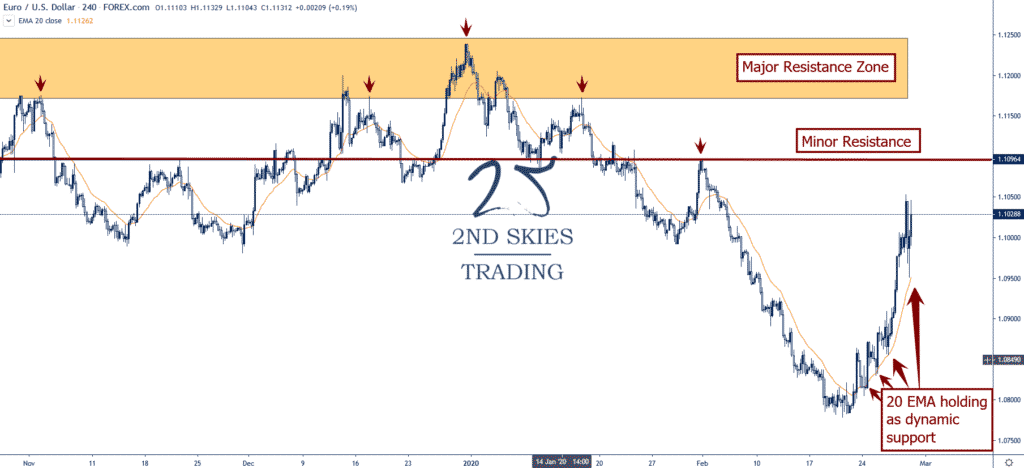

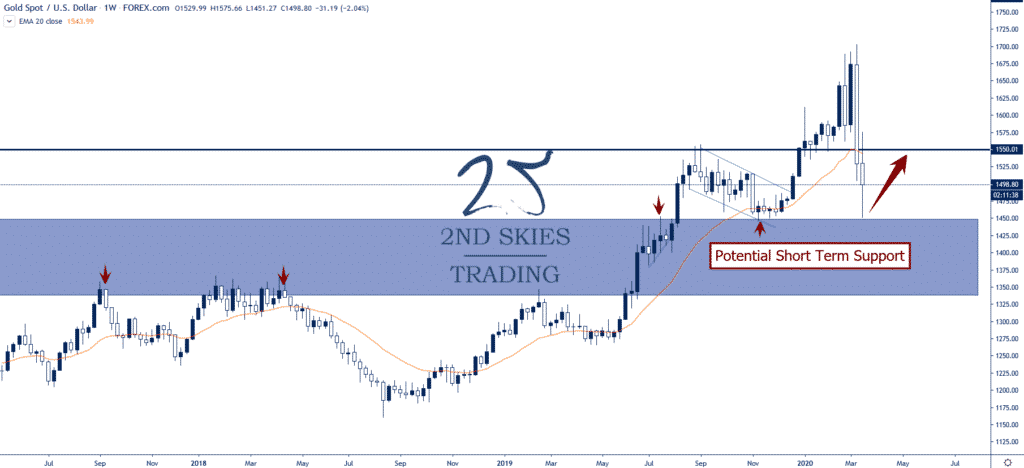

Commodity Trade Idea – Gold ($XAUUSD) – Likely Sold To Fund Losses, Potential Support (weekly chart)

Price Action Context

In the last two weeks, gold has been selling off aggressively.

A lot of traders have been associating gold with a risk off in this case, but if that was the case, why didn’t it start selling off earlier in the market crash?

I think gold has been sold recently as a ‘funding‘ trade to offset losses in other aspects of their portfolio.

Hence I think gold might be trying to bottom around 1450, and there may be a potential short term trade setup here.

Trending Analysis

ST bearish but MT bullish while above 1450 on a weekly closing basis.

Key Support & Resistance Levels

R: 1550, 1675

S: 1450, 1350

******